BREAKING – US Set To Reveal Key Crypto Report—A Make‑Or‑Break Moment For Bitcoin

US crypto watchers are on edge. A new policy report is set to land before the month ends – and it could reshape how digital assets fit into the US government’s plans.

Working Group Sets Release Date

According to an X post by Bo Hines, the President’s Digital Asset Working Group wrapped up its 180‑day study and will publish the findings on July 30.

Based on reports, the group was originally expected to unveil the report around July 22, following an executive order in January by US President Donald Trump. That order asked the team to sketch out how a Strategic Bitcoin Reserve might work.

The report should spell out how much Bitcoin the US holds today. Those coins come from law enforcement seizures over recent years.

Policy wonks and investors alike want to know whether the federal stash is just a data point or the start of a bigger reserve plan.

Strategic Bitcoin Reserve Insights

Inside sources say the document will cover the nuts and bolts of setting up a national digital‑asset fund. It’s likely to recommend using existing seized coins first.

Then it could suggest budget‑neutral methods—like moving assets from other funds—to buy more Bitcoin.

There’s talk of tapping nearly 200,000 BTC that authorities have captured so far. Security, storage and audit rules will also get attention, since a reserve needs tight guards and clear accounting.

The executive order hinted that the reserve would use only lawfully obtained coins. It didn’t detail how long the government must hold them before selling, but some drafts mention a 20‑year holding period for stability’s sake. If that sticks, it would mirror long‑term strategies used for gold and other strategic resources.

Congressional Moves On CryptoOn the Hill, Congress isn’t sitting still. Trump recently signed the GENIUS Act , which lays out rules for banks, credit unions and trusted non‑banks to issue stablecoins.

At the same time, the Senate Banking Committee just rolled out a crypto market structure bill. That proposal aims to decide who’s in charge—whether it’s the SEC or the CFTC—and how to protect everyday users.

Beyond those measures, Senator Cynthia Lummis has reintroduced the BITCOIN Act . It would direct the Treasury to buy 1 million BTC over five years.

Investors see a clear upside if both executive and legislative moves line up. More government buying could add heavy demand to Bitcoin’s market.

Yet some experts warn that holding such a volatile asset on a government balance sheet carries its own risks, from price swings to security costs.

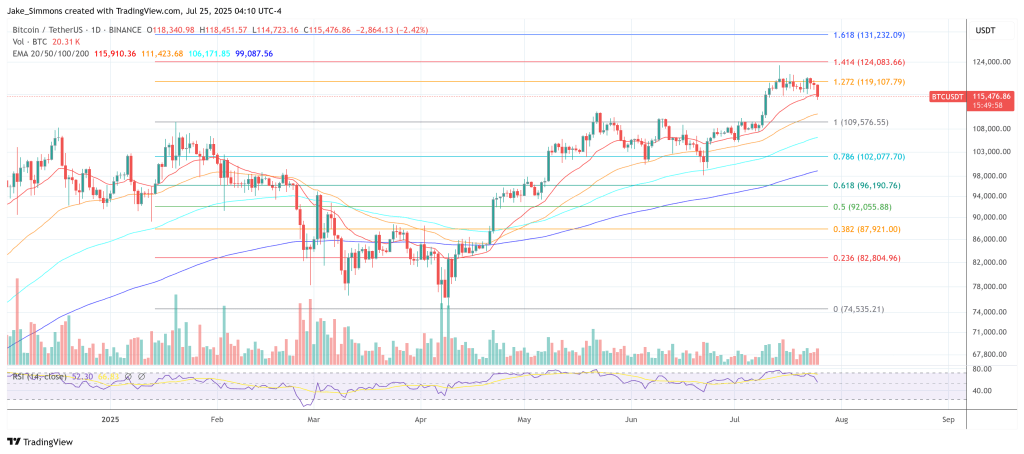

Featured image from Pexels, chart from TradingView

Rise of the Croaked King: How Little Pepe Is Bringing Back the Fun

Meet Little Pepe ($LILPEPE), the pint-sized amphibian on a quest to revive the heroic spirit that fi...

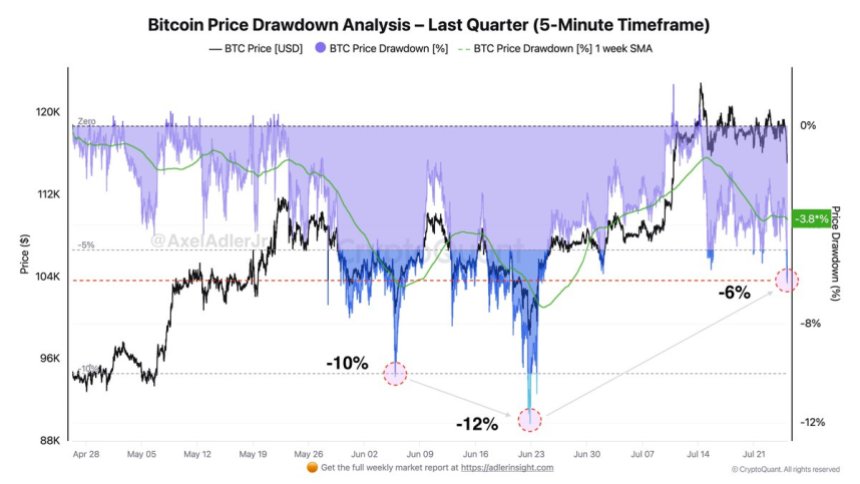

Bitcoin Pullback Remains Within Normal Volatility Range: Drawdown Analysis Shows No Signs Of Panic

Bitcoin is making its first meaningful move since breaking its all-time highs and reaching the $123,...

Bitcoin Price Bleeds As Galaxy Digital Unleashes $1.5 Billion Sell-Off

Bitcoin’s summer melt-up has come to an abrupt halt. The benchmark cryptocurrency slipped from an in...