Top Altcoins To Buy Today As Crypto Market Cools Before Next Bull Run

The post Top Altcoins To Buy Today As Crypto Market Cools Before Next Bull Run appeared first on Coinpedia Fintech News

Top altcoins like ARB, ONDO, XLM, HBAR, and INJ are setting up for the next breakout as the market cools ahead of a renewed altseason push.

In Brief:

-

The Altcoin Season Index has dropped to 43, offering a healthy cooldown before the next breakout phase.

-

Arbitrum (ARB) and ONDO are showing textbook breakout patterns backed by strong ecosystem catalysts.

-

Stellar (XLM) and Hedera (HBAR) are consolidating after sharp rallies driven by RWA and institutional narratives.

- Injective (INJ) leads on-chain growth with a 1,770% surge in active users, signaling strong network demand.

As of July 23, 2025, the CMC Altcoin Season Index stands at 43 out of 100, indicating that the market remains in Bitcoin-dominant territory, although altcoins have started gaining traction.

This marks a moderate rise from last week’s index of 38 and a significant jump from last month’s low of 18, which was deep in Bitcoin season. The altcoin market cap is currently $1.59 trillion, continuing its uptrend despite not yet reaching peak altcoin season (index >75).

The yearly high was recorded at 87 (Altcoin Season) in December 2024, while the yearly low hit 12 (Bitcoin Season) in April 2025. This upward momentum could hint at a gradual shift toward a more altcoin-friendly market environment.

Arbitrum (ARB) Sets Up for a Breakout: Cup-and-Handle in Play

Arbitrum (ARB) is forming a textbook Cup and Handle pattern on the daily chart, signaling a potential breakout after absorbing heavy sell pressure from recent token unlocks.

The price has rebounded from the $0.34 base through multiple support zones and is now consolidating between $0.461 and $0.5045 , shaping the handle.

Technical indicators support this bullish structure: RSI has cooled to 53.7 , MACD remains slightly bullish , and volume is gradually rising —all pointing to healthy momentum.

However, bulls may need to sit tight as ARB continues cooling into the $0.415–$0.461 range. With RSI likely heading toward 35–40 and MACD turning south, a temporary dip toward $0.374 remains possible. That said, this zone serves as a key reload area.

A breakout above $0.5045 , likely between August 2–5 , could ignite a rally to $0.522 , with a measured upside target of $0.60–$0.63 . Backed by the $216M Arbitrum DAO grant and growing L2 momentum, ARB stands out as one of the most technically aligned tokens in this altcoin season.

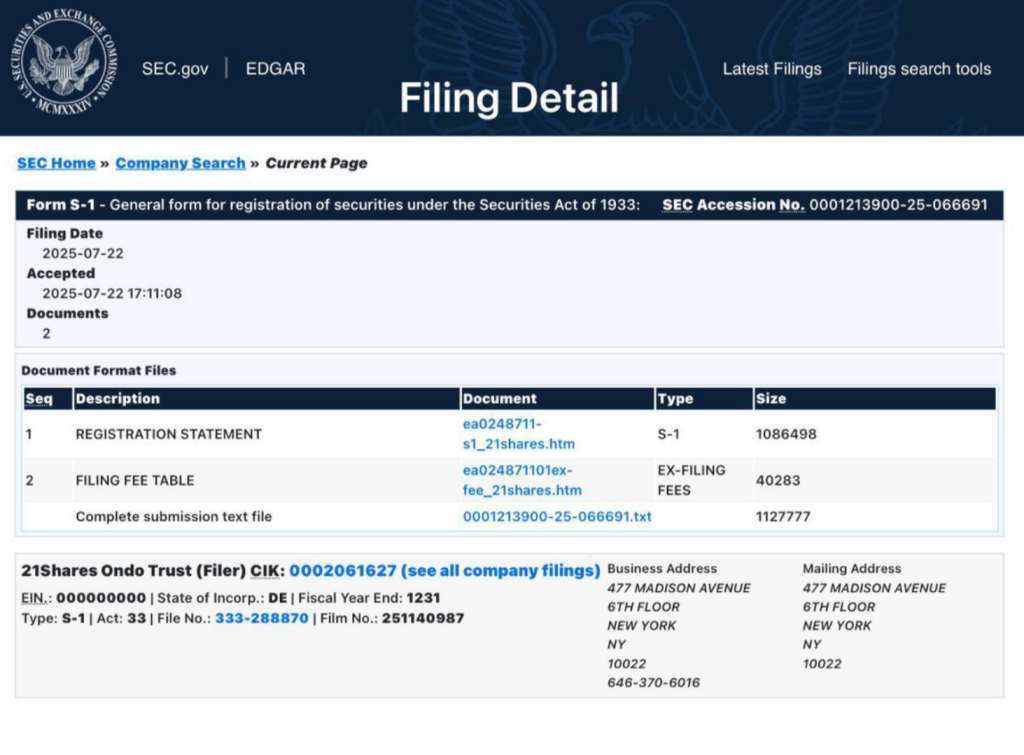

ONDO Price Forms Double Bottom Amid ETF Filing Surge

Following the July 22 SEC filing of the 21Shares Ondo Trust S-1 , ONDO Coin experienced a sharp rally, briefly breaking above the key $1.13 neckline before pulling back.

The move was fueled by speculation around potential ETF approval and growing momentum in the real-world asset (RWA) tokenization space.

On the daily chart , ONDO is now forming a textbook double bottom pattern , with the current price retesting the $0.94–$0.98 support zone —a classic post-breakout setup. If this level holds, the structure remains bullish, targeting $1.30–$1.40 , with a measured move projection up to $1.58 .

Volume remains elevated, and the ETF narrative continues to provide strong tailwinds. A confirmed bounce could validate this ONDO chart pattern and trigger the next leg higher.

XLM Price Forms Bullish Flag After 90% Rally Amid RWA Momentum

Stellar (XLM) has rallied over 90% in July, fueled by rising adoption in real-world asset tokenization and tailwinds from XRP’s legal clarity.

The XLM price is now consolidating within a bullish flag pattern between $0.33 and $0.44 , following its breakout from a long downtrend.

Volume remains strong, and the MACD is cooling off after a parabolic move, with RSI dipping from 77.5 to 59 , suggesting room for re-accumulation before the next leg.

As long as price holds above the $0.37–$0.38 support, the structure remains intact. A breakout from this flag could target $0.51 , with an extended move toward $0.60–$0.62 . With $450M+ in tokenized assets, CBDC pilots, and high-profile partnerships like MoneyGram, XLM remains one of the strongest RWA and cross-border payment plays this cycle.

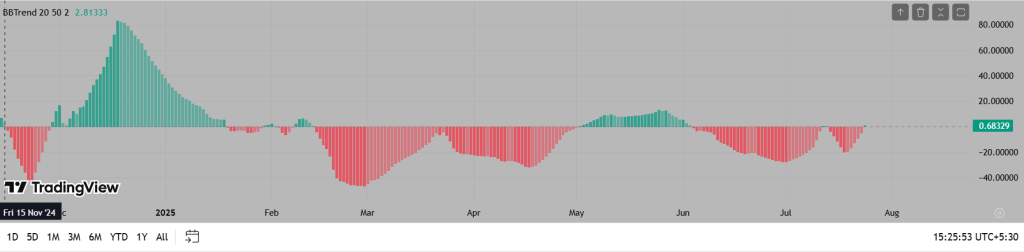

HBAR Price Breaks Out of W Pattern on Institutional Catalyst

Hedera (HBAR) has convincingly broken out of a multi-month W pattern , rallying from the $0.13–$0.14 buy zone to a local high of $0.287 before pulling back.

The price is now testing the $0.23–$0.24 level , which should serve as strong support if bullish momentum holds.

The BBTrend indicator has just flipped green after prolonged negative readings, reinforcing the likelihood of a continuation toward $0.35+ .

On the news front, HBAR’s inclusion in Grayscale’s Smart Contract Platform Fund and Canary Capital’s trust filing provide solid institutional backing.

These developments, paired with the clean technical breakout, make HBAR a compelling case for the next leg up.

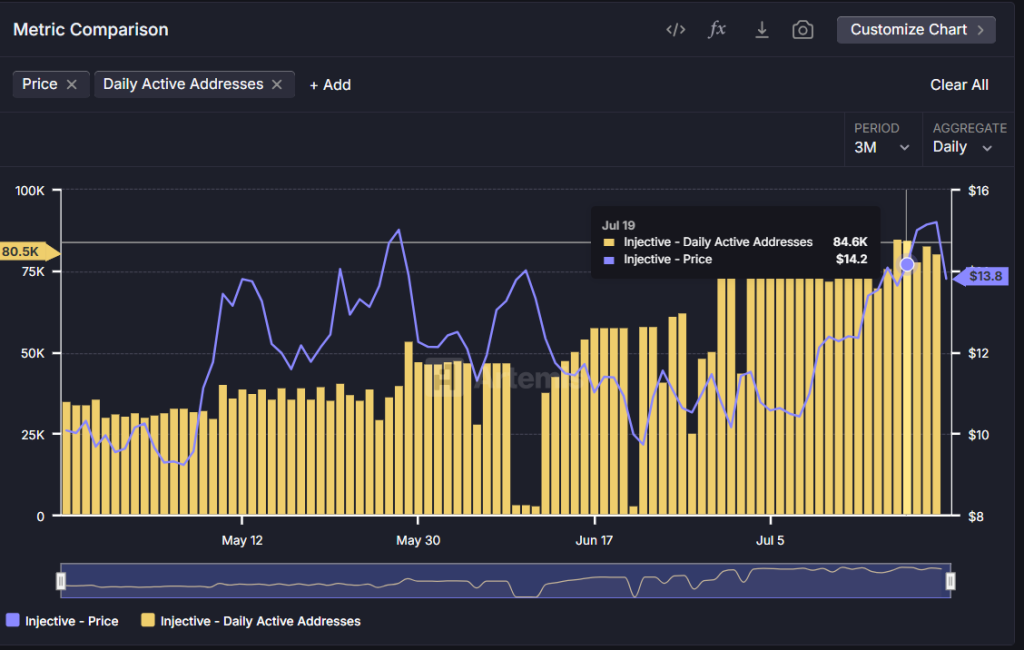

Injective (INJ) Sees Explosive Growth in Daily Users Following Nivara and EVM Rollouts

I njective (INJ) price has experienced a dramatic 1,770% surge in daily active addresses—from just 4,500 in early 2025 to a peak of 84,600 on July 19—marking its highest user activity to date.

This spike coincides with the rollout of the Nivara upgrade and Injective’s EVM testnet, which expands smart contract compatibility and developer tooling.

The surge signals rising adoption of Injective’s Layer-1 network for DeFi and modular dApp deployment, reinforcing its bullish fundamental momentum.

The recent price surge toward $14.2 mirrors this trend, confirming that fundamental momentum is supporting the move.

INJ Price is also testing its 200-day EMA near $13.6, a critical technical level. If bulls can defend this support, the next upside target sits around $16.5, with a breakout above that potentially opening the door to $19–$20.

The strong correlation between address activity and price suggests continued upside if usage sustains.

Galaxy Digital Completes $9 Billion Bitcoin Sale for Satoshi-era Investor: What Next for BTC Price?

The post Galaxy Digital Completes $9 Billion Bitcoin Sale for Satoshi-era Investor: What Next for BT...

Darwin Breaks Through: The First Solana-Powered AI Platform Going Public – And It’s Not Playing Small

The post Darwin Breaks Through: The First Solana-Powered AI Platform Going Public – And It’s Not Pla...

3 Best Cryptos Under $0.01 Ready to Explode in 2025 and Turn $100 Into $10,000

The post 3 Best Cryptos Under $0.01 Ready to Explode in 2025 and Turn $100 Into $10,000 appeared fir...