Stablecoins now exist on dozens of blockchains. USDC operates on 28 networks . USDT supports 13 blockchain protocols . USDe operates across 23 blockchains.

Because blockchains don't communicate directly. Moving stablecoins between chains requires architectural choices that have tradeoffs between decentralization, regulatory compliance, and operational control.

Here I'll explore three distinct approaches: Circle's Cross-Chain Transfer Protocol, Tether's multi-chain issuance model, and Ethena's synthetic design. Each reflects different assumptions about trust, control, and regulatory positioning.

The Cross-Chain Transfer Problem

Traditional bridges use two methods to move tokens between blockchains.

Lock-and-Mint (Wrapped Assets) : Users lock tokens on the source chain in a smart contract. The bridge mints wrapped versions on the destination chain. The original tokens remain locked. Bridge exploits have resulted in billions in losses . Users hold wrapped tokens rather than native assets. Reversing the process requires burning wrapped tokens to unlock originals. E.g., Locking ETH on Chain A to mint wrapped ETH (WETH) on Chain B.

Liquidity Pool-Based (Lock-and-Unlock) : The lock and unlock model is another common approach to bridging assets. It works by creating liquidity pools on both the source and destination blockchains. To transfer tokens cross-chain, assets are locked in the liquidity pool on the source chain and unlocked from the liquidity pool on the destination chain. Eg. Chainlink CCIP uses a lock and unlock mechanism through dedicated token pools to enable cross-chain transfers by locking tokens on the source chain and releasing them from a pool on the destination chain.

For more information, take a look at this article from Chainlink.

Both methods introduce inefficiencies. Users end up transacting with wrapped tokens or pool-based IOUs rather than the native asset.

Stablecoin issuers have developed alternatives that bypass these limitations. Their solutions reflect divergent philosophies about centralization and control.

USDC: Centralized Burn-and-Mint

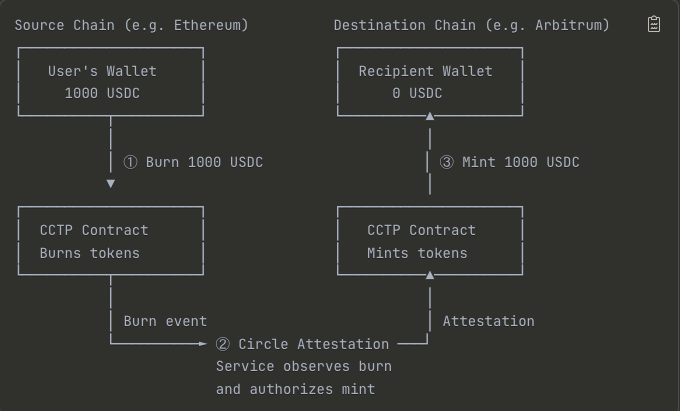

Circle developed CCTP (Cross-Chain Transfer Protocol), a permissionless onchain utility for moving USDC between blockchains through native burning and minting.

USDC moves between blockchains at a 1:1 ratio through native burn-and-mint. No wrapped tokens exist. No liquidity pools are required. Transfers complete quickly without multi-day withdrawal windows. From my experience, the transfer was completed in under 30 seconds. The USDC on each chain are native, issued by Circle, and backed by the same reserve assets.

Control Dynamics

Circle operates the attestation infrastructure. Circle maintains minting authority across all chains. Circle controls the protocol design.

For USDC holders, this centralization aligns with existing trust assumptions. Users already rely on Circle for reserve backing and regulatory compliance. The cross-chain architecture extends rather than expands that trust requirement.

Regulatory Positioning

Circle's model positions USDC as a regulated financial product. The company maintains direct relationships with banking partners and regulators. This approach prioritizes compliance and integration with traditional finance over decentralization.

Critics note that this creates a single point of failure. Circle's attestation service could experience downtime. Regulatory pressure could force Circle to freeze assets across all chains simultaneously. The architecture depends on one company's operational continuity.

USDT: Multi-Chain Direct Issuance

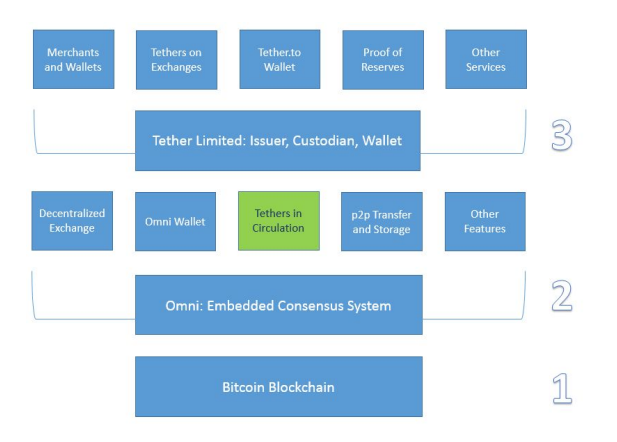

Tether issues USDT directly on 13 blockchain protocols without requiring cross-chain transfer infrastructure. Rather than building burn-and-mint systems like CCTP, Tether deploys and maintains administrative control over smart contracts on each supported chain. Each deployment operates independently.

The Architecture

Tether deploys separate token contracts on each blockchain. USDT on Ethereum is a distinct token contract from USDT on Tron or Avalanche. Each operates independently. The company maintains the ability to mint and burn tokens on each chain through their respective smart contracts.

When users want USDT on a specific chain, they either purchase it directly from an exchange that supports that chain, or they use Tether's official platform to deposit fiat and receive newly minted tokens on their chosen network. Moving value between chains typically happens through exchanges rather than through Tether-operated bridge infrastructure.

This was their original technology stack.

Operational Model

Tether's model separates token issuance from cross-chain transfers. The company focuses on maintaining reserve backing and issuing tokens on individual chains. Users handle cross-chain movement through external venues—primarily exchanges that maintain USDT liquidity pools across multiple networks.

This approach means Tether doesn't operate attestation services or manage cross-chain messaging. Each blockchain hosts independent USDT deployments. All share the same reserve backing, but transfers between chains happen outside Tether's technical infrastructure.

Reserve Structure

Tether maintains centralized reserves backing all USDT across all chains. The total circulating supply across every blockchain must equal or stay below the total reserves held. Reserve reports are published for transparency purposes and are published on a quarterly basis.

Tether Attestation Reports Q1-Q3 2025 Profit Surpassing $10B, Record Levels in U.S. Treasuries Exposure, Accelerating USD₮ Supply Amidst World’s Macroeconomic Uncertainty

— Tether (@Tether_to) October 31, 2025

Learn more: https://t.co/EH8ltqri27

Users trust that Tether maintains sufficient reserves regardless of which blockchain their tokens exist on. The reserve model creates unified backing despite fragmented technical deployment.

Regulatory Considerations

Tether's multi-chain issuance without integrated transfer infrastructure reflects its regulatory positioning. The company avoids building systems that could be characterized as money transmission between jurisdictions. By letting exchanges and users manage cross-chain transfers, Tether maintains that its role is limited to token issuance and redemption.

This creates distributed responsibility. If users lose tokens moving between chains through exchange transfers, Tether argues the exchange bears liability, not the stablecoin issuer. Regulators in different jurisdictions may view this distinction differently.

USDe: Synthetic Architecture

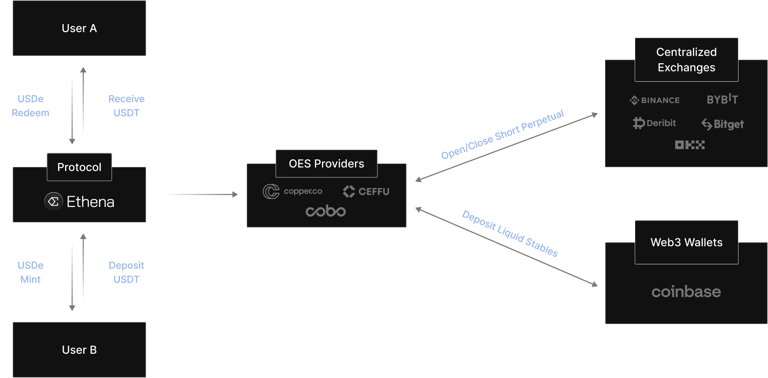

Ethena's USDe represents a third model. Rather than backing the stablecoin with cash reserves, USDe maintains its peg through delta-neutral positions in crypto derivatives markets.

How It Works

Decentralization Claims

Ethena positions USDe as more decentralized than reserve-backed alternatives. The protocol describes USDe as "crypto's first fully-backed, onchain, scalable, and censorship-resistant form of money" with "minimal reliance upon traditional banking infrastructure."

Ethena argues that fiat-backed stablecoins like USDC and USDT face risks because their reserves sit in regulated bank accounts that governments can freeze or seize.

This framing shifts rather than eliminates centralization. Ethena's team controls the derivatives positions that keep USDe stable. The protocol relies on centralized exchanges like Binance and Bybit for hedging. Exchange failures, hacks, or regulatory actions against these venues create similar vulnerabilities to the banking risks Ethena criticizes in traditional stablecoins.

Cross-Chain Implications

USDe's multi-chain presence relies on bridge infrastructure similar to other synthetic assets. The stablecoin exists natively on Ethereum but requires bridges or wrapped versions for other chains. This reintroduces the liquidity fragmentation and bridge risk that Circle's approach aims to avoid.

The synthetic design does enable rapid deployment. Ethena doesn't need to establish new banking relationships or regulatory approvals for each blockchain. For protocols prioritizing speed and regulatory distance, this matters.

Comparing Trust Assumptions

Each model asks users to trust different entities and mechanisms.

USDC : Trust Circle's operational security, regulatory compliance, and reserve management. Trust extends to Circle's attestation service and minting authority across all chains. Single point of technical and organizational control for cross-chain transfers.

USDT : Trust Tether's reserve backing and liquidity management across 13 independent blockchain deployments. Trust the exchanges or services used for moving value between chains. Risk distributed across multiple venues rather than concentrated in issuer-operated infrastructure. Less integrated cross-chain experience, but also less dependency on Tether's operational systems for transfers.

USDe : Trust Ethena's hedging strategies, exchange counterparties, and smart contract security. No direct fiat backing to audit. Depends on derivatives market liquidity and centralized exchange reliability.

None eliminates trust requirements. Each relocates them.

Regulatory Dependencies

The three approaches face different regulatory pressures.

Circle operates within traditional financial compliance frameworks. This provides clarity but creates vulnerability. Regulators can compel Circle to freeze assets or modify operations. Circle's USDC Terms explicitly state that Circle "may be required to freeze USDC and/or surrender associated USD held in Segregated Accounts in the event it receives a legal order from a valid government authority requiring it to do so." The centralized architecture makes enforcement straightforward across all chains simultaneously.

Tether takes a different approach but faces similar pressures. The company doesn't build its own cross-chain transfer systems—exchanges handle that instead. This creates distance between Tether and how tokens move between networks. But Tether still controls issuance and redemption on each chain, which means regulators can still reach them. Tether's legal terms explicitly allow "freezing or confiscation" of USDT and permit Tether to "seize and deliver your property to any applicable Government, law enforcement, or other authorities." Like Circle, Tether can freeze tokens and surrender them to governments when required.

Despite Ethena's positioning as a "crypto-native" alternative, its terms and conditions grant similar powers to block addresses and cooperate with authorities. Ethena can block USDe addresses "associated with illegal activity," report suspected violations to law enforcement, and "surrender associated assets held in the USDe Reserve" when ordered by government authorities. Like Circle and Tether, Ethena can freeze tokens and hand over assets to regulators.

What This Reveals

Cross-chain stablecoin architecture reflects issuer priorities more than technical constraints.

Circle's burn-and-mint model optimizes for regulatory compliance and operational control. The architecture ensures Circle maintains authority over USDC transfers across all chains through centralized attestation infrastructure. This serves users who prioritize regulatory legitimacy and integrated cross-chain experience over decentralization.

Tether's multi-chain issuance without integrated transfer infrastructure maintains flexibility and distributes operational complexity. The company issues tokens independently on each chain but lets external venues handle cross-chain movement. This serves users who value Tether's existing liquidity and market presence while accepting fragmented cross-chain experience and reliance on exchanges for transfers between networks.

USDe's synthetic design enables regulatory distance and rapid deployment. The protocol serves users seeking alternatives to traditional banking relationships, accepting the risks of derivatives-based stability mechanisms.

Future Implications

CCTP demonstrates that burn-and-mint architecture works for centralized stablecoin issuers who prioritize integrated cross-chain transfers. The model may extend beyond Circle. Other regulated stablecoin projects could adopt similar approaches, consolidating control over cross-chain infrastructure.

This raises questions about dependency concentration. As more value moves through centralized attestation services, what happens during operational failures? Do users accept concentrated control points in exchange for seamless cross-chain experience and regulatory clarity?

Alternatively, Tether's model shows that multi-chain presence doesn't require issuer-operated transfer infrastructure. Exchanges and users manage cross-chain movement, distributing operational complexity but creating fragmented liquidity and user experience. This approach may persist for issuers who prioritize flexibility over integration.

Synthetic models like USDe demonstrate how stablecoins can deploy rapidly across chains without traditional banking relationships. Better bridge security, improved synthetic stability mechanisms, or new cross-chain communication protocols could change the tradeoff landscape.

The burn-and-mint model proves centralized issuers can move assets between chains without traditional bridges. Whether this becomes dominant depends on regulatory evolution, user preferences for integrated versus fragmented cross-chain experiences, and whether decentralized alternatives can match the execution quality of centralized infrastructure.

Control over cross-chain transfers matters. These architectural choices will shape which stablecoins survive regulatory pressure and which maintain relevance as blockchain ecosystems fragment across dozens of networks.

Elsewhere

Podcast

Licensed to Shill – Why Central Asia; Why Now? ft. Anthony Howe (GFTN)

This week the Licensed to Shill panel dives into the dynamic world of Central Asia, a region rapidly emerging as a pivotal hub for trade and innovation. Anthony Howe from the Global Finance Technology Network (GFTN) joins us to explore the untapped potential of this region, particularly focusing on Georgia's strategic role in the middle corridor.

Tune in at blockcast.blockhead.co or on Spotify , Apple , Amazon Music , or any major podcast platform.

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .