Poain Focuses on the Next Hot Trend: Digital Asset Strategy Analysis When ETH Price Hovers Around $4.7K

Ethereum’s Price Surge Signals a New Market Cycle

Ether (ETH) is once again in the spotlight of the global crypto sphere with its prices ranged about 4,700, the last time observed at the beginning of 2022. This revival is an indication of renewed investor confidence, a rise in the number of users of decentralized finance (DeFi), and a gradual adoption of technology of Ethereum in the financial systems of the real world.

With institutional funds flowing back into the crypto market, traders are shifting their focus from speculation to strategic digital asset positioning . The question dominating analyst discussions today is: Can Ethereum sustain its momentum beyond $4,700 — and what strategies will thrive in this new digital asset phase?

Market Overview: Ethereum Tests a Major Resistance Zone

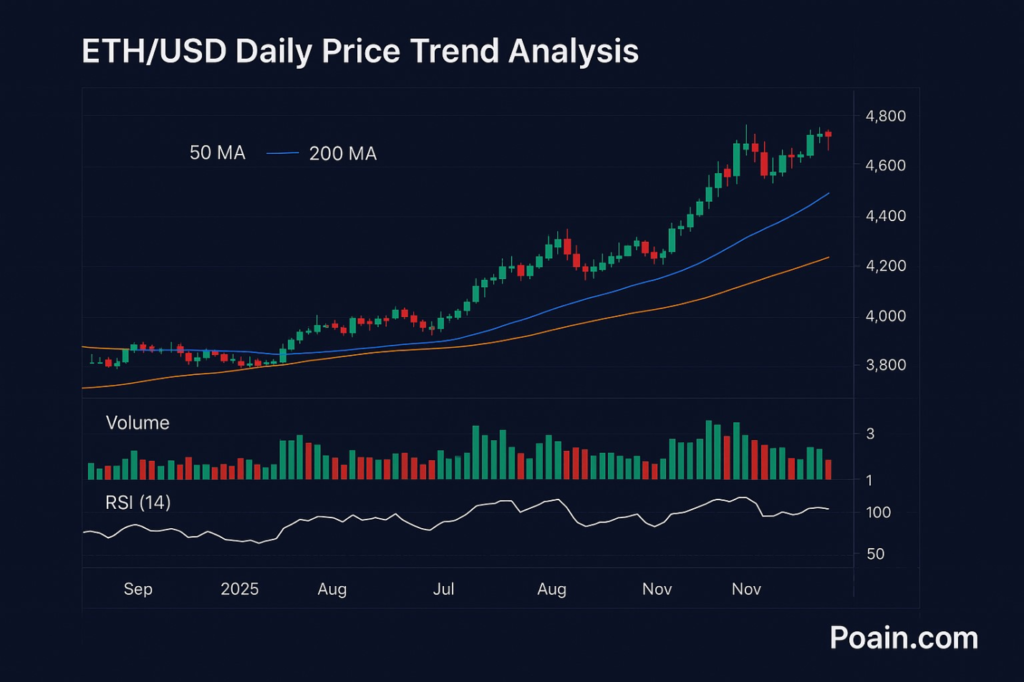

ETH/USD Daily Price Trend Analysis

Description:

The graph of candlesticks shows a consistent upward trend of Ethereum since September reaching $4,700 by the beginning of November 2025. The 50 day moving average (blue) is above the 200 day average (orange) making a robust bullish crossover. The volume of trade has gone up by a margin of more than %18 percent, and the RSI is at 63, and it is under the range of overbought.

Analysis:

The technical construction of Ethereum indicates the continued bullish trend. The golden crossover of the moving averages and the volume of trading on the rise indicate accumulation by the retail and institutional investors. The levels of RSI indicate that the uptrend has been healthy and there are still prospects of the uptrend to appreciate before a correction period sets in.

Institutional Momentum: The Quiet Force Behind the Rally

Etherium is still affected by institutional accumulation in its long-term direction. The number of hedge funds, decentralized autonomous organizations (DAOs), and large staking pools are increasingly buying ETH and are hoping to capture a place before the next market explosion.

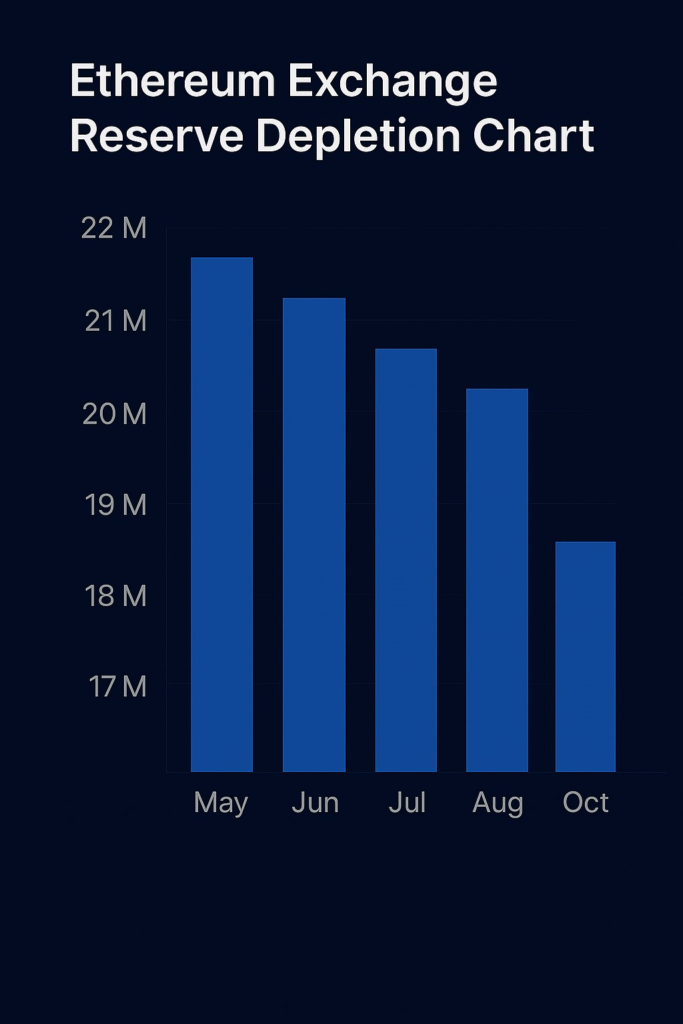

Ethereum Exchange Reserve Depletion Chart

Description:

A six-month bar chart tracks Ethereum exchange reserves declining from 22 million ETH in May 2025 to 17.4 million ETH by late October 2025 .

Analysis:

A dwindling reserve of exchange is usually an indication of long-term trust. As ETH is exchanged to personal wallets or staking agreements, it decreases the burden of selling at once, a positive indication. This trend of withdrawal by the institutions is in line with growing on-chain activity of Ethereum, which is consolidating the arguments in favor of a possible break out of the price above $4700 dollars.

AI-Powered Market Insights: Redefining Digital Asset Strategy

In the modern, high-paced cryptospace, artificial intelligence (AI) has become the winning point when it comes to finding profitable opportunities. The high-order AI tools have the ability to read through intricate patterns of data, sentiment trends and liquidity flows which might not be captured in the traditional approaches.

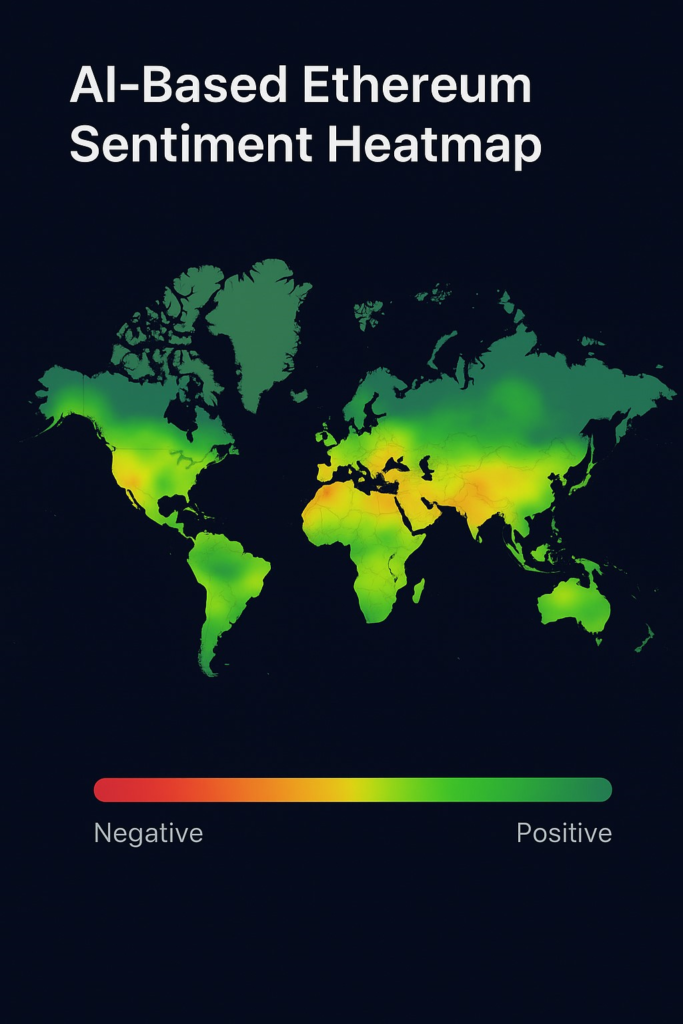

AI-Based Ethereum Sentiment Heatmap

Description:

A heatmap of the world Ethereum sentiment is plotted. The combined social media, trading and blockchain analytics data demonstrate that there exist high positive sentiment (green clusters) in North America and Europe, and moderate optimism (yellow zones) in Asia.

Analysis:

The AI-based sentiment models created by Poain analyze more than 100,000 data entries per day and determine an early sign of trend reversals. The sentiment spike is linked to massive capital inflows to Ethereum-linked exchange-traded funds and staked systems. This AI forecasting and market psychology converging will assist investors in making decisions based on data and not speculation at the right time.

New Investment Change: Multi-Asset and Staking Diversification.

Diversification has become a critical risk management model in digital assets. Today, investors are integrating Ethereum exposure and Layer-2 tokens, as well as staking assets to balance the growth potential and the income stability.

Emerging Investment Trend: Multi-Asset and Staking Diversification

ETH vs. Layer-2 and Staking Yield Comparison

Description:

A comparative performance chart highlights the 30-day return trends:

- Ethereum (ETH): +12%

- Arbitrum (ARB): +8%

- Polygon (MATIC): +6%

- ETH 2.0 Staking Yield: 5.1% annualized

Analysis:

Etherium is the main source of growth, and Layer-2 networks, such as Arbitrum and Polygon, offer scalability and stable returns. This together with ETH 2.0 staking will provide balanced portfolios that can survive the volatility. The algorithmic system developed by Poain determines the performance and liquidity of assets in order to suggest the best allocation ratios in real time by analyzing their correlation with each other.

Poain Dashboard Simulation: Smart Data, Smarter Decisions

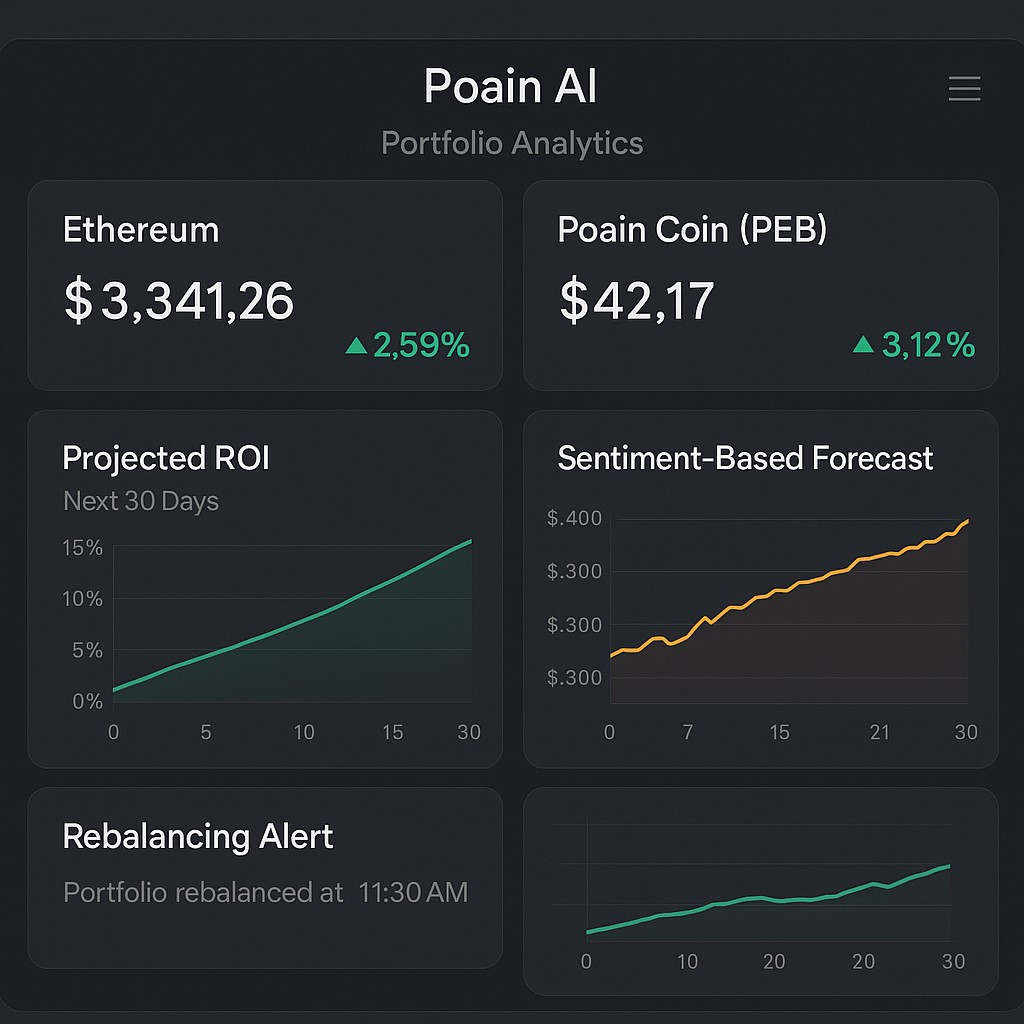

Poain AI Dashboard Simulation

Description:

A sophisticated dashboard with Ethereum and Poain Coin (PEB) portfolio analytics. Projection of ROI curves, real time rebalance alerts, and predictive charts using sentiments are projected on the screen, and this indicates possible trends of growth within the next 30 days.

Analysis:

The dashboard created by Poain represents the combination of AI and blockchain technology. It transforms complex data sets into actionable insights, enabling investors to track performance, manage risks and execute automated strategies depending on the current conditions. As Ethereum is volatile, this smart system turns uncertainty into an opportunity – with its price, the system offers certainty by offering clarity.

About Poain BlockEnergy Inc

Poain BlockEnergy Inc Poain BlockEnergy Inc is a developmental blockchain analytics and investment technology firm working to reshape the way people and institutions interact with digital assets. The company focuses on pre-selling and staking Poain Coin (PEB) in sustainable and AI-enhanced growth and thus, a utility token.

Combining the accuracy of blockchain with artificial intelligence, Poain provides innovative tools that enable users to make informed choices in terms of making investments based on the data. It aims to develop a clear, efficient, and intelligent financial ecosystem with the greatest investor value in all market stages.

Explore Poain’s innovative ecosystem at Click on Link .

Conclusion: The Era of Intelligent Investment Has Arrived

The fact that Ethereum has stabilized at the price of approximately 4,700 dollars represents not only a price breakthrough but also a shift in the analytical and managerial approach towards the digital assets in question. With the coming of AI-based intelligence replacing the use of traditional market tools, investors will have access to more insights, predictive analytics, and automated accuracy.

PoainBlockEnergy Inc is at the leading position of this change – taking investors into a smarter, more secure and informed decision. The world of blockchain finance is rapidly developing, and the individuals who use technology and data are no longer the players, but the pioneers of the financial revolution to come.

Learn more or join the next wave of intelligent digital investing at here .

Media Contact:

Email: info@poain.com

Website: https://poain.com

This article is not intended as financial advice. Educational purposes only.

Top Crypto Events to Unfold in November’s 1st Week

The top crypto events of the week include “TRUST Summit 2025 NYC,” “SmartCon 2025 NYC,” “Blockchain ...

Upcoming Meme Coins Are Dead? Why Noomez ($NNZ) Partner Airdrops Offer Real Utility

Noomez ($NNZ) revives meme coins with Partner Airdrops, real rewards, and on-chain transparency. Joi...

The Best Crypto Presale of 2025? Why Digitap ($TAP) is Dominating BlockchainFX and Pepenode

Digitap ($TAP) leads 2025’s crypto presales with real utility, a live No-KYC Visa card, and growing ...