The post U.S. Government Shutdown 2026 Odds Spike to 76%, Crypto at Risk appeared first on Coinpedia Fintech News

The crypto market is heading into a tense weekend, following the inclusion of the FOMC interest rate decision, Jerome Powell’s speech, the release of PPI inflation data, and an important vote on the crypto market structure bill.

On top of all this, uncertainty is rising as fears grow over a possible second U.S. government shutdown, which could happen on January 31.

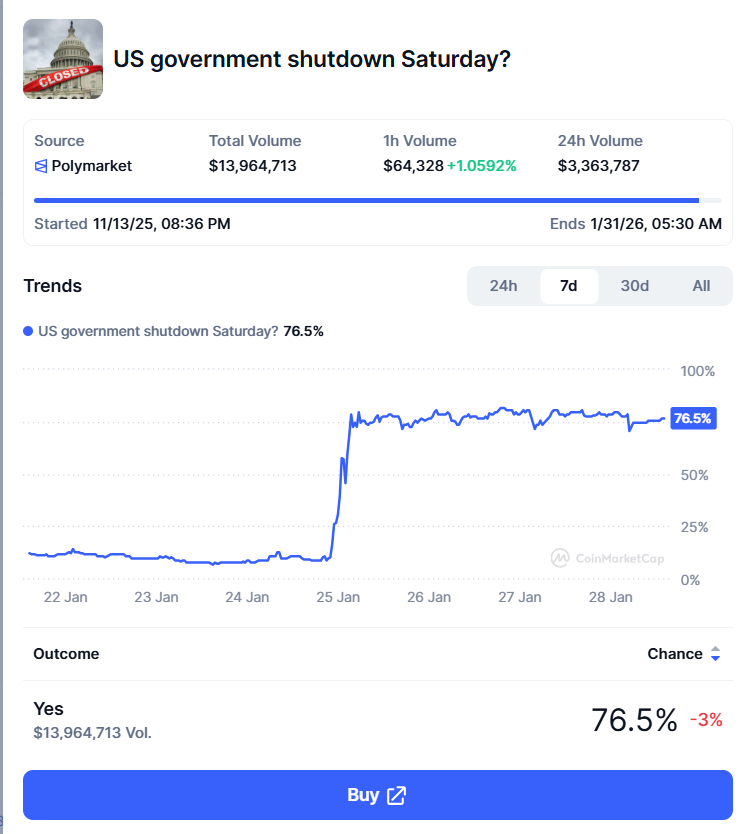

76.5% Chance of a U.S. Government Shutdown

According to Polymarket, there is a 76.5% chance of a U.S. government shutdown if Congress does not approve funding in time. Right now, a $1.2 trillion funding package has already passed the House.

However, it still needs approval from the Senate by midnight on Friday, January 30.

If no agreement is reached, agencies like the Department of Homeland Security (DHS), FEMA, and TSA could see non-essential operations halted.

If this occurs, non-essential workers are sent home without pay, while essential staff continue working and get paid later.

Why the Senate Vote Is So Uncertain

The funding bill needs 60 votes to pass the Senate. Right now, Republicans hold 53 seats, while Democrats and aligned Independents control 47, making the outcome uncertain.

Tension has grown because of recent incidents involving federal immigration agents. In Minneapolis, federal agents fatally shot Alex Pretti, a 37-year-old intensive care nurse, during a protest against immigration enforcement. Protests have continued across several U.S. cities, with both parties demanding answers and accountability.

The issue has added political pressure ahead of the funding deadline, as lawmakers argue not only over dollars, but also how federal agencies carry out their work.

How Crypto Could React

The last major U.S. government shutdown ended in November after nearly 43 days. During that period, crypto markets saw high volatility, not a full collapse.

As of now, markets are not reacting because of politics alone, but more to the loss of visibility.

In past shutdowns, key data like jobs and inflation reports were delayed, making it harder for traders to price risk. Therefore, Bitcoin fell 9%, dropping from around $103,000 to $94,000, while altcoins slid 12%–25% due to lower liquidity.

If another U.S. government shutdown happens, the bitcoin and crypto market will see another short-term collapse.