Dogecoin RSI Signal Returns—Last Time It Sparked A 1,700% Rally

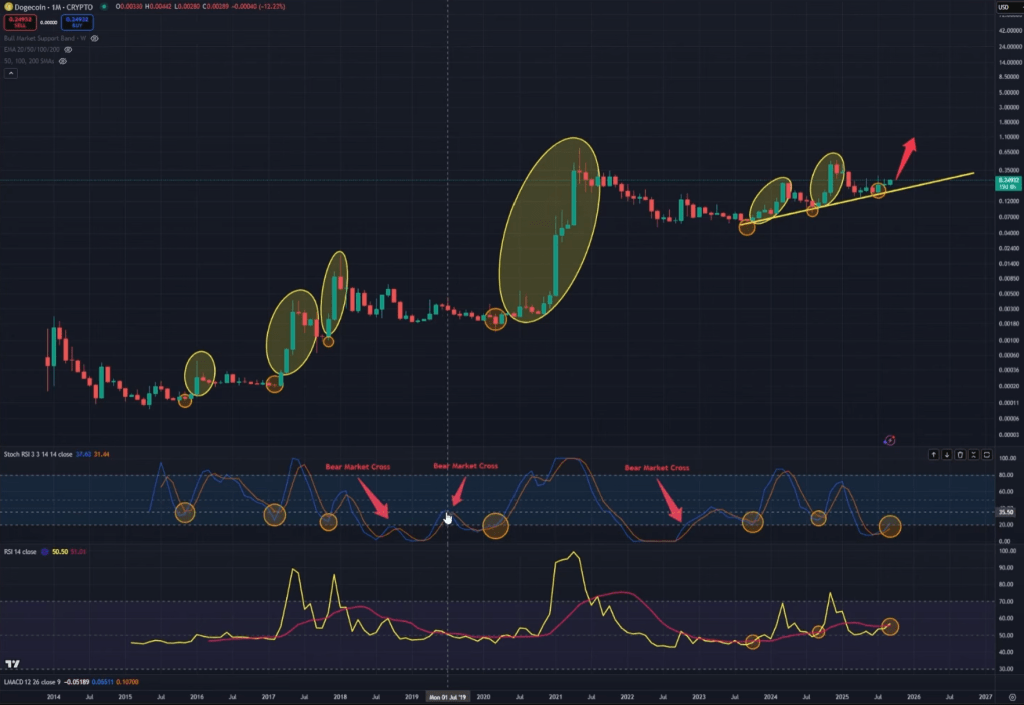

Dogecoin is approaching a familiar inflection on the monthly chart that previously preceded its most explosive advances, according to a new high-timeframe analysis from Kevin (Kev Capital TA) published on September 11. The analyst argues that a fresh stochastic RSI (stoch RSI) cross to the upside on the monthly timeframe—now forming but not yet above the 20 threshold—echoes the technical regime that fueled Dogecoin’s prior cycle blow-offs.

Dogecoin Explosion Imminent?

“Back in February 2017, Dogecoin got a V-shaped stock RSI cross above the 20 level and it went on another rally… 1,852%,” he said , adding that a subsequent monthly cross “produced a very nice 1,751% gain” before the market ultimately topped. The setup, he contends, is again coalescing into Q4.

The framework is deliberately simple: pair the monthly stoch RSI with the monthly RSI and an anchored trend structure. In the 2015–2017 cycle, sustained stoch RSI crosses above 20 were the dividing line between failed bear-market feints and true bull-cycle advances. By contrast, a 2019 impulse rally faded because “the stock RSI never really got a durable cross to the upside,” occurring amid a still-dominant bear regime, he noted. In the 2020–2021 cycle, a new stoch RSI bull cross above 20 “goes on its major bull market rally, which was the biggest rally Dogecoin has ever been on.”

Kevin says the present cycle has followed a cleaner sequence than prior ones. After a confirmed monthly stoch RSI bull cross earlier in the cycle, Dogecoin delivered an initial advance “roughly 280%,” then, following a corrective phase, another monthly cross powered a “November-December rally” of about “497%.” The market then reset again.

Today, he sees that process restarting: “We are getting a monthly stock RSI cross again. However, we have not yet crossed the 20 level. So this is the very beginning stages of a potential rally for Dogecoin.” He emphasizes that historically, “you don’t even get your most bullish price action until the stock RSIs are above the 80 level,” calling the current moment the “first or second inning.”

Beyond momentum, the analyst highlights a three-part structural confluence he considers critical on the monthly chart. First, the RSI itself has repeatedly crossed back above its moving average at inflection points; second, each of those RSI/MA recaptures “has coincided with a stock RSI cross to the upside”; third, price has defended a long-running trend line on a series of higher lows.

After a brief deviation below, “we’re now breaking back above the trend line and the [RSI] MA at the same time after holding the 50 level,” which he describes as a textbook double-bottom reaction. He stresses that monthly closes still matter—“we still have… more than half a month to go… this is not guaranteed”—but the multi-indicator alignment is intact. In his words, “we’re talking about a combination of indicators and technicals that have never failed before,” provided the macro backdrop doesn’t flip adverse.

Macro Conditions Need To Align

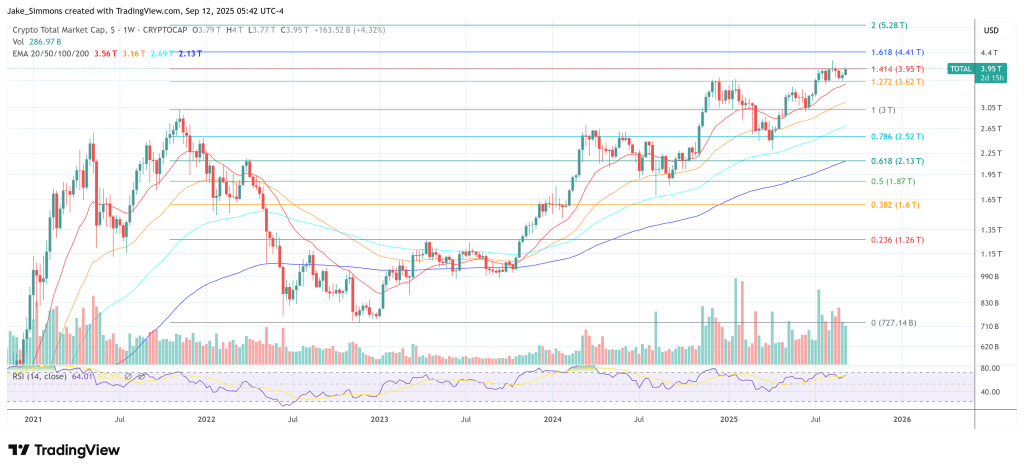

Macro is the caveat and, potentially, the accelerator. Kevin frames US monetary policy as the decisive driver of the crypto risk cycle: “Monetary policy… that’s the earnings report for the crypto market.” He argues that inflation has been range-bound on a year-long view while labor data “continues to soften,” a mix he believes anchors expectations for rate cuts “this month… and… in November and December.”

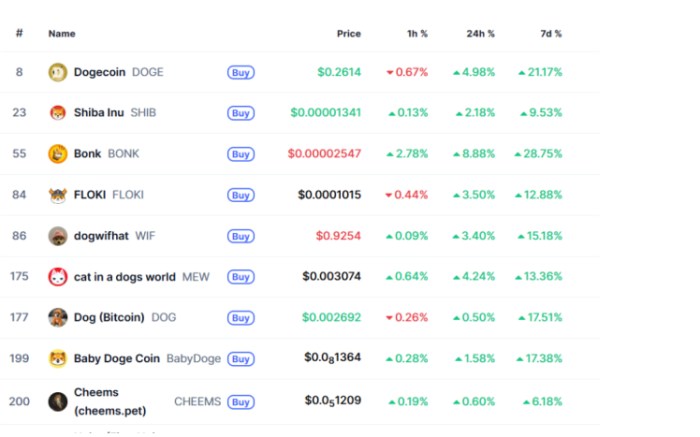

If that path holds and the Federal Reserve’s tone is dovish at the upcoming FOMC , he expects Bitcoin dominance to drift lower and for “alt season” dynamics to reassert, with Dogecoin positioned to “outperform over Bitcoin.” Conversely, a hawkish turn or a renewed inflation drift higher would be a “major hiccup” for the setup.

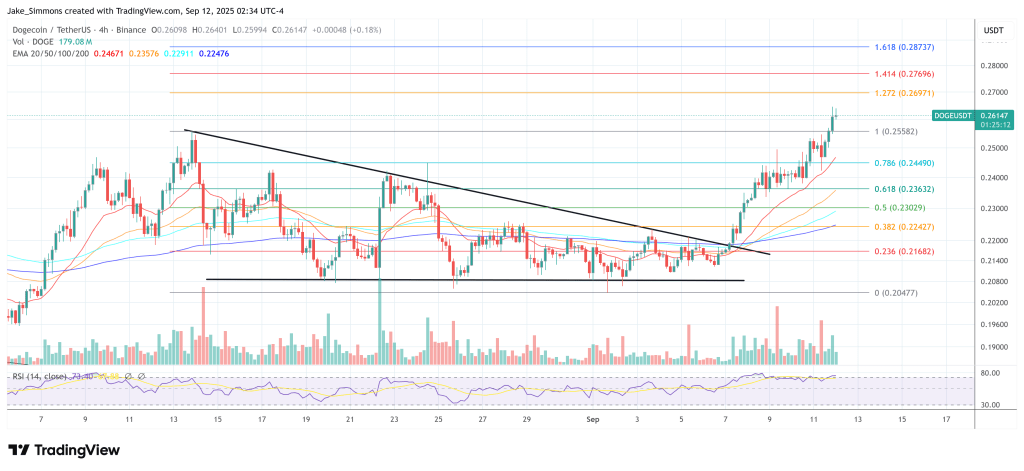

Seasonality and timing also figure in his risk management guidance. September remains “seasonally weak,” and with the FOMC roughly a week away from his recording date, he anticipates choppier, indecisive price action in the near term while markets “sit back and wait for the tone of Powell.”

The higher-timeframe roadmap, however, remains his anchor: monthly uptrend structure, RSI reclaim over its MA, stoch RSI in early-stage turn, and the historical tendency for major Dogecoin expansions to ignite only after those momentum gauges push well into overdrive. “These charts are telling us right in our faces that Dogecoin is preparing for a bigger move higher… the pathway is laid,” he said.

At press time, DOGE traded at $0.261.

Crypto Faces Liquidity Endgame—Debt And Inflation Risks Mount By 2026

Raoul Pal’s latest “Journey Man” episode brings back Michael Howell, CEO of CrossBorder Capital, for...

Dogecoin Up 20% as CleanCore Buys $125M in DOGE —Maxi Doge Could Explode Next

Dogecoin has been steadily rallying, increasing nearly 20% to about $0.25, after a large purchase fr...

$15M In Bitcoin Awakens From 10-Year Slumber As BTC Hits $116K

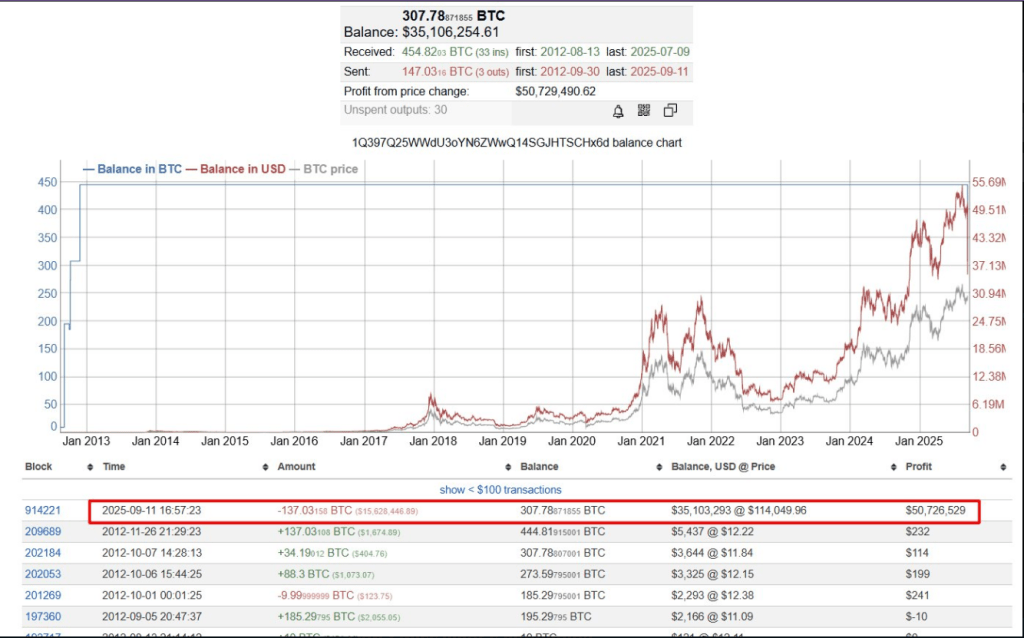

Bitcoin is back in the spotlight after reports confirmed that coins untouched since 2012 have been m...