The post AAVE Price Prediction 2025: Can Chainlink ACE & DAO Buyback Save AAVE From a $150 Dip? appeared first on Coinpedia Fintech News

AAVE price prediction 2025 turns increasingly optimistic as the protocol continues to strengthen its fundamentals through new integrations and strong financial performance. The latest partnership with Chainlink and a $50 million DAO buyback highlight how Aave is evolving from market corrections toward a more sustainable, institution-ready DeFi ecosystem.

Aave Horizon Integrates Chainlink ACE for Institutional-Grade Compliance

Aave’s institutional lending arm, Aave Horizon, has announced a major step forward in compliance and on-chain governance by integrating Chainlink’s Automated Compliance Engine (ACE). The new integration allows Aave to validate identity and policy data at the transaction level, ensuring that tokenized asset markets operate within issuer and regulatory frameworks.

Through Chainlink ACE, Aave can offer secure, compliant-focused lending environments for institutional participants. This represents a pivotal moment in the DeFi sector, where decentralized protocols are increasingly bridging the gap between crypto and traditional finance (TradFi).

The move also signals Aave’s proactive stance in advancing DeFi innovation, which ensures that it remains at the forefront of blockchain adoption. This integration strengthens both AAVE crypto and Chainlink’s position as key players that are powering regulated, and scalable on-chain markets.

DAO Buyback and Robust Fundamentals Reinforce Market Confidence

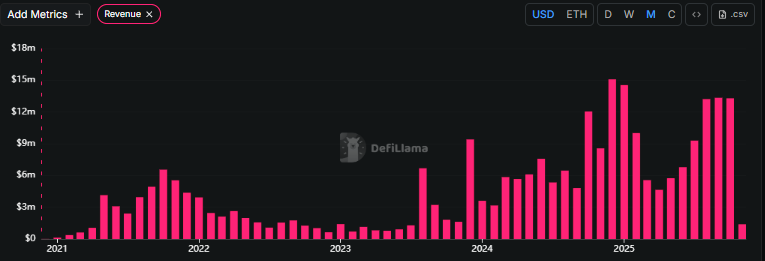

According to DefiLlama data, Aave DAO recently launched a $50 million annual buyback program a decision made possible by the platform’s strong revenue base. Over the past month, Aave generated $98.3 million in fees and $12.6 million in protocol revenue, while maintaining a total value locked (TVL) of $35 billion.

Such consistent growth demonstrates Aave’s long-term stability, distinguishing it from speculative projects. The buyback program, funded through protocol profits, aims to strengthen the ecosystem while rewarding token holders.

These indicators support a bullish AAVE price forecast 2025, reflecting a maturing DeFi protocol built on sound financial mechanics rather than hype.

Technical Setup Points to $150–$160 Support Before Potential Reversal

Despite strong fundamentals, the AAVE price today has faced notable pressure amid broader crypto market volatility. On the AAVE price chart, the token has seen a series of corrections, but analysts suggest that this movement reflects a healthy retracement rather than weakness.

Key support sits in the $150–$160 range, aligning with a long-standing upward trendline that has held since 2023. If this level holds, a reversal could propel AAVE price USD toward $240, with potential upside to $341 in the near term. A decisive break above $341 could open the door for a rally toward $446–$538 by year-end.

This setup, combined with institutional integration via Chainlink ACE and DAO-driven sustainability measures, makes the AAVE price prediction 2025 particularly compelling for investors looking beyond short-term volatility.

![Top 5 Crypto PR Agencies for AI Discovery [With Verified LLM Visibility]](https://image.coinpedia.org/wp-content/uploads/2026/02/24220822/ai-blockchain-1024x536.webp)