Crypto Market Recap: October 2025

U.S. Government Shutdown Sparks Uncertainty

October started with a major shock for the U.S. economy. On October 1, 2025, the federal government shut down after Congress failed to agree on a new budget. Hundreds of thousands of federal employees were sent home, and many agencies stopped or slowed their work. As a result, key economic data, like labor reports and inflation numbers, stopped coming out.

This lack of information created even more uncertainty. The Federal Reserve had to make decisions without fresh data, while investors grew nervous about what might happen next. The shutdown also hit the economy directly, costing billions of dollars each week, lowering consumer spending, and increasing the risk of job losses as government spending slowed down.

As crypto, especially Bitcoin , becomes more connected to the U.S. financial market, these uncertainties quickly affect digital assets as well. The shutdown added pressure to risk assets, eventually leading to a drop in cryptocurrency prices. As long as the shutdown continues, it will remain the main focus in both economic and policy discussions, and its influence on the market will likely grow.

Once the government reopens, we can expect a short-term sense of relief across markets. However, the absence of clear progress on crypto regulation could limit recovery. If the overheated S&P 500 enters a correction phase, crypto might also move sideways or see a mild decline in response.

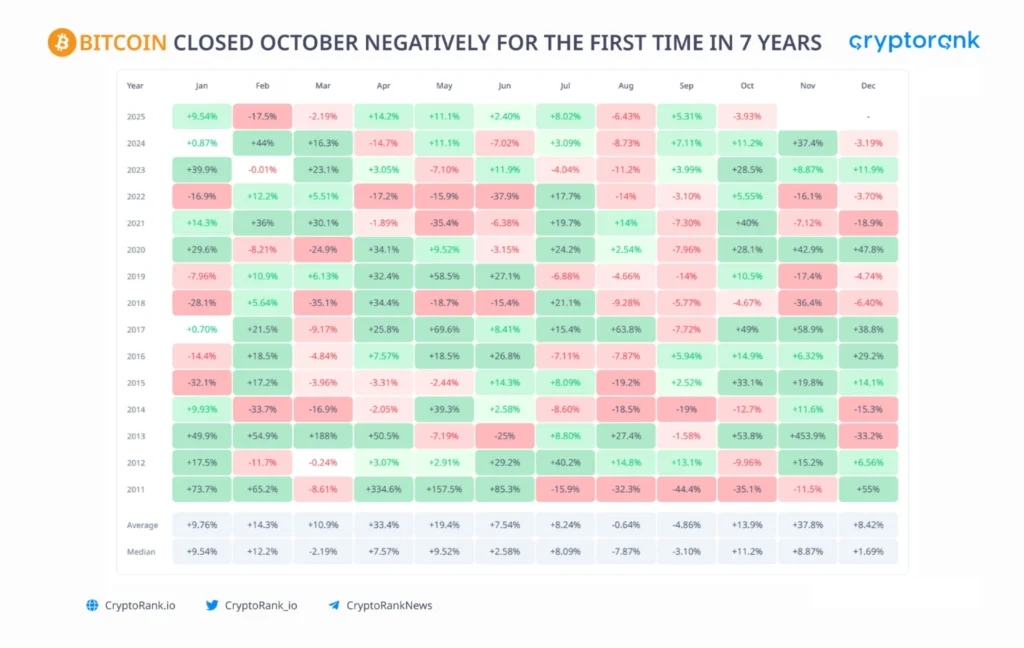

Bitcoin Breaks Its Seven-Year “Uptober” Streak

Traditionally a bullish month, October ended with Bitcoin’s first negative performance in seven years. There were several reasons for this shift. First, Bitcoin had already been rising for months, it grew steadily from April onward, with only a brief pause in August. After such a strong run, the market naturally needed a period of consolidation.A more direct cause was the U.S. federal government shutdown, which created uncertainty across all markets. The impact became especially visible at the start of November, when the prolonged shutdown and delayed economic data triggered another wave of risk aversion, putting additional pressure on Bitcoin and the broader crypto market.

The past month once again confirmed that Bitcoin is becoming increasingly tied to the global financial system. Its sharp reaction to the U.S. government shutdown proved this link clearly. As a higher-risk asset, Bitcoin moved faster and more violently than traditional markets, amplifying the effects of macro uncertainty.

Going forward, Bitcoin’s price dynamics appear closely connected to the U.S. economy, stock market performance, and any future developments in crypto regulation. As global liquidity conditions and American policy shifts evolve, Bitcoin is likely to mirror those changes even more directly, behaving less like an isolated digital asset and more like a volatile extension of the broader financial cycle.

Ethereum Faces Sharper Decline Amid Regulatory Uncertainty

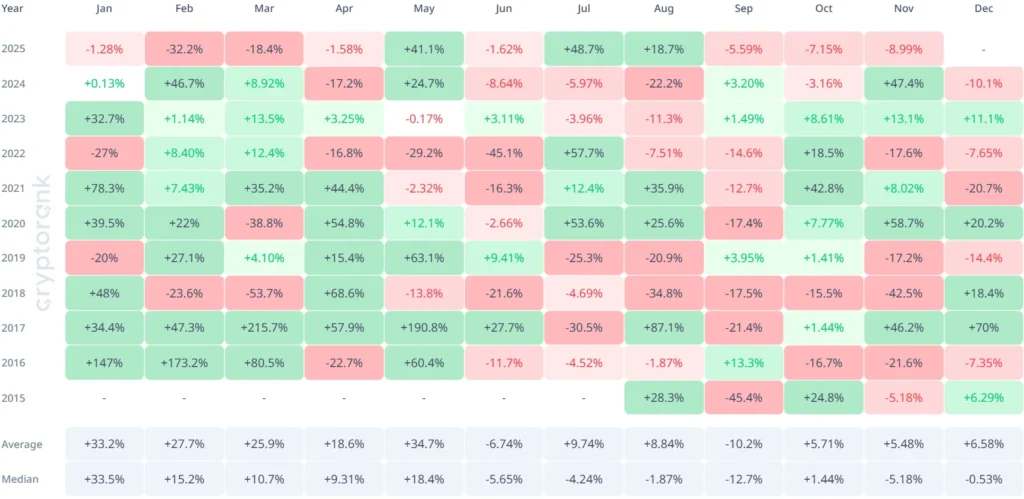

Ethereum , being a riskier asset compared to Bitcoin, saw an even sharper decline and showed greater volatility throughout the month. Over the past two years, Ethereum’s price behavior has been marked by extremes, it either gradually trends downward or experiences sudden monthly surges of 40% or more.

Historically, these strong price rallies have almost always coincided with major catalysts, such as anticipation of an ETF approval, Trump’s election victory, or the passage of the GENIUS Act. At this stage, regulatory developments remain the primary driver for Ethereum’s price outlook. Any significant policy move, particularly one related to institutional access or classification of digital assets, is likely to determine the direction of its next major trend.

The State of Blockchains

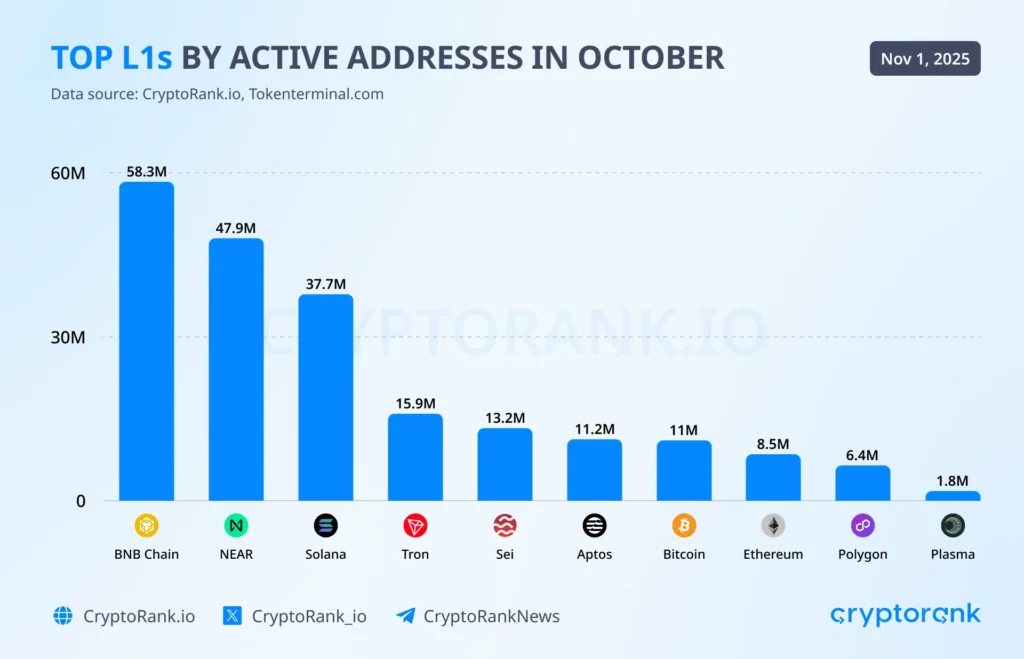

BNB Chain Keeps Leading in Active Addresses

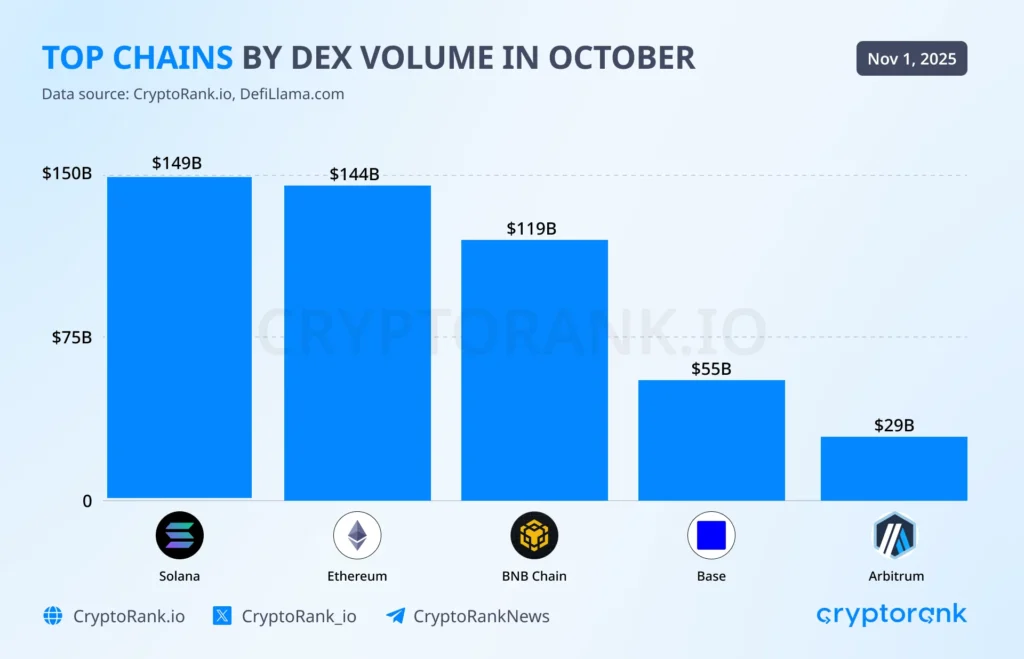

It’s been the best month for BNB Chain this year. Network fees reached $70.7M, the highest since January 2022. The chain also led in October by active addresses, reaching 58.3M users. It recorded $119B in DEX volume, the highest since October 2021, and set a new record in perps trading at $16.8B.

The surge in activity came from perps trading, driven mainly by Aster , a perp DEX that brought thousands of traders to BNB Chain. As users farmed the Aster airdrop, the network’s metrics skyrocketed.This liquidity influx reignited the memecoin sector – four.meme launchpad earned $44M in fees, surpassing its total historical revenue. Many forgotten tokens hit new ATHs, while new runners emerged. By the end of the month, the memecoin hype cooled off, but overall network activity stayed near peak levels.

Solana is the Top Chain by DEX Volume

October was a contradictory month for Solana . Network fees dropped to $27.7M, the lowest level since March. Active addresses dropped to 37.7M, which is far below the peak activity seen a year ago.

On the positive side, total transactions grew by 3% MoM, and DEX volume hit $149M, the highest since February and the top among all chains. Humidify became the #1 DEX by volume, surpassing Meteora, Raydium, and Orca.

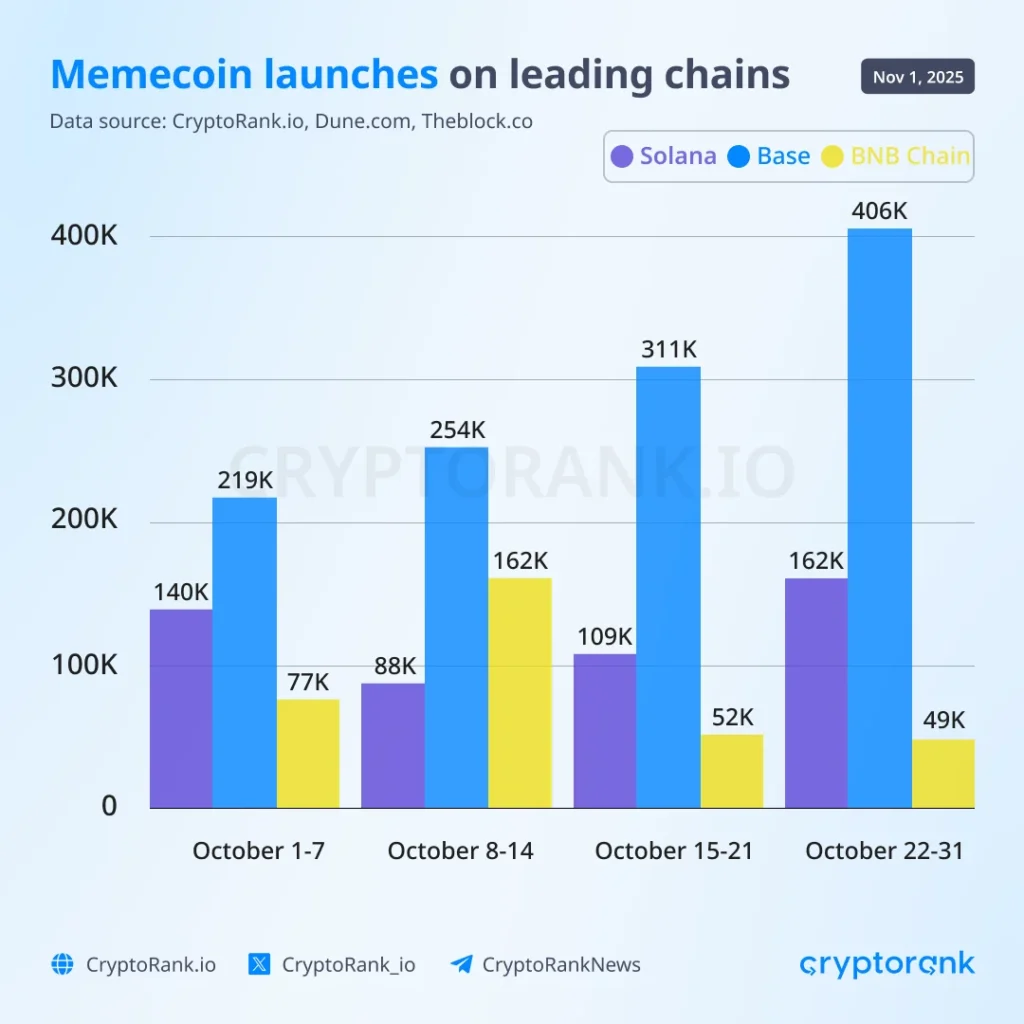

Memecoin activity was at a minimal level this year as traders shifted toward other chains (Base, BNB Chain) and sectors like perps trading and prediction markets. Pump.fun solidified its dominance as Solana’s leading launchpad, now holding 90-95% market share by volume, token launches, and active users.

Meanwhile, a surge in sandwich attacks raised concerns in the community. Around 400K attacks were recorded in October, affecting 200K users and resulting in nearly 20K SOL in losses. Jito banned 15 validators involved, but the impact has been limited so far.

The month also saw the launch of the Solana ETF by Bitmine, which attracted $199M in inflows. However, it had little effect on price, with SOL closing October down 10% overall.

Base Memecoin Activity Grows

Base showed strong performance in October. The network’s TVL surpassed $10B for the first time, while the stablecoin market cap reached $4.63B. Network fees climbed to $9.9M, the highest since January, and DEX volume hit a new ATH of $55B. Total transactions dipped 5% MoM but stayed near record levels. However, active addresses fell 8%, approaching their 2025 low.Memecoin activity surged across the network. With 1.19M new tokens created, Base became the #1 chain in token launches, overtaking both Solana and BNB Chain. Clanker , a Base-native token launch tool, earned $4.8M in fees, marking its second-best result ever. Despite the increased attention, most major Base memecoins dropped over 30% in price.

Speculation around the potential launch of a BASE token continued through October. While the Base team confirmed they are exploring tokenization, no official roadmap has been shared. JPMorgan forecasted that the upcoming Base token could reach a $34B market cap, citing a 2x rise in DeFi TVL over the past year and projecting up to $23B in new liquidity if an airdrop and token launch occur.

Avalanche hits highest transactions count since 2023

In October, the network recorded its highest monthly fees of 2025 at $1.64M. The number of transactions hit 61.5M, the highest level since 2023. Meanwhile, active addresses fell by around 10%, and TVL declined by about 15%.

In ecosystem news, Visa enabled payments in four different stablecoins on Avalanche. BlackRock’s BUIDL added $500M in RWAs, making Avalanche its second-largest chain after Ethereum. Additionally, Avalanche Treasury Co. announced a $675M merger with Mountain Lake Acquisition Corp. to form a publicly listed vehicle for AVAX exposure, with plans to list on Nasdaq in Q1 2026 pending approval.

Altcoin performers

ZEC saw rising institutional interest following Grayscale’s announcement of a Zcash Trust aimed at accredited U.S. investors. With privacy coins gaining renewed attention, investors turned to ZEC as an alternative to public chains. As a result, the token surged over 200% in October.

COAI jumped more than 300% after its listing on Aster, which unlocked liquidity and brought exposure to thousands of new traders. However, the rally was largely speculation-driven, fueled by social media hype and momentum around the AI narrative rather than fundamentals. The token is now sitting at $300M market cap.

DASH became another beneficiary of the privacy meta, breaking out of a five-year downtrend and attracting traders who had been waiting for a reversal. Technical upgrades added to market optimism. The token is now trading at its highest level since 2023.

H (Humanity Protocol) skyrocketed 153% in a single day on October 14 following signs of whale accumulation. The rally was supported by the project’s expansion in the Sui ecosystem and its increasing role in decentralized biometric ID solutions. However, the token later pulled back ~30% from its newly set ATH.

TAO gained 59% in October, standing out among large-cap tokens. The surge came amid growing institutional interest and the launch of the world’s first staked Bittensor Exchange-Traded Product (ETP) by Deutsche Digital Assets and Safello.

DeFi overview: Aave, Ethena, Pendle

Aave

Aave showed a strong resilience during a major market-wide stress event, automatically handling $180 million in liquidations with zero downtime or user disruption. This underscores the strength of its automated risk engine. The protocol continued to attract institutional-scale users and deepen integrations, serving as a crucial liquidity source and collateral platform for the expanding initiatives of both Ethena and Pendle.

After reaching an ATH TVL of $76B, Aave’s TVL pulled back to $63B following a broader market correction. For the first time ever, Aave generated over $100 million in monthly fees, totaling $102.6M. The upcoming V4 mainnet scheduled for late Q4 2025 is going to strengthen Aave’s position as the leading DeFi lending protocol.

Ethena

Ethena went through a major stress test in October when USDe briefly lost its peg on Binance due to an external oracle malfunction. The peg was quickly restored, but the circulating supply dropped from 15B to 9B over the month. Later, during a broader market downturn and heavy liquidations, Ethena successfully handled another stress event — its mint and redeem functions operated without interruption, processing $2B in redemptions within 24 hours.

The protocol expanded its integrations, launching deeper collaborations with major DeFi money markets such as Aave and Pendle to diversify collateral and enhance cross-protocol liquidity. Additionally, Ethena introduced JupUSD, the native stablecoin of the Jupiter ecosystem, built on its Stablecoin-as-a-Service stack. The project also transitioned the USDtb smart contract to Anchorage Digital, making it the first federally regulated stablecoin issued under the GENIUS Act.

Pendle

Pendle launched new “Agentic DeFi” strategies in collaboration with Giza Tech (Pulse), INFINIT Labs (Plasma), AFI Protocol, and Symphony, introducing advanced automated yield products. Institutional recognition also grew, marked by the launch of the Pendle ETP on the SIX Swiss Exchange by 21Shares – a major step toward bridging DeFi yields with traditional finance. Pendle’s new Boros product for trading funding rates on centralized and decentralized exchanges reached $2.83B in trading volume and $4.7B in open interest within 3 months.

Perp DEX Wars

The battle between major perp DEXs has intensified as new players gain traction. The sector has evolved from Hyperliquid dominance into a highly competitive field.

Hyperliquid still led October by trading volume at $308B, but rivals trail closely. Lighter finished October in second place, with $272B, followed by Aster with $260B. Interestingly, during the last week of October, both Lighter and Aster outperformed Hyperliquid as its volumes dropped to July’s lows. However, with $9B in open interest, Hyperliquid remains unmatched. It’s is more than all other players have combined. By the way, both Hyperliquid and Aster also entered the top 10 projects by monthly fees.

The October market crash served as a stress test, showcasing Hyperliquid’s robust infrastructure, which stayed fully operational during mass liquidations. Lighter and Aster grew fast, but we’ll have to see if they can keep it up in the long run, as they rely on incentivized traffic (both have points programs, while Hyperliquid doesn’t).

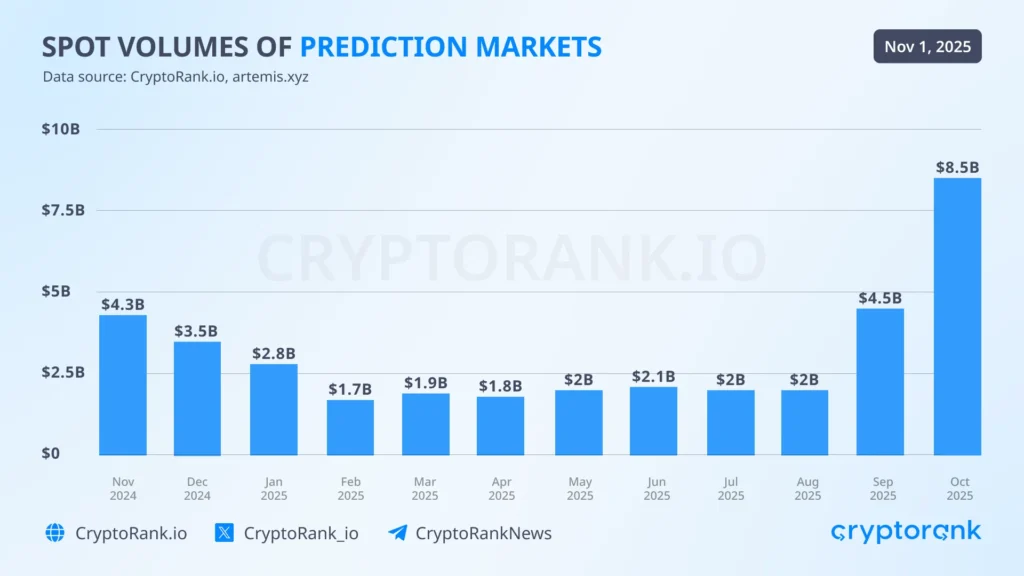

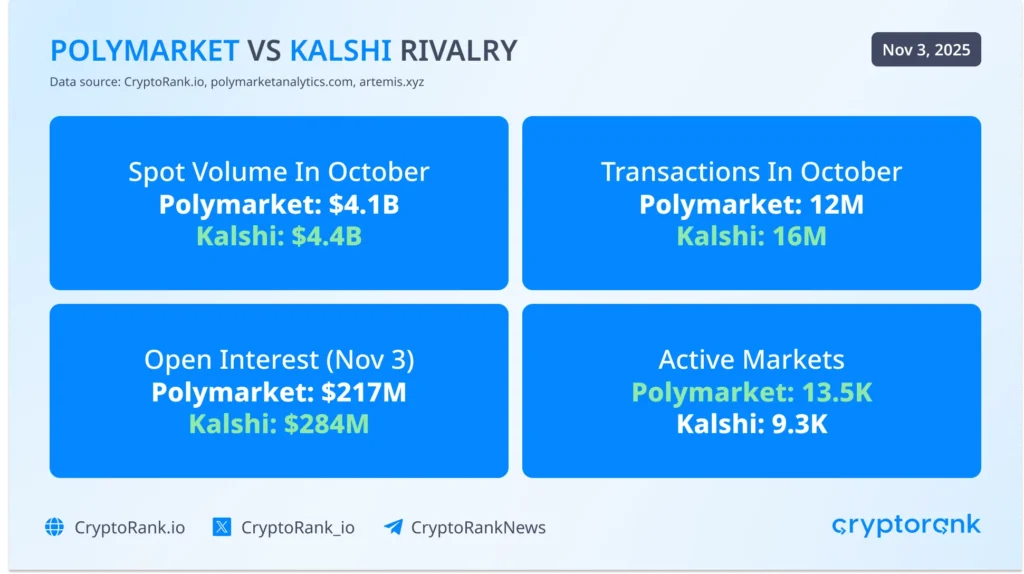

Prediction Markets: Polymarket vs Kalshi

In October, prediction markets became the top narrative, dominating CT mindshare. The total monthly trading volume hit a new ATH of $8.5B, surpassing the U.S. elections level. The number of traders also reached an all-time high of 478K. The rivalry between Polymarket and Kalshi only intensified.

Polymarket is now focused on regulatory steps to legally expand into the U.S. market. Major news came with the announcement of a $2B strategic round backed by Intercontinental Exchange (ICE), the parent company of NYSE, at a $9B valuation. Another big update was the confirmation of the POLY token launch coming in 2026, which will include an airdrop for active users. The news boosted excitement in the crypto community and drove Polymarket activity higher.

Kalshi also announced a new investment round in October – a $300M Series D at a $5B valuation, led by Sequoia Capital and Andreessen Horowitz. In total, the project has raised $565M to date. Its recent partnership with Robinhood has been a game changer, allowing users to trade NFL and college football markets directly through the broker. The “Sports” category now makes up over 90% of Kalshi’s volume. To diversify, the platform is expanding into Polymarket’s territory, crypto, and has onboarded notable CT influencers like John Wang, ICO Beast, 0xUltra, and others.

Now, let’s break some numbers. Kalshi hit $4.4B in volume vs Polymarket’s $4.1B. The gap is pretty small, compared to September, when Kalshi was a clear winner – $2.9B vs $1.6B. Again, most of Kalshi volume comes from sports, whereas Polymarket has it distributed among several categories: sports, politics, and culture. Kalshi also leads in transaction count: 16M vs 12M. As of November 1, it’s Polymarket’s $200M in open interest against Kalshi’s $296M.

Other prediction apps can’t get anywhere close to the numbers demonstrated by these two. Of new launches, it’s worth mentioning Opinion Labs , a prediction market backed by YZi Labs. The access is limited now, though, so keep an eye out for updates.

Bitget Integrates Morph Chain to Strengthen On-Chain Ecosystem

According to Bitget, the collaboration advances its product offerings and reaffirms its objective to...

Milk Mocha’s $HUGS Presale Launches After Whitelist Sellout: Meet 2025’s Most Heartfelt Crypto Movement

Discover how Milk Mocha’s $HUGS presale transforms affection into blockchain value. Experience a pro...

Best Crypto Presales of 2025: Tapzi vs BlockchainFX vs BlockDAG

Tapzi, BlockchainFX, and BlockDAG headline 2025 presales: skill based gaming, fee sharing trading, a...