Jack Ma-Linked Yunfeng Financial Bets Big on Ethereum With 10,000 ETH Purchase

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Jack Ma–backed Yunfeng Financial Group, listed in Hong Kong, purchased 10,000 Ethereum worth $44 million, marking a deeper move into digital asset ventures.

The company

confirmed

that the acquisition was funded entirely through its available cash resources. The move comes as part of Yunfeng’s expansion into Web3, digital assets, and artificial intelligence. Ethereum will serve as a strategic reserve asset for the group.

Ethereum to Be Treated as Investment Asset

In its announcement, Yunfeng clarified that Ethereum will be reported as part of its investment portfolio in official financial reports. The company emphasized that ETH will support tokenization projects and serve as a foundation for new Web3 financial solutions.

Management noted that ETH holdings would not only diversify the company’s assets but also reduce reliance on traditional fiat currencies. The group further outlined potential use cases for Ethereum in insurance, decentralized finance, and new product development.

The company stated that this marks the beginning of its digital asset strategy. Yunfeng plans to expand its treasury allocation by adding other leading cryptocurrencies, including Bitcoin (BTC) and Solana (SOL).

Such diversification will align Yunfeng’s services, ranging from brokerage and asset management to insurance, with new opportunities in decentralized markets.

The Jack Ma Factor in Yunfeng Financial

Public filings show that Alibaba founder Jack Ma holds about 11.15% of Yunfeng Financial through Yunfeng Capital. While he is not directly involved in day-to-day operations, his stake connects the fintech firm to one of China’s most influential entrepreneurs.

This link enhances Yunfeng’s visibility as it transitions from a traditional financial services provider to a company more deeply engaged with blockchain technologies.

Institutional ETH Buying Spree

Beyond Yunfeng’s purchase, market data reveal a wider institutional rush into Ethereum. Blockchain analytics firm Lookonchain reported that whales and institutions have bought 218,750 ETH, worth nearly $943 million, in the past two days alone.

Among these purchases,

BitMine Immersion Technologies

emerged as the largest corporate buyer, securing 69,603 ETH worth $300 million from BitGo and Galaxy Digital.

Meanwhile, five newly created wallets accumulated 102,455 ETH through FalconX, valued at $441.6 million.

https://twitter.com/lookonchain/status/1963777271640232361

Falling Exchange Reserves Signal Supply Crunch

This wave of corporate and whale buying comes at a time when Ethereum’s availability on centralized exchanges is rapidly shrinking.

Data from

CryptoQuant

shows reserves have dropped by almost 10.7 million ETH since September 2022. Current balances stand at just 17.4 million ETH, down from a peak of 28.8 million.

Over the past three months, approximately 2.5 million ETH have been withdrawn from exchanges, primarily absorbed by corporate treasuries and exchange-traded funds.

This supply squeeze has coincided with Ethereum reaching a record high of $4,953.73 in late August 2025. As of press time, ETH trades at $4,340, down 0.67% over the last 24 hours.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/527261.html

Related Reading

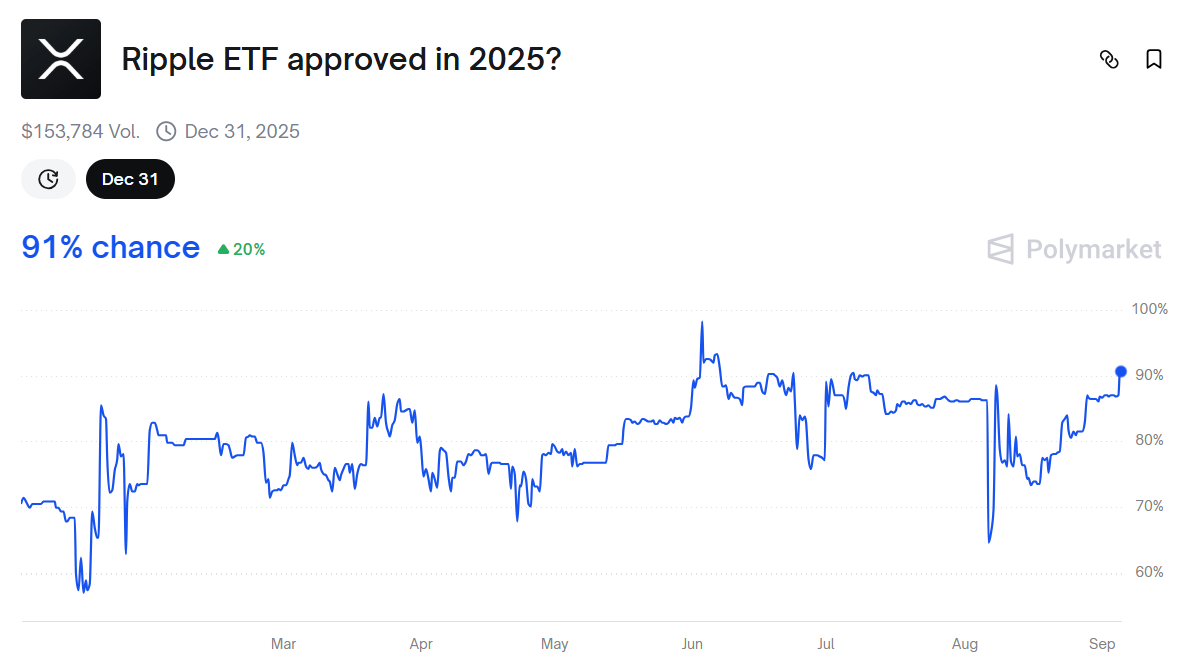

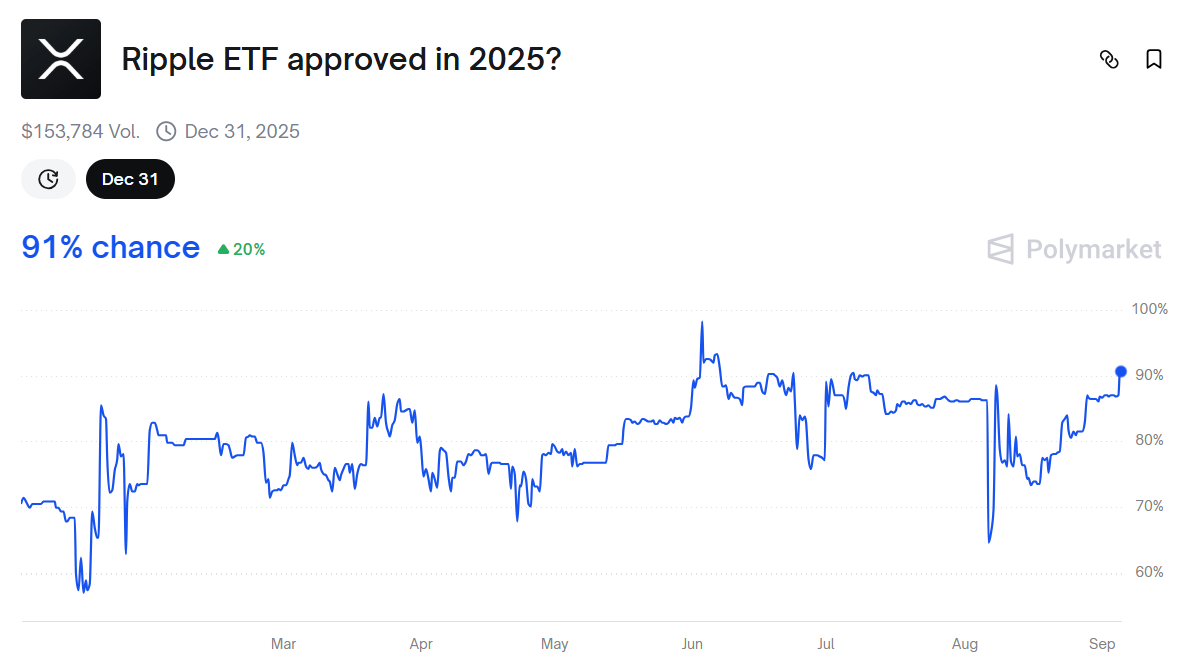

Fib Analysis Shows XRP at $31 and Ethereum at $8,000 on Same Level

A notable market technician has shown that XRP and Ethereum could eye lofty targets at the same Fibo...

Ripple Confirms BlackRock To Attend Swell Conference

Ripple has confirmed that a BlackRock executive will be among the high-profile participants at its u...

Here’s Where XRP Could Trade by December 2025

AI chatbots Google Gemini and ChatGPT predict XRP price for December 2025, considering the bullish d...