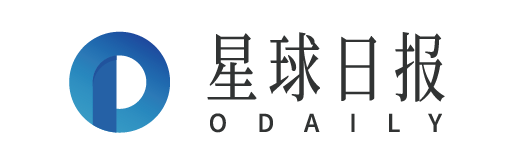

在美国 CPI 数据公布前夕,十年期收益率从 4.40% 的高位回落到 4.36% 附近,两年期现报 4.741% ,投资者集中关注接下来的美联储政策会议记录和关键的通胀数据,用以追踪降息时机和幅度的新线索。

Source: SignalPlus, Economic Calendar

Source: SignalPlus & TradingView,震荡区间有缩窄趋势

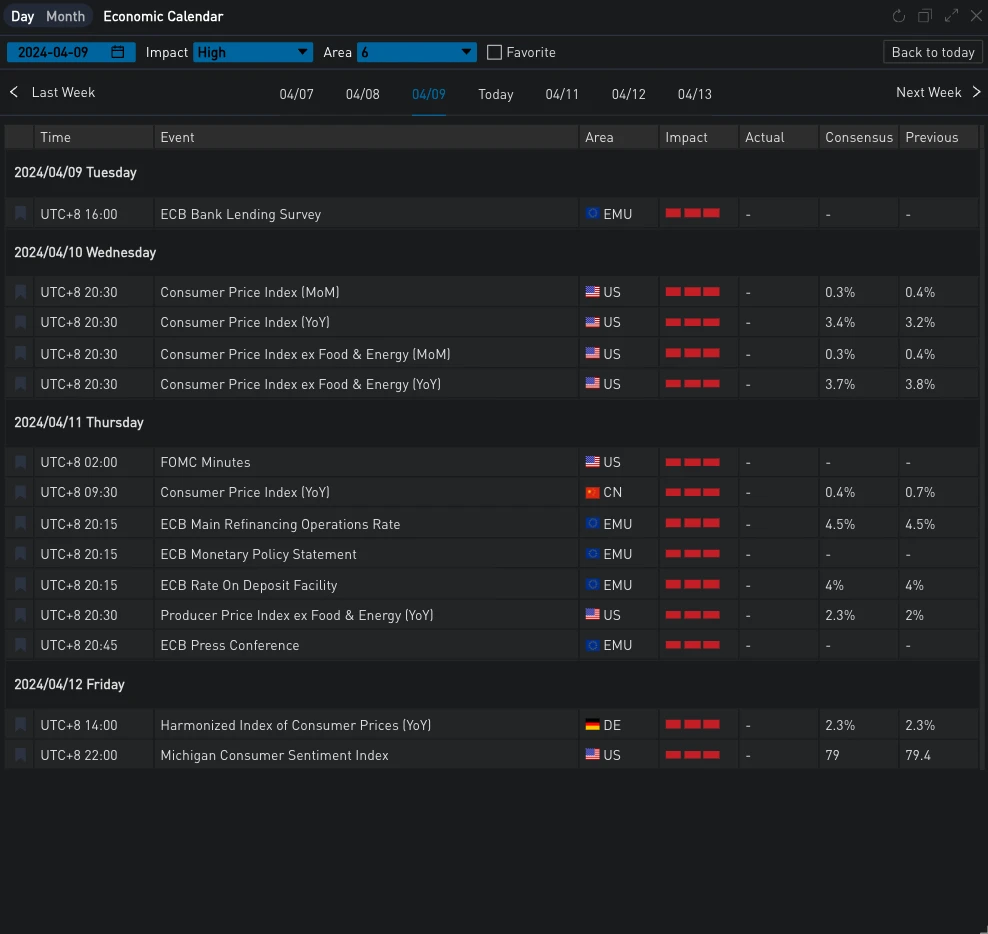

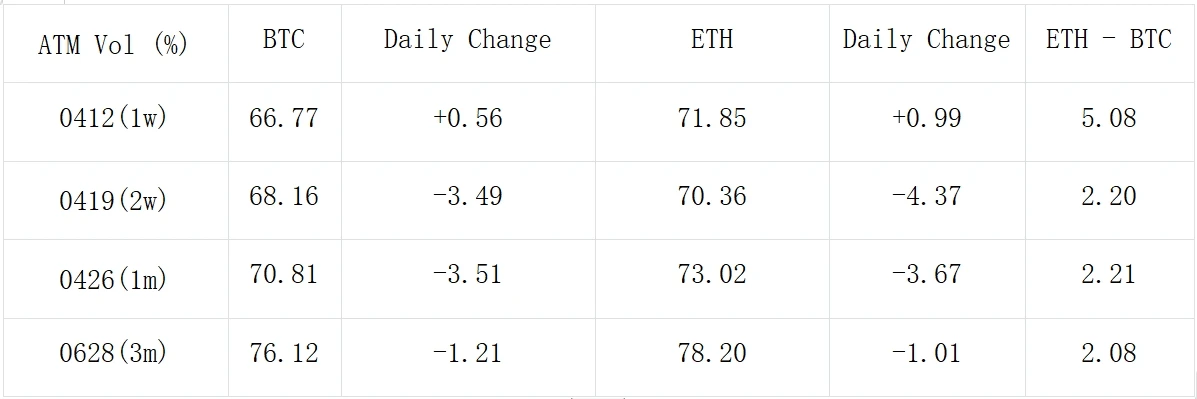

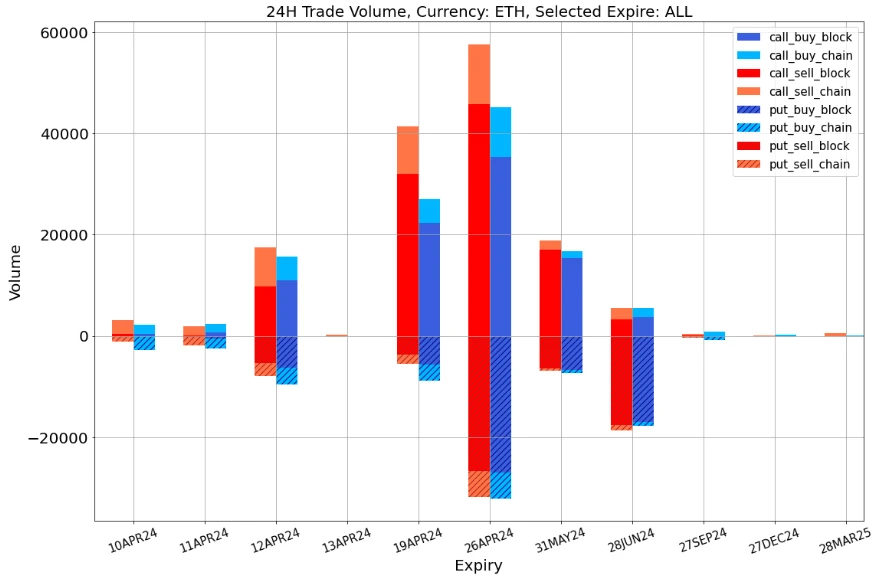

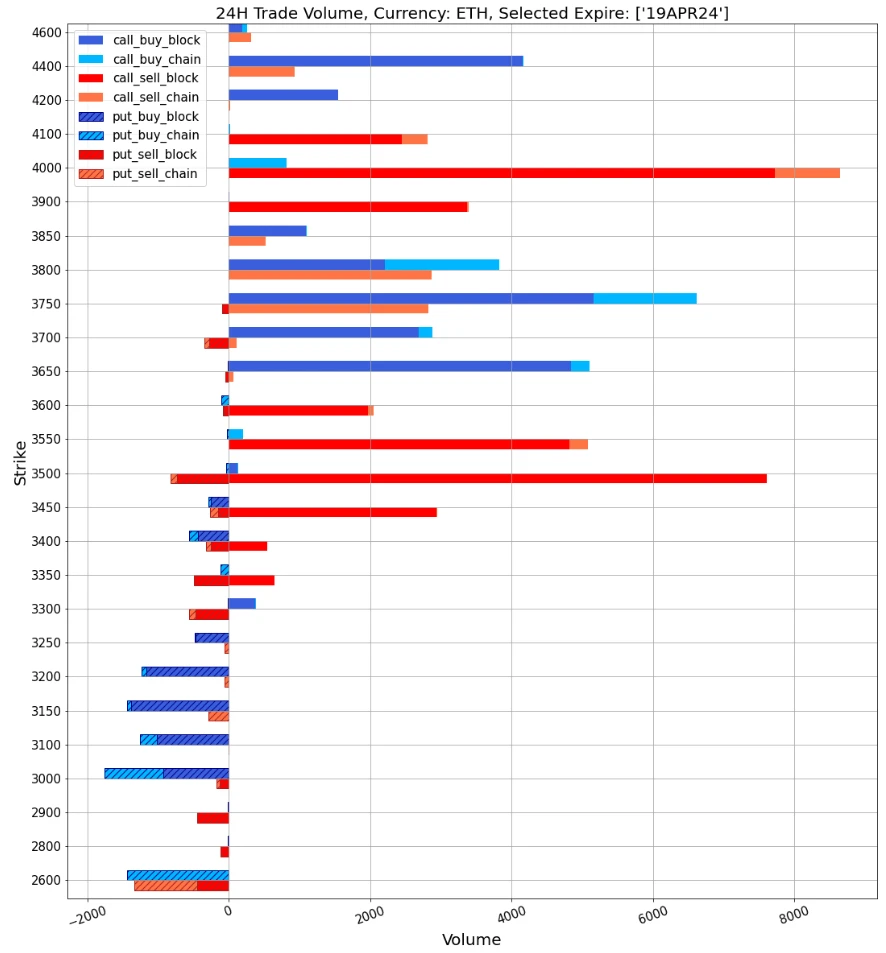

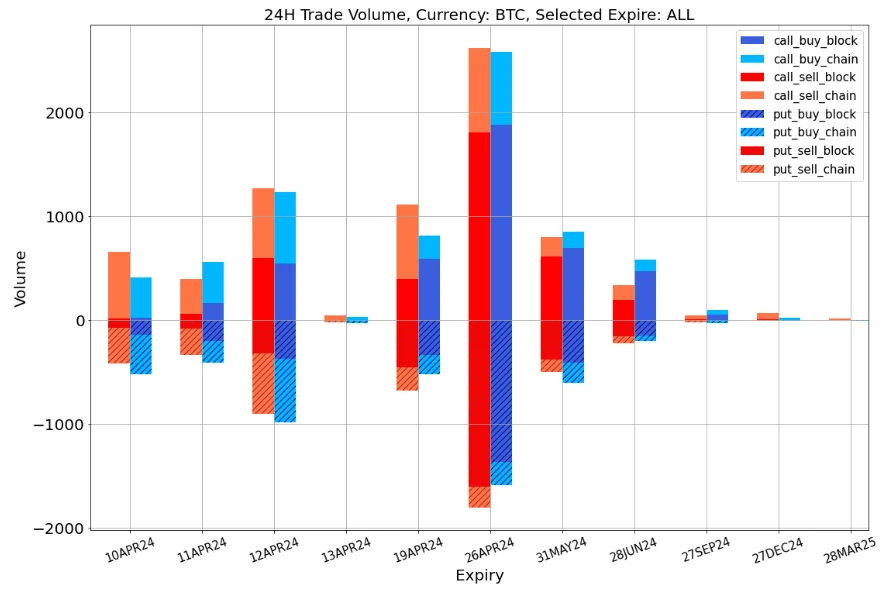

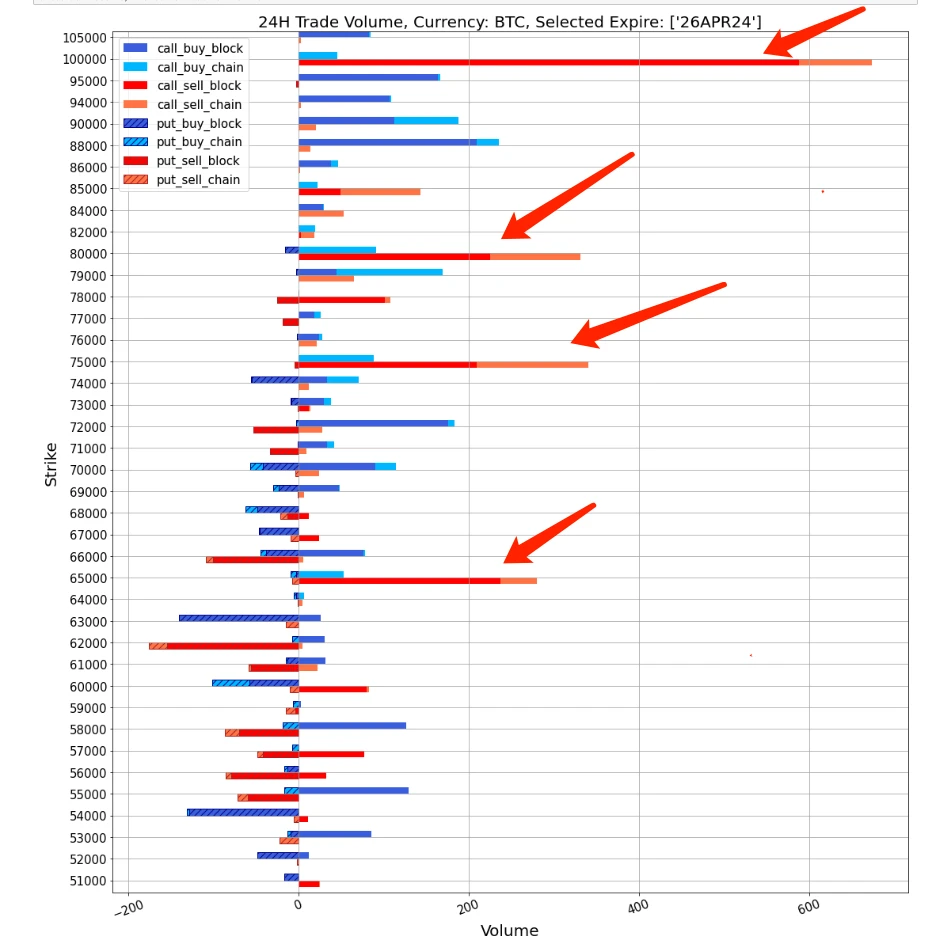

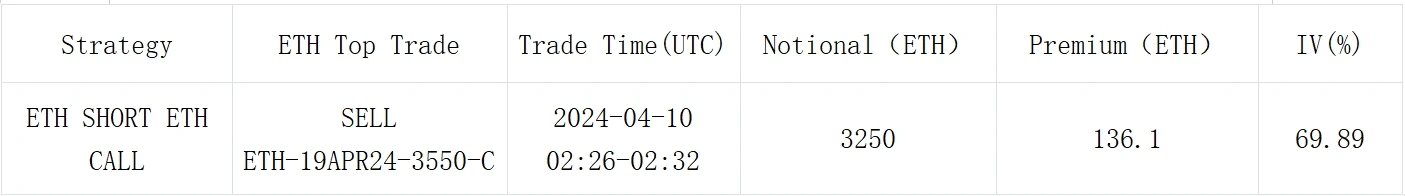

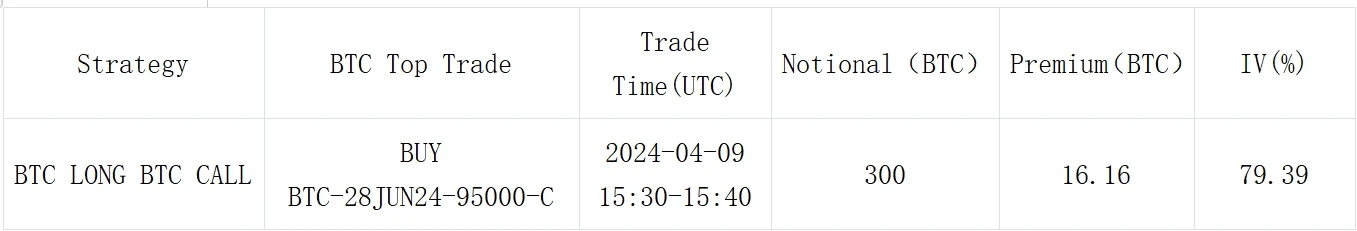

数字货币方面,昨日 IBIT ETF 买入流量恢复,与 GBTC 的流出量基本打平;币价上,BTC 在 7 W 下方维稳,震荡区间呈现收窄的趋势。期权方面,四月的隐含波动率下降 3-4% Vol,从交易上看,过去一日 BTC 四月底的卖压异常强劲,大多砸在 75000/80000/100000 美元等关键水位,导致前端 Vol Skew 再度发生大幅倾斜。ETH 19 ARP 24 的看涨一测呈现出 Seagull Flow,以相对谨慎的态度看跌上行波动。

Source: Deribit (截至 10 APR 16: 00 UTC+ 8)

Source: SignalPlus, ATM Vol

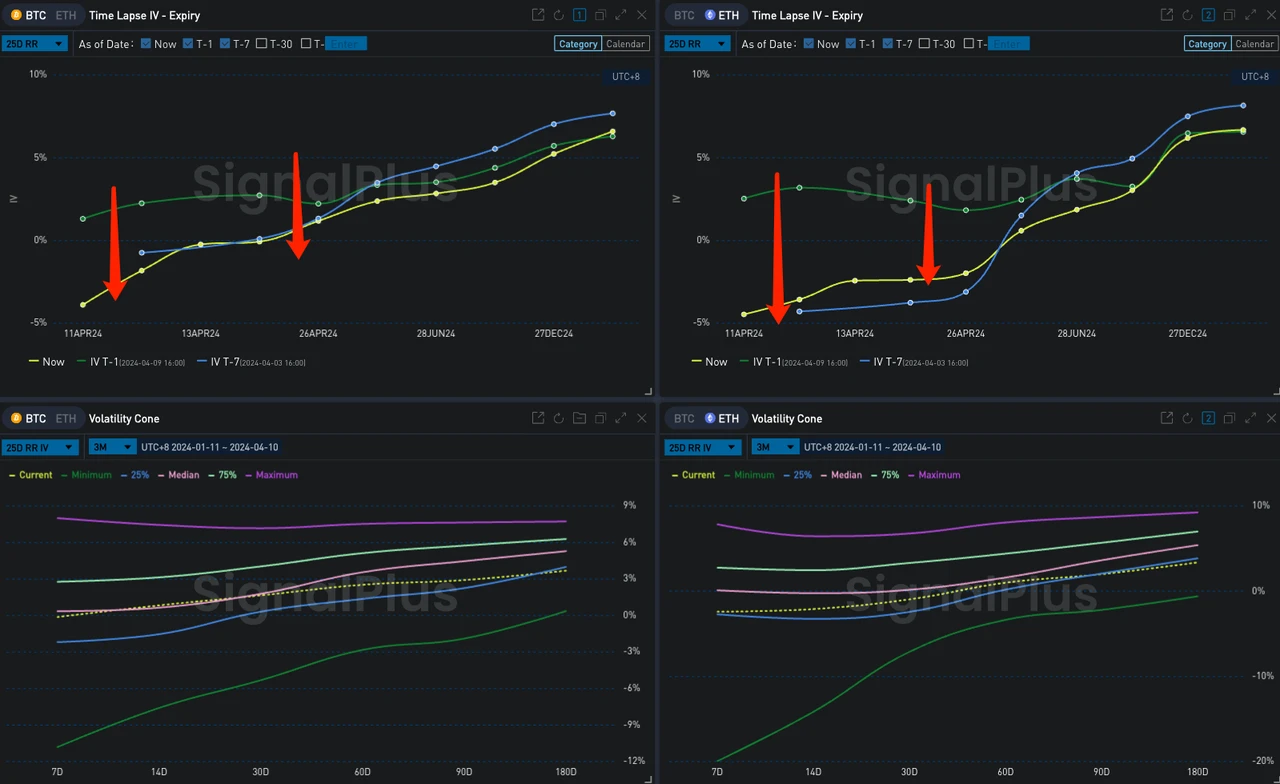

Source: SignalPlus, Vol Skew

Data Source: Deribit,ETH 19 APR 24 呈现 Seagull Flow;28 JUN 24 为 3000-2500 Long Put Spread;31 MAY 24 是 4000 & 4100 的 Long Call

Data Source: Deribit,BTC 交易分布,四月底大量看涨期权卖出

Source: Deribit Block Trade

Source: Deribit Block Trade