Renowned Crypto Analyst Targets Bitcoin Price at $120K as Technical Indicators Flash Bullish

- Bitcoin could reach $120,000 if it manages to maintain prices above $90,000.

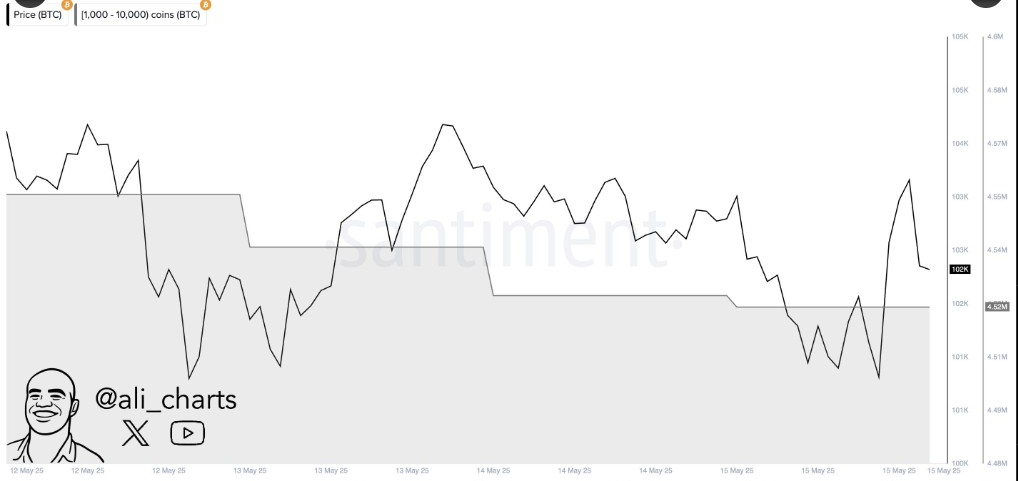

- Large wallet holders started selling a significant portion of their Bitcoin when the price exceeded $100,000.

- Funds such as ETFs and leveraged long positions have been popular with investors.

Bitcoin has maintained its position above $103,000 currently, following a significant upward earlier this week. Although whales are taking profits, technical indicators, and institutional buying indicate that Bitcoin could continue its current uptrend. Analysts predict that Bitcoin must hold above $90,000 to sustain its upward trajectory.

Ali Charts Analysis Hint at $120K Peak

Analyst Ali Martinez believes that Bitcoin is currently building a solid uptrend. The Cumulative Value Days Destroyed (CVDD) metric indicates that Bitcoin is trading above its “HOT” line and is in the middle of the second accumulation phase. Martinez forecasts that the next cycle peak could take place around $120,000 only if Bitcoin remains above $90,000.

According to Martinez, Bitcoin prices tend to stay within the typical ranges established by past market cycles. It indicates that further increases are possible if economic and technical conditions remain positive.

He also mentioned that whales have been taking more profits from the market recently.

During a 72-hour period, wallets managing 1,000 to 10,000 BTC sold over 30,000 BTC. Following Bitcoin gaining $100,000, there was a major selling trend by whales, suggesting there could soon be a price dip.

ETF Inflows Climb While Leverage Falls

Institutional investors are continuing to show interest in Bitcoin in the face of recent selloffs. Spot Bitcoin ETFs in the United States saw inflows of $319.56 million on May 14, reversing the $96 million of outflows noticed the day before. Institutional investors are still trying to get involved with Bitcoin by increasing their holdings through ETFs.

However, futures markets show signs of increased caution. Laevitas noted that the premium on two-month Bitcoin futures dropped from 7% to 5%, suggesting a pullback in bullish positions. That premium’s last occurrence coincided with Bitcoin trading around $84,500, signaling that traders anticipate periods of sideways movement or low volatility in the market ahead of further price increases.

Technical Analysts Maintain Bullish Structure Outlook

According to analyst Michaël van de Poppe, Bitcoin is in a solid upswing so far and should continue to rise if it secures support above $98,000. He highlighted the importance of the $110,000–$115,000 price level as an accumulation area. Van de Poppe also noted how an evident double-bottom pattern below $81,000 impeded the recent upward surge.

Analyst Javon Marks mentioned that Bitcoin has recently shaped a bull flag pattern just below its record price. Marks predicts that a break above the flag could lead to new records for Bitcoin. Additionally, Marks notes that altcoins resembling cycles from past bull runs often come after significant BTC rallies.

Recently, BitMEX founder Arthur Hayes forecasted that Bitcoin will surpass the $1 million mark in just under six years. He attributed the price surge largely to the loss of confidence in U.S. Treasuries and the inflow of global capital into cryptocurrencies.

Hayes predicts that Bitcoin may become a more widely adopted store of value as more people move money away from conventional investment options. At the time of writing, Bitcoin trades at $103,663, up 1.7% in 24 hours.

Crypto Sector Shows Mixed Outlook Amid Growing Speculations of Altcoin Season

Crypto market shows mixed signals with a minor Bitcoin ($BTC) dip, Ethereum ($ETH) rise, while DeFi ...

This New Crypto Could Rival XRP and Replace Cardano and Tron In The Crypto Top 10 This Year

Remittix is gaining momentum as XRP 2.0, raising $15M in presale and aiming to replace Cardano and T...

BlockchainReporter Weekly Crypto News Review: Regulations Tighten, Adoption Continues

We saw regulatory moves and national adoption plans in the crypto sector. Deepening integrations bet...

(@APompliano)

(@APompliano)