Hyperliquid Hits $400B Trading Volume and $100M Revenue as HYPE Price Eyes $55 Breakout

Hyperliquid is slowly building a name within the decentralized finance (DeFi) sector. In August, the platform recorded nearly $400 billion in perpetual trading volume and more than $106 million in revenue, according to DefiLlama.

This milestone not only cements Hyperliquid’s dominance in the decentralized perpetuals market, where it now controls around 70% of market share, but also signals growing adoption by both retail and institutional investors.

A key driver of this success is its proprietary HyperEVM blockchain, designed for speed, scalability, and zero gas fees. These features replicate the performance of centralized exchanges while maintaining DeFi’s transparency and user custody, making Hyperliquid an appealing alternative to platforms like Binance or Solana-based DEXs.

Whale Activity and Market Sentiment

Despite its strong fundamentals, HYPE , the platform’s native token, is facing volatility. Currently trading around $44, HYPE has retraced from the $51 mark but remains on track for a possible breakout. Analysts point to resistance at $48.73, with upside targets at $52, $55, and even $73 if bullish momentum persists.

Whale activity has added intrigue to the token’s outlook. Recently, a whale deposited over $3 million USDC into Hyperliquid and opened a leveraged short against HYPE, sparking debate about near-term price action.

While shorts suggest caution, derivatives data shows rising open interest and a slight long bias, hinting at sustained optimism among traders.

Can Hyperliquid Become the Next “Killer App”?BitMEX co-founder Arthur Hayes has gone as far as calling Hyperliquid a “decentralized Binance,” projecting the HYPE token could rise over 100x if adoption keeps pace. The launch of a 21Shares Hyperliquid ETP on the SIX Swiss Exchange also signals mounting institutional confidence.

Still, challenges remain. Hyperliquid has faced brief outages and accusations of whale manipulation in newly launched futures markets. To counter this, the team has implemented stricter safeguards, including tighter price caps and external data integrations. These moves aim to balance rapid growth with market integrity.

With trading volumes surging, institutional adoption growing, and technical indicators hinting at a potential HYPE breakout toward $55, Hyperliquid stands at a defining moment. If it maintains momentum while addressing risks, it could cement itself as crypto’s next true “killer app.”

Cover image from ChatGPT, HYPEUSD chart on Tradingview

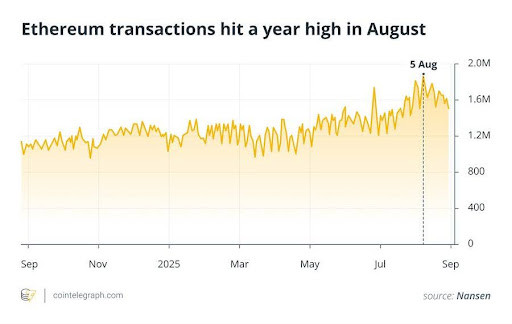

Ethereum Network Activity Surges As Daily Transactions Reach 12-Month Peak — Details

Ethereum’s on-chain activity has reached a new milestone and recorded 1.8 million daily transactions...

Cardano Founder Says Chainlink Quoted Them An ‘Absurd Price’, Here’s Why

Cardano’s founder, Charles Hoskinson, has clarified why the blockchain platform was excluded from a ...

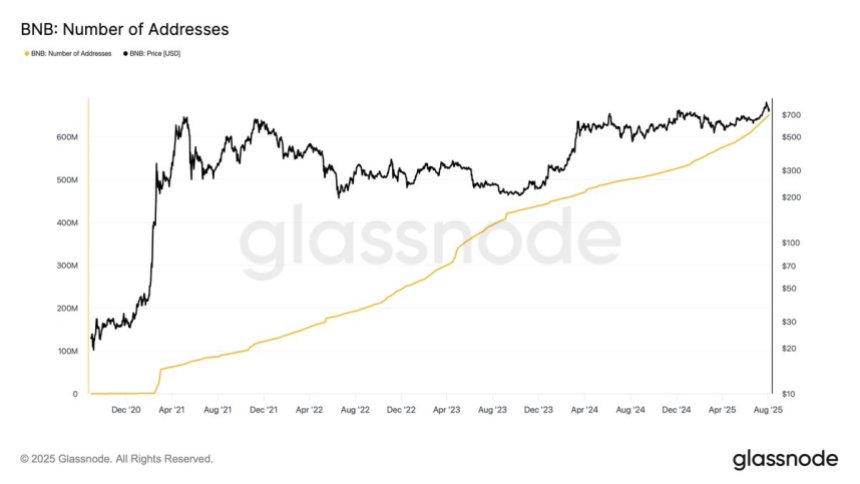

BNB Chain Surpasses 650M Unique Addresses – Binance Adoption Continues

Binance is once again in the spotlight as its native token, BNB, tests a crucial level after recentl...