Ethereum Supply On Exchanges Shrinks: Multi-Year Lows Signal Bullish Setup

As Ethereum (ETH) fell below $4,000 for the first time since August 8, amid a market-wide pullback, the exchange reserves of the cryptocurrency also recorded a sharp decline. Notably, leading crypto exchanges like Binance and Coinbase Advanced witnessed a sharp increase in ETH outflows.

Ethereum Reserves On Binance, Coinbase Advanced Dwindle

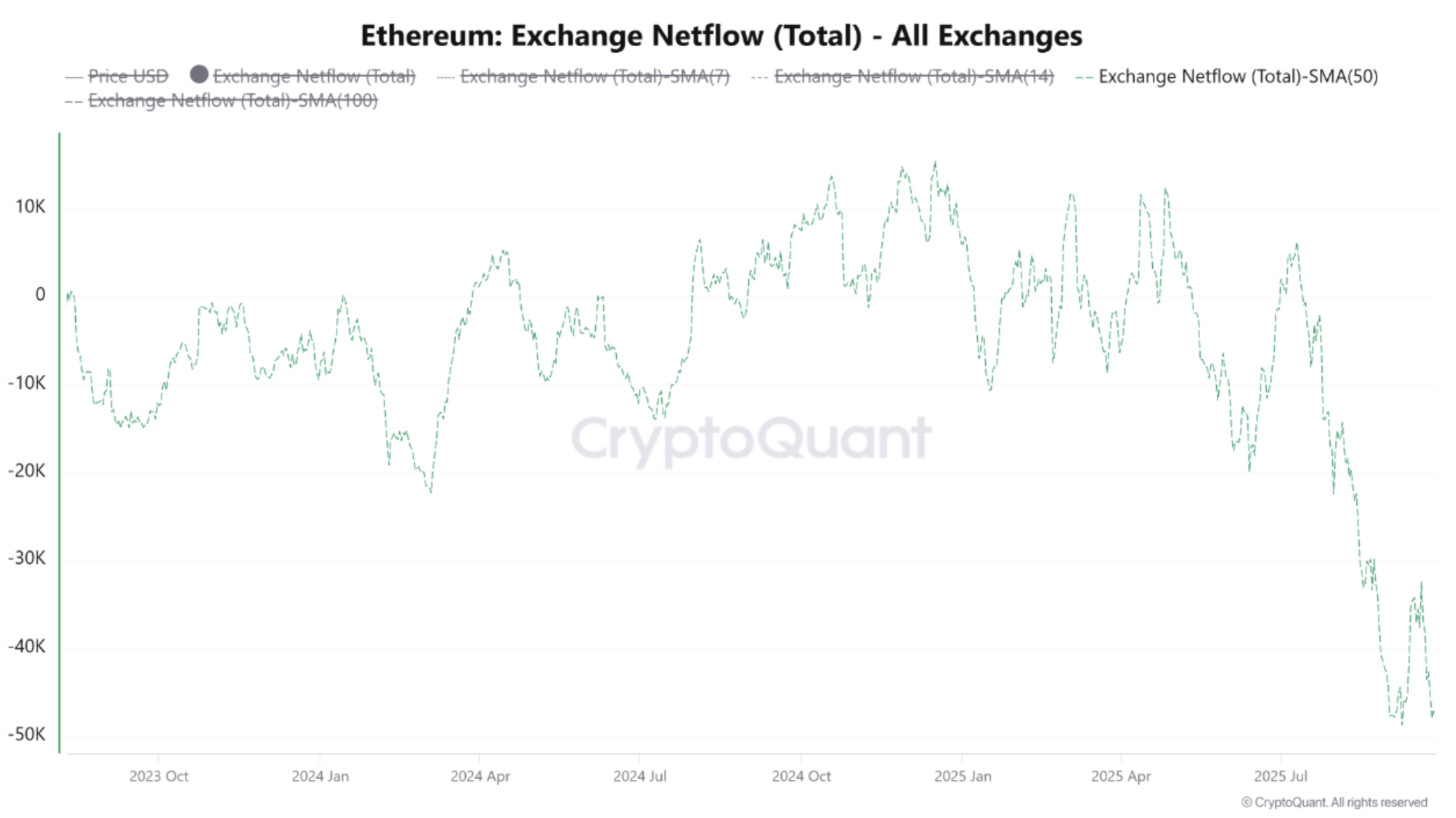

According to a CryptoQuant Quicktake post by contributor CryptoOnchain, Ethereum outflows across all leading crypto exchanges have surged. In August-September 2025, the 50-day Simple Moving Average (SMA) netflow fell below -40,000 ETH per day, the lowest level since February 2023.

The 50-day SMA dropping below -40,000 ETH per day signified reduced spot market supply and potential upward price pressure. The analyst shared the following chart to explain this dynamic.

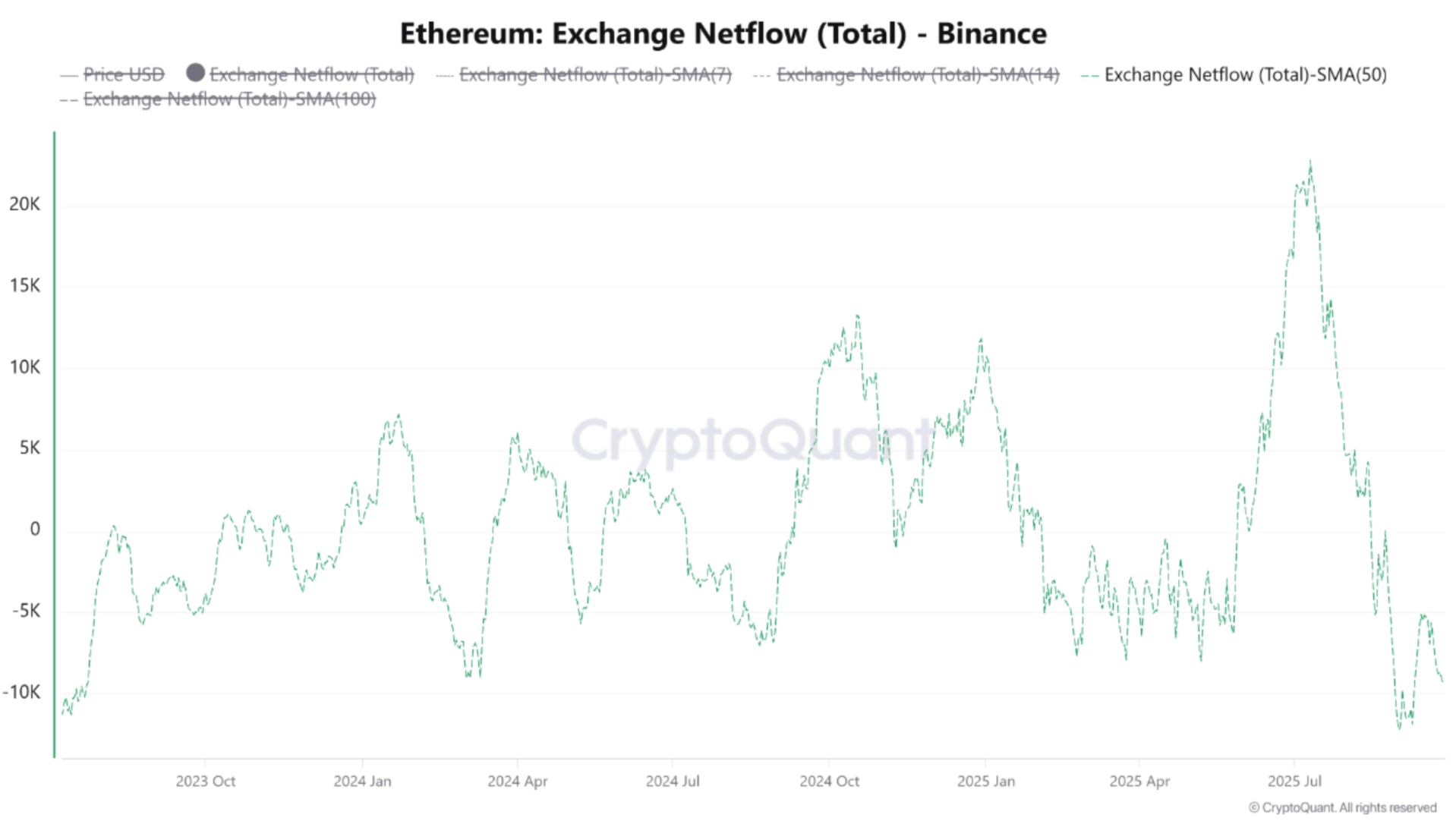

Meanwhile, data from Binance crypto exchange shows netflow fluctuations over the past two years, oscillating between positive and negative values. However, a clear move towards heavy outflows has emerged in recent months.

The following chart shows how the 50-day SMA has reached its lowest level in two years on Binance. This indicates diminished liquid holdings on Binance, in line with the broader market trend.

A similar trend can be observed on Coinbase Advanced, a top crypto trading platform that primarily serves institutional investors and US-based clients. Here, the 50-day SMA has dropped to around -20,000 to -25,000 ETH, recording the lowest level ever for this exchange.

The CryptoQuant contributor noted that the significant decline on Coinbase Advanced since early summer 2025 indicates large-scale asset transfers. Presumably, these are done by institutional investors into cold wallets or non-custodial platforms.

CryptoOnchain concluded by saying that the combination of multi-year lows at Binance, coupled with all-time lows at Coinbase Advanced, signals a structural, market-wide trend of ETH withdrawals from exchanges. They added:

This kind of liquidity drain typically reduces immediate supply and sets the stage for potential medium‑term bullish moves – provided demand in the market rises.

ETH Whales Preparing For Another Rally?

Although ETH’s momentum has turned bearish over the past few weeks, on-chain data reveals that ETH whales – wallets with significant ETH holdings – are quietly accumulating the digital asset ahead of another potential rally.

Most recently, crypto analyst Darkfost highlighted that ETH accumulator addresses are rising at an unprecedented rate. Notably, close to 400,000 ETH was added to these specialized wallets on September 24.

ETH whales accumulating the digital asset despite its subpar price performance over the past few weeks is not surprising, as bullish macroeconomic prospects point toward a potential upcoming rally for the cryptocurrency. At press time, ETH trades at $3,900, down 2.8% in the past 24 hours.

SoftBank, Ark Invest Among Potential Investors In Tether’s $15 Billion Funding Round

The industry’s largest stablecoin issuer, Tether (USDT), is reportedly in discussions with a series ...

Ethereum Stuck Below $4,060: A Fakeout Or Fresh Leg Down To $3,600?

Ethereum finds itself at a crossroads after tapping the $3,800 liquidity level and bouncing back, on...

Bitcoin Bull Run Is Over? These Signals Show Where The Market Is At

Bitcoin (BTC) has entered a critical phase in its cycle, prompting analysts to debate whether the lo...