Peter Thiel's Founders Fund has completely exited its position in Ethereum treasury firm ETHZilla, according to a Schedule 13G filing with the Securities and Exchange Commission dated 17 February.

The filing shows zero shares remaining – a dramatic reversal from the 7.5% stake the venture fund disclosed in August 2025, when ETHZilla was riding high on investor enthusiasm for digital asset treasury (DAT) stocks.

From $107 to $5

ETHZilla, which pivoted from its origins as failed biotech company 180 Life Sciences to become an Ethereum-hoarding firm modeled after Strategy's (MSTR) Bitcoin playbook, saw its shares hit an all-time high of nearly $107 last August. By December 30, the stock had collapsed to $4.99 – a 95% drawdown. It currently trades at $3.62.

The implosion forced ETHZilla to panic-sell its holdings. The firm offloaded $40 million of ETH in October, followed by another $74.5 million in December to service debt from convertible notes.

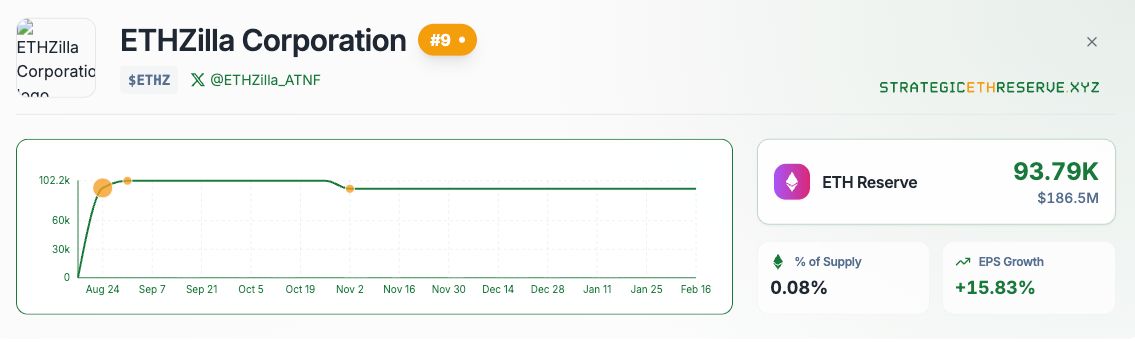

At its peak, ETHZilla had accumulated over 100,000 ETH tokens. According to Strategic Eth Reserve, it currently holds 93.79K ETH, or around $186.5 million worth.

Treasury Model Under Pressure

Thiel's exit highlights growing skepticism toward the digital asset treasury model beyond its Bitcoin origins. While Strategy has maintained conviction in its BTC accumulation strategy, Ethereum-focused imitators have struggled amid ETH's weaker price action and higher volatility.

The timing is notable: Ethereum co-founder Vitalik Buterin himself has been selling. Blockchain analytics platform Arkham shows Buterin sold approximately 3,000 ETH (roughly $6.6 million) over three days in early February, part of a 16,384 ETH withdrawal he announced on January 30.

Buterin framed the sales as funding a "period of mild austerity" for the Ethereum Foundation over the next five years, with proceeds earmarked for open-source projects, biotech, and securing Ethereum's position as a "scalable world computer."

What's Next for ETHZilla?

Desperate for a new narrative, ETHZilla has pivoted again – this time launching ETHZilla Aerospace earlier in February to offer tokenized jet engine leasing exposure.

Whether institutional investors will bite remains to be seen. With Thiel out, the company has lost a powerful validator of its treasury thesis.