Solana (SOL) Price Plunges as Token Launches Hit 11-Month Low—Is the Hype Cycle Over?

The post Solana (SOL) Price Plunges as Token Launches Hit 11-Month Low—Is the Hype Cycle Over? appeared first on Coinpedia Fintech News

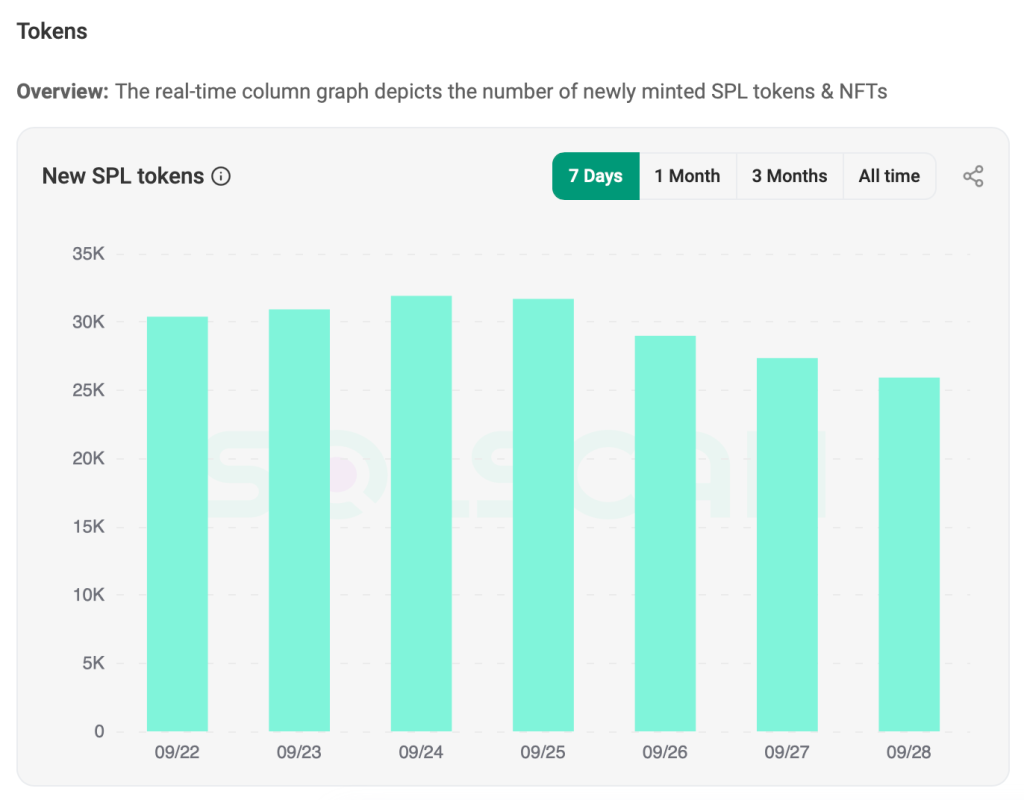

Solana (SOL) price has been one of the most talked-about altcoins of 2025, but the past week has seen its price spiral downward, rattling both retail and institutional investors. Adding fuel to bearish sentiment, weekly token launches on the Solana network have dropped to their lowest levels since October 2024.

With network activity cooling and speculative flows drying up, questions are swirling: is Solana entering a slowdown phase, or is this just a temporary shakeout before the next major rally?

What’s Driving the SOL Price Plunge?

As SOL faces mounting selling pressure, multiple factors are converging to push the token lower. From technical liquidations to ecosystem-wide slowdowns, the drivers behind Solana’s recent price action reveal both immediate risks and longer-term implications for investors and developers alike. Here’s a closer look at the main forces shaping SOL’s current slump:

Sharp Decline in Token Launches

New token creation on Solana has fallen dramatically, signaling waning speculative interest. Token launches are more than just new projects—they generate demand for SOL as gas, liquidity, and staking collateral. A sharp pullback suggests that developers and investors are sitting on the sidelines, reducing ecosystem momentum and creating a drag on price.

Liquidations and Derivatives Pressure

Hundreds of millions in leveraged long positions have been wiped out, sparking a cascade of liquidations. This technical sell-off magnified downside momentum, pushing SOL below key psychological levels and triggering further stop-losses across exchanges.

Weakening Market Sentiment

The broader crypto market downturn has compounded Solana’s challenges. Investors are showing reduced risk appetite, with open interest declining and trading activity thinning out. Negative narratives about Solana’s slowdown in growth are amplifying fear, uncertainty, and doubt (FUD).

Migration of Speculative Capital

As Solana’s “meme coin mania” cools, capital appears to be rotating into Ethereum L2s and other high-activity ecosystems. This trend underscores a shift in investor focus, weakening Solana’s comparative appeal in the short term.

Why This Matters for Solana’s Future

The fall in token launches and the ongoing SOL price drop are not isolated events—they form a feedback loop.

- A weaker price discourages new projects from launching.

- Fewer launches reduce SOL’s utility demand and network buzz.

- This further undermines sentiment, pushing prices lower.

While this cycle is painful, it also clears excess speculation. Projects that do launch in this environment are more likely to be quality-driven and less hype-dependent, potentially setting a foundation for more sustainable growth once market conditions stabilize.

SOL Price Analysis—Breakdown or Setup for Rebound?

While the broader market gains strength, the SOL price fails to secure some crucial range. If Solana manages to hold support around key price zones, a rebound is possible once speculative confidence returns. However, continued stagnation in token launches could drag SOL further into bearish territory. Traders should keep an eye on on-chain activity, developer momentum, and capital inflows as leading indicators of Solana’s next move.

The daily chart of Solana suggests the token is trading under a heavy bullish influence, despite the broader market sentiments having turned negative. The price is trading much above the Ichimoku cloud and, moreover, has rebounded each time it entered the cloud. On the other hand, the MACD is hinting towards a drop in the bearish pressure while the levels are heading for a bullish crossover. Therefore, the Solana (SOL) price appears to be poised for a bullish continuation, while the buyers’ participation could be pivotal to keep up the momentum of the rally.

XRP Ledger Uses Bitcoin-Style Block Hashing, Says Former Ripple Exec

The post XRP Ledger Uses Bitcoin-Style Block Hashing, Says Former Ripple Exec appeared first on Coin...

Your Shortcut to the Next 1000x: MoonBull Presale Is Live – Top New Meme Coin to Watch, While Cheems and Popcat Heat Up

The post Your Shortcut to the Next 1000x: MoonBull Presale Is Live – Top New Meme Coin to Watch, Whi...

Binance To List Swarm Network’s TRUTH From October

The post Binance To List Swarm Network’s TRUTH From October appeared first on Coinpedia Fintech New...