TRON Inc. Plans $1B Buyback of 3.1B TRX Tokens Amid Price Resilience at $0.33

Good news for TRX investors as TRON Inc. has filed a $1 billion shelf offering with the U.S. SEC, aiming to acquire up to 3.1 billion TRX tokens. This initiative marks an 849% jump from the firm’s last major token purchase of 365 million TRX in June 2025, which coincided with the start of a bullish TRX rally.

Currently, TRX trades at $0.33, showing price resilience despite a 2.94% dip over the last 24 hours. Market watchers are eyeing the $0.35 and $0.40 resistance levels, with the all-time high sitting at $0.44.

The shelf offering enables TRON Inc. to gradually accumulate tokens, reducing the risk of market disruption while maintaining steady upward pressure on the price.

Institutional Confidence and TRON Whale Activity Soar

TRON’s strategic growth has been boosted by a 526% surge in whale transactions, coupled with record-high unrealized profits on the network.

Following its successful Nasdaq listing via a $100 million reverse merger with SRM Entertainment, TRON Inc. is increasingly attracting institutional capital. This mirrors corporate strategies like MicroStrategy’s Bitcoin reserves, signaling a potential paradigm shift in blockchain finance.

Technical indicators remain bullish. TRX sits above key moving averages, with momentum metrics such as MACD and RSI supporting continued price strength. Analysts suggest a breakout above $0.35 could set the stage for a rally toward $0.43.

Stablecoin Dominance and Ecosystem ExpansionTRON now hosts over $80.8 billion in USDT, surpassing Ethereum in Tether supply and processing over $20 billion in USDT daily. The network’s low-cost infrastructure has made it a preferred choice for stablecoin transactions, bolstering its position in cross-border payments.

Despite regulatory scrutiny and governance questions, TRON continues to expand its DeFi and dApp ecosystems. With $1 billion in planned token purchases and institutional backing growing, TRX could be poised for a significant upward trajectory.

Cover image from ChatGPT, TRXUSD chart from Tradingview

Ripple Exec Reveals What Will Drive The XRP Price Value

Ripple Labs Chief Technology Officer, David Schwartz, has offered rare and pointed clarity on what d...

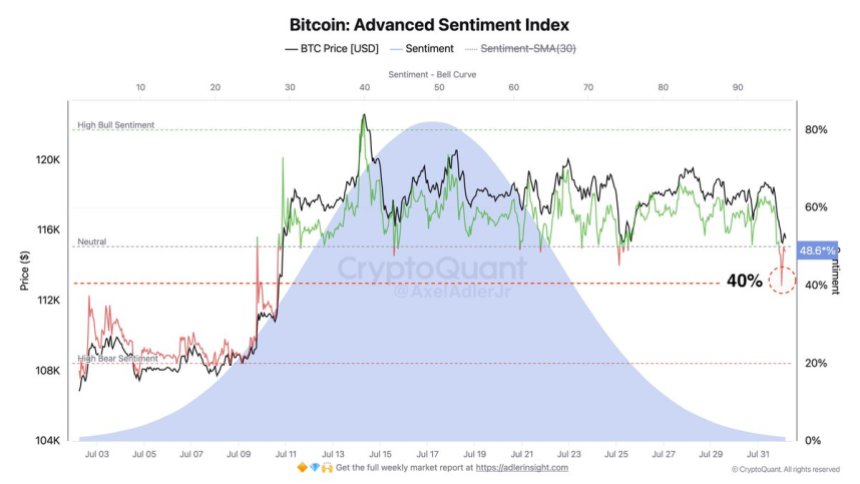

Bitcoin Advanced Sentiment Index Reaches Bearish Levels: Futures Traders Show Caution

Bitcoin has broken down from the two-week consolidation range that held the market between $115,724 ...

SEC Delays Appeal Withdrawal In Ripple Lawsuit, Pro-XRP Lawyer Says Expect To Hear Something In This Timeframe

The Ripple vs. SEC lawsuit appears to be nearing its final stages, but the path is not yet clear. Al...