Dogecoin Draws New Attention As Open Interest Tops $3 Billion

According to CoinGlass and market reports, Dogecoin’s futures open interest breached the $3 billion barrier as traders piled back into the memecoin on August 12.

The token climbed to $0.25 that day, and traders recorded a one-day gain of 4.10% while market capitalization rose nearly 4%.

Short bursts of buying pushed derivatives exposure higher, and that helped push DOGE back into headlines.

Open Interest Breaks $3 Billion

Reports have disclosed that futures traders committed roughly 14.4 billion DOGE into positions over a single day — a figure that lines up with the $3.41 billion open interest reading when priced near $0.25.

That number is striking because it means a huge amount of DOGE is sitting in unsettled contracts, not just spot wallets. Some traders see this as a sign of renewed confidence.

Bullish Bets And Some Caution

Rising open interest alongside a rising price often shows new money is coming in, and that is what many market watchers are pointing to now.

At the same time, derivatives volume on some platforms has not kept pace with OI, which can make the move fragile if momentum fades or if a large position reverses.

Reports from exchange data show futures volume dipped while OI climbed, suggesting more traders are holding positions rather than actively rotating them. That dynamic raises the chance of sharp moves if sentiment flips.

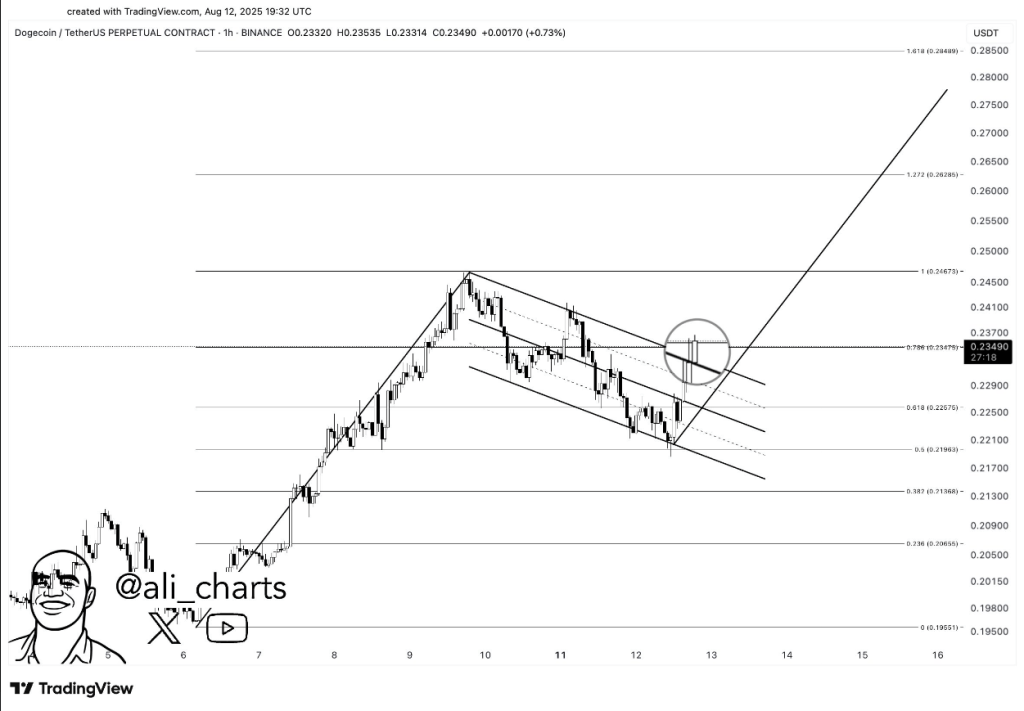

Analyst Targets And Market SignalsAccording to crypto analyst Ali Martinez, Dogecoin is forming a bullish flag on the hourly chart with a target set at $0.27, a view he shared publicly on X.

Other market voices have pointed out that a clean break and higher trading volume would be needed to make that target more likely.

$0.27 next for Dogecoin $DOGE ! https://t.co/bKkOj6fz2z pic.twitter.com/Z5MXTOA2fG

— Ali (@ali_charts) August 12, 2025

Based on data, keep an eye on funding rates, options flow, and whether futures volume begins to climb with open interest.

Funding rate trends will show whether longs are paying to hold positions, and sudden spikes in liquidations can force quick reversals.

Bitcoin’s moves should also be on the radar; memecoins tend to follow the big market swings. If price and OI both keep rising with stronger volume, the bullish case gains some weight. If OI rises while volume falls, the move looks more brittle.

Dogecoin’s jump to about $3.41 billion in open interest and the commitment of roughly 14.41 billion DOGE into futures point to renewed trader interest.

Featured image from Unsplash, chart from TradingView

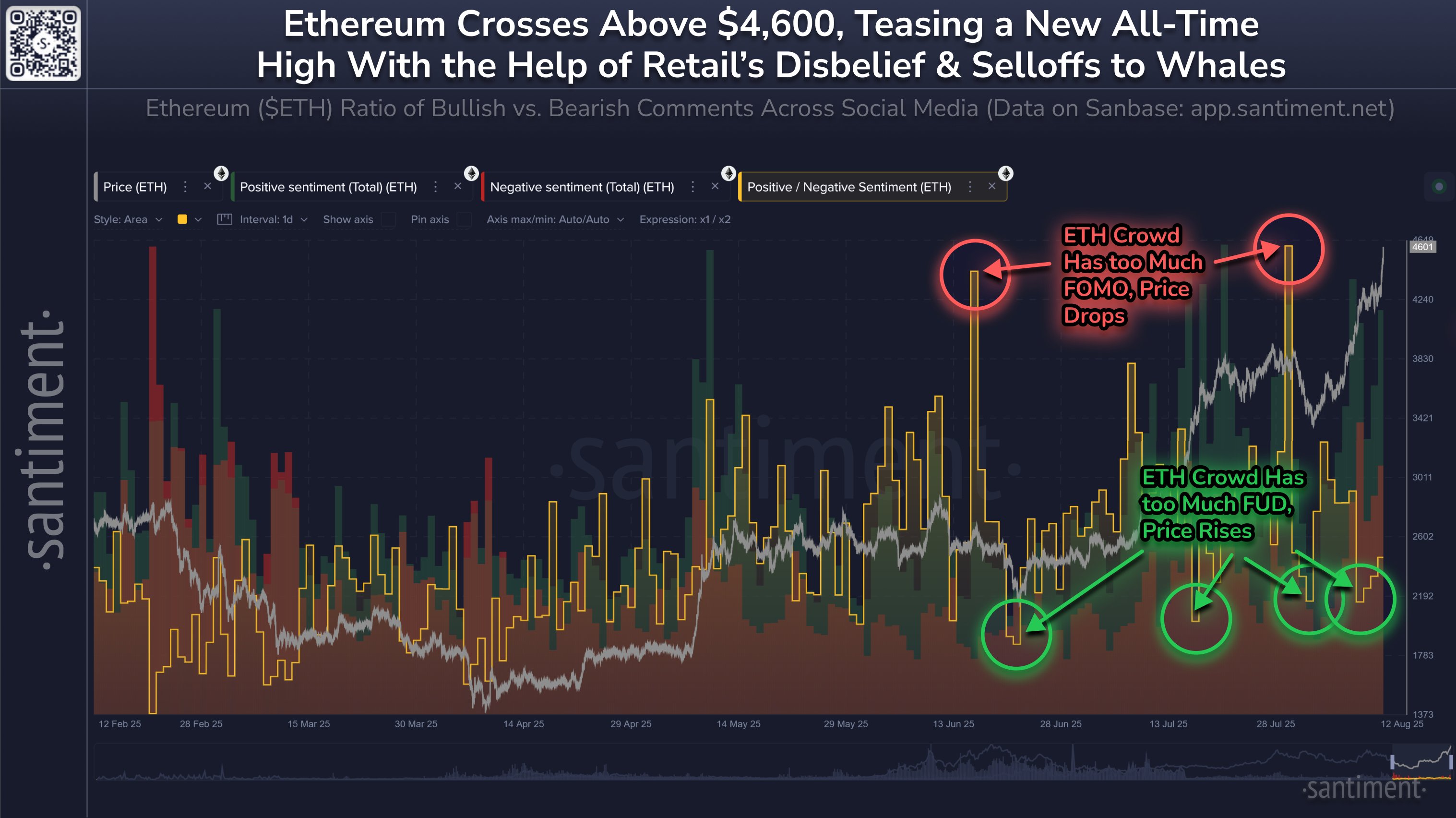

Historic Test Ahead: Ethereum Nears Its All-Time High Amid Retail Sell-Offs

Ethereum is closing in on a historic test, hovering just 6.4% below its all-time high of $4,891. Des...

SOL Surges on Tokenization Boom and ETF Countdown: Could This Be the Start of a Mega Rally?

Solana (SOL) has exploded 12% in the past 24 hours, briefly touching the $200 mark, as a wave of ins...

Ethereum Retail Mood Still Bearish: Perfect Setup For ATH Break?

Data shows Ethereum sentiment on social media doesn’t lean too bullish right now, something that cou...