Tech Rout Weighs on Crypto Sentiment

This edition of Blockhead Daily Bulletin is brought to you by SRK Haute Hologerie, a distinguished watch dealer known for their collection of extremely rare luxury timepieces. The company brings its passion of luxury watch collecting and experience in financial markets to advise, build and create word-class collections. It provides access to rare, in-demand timepieces to those that seek artistry, rarity or value within the world of Haute Horlogerie. For over two decades, SRK has been quietly advising and building collections across the globe. Whether it’s helping clients with their first timepiece or presenting them with the 250th for their collection, SRK pride itself on advising and sourcing luxury pieces utilizing the knowledge and relationships only it has.

A recovery in Bitcoin was cut short as an unexpected threat emerged. Prominent AI and data center firms, which have significantly contributed to the growth of the US stock market this year, reported disappointing earnings for the June quarter.

Concerns regarding escalating debt levels and declining profit margins were highlighted in the publications. The decline in AI stocks resulted in a 1.3% decline for the Nasdaq on Friday, marking its most significant drop since the employment-related downturn on August 1st. On Tuesday closed 0.82% down.

Due to the significant correlation observed with the Nasdaq since June, Bitcoin's price has experienced a decline of about 4%.

However, beneath the surface volatility, institutional flows paint a more nuanced picture. Our BRN analyst notes that BTC spot ETFs logged +$333 million on Tuesday, led by Fidelity FBTC with +$133 million, while ETH spot ETFs posted –$135 million with no ETF seeing any inflows.

This ETF flow divergence coincided with continued corporate treasury accumulation. MicroStrategy bought 4,048 BTC, with total holdings rising to 636,505 BTC at $73,765 cost basis and 25.7% YTD BTC yield. Meanwhile, SharpLink added 39,008 ETH to raise total holdings to 837,230 ETH at an average cost basis of $4,531.

Treasury and yield themes are broadening across the crypto ecosystem: ETHZilla deployed $100 million ETH into EtherFi for restaking, while CEA Industries added 38,888 BNB, raising holdings to 388,888 BNB with a goal for 1% of BNB supply by year-end. Additionally, CleanCore raised $175 million for a DOGE treasury.

Market Outlook Remains Mixed

Predictions on where its price will go differ greatly because Bitcoin encounters difficulties. While some industry watchers are pessimistic and predict a quick recovery, others are worried about a drop to near $100,000.

The consensus is that the price will level out at roughly $107,000, while naysayers warn that a further dive below $92,000 is possible if the current trend keeps going down.

This weariness stems from the fact that Ethereum, the second-largest cryptocurrency by market cap, has garnered more attention from investors and traders than Bitcoin has in recent times. The optimistic feeling and increasing momentum around Ethereum persist, even if it had a comparable 6.3% fall over the past seven days.

Concern over unstaking among Ethereum investors used to be widespread, but it seems to have subsided recently.

Adding complexity to the crypto narrative, our BRN analyst highlights that gold hit a record $2,600/oz (+33% YTD) as BTC traded largely decoupled from a flat S&P 500; tariff headlines and push for "bigger" rate cuts add policy noise.

With all this market whiplash, it's clear that Bitcoin's price is now more of a puppet on the strings of global liquidity and the US market than a solo act, yet institutional flows suggest underlying support remains intact.

What Does the Technical Analysis Show?

According to TradingView, in both the spot and futures markets on Binance and Coinbase, it appears that the cumulative volume delta indicates that the 10,000 to 10 million Binance group is selling more than purchasing.

From a technical perspective, this trend is still a major element impacting the intraday price swings of Bitcoin. Data reveals that short positions deepen with each failed effort to flip support and resistance, and selling in futures continues to impede Bitcoin price breakouts.

On the other hand, spot buyers in the retail-size cohort (100 to 10,000) are purchasing each new bottom.

BRN adds important context to this technical picture: BTC is currently holding the $110k - $112k zone with a dense cost basis at ~$110k (1–3m holders); only ~9% of supply sits in loss, which reflects a shallow dip by cycle standards. Additionally, the mean coin-age for 3 months and 6 months is on a gentle rise, signaling accumulation with 10k - 100k BTC cohort stable (no broad whale distribution).

The most noticeable cluster near $104,000 is shown on Bitcoin's 30-day liquidation heatmap, which demonstrates that downward liquidity is still being absorbed. When looking over shorter periods, the bids appear at $105,000, $102,600, and $100,000 on the BTCUSDT 1-hour chart at TRDR.io. With the order book set to 10% depth, you can also find bids in the $99,000 to $92,000 range.

The present order book liquidity and the weakness in BTC prices indicate a predisposition towards additional drops, with sellers dominating over those trying to purchase the dips, despite buyers exhibiting eagerness for acquiring at lower levels.

In the near term, the negative impact of whales selling on the open market is expected to persist.

Technical Indicators Signal Caution

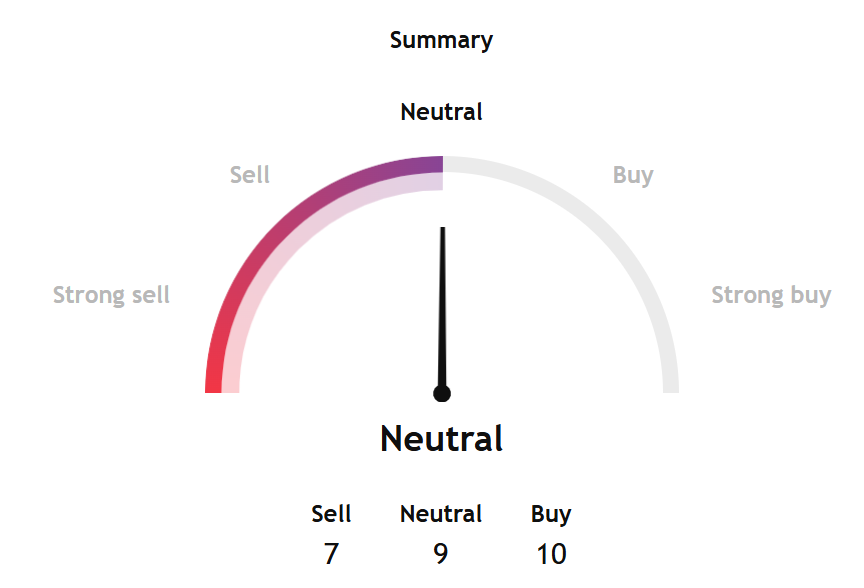

TradingView's BTCUSD technical analysis, which includes the most widely used technical indicators, including moving averages, oscillators, and pivots, gave a neutral signal for the week ahead.

A breakdown shows more sub-indicators under moving averages and oscillators, giving a sell signal.

Source: TradingView

Separately, InvestTech's Algorithmic Overall Analysis gave a weak score for the OG token. The recommendation in the one-to-six-week timeframe is negative.

Bitcoin is currently experiencing a downward trend within a defined channel. This pattern suggests that investors have been liquidating their positions at decreasing prices, reflecting a bearish sentiment surrounding the asset.

According to InvestTech, the top crypto has established support levels at $101,300 and resistance levels at $110,000.

The present order book liquidity and technical weakness suggest potential for additional drops, with sellers dominating over those trying to purchase the dips in the near term. However, the institutional flow data and shallow supply-in-loss metrics suggest this represents a manageable correction rather than a major breakdown.

Overall, the outlook balances technical caution with institutional conviction - while the recommendation across various technical outlooks remains negative for the one to six weeks ahead, the quality of underlying flows and the historically shallow nature of the current dip provide reason for measured optimism among long-term holders.

Elsewhere

Gold at ATH, BTC Reclaims $111K, ETH Sees ETF Outflows But Corporate Bids Persist

Your daily access to the back room....

SEC, CFTC Clear Path for Spot Crypto Trading on Registered Exchanges

Joint statement marks regulatory shift under Trump administration's pro-crypto agenda...

Solana Validators Approve Alpenglow Upgrade to Cut Transaction Times to 150ms

A vote among validators saw a 98.27% approval rate for overhaul targeting Visa-level speeds by 2026 ...