Wealth Manager Says BlackRock Will File for Spot XRP ETF, Says It’s Just Running Late

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Nate Geraci, the President of NovaDius Wealth Management, remains confident that BlackRock will eventually file for spot XRP and Solana ETFs.

Geraci reiterated this perspective in his latest appearance on the Thinking Crypto Podcast with Tony Edward, discussing the recent developments in the SEC’s decisions relating to crypto ETFs.

They examined the SEC’s approval of in-kind redemptions for crypto-related exchange-traded products (ETPs) and the agency’s decision to greenlight and delay basket ETF products from Grayscale Investments and Bitwise.

Notably, the conversation took an interesting turn when Edward asked Geraci to comment on whether BlackRock will file for XRP or Solana ETFs after successfully launching similar products for Bitcoin and Ethereum.

"BlackRock Will File for XRP and Solana ETFs"

In response, Geraci emphasized that he

believes

BlackRock will file for both XRP and Solana ETFs. With other asset managers like Bitwise, Franklin, and Grayscale already in the application process for standalone XRP and Solana ETFs, he warned that BlackRock is "getting a bit late" in joining the race.

For context, asset managers in the U.S.

indicated

interest in launching Solana and XRP ETFs in June and October 2024, respectively. The approval process has begun ever since, with the SEC delaying its decision on the products on several occasions.

According to

sources, the SEC has a final deadline of Q4 2025 to decide whether the ETFs tied to XRP and Ethereum will see the light of day.

“We're getting closer to the finish line, and they [BlackRock] still haven’t filed,”

Geraci said. He suggested that the world’s largest asset manager could be waiting for the release of a formal regulatory framework before

“swooping in at the last minute”

and eventually filing for the spot and XRP ETFs.

Why BlackRock Will File for XRP and Solana ETFs

His confidence stems from BlackRock’s longstanding advocacy for index-based products, like the S&P 500. He suggested that the firm consider indexing as an appropriate way to access various asset classes.

Given BlackRock’s commitment to index strategies, Geraci expects the firm to launch a broad index-based crypto ETF featuring multiple tokens.

“If you're going to do that, then it seems like you would have standalone spot crypto ETFs as well,”

he stated.

Beyond indexing, Geraci believes that BlackRock might file for an XRP or Solana ETF for defensive purposes. He acknowledged BlackRock’s dominant market position in the crypto ETF market, noting that the firm has the largest Bitcoin and Ethereum ETFs.

However, he expects BlackRock to apply for more crypto ETFs to gain an early mover advantage if the products eventually gain traction.

Geraci added that if BlackRock continues to offer only Bitcoin and Ethereum ETFs and refuses to file for similar products for XRP and Solana, then the asset manager is already choosing winners, which he finds illogical.

“I still think that they will file for those [XRP and Solana ETFs] and launch both, but I will say we’re getting a little bit late in the process,”

he concluded.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/521100.html

Previous:谁杀死了跨链之王 Cosmos?

Related Reading

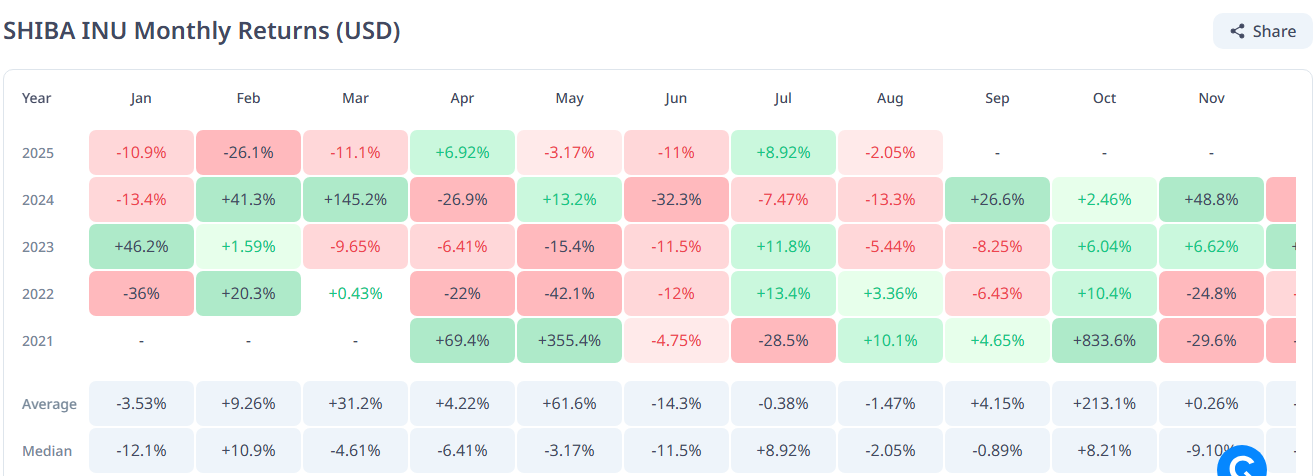

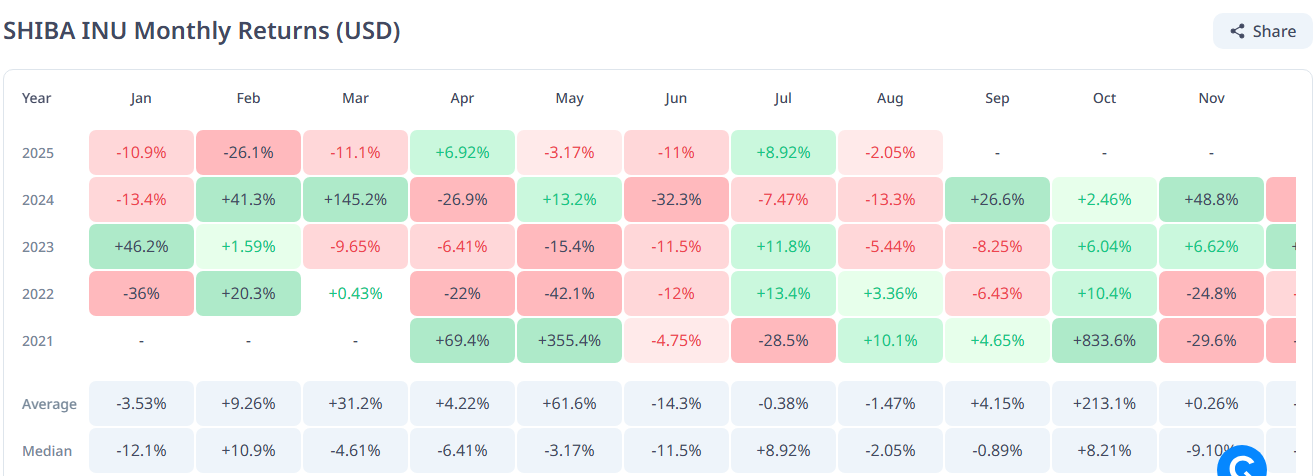

Here’s Potential Price for Shiba Inu if Dogecoin Hits $1.50

A veteran crypto investor has predicted that Shiba Inu could clinch a new all-time high (ATH) if Dog...

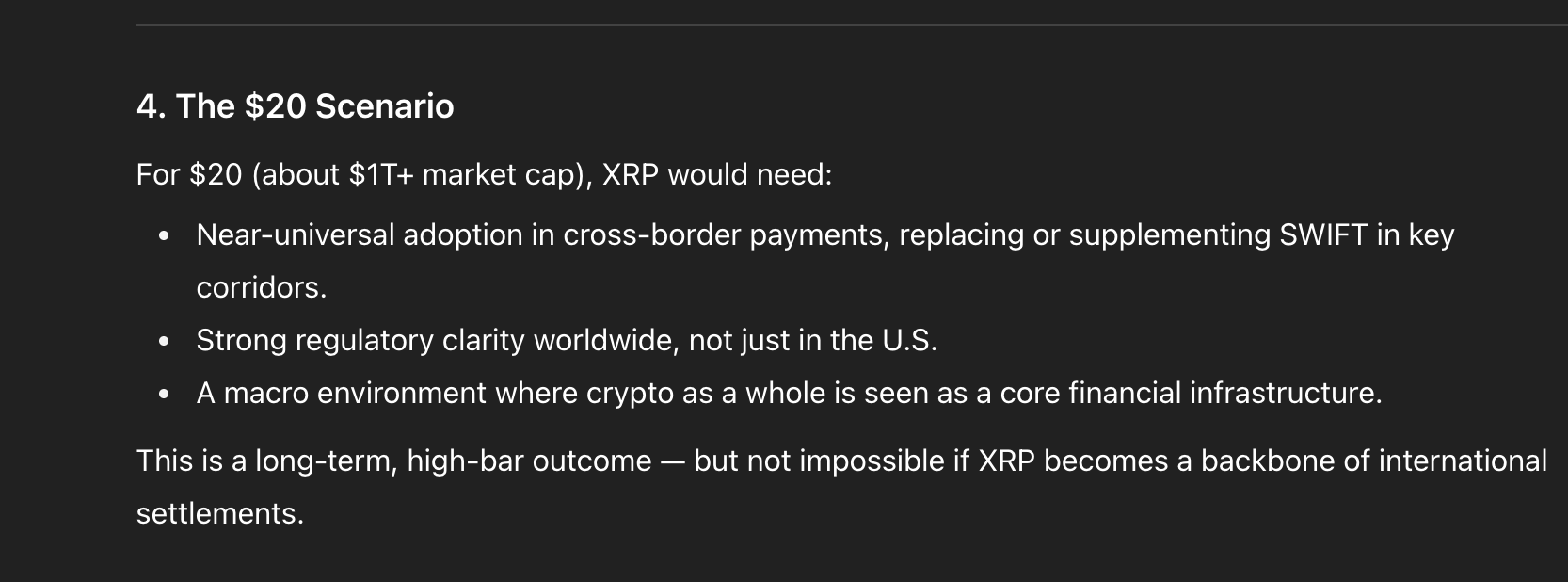

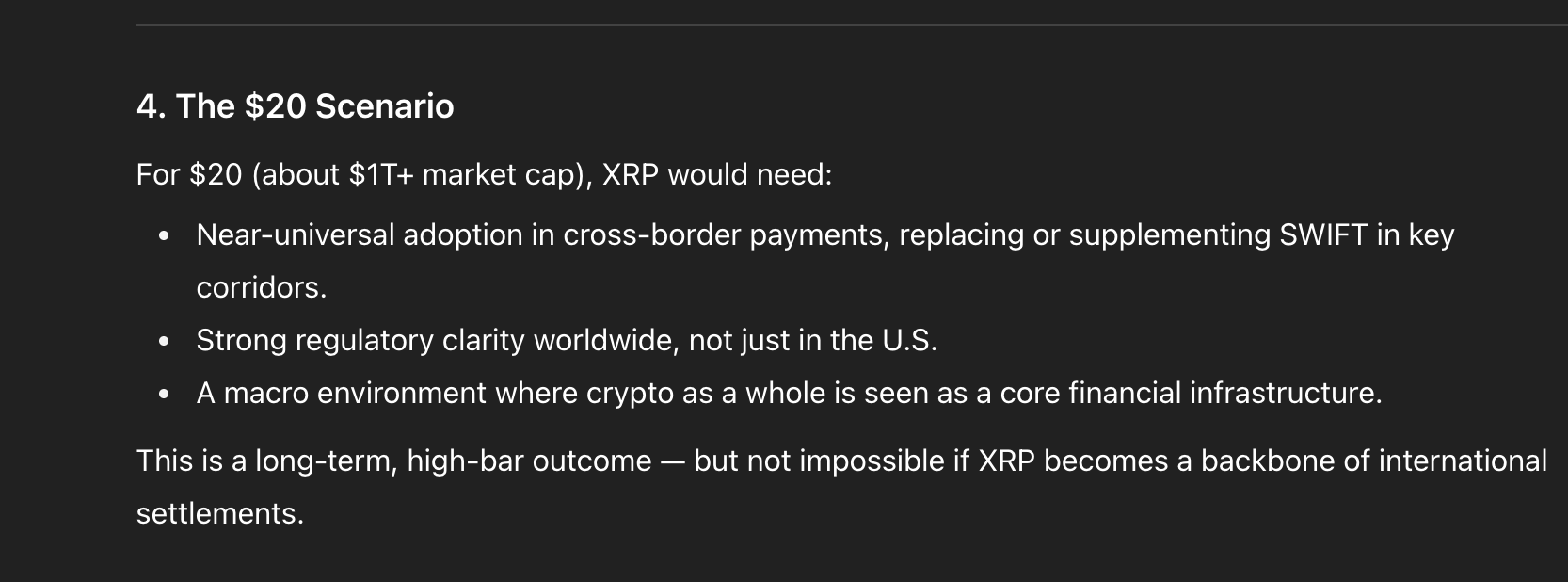

XRP Price News: With SEC Battle Over, Can XRP Hit $5, $10, or $20

The nearly five-year legal battle between Ripple and the U.S. SEC is officially over, and attention ...

Donald Trump-Inspired World Liberty Financial Exploring $1.5B Crypto Vehicle to Hold WLFI Tokens

The Donald Trump-inspired World Liberty Financial is exploring plans to create a publicly traded cry...