Crypto Market Crash: Are Falling U.S. Bond Yields the Real Reason?

The post Crypto Market Crash: Are Falling U.S. Bond Yields the Real Reason? appeared first on Coinpedia Fintech News

The cryptocurrency market starts its week on a bearish note, wiping out nearly 4.5% in value and hundreds of billions in market cap within just 24 hours. Bitcoin led the drop, sliding about 3% to $112,800 and pulling the broader digital asset market lower with it.

While many pointed to weak momentum and profit-taking as the cause, a deeper factor can be found in the bond market, which is quietly shaping global investor sentiment.

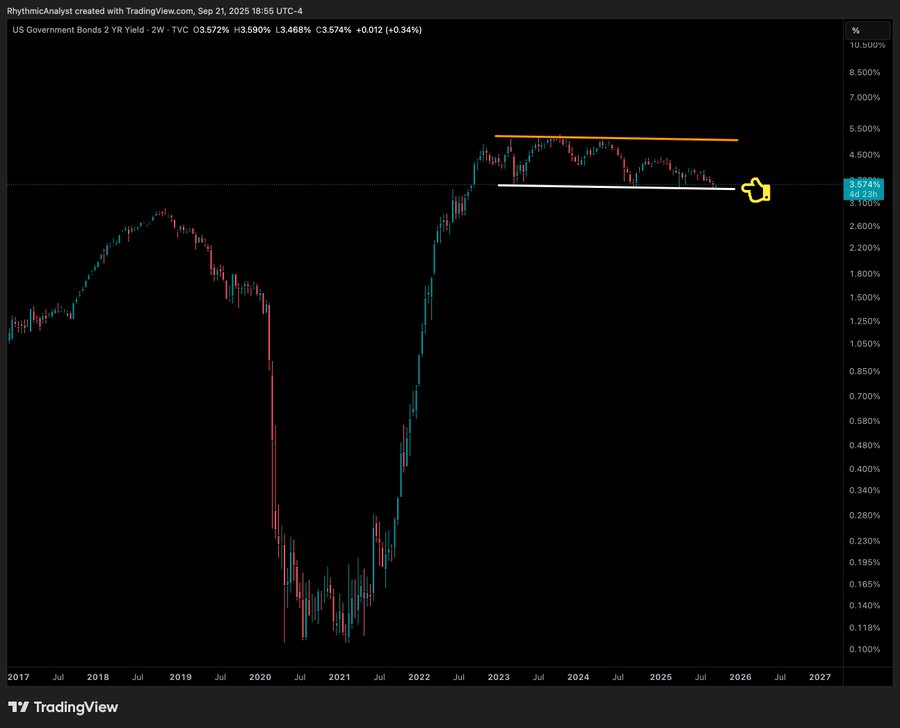

2-Year Bond Yields Sit At Low

Bond yields are more than just numbers for Wall Street, they set the tone for where money flows. According to the market analyst Mihir , U.S. Treasury yields have become one of the strongest signals for both stocks and crypto.

After the COVID money-printing era, yields surged higher, reflecting growing economic uncertainty. Since early 2023, 2-year yields have moved sideways, giving room for risk assets like crypto to rise. However, rising yields usually hurt Bitcoin and altcoins as investors choose safer returns.

But now, they sit at a critical support level, and the 2-year bond yields have already triggered a downtrend, it’s just that a new low hasn’t been made yet. If they drop further, it could shift global markets.

As Mihir noted that the next few weeks will reveal whether this becomes the key driver for crypto prices.

Fed Rate Cut Buzz Fades

This bond pressure came just as the excitement from the Fed’s recent rate cut began to fade . Bitcoin and major altcoins dropped late Sunday, as traders grew cautious about future policy moves.

Fed Chair Jerome Powell described the cut as a “risk management” step and hinted there was no rush for further cuts.

- Also Read :

- Why Crypto Market is Down Today? BTC Rejection at $117k, ETH Hit by Liquidations

- ,

That cautious tone added to market nerves, leading to heavy liquidations. In the last 24 hours alone, 403,784 traders were wiped out, with $1.7 billion in total liquidations. The largest hit was a $12.74 million BTC trade on OKX.

Altcoins Take a Bigger Hit

As Bitcoin struggled, altcoins suffered even sharper declines. Ethereum fell over 7% to $4,190, its lowest in more than a month. XRP dropped 6% to $2.76, a three-week low. Solana slid 7%, while Cardano sank 9%.

Even meme coins weren’t spared, with Dogecoin plunging 11% and TRUMP falling 9%.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The market is down due to rising bond yields making safer investments more attractive, fading optimism from the recent Fed rate cut, and over $1.7 billion in leveraged long positions being liquidated.

Rising bond yields offer investors safer, guaranteed returns. This often pulls capital away from riskier assets like Bitcoin and altcoins, leading to price declines in the crypto market.

Initially yes, but the effect faded. The Fed signaled caution about future cuts, creating uncertainty and causing traders to take profits, which added to the market’s downward pressure.

Altcoins fell sharper than Bitcoin. Ethereum dropped over 7%, while Solana and Cardano sank 7% and 9% respectively. Meme coins like Dogecoin plunged over 11%.

Liquidations signify extreme volatility. While not unusual, they highlight the risks of high leverage. Investors should be cautious and avoid overexposure in such thin liquidity conditions.

US Economic Calendar This Week: Key Events That Could Shake Crypto Markets

The post US Economic Calendar This Week: Key Events That Could Shake Crypto Markets appeared first o...

Pi Network News Today: Pi Coin Price Hits New All-Time Low at $0.2552

The post Pi Network News Today: Pi Coin Price Hits New All-Time Low at $0.2552 appeared first on Coi...

Pro-XRP Lawyer Says SEC Lawsuit Excuse No Longer Holds Back XRP Price

The post Pro-XRP Lawyer Says SEC Lawsuit Excuse No Longer Holds Back XRP Price appeared first on Coi...