By changing how digital assets, interactions, and assets are managed across Web3 and blockchain ecosystems, LUKSO is steadily gaining momentum.

This is because LUKSO lays emphasis on a creator-first vision, centered on: design, fashion, and lifestyle, offering a cohesive framework where economic, cultural, and social activities grow in a truly decentralized way.

The upcoming launch of the Ethereum – LUKSO bridge marks a symbolic full-circle moment for LUKSO co-founder Fabian Vogelsteller, the author of the ERC-20 token standard that laid the foundation for Ethereum’s token economy. With LUKSO, he brings that experience full circle, launching a new Layer 1 blockchain built on entirely new token and identity standards, now bridged back to Ethereum.

To take its innovation higher by offering seamless interoperability with the Ethereum network, the Ethereum – LUKSO Bridge seeks to be a transformative force for users, developers, and creators in the blockchain space.

The Ethereum-LUKSO Bridge: A Two-Way Gateway

The Ethereum – LUKSO Bridge facilitates the transfer of assets, such as tokens and non-fungible tokens (NFTs), between Ethereum and LUKSO.

On the

BlockHash Podcast

, Jean Cavallera, Lead Smart Contract Engineer at LUKSO, described the bridge as

“a two-way bridge. It’s not only Ethereum to LUKSO, it’s also LUKSO to Ethereum. It will be interesting because you can bridge LYX, the native currency from LUKSO, onto Ethereum. For users who can’t directly access LYX, they’ll be able to swap it on Uniswap.”

As a result, liquidity expansion and asset migration will become a reality through this bridge. Users will have the opportunity to move assets, such as NFTs and LYX tokens, between LUKSO and Ethereum. This is especially impactful because the bridge will support LUKSO’s new token standards: LSP7 (Digital Assets) and LSP8 (Identifiable Digital Assets, such as NFTs), which introduce transfer hooks, flexible metadata, and direct interaction with Universal Profiles

This is a welcome move since this bi-directional structure opens new liquidity flows and gives users the option to tap into the expansive Ethereum ecosystem, including DeFi protocols, NFT marketplaces, and dApps, without leaving the LUKSO experience behind.

Universal Profiles Meet Cross-Chain Utility

Since LUKSO incorporates a unique blockchain-based identity system called

Universal Profiles (UPs)

, the upcoming bridge will play an instrumental role in making UPs function as digital passports across social platforms, games, metaverses, and dApps.

By integrating the Universal Profiles, the Ethereum – LUKSO bridge will help unlock profile-based ownership, permissions, and interactions.

Additionally, whenever tokens are bridged, they can be linked with users’ Universal Profiles. This allows assets to carry not just financial value but social and identity context as well.

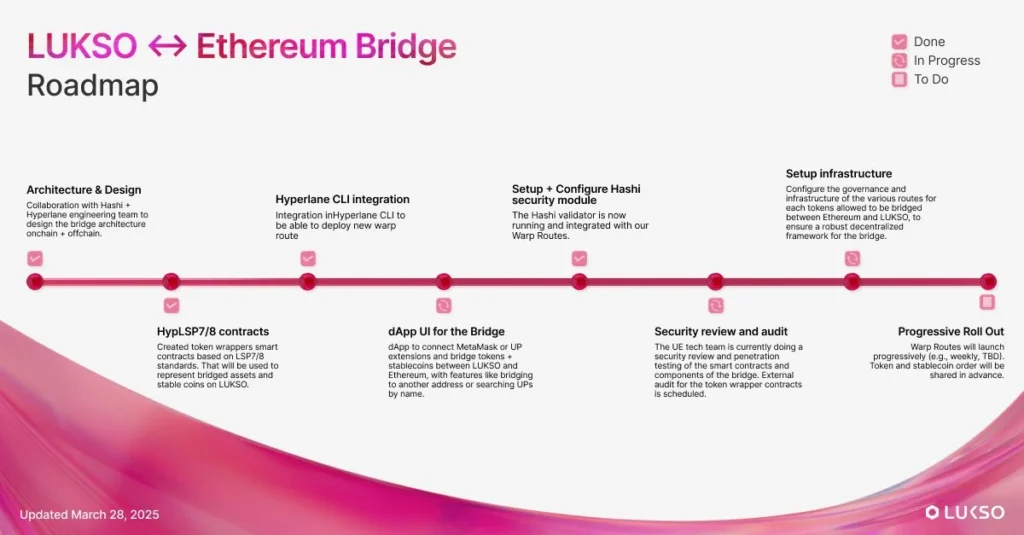

The bridge dApp is currently in its final testing phase, with smart contract audits underway for both the bridge token contracts and the updated LSP7 standard, making sure that the infrastructure is secure and reliable at launch.

On the product side, the LUKSO team is refining the bridge UI to provide a smooth and intuitive experience. Behind

the scenes,

they’re also preparing official warp routes, the underlying logic allowing selected token types to be transferred between the chains smoothly when the bridge opens to the public.

Jonathan Wan, the Chief Growth Officer at LUKSO, pointed out:

“If you have a token on Ethereum and you wanted to actually engage your audience in a more kind of automated on-chain way, bridge that over to LUKSO, you know, have that Universal Profile, and because of the standards, really cool things can happen now.”

A Developer-Friendly Bridge for a Standards-Driven Future

As an Ethereum Virtual Machine (EVM)-compatible Layer 1 blockchain, LUKSO allows developers to smoothly port ETH applications to its network while offering a more powerful building environment thanks to its smart contract standards (LSPs).

Therefore, the Ethereum – LUKSO bridge will play an instrumental role in improving a developer-friendly environment across different sectors, such as decentralized finance (DeFi).

Wan said,

“Any network needs, you know, that core economic kind of infrastructure for the flywheels really to run. It’s going to enable a lot of things right even for something like DeFi within LUKSO. There’s a lot of things that are possible now on LUKSO that just weren’t on any EVM chain before.”

Why the Ethereum – LUKSO Bridge Matters

The Ethereum–LUKSO Bridge represents more than technical interoperability, it’s a step toward creator-centric, identity-aware infrastructure in Web3. By allowing assets to move between chains, the bridge directly supports the adoption of LUKSO’s core innovations: Universal Profiles, social recovery wallets, and standardized NFT metadata.

These features are built on LUKSO’s growing standards track, including LSP7 (Digital Assets), LSP8 (Identifiable Digital Assets), and supporting modules like LSP6 (Permissions), LSP1 (Hooks), and LSP3 (Metadata). Together, they facilitate smart contract-based accounts that are expressive, secure, and deeply composable.

Beyond asset movement, the bridge connects ecosystems, social, cultural, and economic, allowing Ethereum users and developers to engage with LUKSO’s creator-focused architecture and identity standards. This means they’ll have the opportunity to adopt or migrate to the LUKSO ecosystem, and vice versa.

Jean Cavallera said:

“It’s interesting because often in crypto we talk about a bridge between chains. The reality is that it’s actually routed at the technical level. To represent it visually, you can think of it as two islands. You have one island which is Ethereum, one island is LUKSO, and you could reach the other island using different ways of transport.”

Given that creators’ needs and preferences, such as digital collectibles, art, and fashion, are central to LUKSO’s vision, the bridge will allow them to integrate Ethereum-based assets, such as tokens, NFTs, and wrapped tokens, into the LUKSO ecosystem.

Cavallera added:

“There are basically different aspects to the bridge that you can think of; it’s going to bring value to the ecosystem. First of all, there will be the wrapped version of stablecoins on LUKSO, which is relevant because you will have ecosystem tokens that have actual pegged value to certain fiat currencies.”

What to Watch For

The Ethereum – LUKSO Bridge ought to be seen as an initiative toward a more user-friendly and interconnected blockchain ecosystem.

Additionally, this bridge will direct more liquidity by allowing cross-chain transfers between the LUKSO and Ethereum networks, as well as asset interoperability, now tied to identity via Universal Profiles.

By allowing easy cross-chain asset movement and identity-linked interaction, the Ethereum – LUKSO bridge is especially relevant for NFT marketplaces, DeFi protocols, and decentralized exchanges (DEXs).

As a force to be reckoned with, Wan believes,

“The bridge is really just the start because it’s going to usher in more liquidity. We’ve already got protocols on the DeFi side of things, building out the infrastructure on LUKSO so that we can enable these flywheels within the ecosystem. And then also we’re pairing that with the approach of getting the native token out to other ecosystems.”

Therefore, the Ethereum – LUKSO Bridge intends to kick off a new chapter of creator-centric, profile-powered, cross-chain interaction, a shift that positions identity, not just assets, at the center of Web3.