Crypto Asset Inflows Reach $785M as Ethereum Sentiment Turns Bullish

Favorite

Share

Scan with WeChat

Share with Friends or Moments

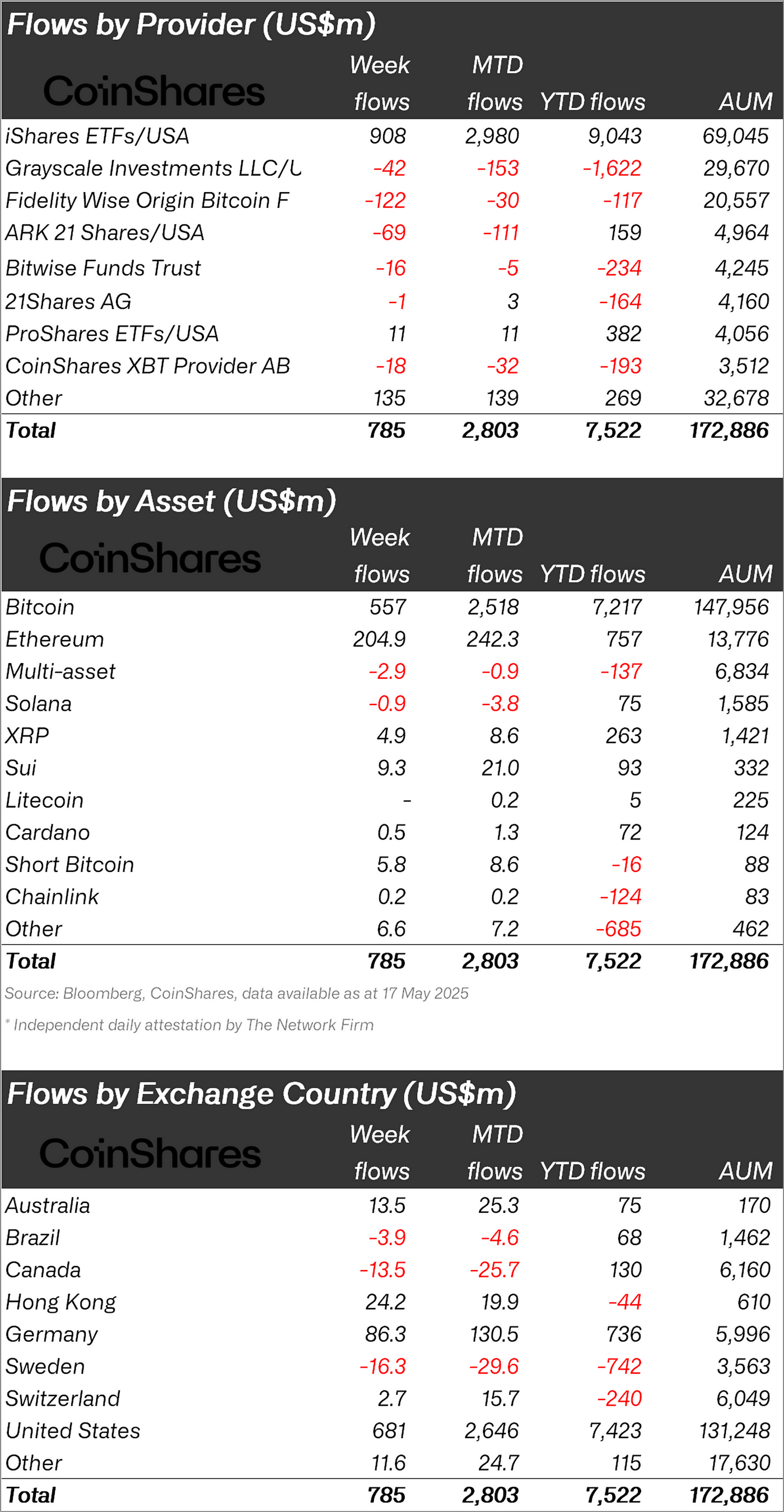

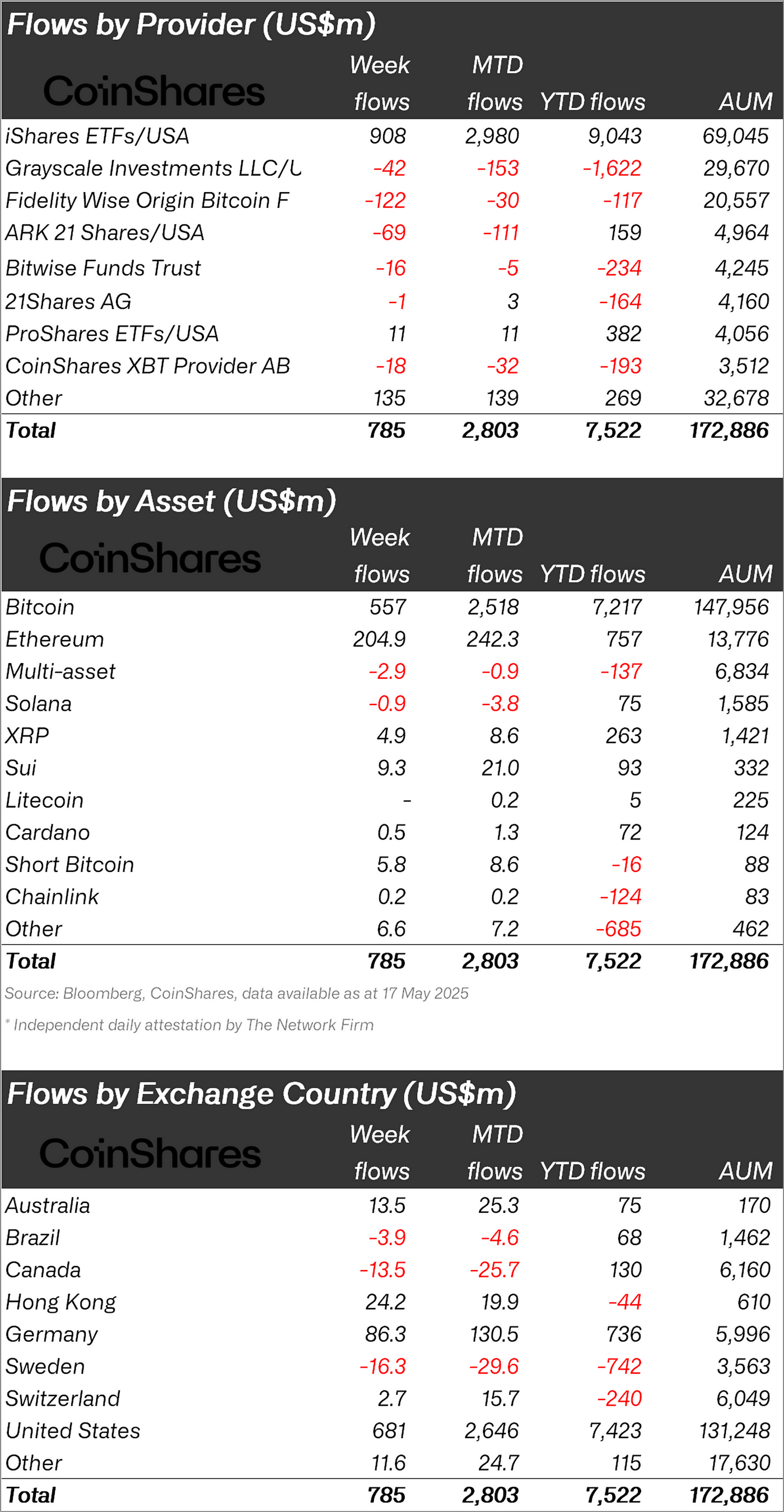

Crypto asset investment products, led by Bitcoin and Ethereum, have continued their recovery streak, recording $785 million in inflows at the end of last week.

The latest

record

marks the fifth consecutive week of positive flows, pushing the year-to-date (YTD) totals to $7.5 billion. Specifically, the rebound fully offset the February–March correction that saw nearly $7 billion in outflows.

U.S. Dominates Inflows, While Canada and Sweden Lag

The United States led regional inflows with $681 million, bolstered by demand for U.S.-listed ETFs, particularly from

BlackRock’s iShares Trusts

. Specifically, BlackRock’s Bitcoin and Ethereum ETFs registered inflows of $908 million. However, outflows from other issuers like Grayscale and Fidelity weakened the cumulative weekly flows of the U.S. ETF market.

Meanwhile, Germany followed with $86.3 million, improving the monthly flows to $130.5 million. Hong Kong added $24.2 million, its largest weekly inflow since November 2024. In contrast, sentiment remained bearish in Canada, Brazil, and Sweden.

Sweden posted the largest weekly outflow at $16.3 million, while Canada and Brazil saw $13.5 million and $3.9 million in redemptions, respectively.

Ethereum Reclaims Investor Confidence

Notably, Ethereum emerged as the standout performer, attracting $204.9 million in inflows for the week. This marks a strong shift in sentiment amid the success of the Pectra upgrade.

In the spot market,

Ethereum

experienced a massive price improvement, soaring 17% from the weekly low of $2,344 to over $2,730. With $575 million in YTD inflows, Ethereum is showing signs of renewed institutional interest after a relatively slow start to the year.

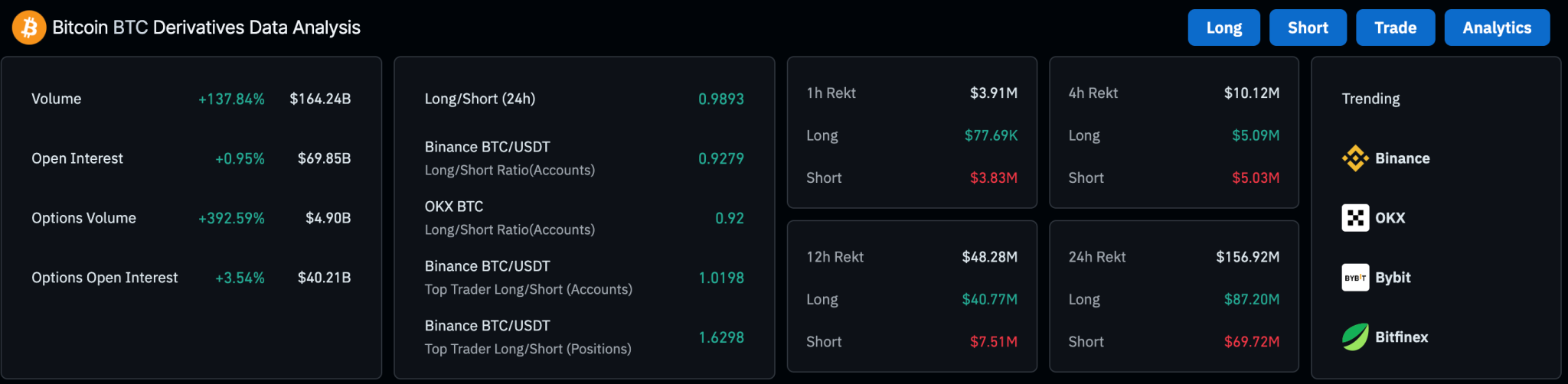

Bitcoin Leads, but Momentum Slows

Meanwhile,

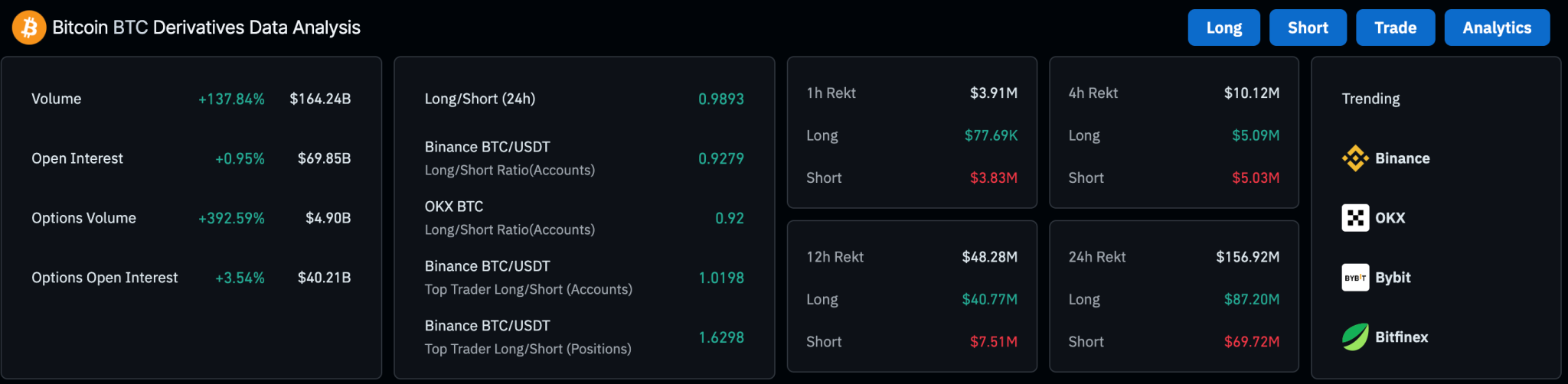

Bitcoin

continued to dominate asset flows with $557 million in inflows, although momentum eased slightly compared to previous weeks. According to CoinShares, the softer flows could reflect investor caution following continued hawkish signals from the U.S. Federal Reserve.

Notably, short-bitcoin products saw $5.8 million in inflows, indicating that some investors were hedging against possible downside risk.

Mixed Signals for Altcoins

XRP products attracted $4.9 million in weekly inflows, contributing to a YTD total of $263 million. Meanwhile, Sui continued to gain modest traction, adding $9.3 million.

However, Solana saw outflows of $0.9 million, its second consecutive week in the red. Multi-asset products also reported outflows of $2.9 million, reflecting a more selective approach from investors.

Mixed Signals for Altcoins

XRP products attracted $4.9 million in weekly inflows, contributing to a YTD total of $263 million. Meanwhile, Sui continued to gain modest traction, adding $9.3 million.

However, Solana saw outflows of $0.9 million, its second consecutive week in the red. Multi-asset products also reported outflows of $2.9 million, reflecting a more selective approach from investors.

Mixed Signals for Altcoins

XRP products attracted $4.9 million in weekly inflows, contributing to a YTD total of $263 million. Meanwhile, Sui continued to gain modest traction, adding $9.3 million.

However, Solana saw outflows of $0.9 million, its second consecutive week in the red. Multi-asset products also reported outflows of $2.9 million, reflecting a more selective approach from investors.

Mixed Signals for Altcoins

XRP products attracted $4.9 million in weekly inflows, contributing to a YTD total of $263 million. Meanwhile, Sui continued to gain modest traction, adding $9.3 million.

However, Solana saw outflows of $0.9 million, its second consecutive week in the red. Multi-asset products also reported outflows of $2.9 million, reflecting a more selective approach from investors.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/506799

Related Reading

Meliuz Chair Says Bitcoin is Like a Nuclear Reactor on the Brazilian Firm’s Balance Sheet

Méliuz Chairman Israel Salmen has described Bitcoin as a "nuclear reactor" now integrated into the B...

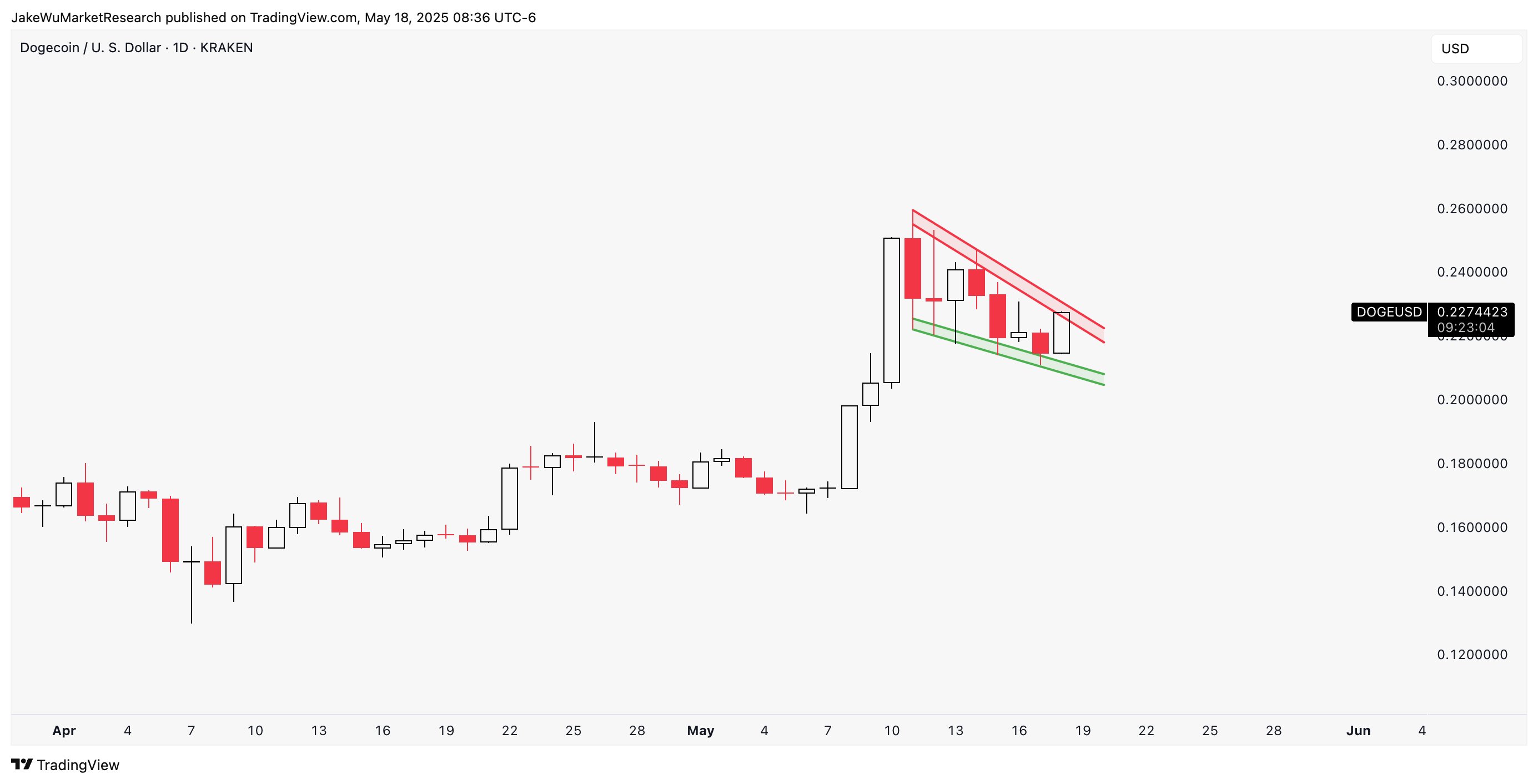

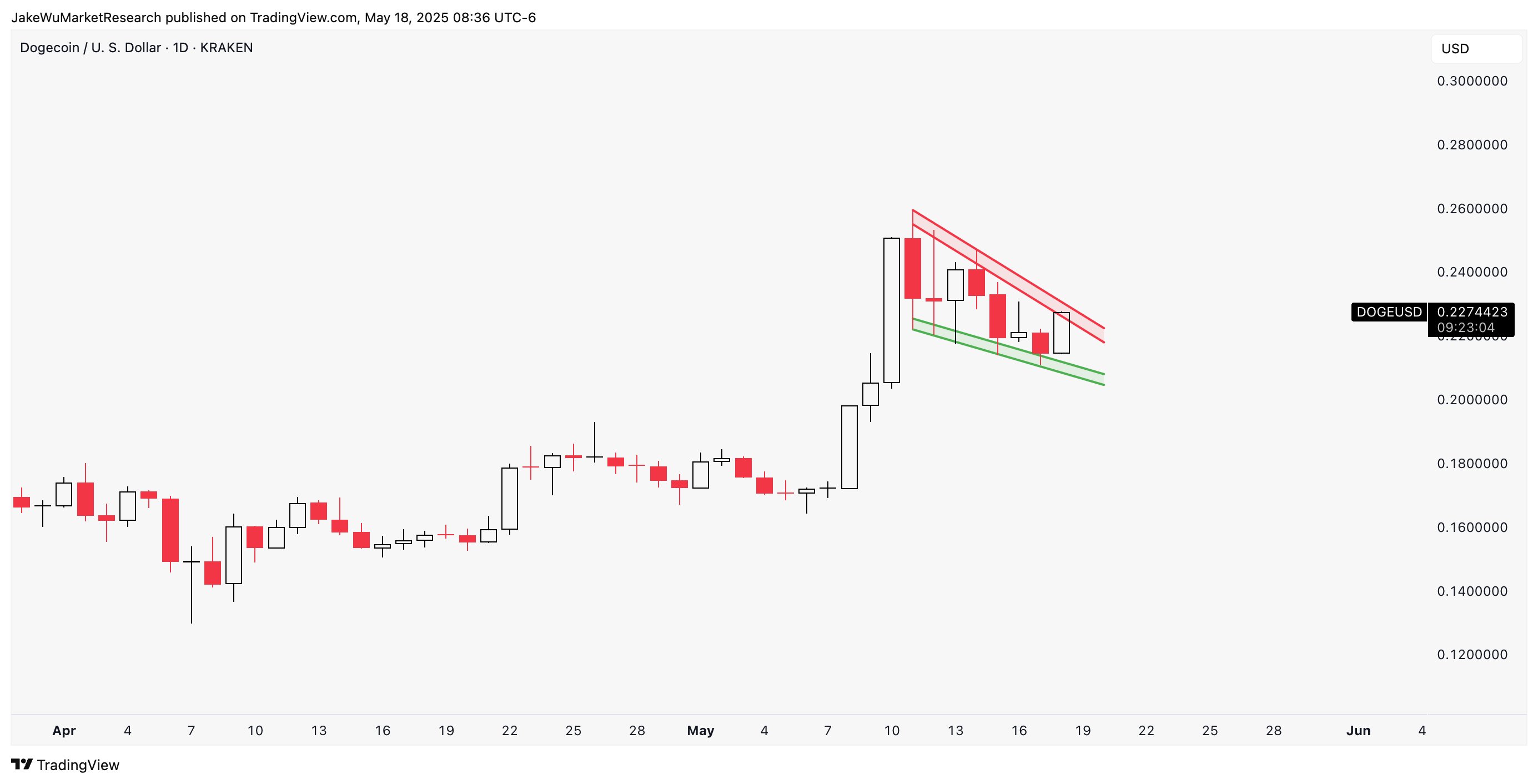

Analyst on Dogecoin: ‘No Way I’d Skip This Trade — Chart Signals a Run to $0.45’

A top market analyst has lauded the exceptional bullishness in the Dogecoin chart, predicting a quic...

Why Is Bitcoin Falling Today? Here is The Likely Reason

Bitcoin edged lower on Monday following a major shift in investor sentiment after Moody’s Ratings do...