After 43 days of frozen federal services, Washington is finally moving to reopen the U.S. government, and crypto traders are already tilting risk back on. The Senate approved a stopgap deal on Monday and the House is slated to follow today, a sequence that has lifted sentiment across risk assets and removed a major policy overhang on crypto liquidity.

History suggests reopening standoffs can be a tailwind; when the 2019 shutdown ended, it brought Bitcoin from the brink of death, giving it an immediate 8% boost, and started the path to its long-term recovery. That doesn’t guarantee a repeat, but it sets the tone as markets digest fresh regulatory headlines out of Capitol Hill and position for a Q4 bounce.

Presales have held up relatively well through the volatility because they operate on fixed pricing and a pipeline of catalysts rather than daily chart swings. With the shutdown’s drag easing and a clearer legislative path emerging, investors are rotating toward higher-beta, lower-cap opportunities that can re-rate on listing.

That’s the backdrop powering interest in Best Wallet Token (BEST) , the utility token of the Best Wallet ecosystem. With its presale in the final stretch and momentum building, the clock to November 28 listing is sparking genuine FOMO among buyers hunting the next breakout.

Will Markets Rebound as D.C. Reopens and Crypto Rules Take Shape?

The Senate’s shutdown-ending bill has already buoyed risk sentiment and set the stage for the House to pass it today, restoring federal pay and services and calming macro nerves. At the same time, the Senate Agriculture Committee published a discussion draft that would put the CFTC in charge of digital commodities while expanding consumer safeguards and clarifying self-custody rights.

That mix of macro relief and policy clarity is exactly what traders wanted into year-end, but it also benefits wallet infrastructure providers. In an X post, Best Wallet touched upon the US Senate’s draft, noting CFTC leadership on commodities and stronger consumer protections, while welcoming the support for self-custody and development.

If that direction stands, wallet-centric ecosystems look positioned to benefit first because fee and yield mechanics sit closest to end users. It is a timely tailwind to consider as BEST approaches its listing window.

The key point for presale hunters is that when uncertainty fades and rules solidify, capital typically flows back down the risk curve, lifting quality presales first. That dynamic helped post-shutdown in 2019, and could materialize gains for projects like Best Wallet this time around.

Self-Custody With a Suite of User-Centric Tools: Core Idea of Best Wallet

Best Wallet is a self-custody, multichain app that rolls wallet management, a DEX aggregator, and a staking hub into one interface. Users can hold and swap across Bitcoin, Ethereum, Solana, BNB Smart Chain, Polygon, Base, and more, while the in-app aggregator hunts competitive routes and yields without giving up keys.

Inside “Upcoming Tokens,” the app curates new sales and partner launches so users can research and participate from the same dashboard. This is where the BEST token ties the loop. Holding the token unlocks lower swap fees, boosted staking APYs, governance on ecosystem proposals, and priority access to vetted presales. The need for BEST at every step of the user’s journey creates a clear feedback flywheel between app growth and token demand.

The roadmap layers in Best DEX and payments integrations to deepen utility over time. The app is already live with staking and trading flows that make the token’s perks immediately tangible inside the product.

Analysts on the popular 99Bitcoins YouTube channel broke down why BEST could mirror or outperform previous success stories from its field. The case is straightforward: a fast-growing wallet with a native token that ties fee discounts, staking yields, and feature access into one flywheel tends to build sticky users and on-chain volume.

Final Stretch Before 100x? Why BEST’s Last-Round Metrics Matter

The numbers are doing the talking. Best Wallet Token is still fixed at $0.025935 in the final round, giving late buyers a clean entry before price discovery on listings. Fundraising has raced past $16.9 million and is closing in on the $17 million milestone, reflecting growing momentum into the cutoff. By the time you read this, that figure may already have tipped higher.

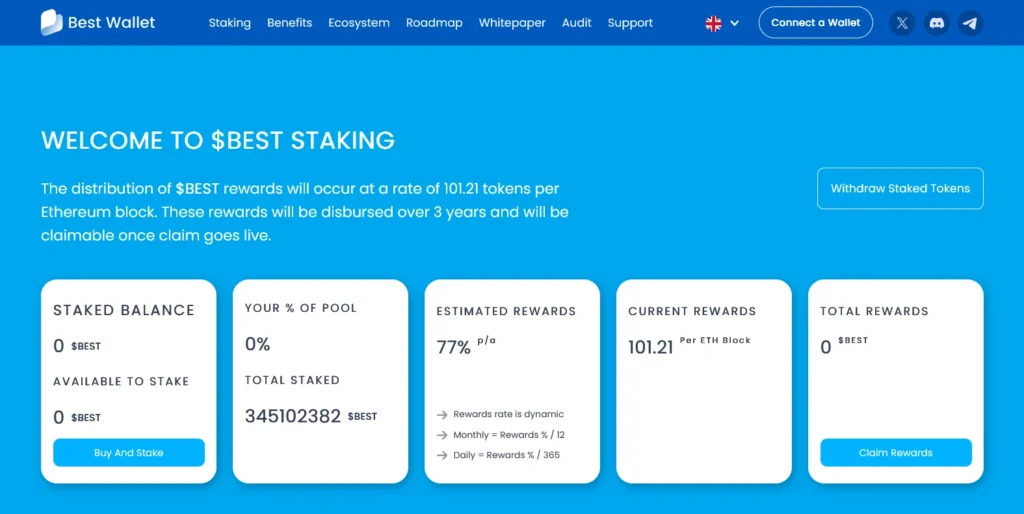

One of the core hooks is also a highly attractive staking yield. BEST can be staked directly from the presale with headline rates up to 77% APY, designed to bootstrap liquidity and retention inside the wallet ecosystem. That incentive has already pulled nearly 350 million BEST tokens into staking, tightening near-term float ahead of exchange debuts.

But the clock is the final catalyst. The presale ends on November 28, which concentrates demand in a clear window and aligns with friendlier macro tape as D.C. reopens and rulemaking firms up. Fixed pricing plus visible utility is a potent mix for first-wave revaluation once trading begins. If the risk-on tone fully develops, a wallet token with real usage, fee perks, and staking could lead the charge.

Visit Best Wallet Token Presale