WLFI Slides 15% After Launch As Trump Token Team Eyes Burn Strategy

World Liberty Financial’s Trump-linked WLFI token plunged in price after a high-profile debut, prompting its backers to propose an aggressive buyback-and-burn plan to steady the market.

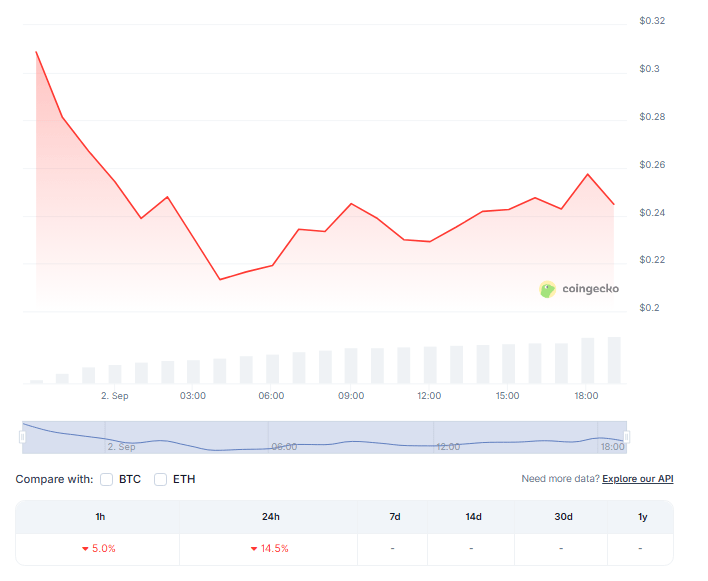

According to trading data and market reports, the token briefly traded above $0.30 at launch before falling as much as 15%–30% and settling around $0.21–$0.24 in the hours that followed.

Early Volatility And What Hit The Market

Based on reports , the sharp drop followed a large token unlock that added roughly 25 billion WLFI to circulating supply, a move that instantly inflated the paper value of the Trump family’s holdings.

That unlock pushed the family’s stake into the billions on paper—various outlets put the tally near $5 billion to $6+ billion depending on the price used.

Trading venues including Binance, OKX and Bybit handled early volume, and roughly $1 billion changed hands in the first hour on some platforms, according to coverage of the debut.

Reports say early investors were allowed to sell a portion of their holdings, which likely amplified selling pressure as markets digested the newly tradable tokens.

Proposal To Use Fees For Buybacks

In response, World Liberty Financial’s community and team floated a buyback-and-burn program that would route 100% of protocol-owned liquidity (POL) fees from chains such as Ethereum, BNB Chain and Solana toward repurchasing WLFI on open markets and permanently burning those tokens.

The aim, according to proponents, is to reduce circulating supply and support longer-term holders. Critics warn that burns funded by fees may take years to materially reduce the massive unlocked supply.

Analysts and commentators pointed out a mismatch between headline valuations and the practical reality of supply dynamics. Depending on which price is used, WLFI’s market cap was reported across a wide band—some outlets published peak valuations in the billions, even as price swings kept the effective market cap volatile throughout the day.

Political Ties And Regulatory QuestionsReports disclose that the project’s ties to US President Donald Trump and his family have drawn extra scrutiny.

Observers say that when political figures hold large token positions, questions about conflicts of interest and regulatory oversight tend to rise faster than normal market noise.

World Liberty insists the project is a private venture with governance rules, but regulators and critics have said they will be watching closely.

Market participants are now watching vote outcomes and governance updates closely. If the fee-to-burn plan is approved and implemented, it will be measured by how much protocol revenue it can divert into buybacks and how quickly those repurchases can reduce supply.

Featured image from Meta, chart from TradingView

WLFI: The Next Cult Coin? Analyst Outlines Potential For Explosive Growth

The recent debut of the World Liberty Financial token (WLFI) in the cryptocurrency market has genera...

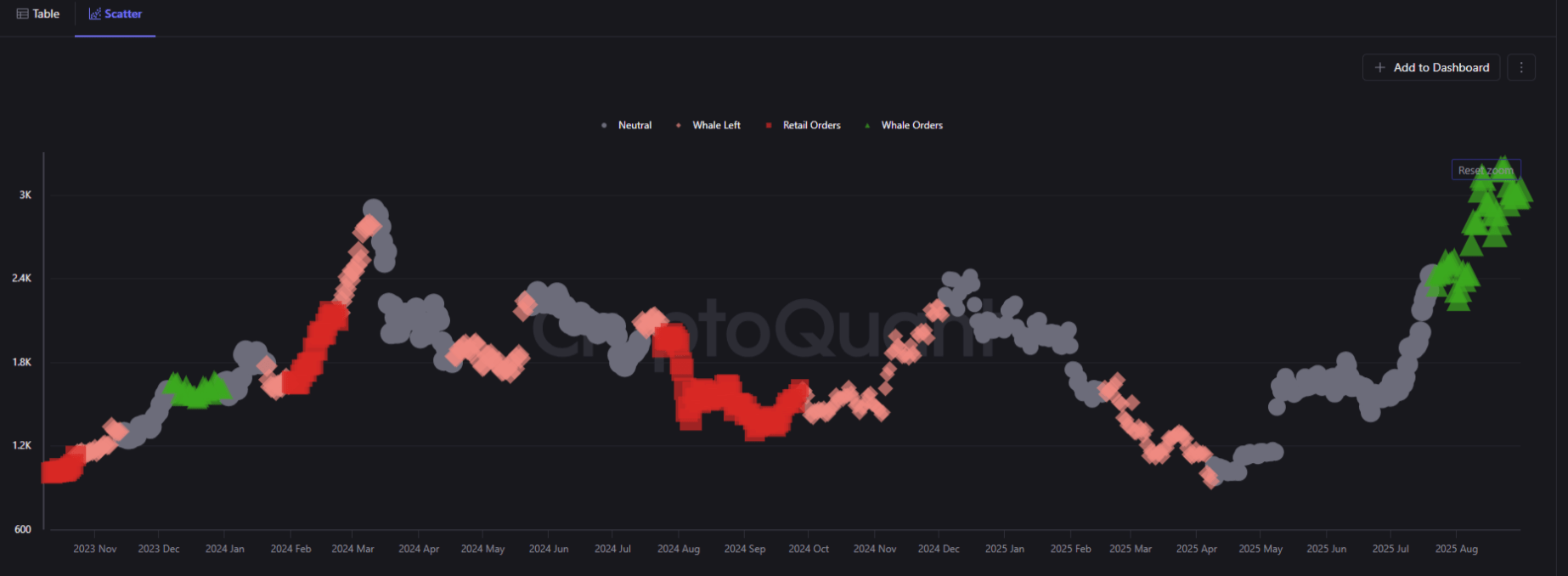

Ethereum’s Latest Rally Fueled By Large-Scale Binance Orders, Analyst Says

Fresh data from Binance shows that Ethereum (ETH) average order size has been trending upward since ...

Metaplanet Becomes A Global Bitcoin Powerhouse with 20,000 BTC Hoard, More Buys Ahead?

In a notable achievement, Metaplanet has made headlines by significantly expanding its Bitcoin treas...