Today, a whale completely closed its 15,000 ETH ($44.15 million) long position, earning a profit of $782,500, according to on-chain transactions flagged by market analyst Lookonchaion. As per the data from the analyst, the trader opened the long position three days ago, on November 25, 2025, when he deposited $10 million USDC into Hyperliquid and opened a 5x long leverage position on 15,000 ETH ($44.15 million). The investor’s recent move indicates robust confidence in the digital token. The position signals that the whale expected the Ethereum price to surge in the coming days or weeks.

What This Whale Knew That Other Traders Don’t

Ether’s price has recently been moving in a tight range and struggling to break above the crucial $3,112 and $3,152 resistance levels. Despite that, the whale’s huge long bet signals that momentum is about to return to the Ether market.

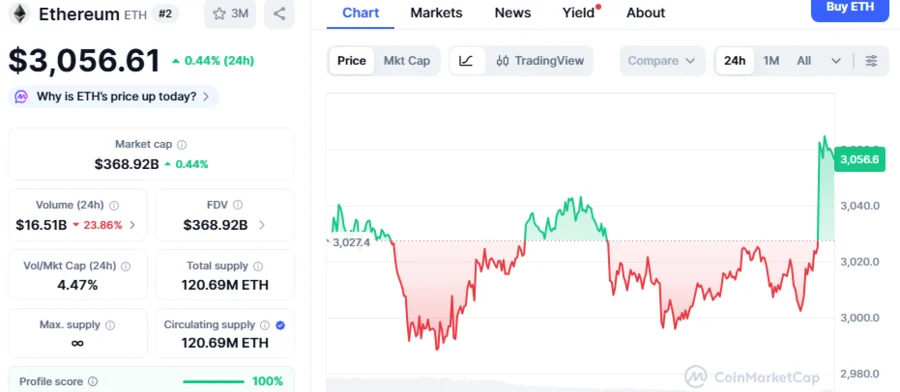

According to on-chain metrics, Ethereum’s recent downturn sent its price to $2,626, noted on Friday last week, November 21, a low witnessed four months ago on July 9. On Tuesday this week, November 25, the trader opened the long position when Ethereum was trading at $2,857, anticipating the token’s price to rise. He launched the long position shortly before last week’s price recovery. Over the past week, Ether gained 10.7%, climbing from a low of $2,626 to the current $3,056 level.

Trader’s accurate trading came after one of the cryptocurrency market’s most volatile periods, when Bitcoin plunged to a low of $80,659, and Ethereum dropped to $2,626 on November 21 last week. During that week, most crypto assets moved significantly lower as BTC, ETH, and several others all experienced heightened pressure from increasing macroeconomic uncertainties, declining derivatives conditions, heavy institutional outflows, and increasing risk-off sentiment across crypto assets.

Ether Gains Strengths as Exchange Reserves Fall to Multi-Year Lows

However, slight confidence is returning to the wider crypto market , reignited by end-of-year optimism. Bitcoin and Ethereum are among the outstanding performers over the past week. Their prices, which currently stand at $91,136 and $3,056, have been up 8.03% and 10.7%, respectively, in the last seven days. The improvement of crypto ETF inflows in the past days further indicates rising bullish conditions in the market.

Also, metrics from CryptoQuant today revealed that Ethereum reserves on centralized exchanges have drastically declined to multi-year low levels. Since early July, the Ethereum exchange supply has dropped significantly from 20.9 million ETH to the current 16.8 million level, according to data from the analyst. This means that whales are withdrawing ETH, decreasing sell pressure, and hinting that big moves are upcoming.