Surging ETF Inflows Contrast With On-Chain Fatigue as BTC Reclaims $110K

Key Takeaways

- BTC spot ETFs logged +$219 million on Aug 25 and +$88 million on Aug 26, snapping a six-day outflow streak. ETH ETFs led with inflows of +$444 million (Aug 25) and +$455 million (Aug 26), marking four straight days of inflow.

- SharpLink added 56,533 ETH ($252 million), lifting holdings to 797,704 ETH (~$3.7 billion).

- BTC reclaimed $110K support, trading ~$111.4K; ETH back above $4.5K, SOL back above $200, and XRP also hit $3. Reclaim of key price levels coincides with ETF inflows + dip-buying.

- US govt reported to begin publishing economic data on blockchain in a bid to improve regulatory optics and solidify digital infra credibility.

Macro & Policy Drivers

Federal Reserve Governor Lisa Cook insists that President Trump has "no authority" to fire her and is looking to challenge the directive in court. Rate cut expectations continue to define the macro environment along with tariffs, as India refuses to enter new negotiations with the U.S. The proposed plan by the U.S. Government to release economic data on blockchain is viewed as a symbolic step for digital legitimacy. This could serve as a medium-term signal constructive for the blockchain adoption narrative.

Trump Media has partnered with Yorkville Investment and Crypto.com for a $1 billion CRO treasury with $200 million cash backing and a $5 billion equity line. This is a milestone for corporate treasury adoption of alt tokens, which raises concentration/liquidity risk, but also boosts CRO’s institutional narrative.

Market Signals

Bitcoin (Spot & On-Chain)

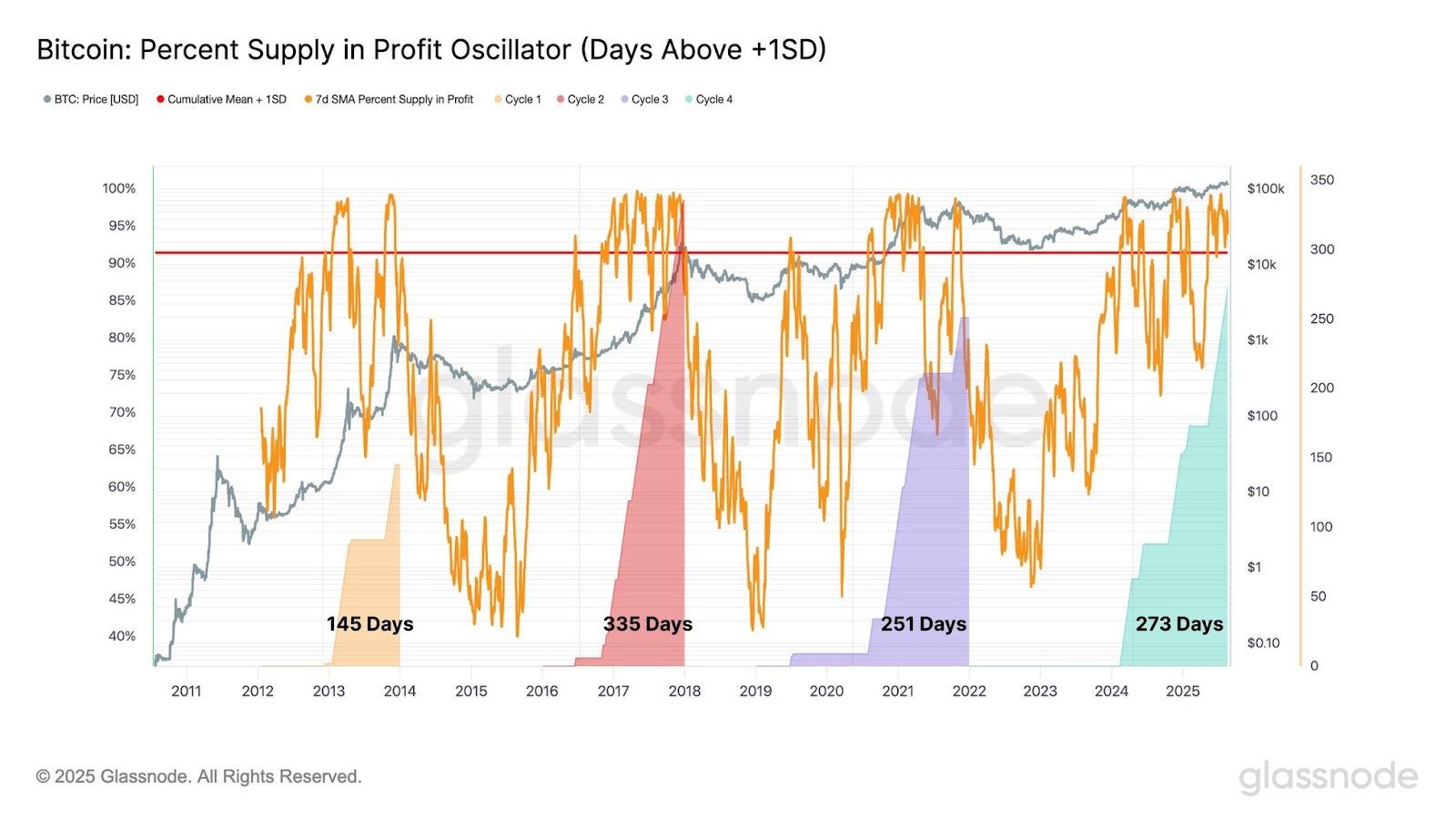

BTC reclaimed the $110K support, which is a key cost basis for 1m to 3m holders. On-chain, transfer volume slipped to $23.2 billion (–13%), approaching the yearly average of $21.6 billion. A break below the yearly average will confirm demand contraction. Currently, BTC is in profit for 273 days (>1σ band), which is the 2nd longest run since 2015–2018, pointing to a cycle extension, albeit a fragile one.

Ethereum (Spot & On-Chain)

The combined ETF inflows of almost $900 million, along with SharpLink’s $252 million purchase, have sustained Ethereum’s current leadership. This has seen price move back above $4.5K, with ETF momentum and structural demand from treasuries. However, network activity has mirrored broader slowdown while profit-taking risks remain elevated (MVRV >2).

Issuance vs. Institutional Demand (BTC)

Current miner issuance continues to hover around 850 to 900 BTC/day. The last two days of ETF net demand have been approximately 1.5x daily issuance. Along with recent treasury acquisitions by Metaplanet, Strategy, etc., this could reinforce supply absorption if sustained in the near term.

What Today’s Tape Says

BTC reclaimed $110K with ETF inflows and treasury accumulation providing a backstop. But network activity slowdown + fragile derivatives structure, which suggests that the rally is not fully confirmed.

Sustained hold above $111.4K opens room to $113.2K - $115K, while a rejection risks retest of $108.9K. ETH leadership reinforced by ETF bid and SharpLink treasury flows.

Positioning (neutral-to-constructive tilt)

- Cash: 30% — maintain cash reserves for IV spikes, policy volatility.

- BTC: 25% — core sleeve; support at $110K–$111K; cut risk if break < $108.9K.

- ETH: 30% — Still overweight due to ETF inflows and treasury demand; manage risks near ATH volatility.

- SOL: 7% — high-beta sleeve; volatility sensitive.

- XRP: 4% / BNB: 4% — diversified beta.

Bottom Line (Aug 27)

ETF inflows and treasury accumulation have briefly restored demand, lifting BTC above $110K and ETH above $4.5K. But weakening network activity, extended profit run, and alt-OI fragility argue for caution. Until BTC reclaims $113K - $115K with sustained inflows, keep positioning balanced: constructive but liquidity-aware, with ETH leadership guiding the tape.

Google Executive Positions Company's Blockchain Against Stripe, Circle Rivals

Web3 strategy head highlights GCUL platform's neutral positioning as competition heats up in enterpr...

BIT Mining Launches AI-Focused Stablecoin DOLAI on Solana

NYSE-listed company targets autonomous AI agent payments with dollar-backed token...

Caution & Uncertainty Persist in Crypto Markets

While global stocks rally on Fed easing hopes, cryptocurrencies show signs of hesitation amid mixed ...