Indonesia Considers Bitcoin as Part of National Reserve

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The office of the Indonesia Vice President held discussions with Bitcoin advocates to explore the possibility of using Bitcoin as a national reserve.

According

to Bitcoin Indonesia on X, the meeting with pro-crypto officials marks a significant step in exploring digital assets at the sovereign level. The talks included a proposal to use Bitcoin mining as a reserve mechanism.

Although no official policy has been announced, Bitcoin Indonesia, the largest Bitcoin community in Asia, notes that officials expressed interest in further education efforts.

Exploring Bitcoin as a Strategic Asset

According to the group, the conversation focused on how Bitcoin could support economic strength and reserve diversification. Bitcoin Indonesia highlighted global macroeconomic trends and shared resources such as The Bitcoin Standard, The Fourth Turning, and Ray Dalio’s The Changing World Order.

Bitcoin Indonesia referenced Michael Saylor’s Bitcoin price forecast for 2045, tying it to the 100th anniversary of Indonesia’s independence. The symbolic alignment appeared to resonate with officials.

A representative from the Vice President’s office, Adhit,

emphasized

the need for continued public education on Bitcoin, highlighting it as an important step in Indonesia’s engagement with digital assets.

https://twitter.com/bitcoinindo21/status/1952695157343822170

The group also echoes the idea that education is key to adoption, adding that Bitcoin Indonesia is committed to providing learning resources and outreach without cost.

Current Reserves and Regulatory Environment

Indonesia’s foreign reserves are traditionally composed of gold, U.S. dollars, and government bonds. Adding Bitcoin would represent a major change in strategy and place Indonesia among the few nations actively exploring digital assets at a sovereign level.

Earlier in July, Bank Indonesia (BI)

reported

a slight rise in the country’s foreign exchange reserves to $152.6 billion at the end of June 2025, up from $152.5 billion in May. This increase was driven by tax revenues, service income, and global bond issuances, as the central bank worked to stabilize the rupiah amid global financial uncertainty.

Notably, Indonesia just

raised

crypto transaction taxes from August 1, with domestic trades taxed at 0.21% and overseas trades at 1%. VAT on purchases is removed, but crypto mining faces a higher 2.2% VAT, and mining income will be taxed under regular income or corporate tax from 2026. The changes follow a surge in crypto activity, with over 650 trillion rupiah traded in 2024.

Regional and Global Context

Indonesia’s interest follows similar developments in other nations. El Salvador made headlines in 2021 by adopting Bitcoin as legal tender and adding it to its national reserves. Earlier this year, the country

expanded its Bitcoin holdings to 6,067

.

Kazakhstan is also considering crypto assets

for its national investment strategy, including a state-backed reserve and stricter regulations. Central Bank Governor Timur Suleimenov said the plan, still under review, aims to diversify reserves by investing in crypto ETFs or blockchain firms, following global trends but with caution due to high risks.

Bhutan is also among the Asian countries exploring Bitcoin. Since starting Bitcoin mining in 2020, crypto has become central to Bhutan’s economy,

contributing up to 40% of GDP

. With 11,711 BTC valued at $1.3 billion, Bhutan now holds the world’s third-largest national Bitcoin reserve, managing it with hedge-fund-level precision.

Notably, Bitcoin Indonesia said the meeting was about ideas, not hype. The group left behind books and a conference T-shirt for Vice President Gibran Rakabuming Raka as part of a broader effort to drive public education and policy engagement.

Meanwhile, in March, Donald Trump created a

Strategic Bitcoin Reserve

, with the White House calling Bitcoin “digital gold.”

The U.S. currently holds 198,109 BTC ($17.5B), which will not be sold but may be increased cost-effectively. The move aims to give the U.S. strategic advantages, with Michael Saylor declaring America now holds the world’s largest Bitcoin reserve.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/520819.html

Related Reading

Tom Lee Picks Ethereum Over Bitcoin, Says Ether Is the Biggest Macro Trade for the Next Decade

Tom Lee, the co-founder and CIO of Fundstrat, has doubled down on Ethereum, picking the altcoin as h...

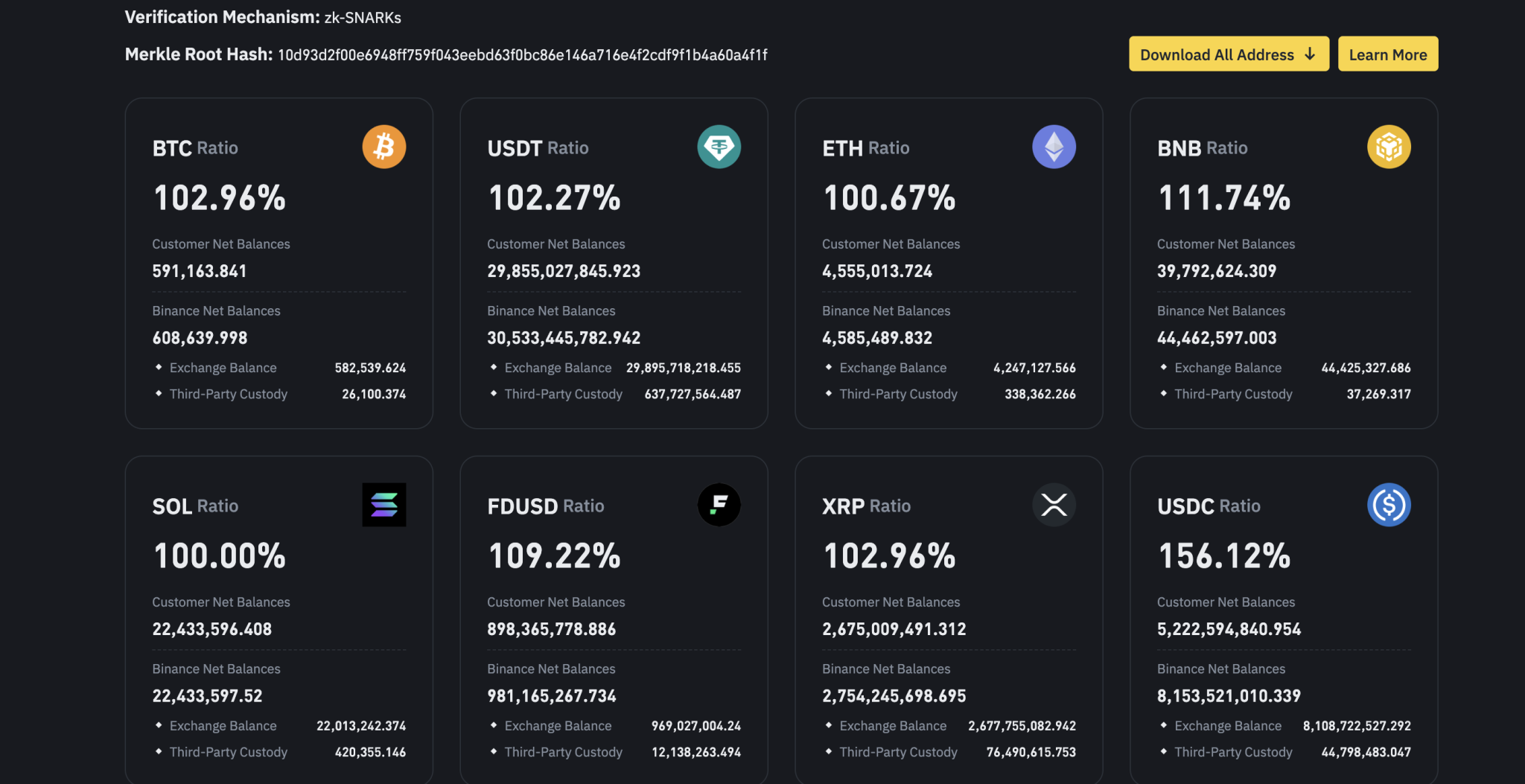

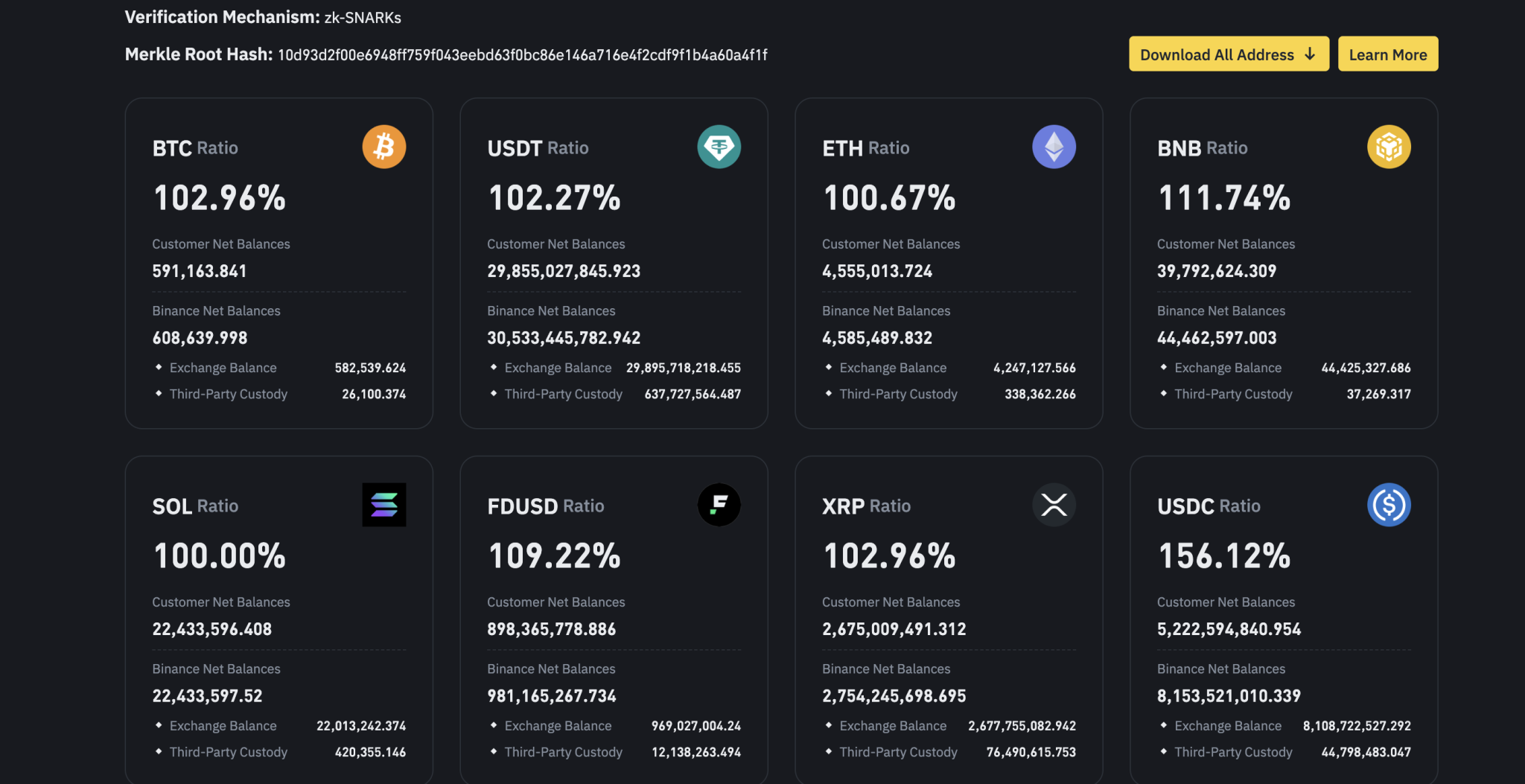

Here’s How Much XRP Binance Holds in Its Latest Proof-of-Reserves Report

The largest crypto exchange, Binance, has released its latest proof-of-reserves report, detailing in...

Bakkt Acquires 30% of Japan’s MarushoHotta, Plans Bitcoin Pivot

Bakkt, a crypto infrastructure and service provider company has agreed to acquire a stake in a Japan...