Dogecoin’s price is back at a crucial line. It’s testing the $0.168 area for a second time since mid‑April. A clear break could send the meme coin spinning lower. Bulls and bears are watching every tick.

Key Support Under Scrutiny

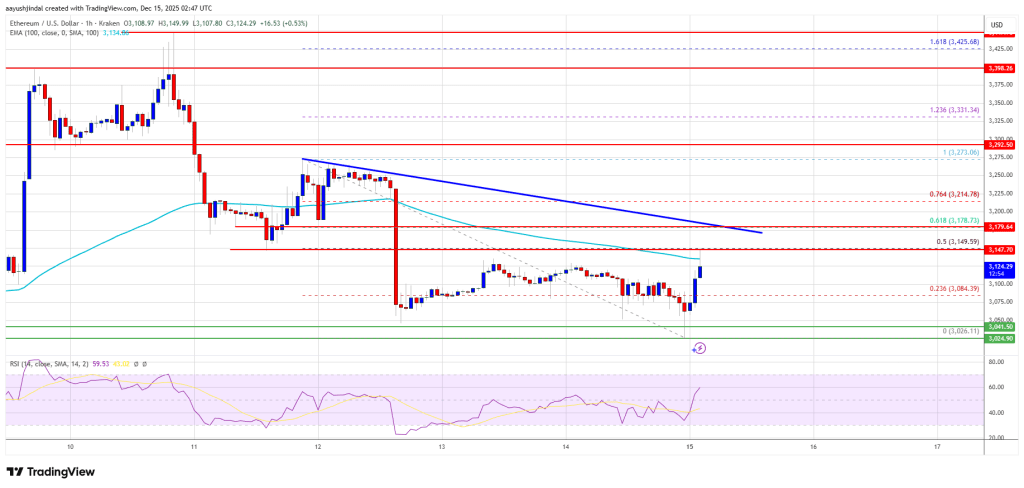

According to crypto expert Ali Charts, Dogecoin fell roughly 30% from its mid‑May high. That slide brought it down to the same $0.168 mark that held as support last April.

If prices drop below that level on a weekly close, there are hardly any bids to slow the fall. Below $0.168 lies what traders call a “gap area,” where past buying activity was sparse. That could open the door to steeper losses and fast moves.

Cup And Handle Pattern

Based on reports, the current chart forms part of a four‑year cup‑and‑handle setup. The lower boundary of a symmetrical triangle sits right where the handle meets its cup. A clean break above the triangle’s upper trendline would point to a target near $0.75.

#Dogecoin $DOGE must hold above $0.168 to avoid a 30% price drop! pic.twitter.com/PDhqo7fpcK

— Ali (@ali_charts) June 15, 2025

That projection comes from the 1.618 Fibonacci extension of the cup’s depth. Hitting $0.75 would mean a 350% gain from today’s levels.

Momentum Indicators Signal WeaknessMomentum readings have lost much of their shine. After a brief golden cross in May, the 50‑day moving average slipped under the 200‑day in early June. The MACD line is widening beneath its signal, hinting at longer‑term selling pressure.

The RSI sits at 42, under the neutral 50 mark, and drifting lower. Under 50 on the RSI often points to more sellers than buyers. With those readings turning sour, bulls need a strong bounce around $0.168 to stay alive.

ETF Decision Could Swing Sentiment

ETF Decision Could Swing Sentiment

All eyes now turn to June 15, when US regulators may rule on a spot Dogecoin ETF . Approval would let traditional money flow in from big funds.

A thumbs‑down or a delay, on the other hand, could spark fresh sell‑offs. That decision could make or break the next leg of Dogecoin’s move.

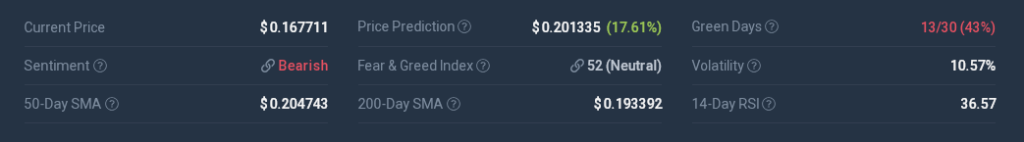

According to CoinCodex data , Dogecoin has recorded 13 out of 30 green days over the past month, with price swings of about 10.57% on average.

Their forecast pegs DOGE at $ 0.20 by July 18, a 17% rise from current levels. Market sentiment sits in the neutral zone, and on‑chain signals aren’t flashing clear buy or sell warnings.

This week’s action around $0.168 will tell us if Dogecoin can steady itself. Holders and traders should watch volume, weekly closes, and that looming ETF call. If support holds, we may see a rebound.

If it breaks, lower levels could come into view fast. Either way, Dogecoin is at a make‑or‑break moment—and everyone will be listening for the next big clue.

Featured image from Unsplash, chart from TradingView