US Fed to Host Public Forum on Future of Digital Payments

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The U.S. Federal Reserve has announced that it will host a

Payments Innovation Conference

in October.

The gathering will explore how emerging technologies are reshaping the financial system. Regulators, academics, technology experts, and financial institutions participate in a full day of panels and discussions.

Notably, the event will cover some of the most debated innovations in the industry. These include stablecoin business models, tokenization of assets and services, the convergence of traditional and decentralized finance, and the role of artificial intelligence in payments.

According to the Fed, the conference will also provide an opportunity for industry leaders to share perspectives on the opportunities and risks in these technologies.

Fed’s Emphasis on Safety and Efficiency

In a

statement

announcing the event, Federal Reserve Governor Christopher Waller said that innovation has always been a driving force in payments. He noted that consumers and businesses are demanding faster, safer, and more flexible options. As a result, regulators must evaluate new approaches.

Waller added that the conference would serve as a platform for exchanging ideas. These discussions will center on enhancing the security and efficiency of the payment system.

Importantly, the Fed confirmed that the proceedings will be livestreamed and made publicly available on its website. This move ensures transparency and provides wider access to the debates.

Policy Shifts Signal Openness to Crypto

The Fed’s decision to organize such a forum comes amid a noticeable change in its policy stance toward digital assets. Earlier this year, the central bank

withdrew guidance

that had discouraged banks from engaging in crypto and stablecoin activities.

It also ended special supervisory programs that were tasked with overseeing banks involved in cryptocurrency businesses. Additionally, the removal of the “reputational risk” classification from bank examinations is also a step toward normalizing banking relationships with crypto firms.

These moves have been welcomed by industry participants who argued that prior rules effectively led to “

crypto debanking.

”

Stablecoins Gaining Recognition in Policy Circles

Stablecoins remain one of the most discussed areas of innovation. The minutes from the July meeting of the Federal Open Market Committee (FOMC) suggested that fiat-pegged stablecoins could play a useful role in enhancing payment efficiency.

Committee members also observed that greater adoption of stablecoins could increase demand for high-quality collateral, particularly U.S. Treasury securities.

This marks a significant acknowledgment from the Fed that such digital instruments may complement the existing financial system rather than pose a threat to it.

By spotlighting stablecoins and tokenization, the Fed is signaling that it sees these technologies as more than passing trends. Instead, they are building blocks of the future financial system, capable of reducing friction in cross-border transactions, improving settlement speed, and opening new avenues for financial inclusion.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/527036.html

Previous:链上枯坐许久,ICM、CCM、PM能否开启下一轮叙事?

Next:为什么大家都在「盯」稳定币,却很难入场?

Related Reading

XRP Uncertainty: Is XRP Still Worth Holding

Crypto rivalries often get noisy, and in the past few weeks, XRP has again become the target of shar...

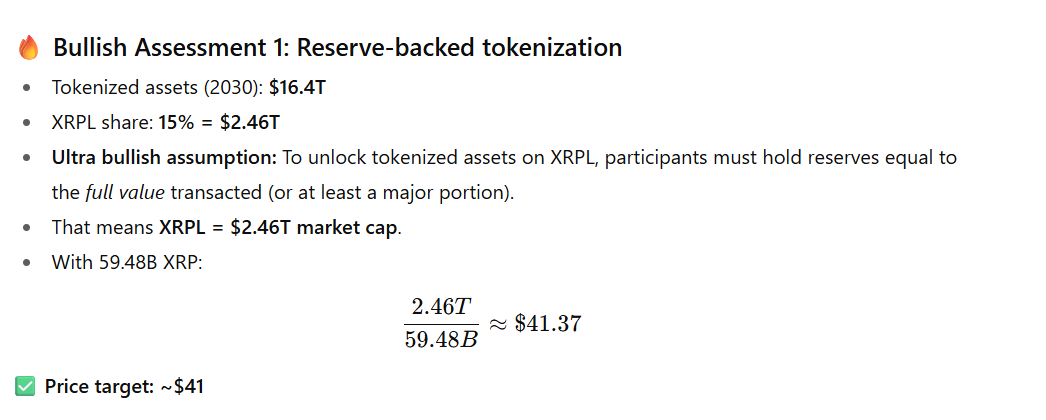

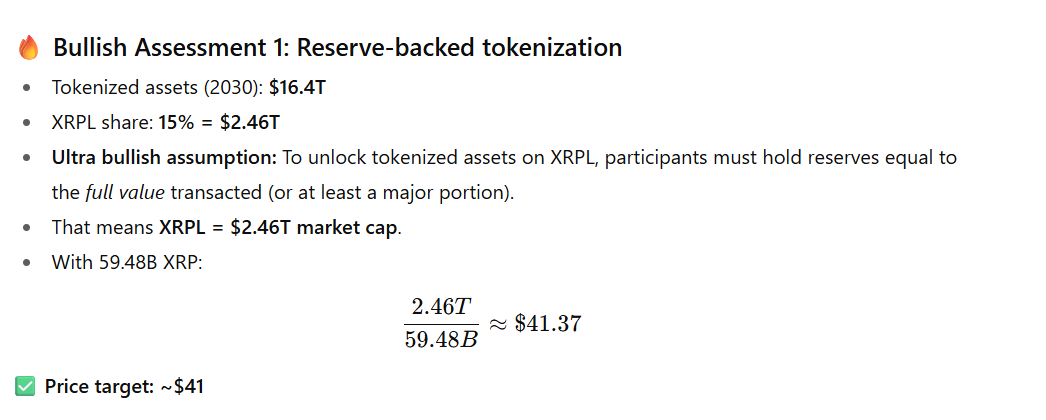

Here’s the Possible XRP Price if Tokenization Reaches 10% of Global GDP by 2030

XRP could benefit tremendously if tokenization claims 10% of the global GDP by 2030 and the XRPL cap...

Cardano Founder Demands Apology from Critics After Audit Confirms 99%+ ADA Vouchers Redeemed

A recent forensic audit and investigative report has exonerated Cardano founder Charles Hoskinson of...