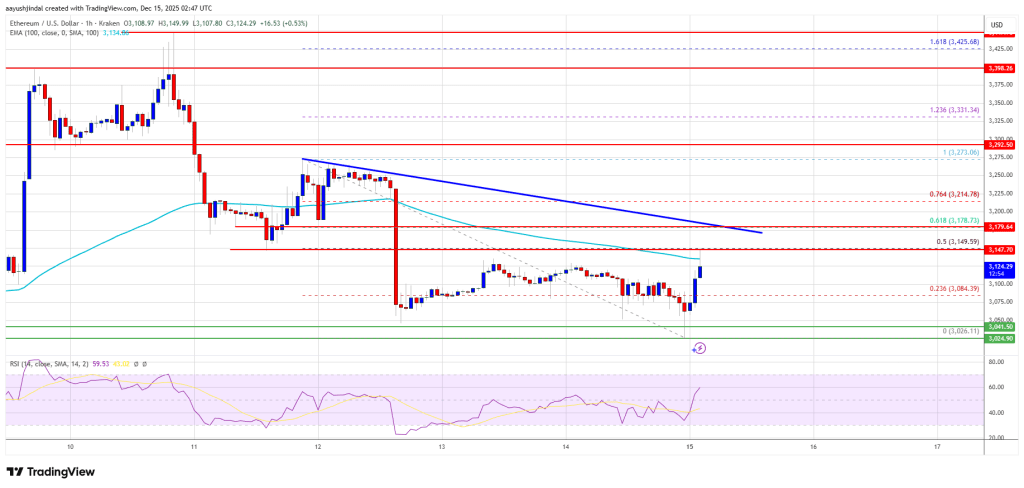

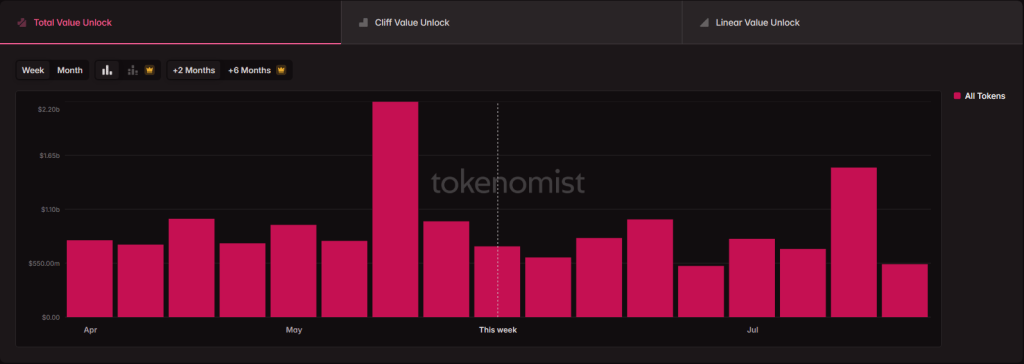

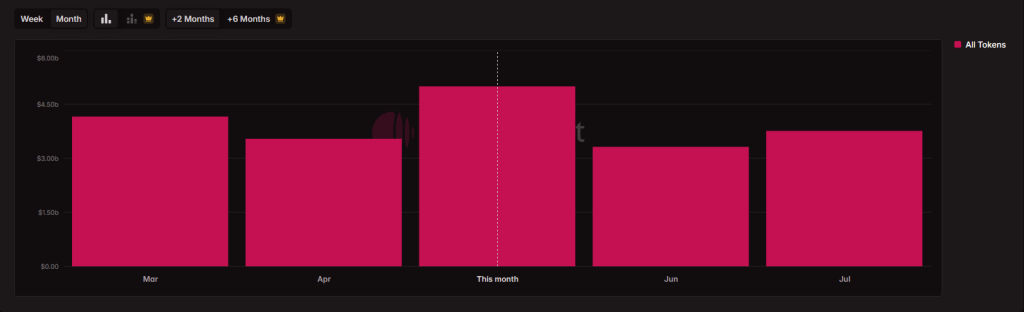

Crypto assets to the tune of over $3 billion are heading into circulation in June. That marks a 32% drop from May’s haul of $4.9 billion. According to crypto vesting tracker Tokenomist , investors and traders will face new supply pressure again this month.

Total Token Unlocks Dip In June

June’s release of $3.3 billion is down sharply from May’s nearly $5 billion. A lot of that change comes from projects finishing earlier vesting schedules. But $3.3 billion is still a heavy weight on token prices. Markets usually wobble when billions of dollars suddenly become tradable.

Cliffs Versus Gradual Releases

About $1.4 billion of June’s tokens will hit wallets all at once in what’s called a cliff unlock. That means a lump sum becomes liquid on a set date. The rest— nearly $2 billion—will drip into the market bit by bit with linear unlocks. A slow trickle of new supply can soften the blow, but it still adds up over time.

Several major projects lead the pack in June. Metars Genesis ( MRS ) will drop over $190 million worth of tokens on June 21 to back an AI partnership. Since March, MRS has unlocked 10 million tokens each month, pushing nearly $1 billion into circulation so far.

On June 1, SUI will unlock 44 million coins—about $160 million in value. Over $70 million of that goes to Series B investors. To date, SUI has released more than 3 billion tokens valued at roughly $12 billion, or about 33% of its total supply. Another 5.22 billion tokens, worth nearly $20 billion, are still locked without a set date.

Other Projects To Watch

Other Projects To Watch

A handful of well-known tokens also have vesting dates in June. Fasttoken will hand out 20 million tokens—around $88 million—to its founders. LayerZero plans to unlock 25 million tokens worth over $70 million for core contributors and strategic partners.

Aptos will release 11.30 million tokens, about $60 million, to its team, backers and community fund. ZKsync sets free over 760 million tokens valued at almost $50 million to investors and staff. Even Arbitrum joins the list, adding to the pressure on Layer-2 markets.

What This Means For TradersBased on reports, big unlocks tend to spark price swings. Cliff events often trigger fast sell-offs as holders gain full access. Gradual releases can drag on prices over weeks. Those who trade around these dates should be ready for volatility.

For long-term holders, dips caused by fresh supply might offer a chance to add to positions. Either way, tracking vesting calendars could help time moves and spare traders from nasty surprises.

Featured image from Unsplash, chart from TradingView