Arthur Hayes Outlines Why Zcash Could Surge To $10,000–$20,000 Fast

Arthur Hayes thinks Zcash can move an order of magnitude faster than most investors expect—and he spelled out why in a Coin Bureau interview released on November 3.

The former BitMEX CEO ties the new Zcash bull case to a three-part story that mixes technical maturation, visible shifts in on-chain behavior, and a looming supply inflection. “I think that 10% to 20% of the value of Bitcoin quite quickly is something that Zcash could achieve,” he said—an estimate that, at current Bitcoin prices, translates to roughly $10,000–$20,000 per ZEC.

Why Zcash Could Skyrocket To $10,000-$20,000

For Hayes, the technology is no longer the 2016 experiment that divided the market over ceremony theater and cryptographic trust. He recounted being “deep into Zcash in 2016” when BitMEX listed a pre-genesis futures market and spot prices briefly printed around “$3,000 a coin on Poloniex” before supply filled in.

What’s changed, he argues, is the removal—by protocol upgrades—of the original single biggest credibility drag. “One of the big issues with Zcash back then was this trusted setup issue… but essentially, I think it was the Halo 2 upgrade recently removed or maybe a few years ago removed that trusted setup issue.” That, in his telling, reframes Zcash from a clever but encumbered R&D project into a privacy asset whose cryptography now clears the institutional sniff test.

He couples that with direct user-level experience. Hayes says he installed Zashi, Zcash’s flagship wallet, and used Near Intents flows to shield and swap, which he likened to an industrial-strength mixer. “When you do that, it’s essentially like Tornado Cash on steroids,” he said, emphasizing that the resulting output asset “appears, but it’s not linked to any other transaction.”

Costs remain a friction—“It’s definitely not cheap yet”—but he points to trend data he has reviewed showing a secular rise in actual privacy usage: “the amount of shielded transactions is approaching I think 30%, up from like a few percentage points when I cared about Zcash a long time ago.” In other words, the privacy feature set is not just theoretically stronger; it is being used.

The demand narrative rests on a simple claim: in the age of on-chain forensics and AI-enabled pattern recognition, true cash-like privacy is a product with differentiated utility. Hayes draws a sharp line between pseudonymity and privacy. “I believe in privacy coins… I think Bitcoin being synonymous is actually a good thing because I want to be able to track Bitcoin, but I also want to have internet cash where there is no traceability of that.”

He contrasts Zcash with Monero’s recent headlines, citing reports that “the Japanese authorities were able to deanonymize Monero by… linking together different disparate parts of some information.”

Scarcity is the third pillar. Hayes flags the Zcash halving “coming up in a few weeks, November,” framing it as the timing catalyst that could supercharge reflexivity if investor attention and liquidity arrive in tandem. The supply cut is not the entire story for him—he dismisses halving dogma in Bitcoin—but he does view a synchronous demand narrative plus a mechanical issuance drop as unusually potent for a small-float asset when a privacy bid is already rising on-chain.

Liquidity and access are precisely why he sees the setup as asymmetric. Zcash is not broadly quotable, which is a risk and an opportunity. “I hit up… eight or nine OTC brokers. Only two brokers would quote me Zcash,” he said, describing how hard it was to acquire size through traditional venues. He expects that, if the price begins to trend, the path will run through permissionless rails rather than regulated exchanges. “If the price rises high enough… I can buy it on one of these decentralized exchanges and that’ll be how you really get access… just like how Bitcoin was back [then].”

Hayes also addresses the change in his own posture, including what catalyzed it. He credits a dinner during Token2049 with Naval Ravikant, who “started shilling me on Zcash,” prompting him to push past his 2016-era objections and re-underwrite the protocol. “I bought a few million bucks on the spot at that point,” he said, adding that he kept buying “even though I bought it after the 80% pump when Naval sent out that tweet.”

Hayes believes the upside can compress into weeks rather than years. In his words: “I’ve bought a lot of it… I’m still buying it. I think that this is probably going to be one of my better trades of the cycle.”

At press time, ZEC traded at $464.

Analyst Reveals What Ripple’s Latest Launch In The US Means For The XRP Price

Ripple’s latest acquisition has firmly positioned the company within the heart of the US financial m...

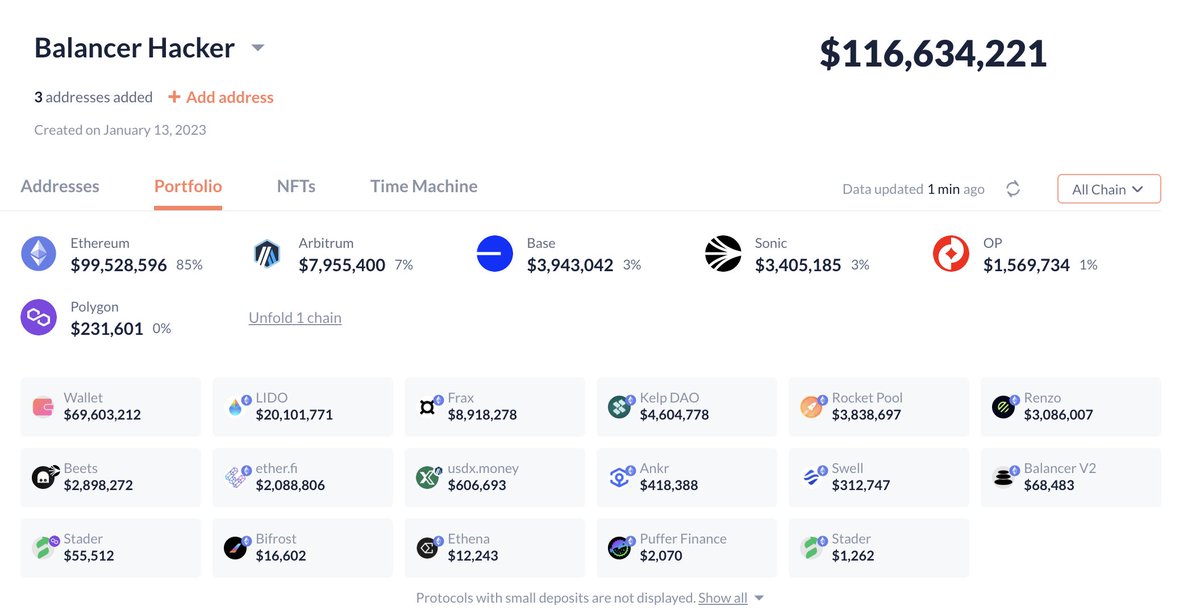

Balancer Hacker Now Converting Loot to Ethereum: Stolen Funds Surge To $116.6M

Balancer, a major DeFi protocol, has suffered a significant exploit, with approximately $116 million...

Privacy Coins Comeback: $25B Market Cap Milestone Sparks Bullish Hopes for Monero

Privacy-focused cryptocurrencies, such as Monero, are roaring back, with the total market capitaliza...