Calm Before The Surge? Bitcoin Price Stability Signals Sustainable Rally Ahead

Bitcoin is entering a phase of unusual calm, with price volatility dropping to some of its lowest levels in years. For many analysts, this reduced volatility is not a sign of weakness; rather, it’s a sign of strength. If this trend continues, the groundwork could be laid for a sustainable bull run fueled by Bitcoin’s growing reputation as a long-term store of value.

Can Reduced Volatility Redefine Bitcoin’s Market Identity?

Bitcoin is entering a new phase in its market evolution. As highlighted by CryptoRank_io on X, the world’s leading cryptocurrency has seen its volatility steadily decline in tandem with the growth of its market capitalization. This trend suggests that Bitcoin is maturing from a speculative, high-risk asset into a more stable, long-term investment vehicle.

Such a shift toward stability could significantly impact how Bitcoin evolves in the years ahead, rather than the explosive, parabolic rallies and brutal corrections that have historically defined BTC’s price action. The lower volatility suggests that the next phase of growth may come in the form of steadier and more sustainable increases with shallower pullbacks.

This is a crucial development for institutional investors and major funds . Traditional finance prefers assets with predictable risk profiles, and Bitcoin’s reduced volatility makes it far more attractive for large-scale allocation.

BTC’s market structure signals bearish sentiment despite rising open interest. According to Luca, the Bitcoin market is showing signs of tension. Since BTC topped out in mid-August, a clear divergence has emerged between Open Interest and Funding Rates. While Open Interest has been steadily climbing, indicating that more positions are being opened, Funding Rates have been trending lower.

This setup suggests that bears are doubling down and loading up on short positions in anticipation of further downside . Traders seem to be betting that the latest move lower is just the beginning, especially as BTC heads into September, which is a historically weak month for Bitcoin. Luca noted that this aligns with his previous observations, suggesting that the market may continue to favor bearish positioning in the near term.

Sideways Movement Highlights Bitcoin Stability

Daan Crypto Trades also revealed that Bitcoin has largely been consolidating over the past few months, showing sideways price action compared to the Standard & Poor 500 (S&P 500). BTC is only up around 10% vs the 2021 all-time high in relation to stocks in 2021.

The trend highlights that the cryptocurrency has yet to replicate the dramatic gains seen in previous cycles. Daan points out that the S&P 500’s performance during this period has been significantly boosted by the surge in AI-related developments , which accelerated equity market gains.

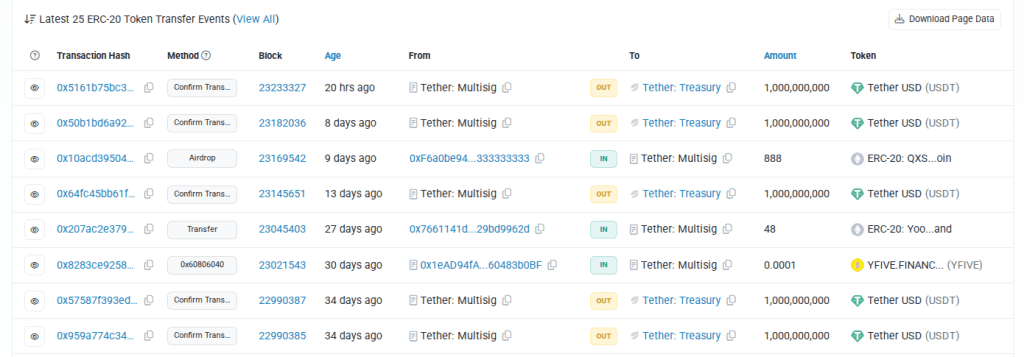

Tether Unleashes $1 Billion In New USDT As Crypto Market Recovers

Tether minted 1 billion in USDT on Wednesday, a move that market watchers say added fresh liquidity ...

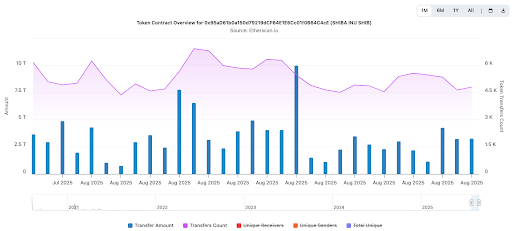

Shiba Inu Sees 300% Surge In This Major Metric, Is The Bottom In?

Shiba Inu (SHIB) is experiencing renewed interest after fresh data revealed a massive 300% spike in ...

Bitcoin OG Who Told People To Buy BTC At $1 Reveals How High XRP Price Will Go

The crypto market is paying close attention after one of the most famous early Bitcoin voices shared...