Will the Fed Inch Closer to 'Neutral' Anytime Soon?

For cryptos, the US administration's easy digital asset policy under Trump 2.0 and the Federal Reserve's rate cut cycle were bets for a significant boost.

We have seen Bitcoin surge above the $100,000-mark and hit an all-time high of $125,500 this year on those bets.

While cryptos have taken a hit during the much-touted "Uptober" month, Bitcoin has remained resilient to high volatility and loss of investor confidence since the October 10 flash crash.

Much of that has to do with bets of Fed easing further into 2026.

As concerns about the US labor market grow, upside inflation risks are decreasing.

In addition to potentially ending quantitative tightening, the Federal Reserve is anticipated to react on Wednesday with another 25 basis point interest rate cut.

Current Conditions Point to Another Rate Cut

Considering the current landscape of solid economic growth, high inflation, low unemployment, and equity markets reaching record levels, it’s understandable to wonder why the market is fully anticipating a 25-basis-point interest rate cut on Wednesday, along with an additional 25 bps reduction expected in December.

The Fed lowered rates during the September FOMC meeting, marking a return after a nine-month pause.

Chair Jerome Powell described this decision as a measure of “risk management.”

While above-target inflation remains a concern and tariffs continue to present challenges, it is reasonable to conclude that the anticipated price increases from tariffs are not materializing as severely as initially expected.

The more urgent concern is the declining job market, with a distinct possibility that the “low hire, low fire” scenario evolves into a “no hire, let’s fire” narrative.

This threatens the objective of enhancing employment, which may subsequently lead to a sluggish economy and increase the likelihood of the central bank failing to meet its 2% inflation target in the medium to long term.

Inflation Threat Missing?

The customs revenue and goods import figures for July and August suggest a realized tariff rate of approximately 10%, significantly lower than the estimated 18% rate derived from the announced tariffs by country and sector.

The customs revenue for September did not indicate any acceleration, suggesting a significant substitution effect is already in play.

US companies seem to be opting for lower-tariff countries for their sourcing needs, leading to a shift in the composition of imports. Alternatively, there may be a temporary collection issue stemming from resource constraints.

The outcome indicates that firms are better positioned to manage rising costs, leading to a lesser effect on inflation than initially anticipated.

The core inflation in the US was validated by a modest increase of 0.2% month-on-month in September.

BRN anticipates an increase in the realised tariff rate and a more significant effect on goods prices in the upcoming months.

However, a gradual pass-through of tariffs allows for a longer period in which disinflationary factors can help alleviate some of the pressure. Factors contributing to this trend encompass reduced energy expenses, diminishing wage inflation, and a deceleration in housing rental prices.

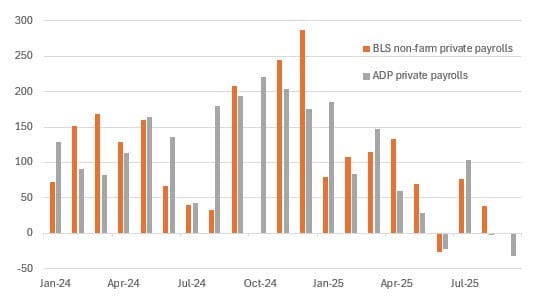

In terms of jobs, the government shutdown has meant that we are not getting official statistics, so we are having to rely on third-party sources. The ADP private payrolls report indicates a net decline in jobs over three of the last four months, and the ISM data further points to a contraction in employment levels.

Households are apprehensive, with over 50% anticipating an increase in unemployment in the coming year.

Current business surveys indicate a rather subdued outlook for the economy. Similar to market expectations, BRN anticipates that the Fed will implement a rate cut this week, with an additional 25 basis point reduction likely in December.

Fed to Extend Easing Cycle Into 2026

During the September FOMC meeting, the Fed revised its forecasts, indicating that the median expectations among officials propose that two rate cuts, along with an additional one in 2026, would sufficiently bolster growth while managing inflation levels.

The market exhibits a level of skepticism, as there is a prevailing belief that a swiftly cooling jobs market will necessitate more assertive measures.

Approximately 125 basis points of possible reductions, bringing the Fed funds rate to 3%, are reflected in Fed funds futures contracts for the conclusion of 2026.

The optimistic perspective is that more relaxed financial conditions, characterized by reduced Fed funds and Treasury yields along with a weaker dollar, are likely to bolster economic activity.

This clarity regarding trade outcomes may encourage corporations to reinvest and resume hiring efforts.

In this context, it appears we might see just one additional rate cut in 2026, or potentially no further measures at all.

BRN maintains a cautiously optimistic perspective, yet believes that a minimum of two additional rate reductions next year will be necessary to facilitate that recovery.

A more pessimistic perspective suggests that our stance on tariffs may be misguided, potentially leading to a significant short-term impact on prices.

This could, in turn, constrain consumer spending power and compress corporate profit margins. The decline in economic activity becomes more pronounced as the labor market shows signs of weakening in this context.

In the event of a correction in asset prices, whether in residential real estate, stock or crypto markets, it will necessitate a more assertive response to bolster the economy, potentially requiring policy rates to be reduced significantly below 3%.

'Missing' Data Leads to Anxiety

The recent government shutdown and postponed data releases provided a temporary boost to the dollar, as the lack of information limited speculation regarding additional easing measures.

However, the foreign exchange market has recently become directionless.

The upcoming jobs data release may ultimately hold greater significance for the dollar than the October FOMC meeting itself.

In September, a clearly anticipated decision by the Fed led to a significant rebound of the US dollar. The likelihood of a similar reaction occurring again appears diminished at this point, as the positioning has become more balanced.

Nonetheless, the current landscape suggests that the potential for the dollar to strengthen is more pronounced on FOMC day, as Powell might once again prioritize a cautious approach in his commentary regarding inflation and employment trends.

Elsewhere

Podcast

Licensed to Shill VII: Token Listings, Market Makers & Regulation, ft. Gracie Lin (CEO, OKX Singapore)

This episode of Blockcast's Licensed to Shill features Gracie Lin, OKX Singapore CEO, alongside usual panelists Nikhil Joshi, Lisa JY Tan and host Takatoshi Shibayama, who revisit the contentious topic of token listing practices on exchanges. The conversation covers the evolving roles of centralized (CEX) and decentralized (DEX) exchanges, with Lin highlighting that regulatory clarity will ultimately guide the industry's structure.

We're a media partner for the upcoming Singapore Fintech Festival! Use the promo code SFFSMPBH for 20% off all delegate passes at this link !

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link .

Bitcoin Holds Above $113k as CPI Cools & Fed Cut Looms

Your daily access to the backroom...

Bitcoin Holds Above $113k as CPI Cools & Fed Cut Looms

Your daily access to the backroom...

Consensus Hong Kong 2026 Returns February 10-12 With Expanded Programming

Premier crypto and blockchain conference doubles down on Asia following sold-out inaugural event tha...