Social media giant Meta is in discussions with crypto firms to introduce stablecoins as a means to manage payouts on its platforms, according to a report by Fortune on Thursday. This exploration comes three years after Meta abandoned its ambitious Diem (formerly Libra) cryptocurrency project.

Five sources familiar with the matter, whose identities are known by Fortune but who spoke anonymously, stated that Meta has also hired Ginger Baker, formerly of fintech giant Plaid and a board member of the Stellar Development Foundation, as a vice president of product specializing in fintech and payments to help steer these discussions.

The sources indicate that Meta's primary interest in stablecoins lies in their ability to facilitate payouts to individuals across different regions more efficiently and with lower fees compared to traditional methods. One executive at a crypto infrastructure provider suggested Instagram could use stablecoins for smaller payouts to creators in various markets. Meta is reportedly in a "learn mode" and is likely to be agnostic to the specific stablecoin used.

Fortune noted that Meta reached out to crypto infrastructure companies earlier this year for these preliminary discussions focused on the payouts use case.

At the same time, Fortune reported, citing an unnamed source, that stablecoin issuer Circle has also hired Matt Cavin, formerly of gaming blockchain company Immutable, to lead discussions with Meta and other Big Tech firms. Cavin's LinkedIn profile notes his role in leading "tier-1 strategic partnerships" at Circle, Fortune said.

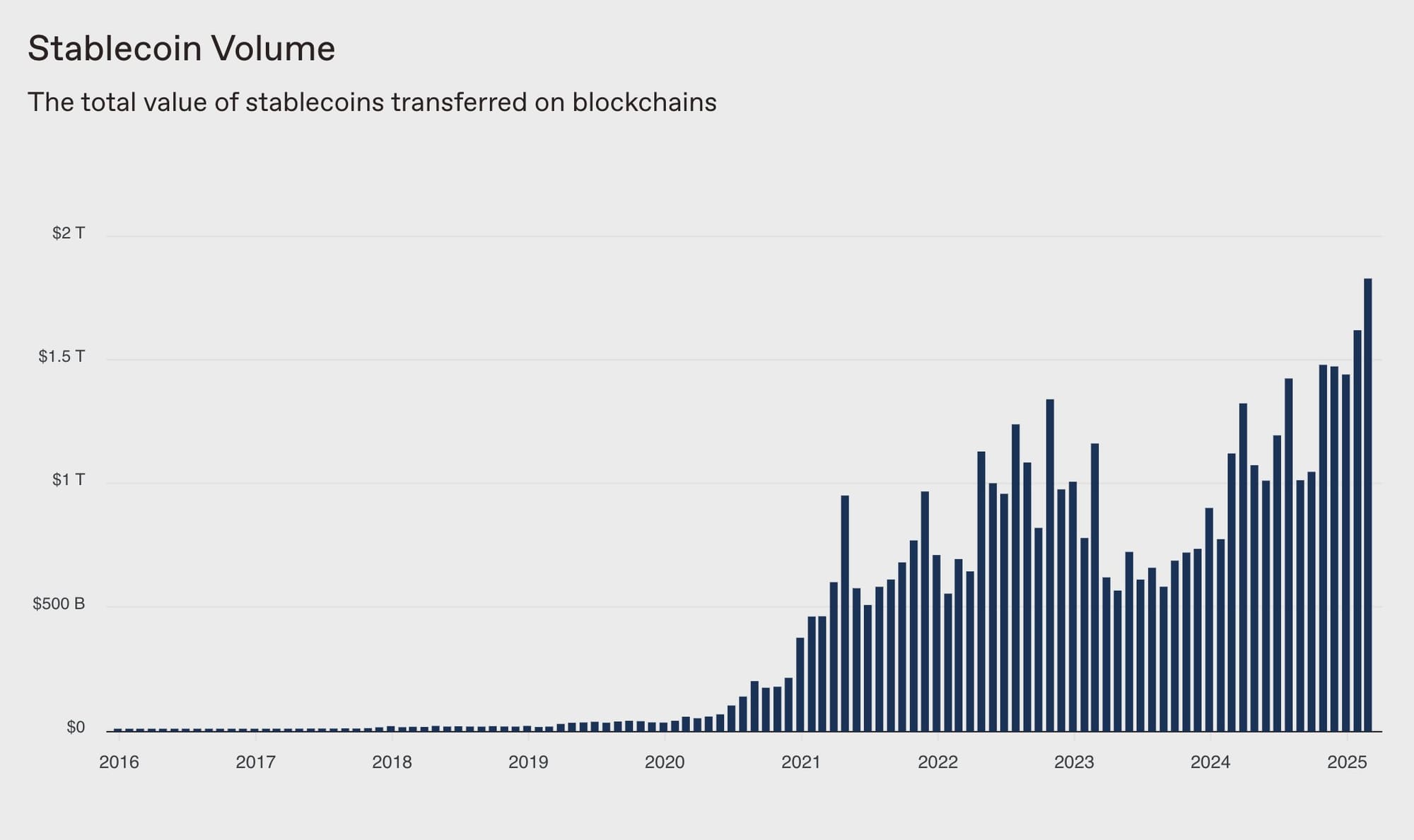

According to a16z crypto, stablecoin transaction volumes hit a record high of $1.82 trillion in March 2025.

The past month has seen significant moves in the stablecoin space, including Visa's partnership with Bridge and its joining the Paxos-led Global Dollar Network , as well as Fidelity's reported development of its own stablecoin , alongside Stripe's unveiling of stablecoin-powered financial accounts .