Markets Hold Steady as Trump Challenges the Fed’s Grip

A single post from Donald Trump not too long ago had the power to influence Wall Street and broader financial markets, including the cryptocurrency market, for several days.

Currently, he poses a challenge to the authority of the globe's most influential central banker, yet Treasury yields remain largely unaffected. Equities maintained their consistent upward trajectory. Safe-haven assets remain largely stagnant.

This calm is not merely a consequence of seasonal trading slowdowns; it signifies something more profound. Despite the surrounding political turmoil and recession alerts, the US economy remains resilient, and the markets, surprisingly, are acting logically.

Cryptocurrencies, which Trump's tariffs have less direct effect on, have largely overlooked the President's threats. Bitcoin has surged to a new all-time high of above $123,000 but fell back below the $120,000 mark last week.

Bitcoin's surge past $123K was a milestone that signals more than just bullish sentiment. It is a reflection of deeper market shifts: institutional capital is flowing in at unprecedented levels, and policymakers are finally drawing clearer lines

Ira Auerbach, Head of Tandem at Offchain Labs, the team behind the largest Ethereum L2, Arbitrum, said, "Bitcoin’s record sprint past $123K isn’t just a chart-watcher’s thrill; it’s the logical collision of three forces that all hit the tape this week. First, spot-ETF inflows are running at a $4 billion month-to-date pace, giving us a fire hose of institutional capital that simply didn’t exist two years ago. Second, Washington is edging toward genuine rule-making: the SEC’s new ETF guidance and Congress’s looming votes on the Clarity and GENIUS Acts tell the market that grown-ups are finally writing the playbook. Third, corporates keep voting with their treasuries."

The former SVP/Head of Digital Assets at Nasdaq, Auerbach, added, "Bitcoin Standard’s 30,000-coin SPAC is just the latest proof that CFOs prefer self-custodied ‘digital gold’ to negative-yielding cash. Put those together and you get the flywheel we’re seeing now: policy clarity reduces headline risk, which invites bigger balance sheets, and the fresh demand keeps reinforcing price. Until one of those gears jams, the bid for bitcoin — and by extension, the broader crypto market — looks structurally intact."

The OG token has seen a 19% rally over the past three weeks and is currently in a phase of consolidation, trading just below its all-time highs.

The top crypto is currently stabilizing and staying within a defined range following a phase of profit-taking at elevated levels.

Bitcoin was last changing hands below $119,000, reflecting an increase of 0.6% on Monday. Yet it remains nearly 3.2% below its peak of $123,091 reached on July 14.

According to CoinMarketCap, Bitcoin see-sawed between $116,550 and $119,200, with a trading volume of $62.97 billion.

Over a more extended period, the BTC price has successfully surpassed an 8-year resistance line that had previously proven unbreakable from 2017 to 2021.

Should it successfully close and maintain above the resistance trendline, we could anticipate a further rally towards the $130,000–$150,000 range. The critical support thresholds are currently positioned at $110,000 and $100,000.

Altcoins Gain Momentum

There is a noticeable shift occurring in the cryptocurrency markets, with Ethereum prominently emerging as a focal point.

Ethereum was last trading at $3,794, reflecting a 4% increase, accompanied by a trading volume of $47.02 billion. ETH see-sawed between $3,671 and $3,819 over the last 24 hours.

Fueled by substantial spot ETF inflows and heightened interest from corporate treasuries, ETH has notably surpassed Bitcoin in performance over the past week or so.

This divergence is transforming the market landscape, as ETH broadens its trading range and weekly option premiums surge, reflecting increased trader optimism.

Currently, Bitcoin dominance has decreased to 61%, reflecting a 6.37% decline over the last month, indicating potential early signs of an altcoin season.

A token's dominance refers to the proportion of its market capitalization relative to the total market capitalization of all cryptocurrencies combined.

This approach effectively illustrates the scale of a particular coin in the entire cryptocurrency market, as the value of each asset is assessed comparatively.

The calculation by TradingView involves taking a token's market cap, dividing it by the total market cap of the leading 125 tokens, and then multiplying the result by 100.

Separately, the recent surge in XRP to a new all-time high, along with the robust performance of altcoins such as SOL, indicates an increasing interest from investors that extends beyond Bitcoin.

As the US jobless claims and ISM data are scheduled for this week, there is an expectation of sustained volatility, which could present both risks and opportunities for traders.

What Technicals Are Telling Us?

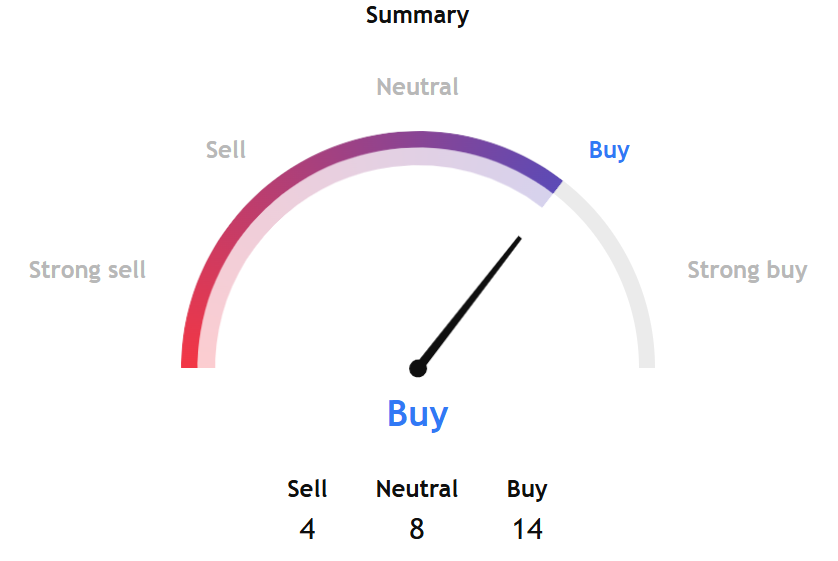

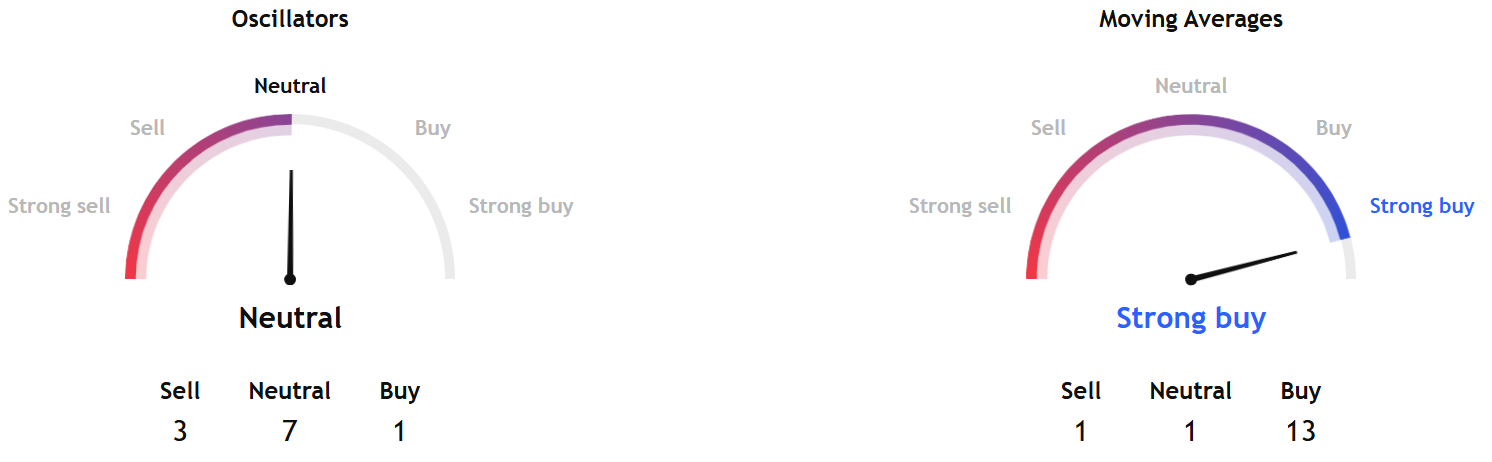

TradingView's overall BTCUSD technical analysis for the week ahead shows a "buy" signal.

A deep dive into the gauge shows indicators under moving averages pointing to a 'strong buy' stance, while oscillators give a 'neutral' signal.

Clearly, those analyses point to an upward momentum building within Bitcoin.

InvestTech's 'Algorithmic Overall Analysis' gives Bitcoin a positive score of 89, down from over 90 last week.

According to InvestTech, Bitcoin is currently exhibiting a positive trajectory within a short-term ascending trend channel.

This indicates that market participants have consistently acquired the token at elevated prices, suggesting positive progress for its value.

The price has experienced a significant increase following the favorable indication from the rectangle formation upon breaking through the resistance at $107,710. The target of $115,727 has been achieved, yet the pattern continues to indicate a movement in the same direction.

The currency is nearing a critical resistance level at $120,000, which could trigger a bearish response.

Nonetheless, a move above $120,000 will indicate a favorable trend. The OG token is generally viewed as having a favorable technical outlook for the near term.

SoSoValue data shows the Daily Total Net OI (Delta) at -$54.17 million, indicating that an increase in open contracts for 'Puts.'

This suggests that market makers need to sell underlying assets to hedge their positions, resulting in the sale of more ETFs. This is true even with healthy Bitcoin ETF inflows, which indicate some weakness for the OG token.

ETFs now make up 6.51% of Bitcoin's market cap.

In the near term, technical analysis of Bitcoin points to a new all-time high should the OG token breach above the resistance of $120,000.

Elsewhere

Blockcast

Future-Proofing Crypto: Quranium's Quantum Revolution

This week, host Takatoshi Shibayama speaks to Kapil Dhiman, co-founder and CEO of Quranium , a quantum-proof blockchain founded in 2024 that combines AI-native architecture, EVM compatibility and quantum security. They discuss Kapil's journey from a CPA to an entrepreneur in the blockchain space, the significance of quantum computing, and the dual nature of technology – its potential benefits and risks. Kapil emphasized the urgency of preparing for a quantum future, the importance of security in digital assets, and the roadmap for Quranium's innovations in creating a secure environment for cryptocurrency.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Thailand's SEC Proposes Streamlined Investor Protection for ICOs

New regulations aim to reduce the burden on both ICO portals and investors by adjusting knowledge an...

Bullish Takes Aim at Public Markets with NYSE IPO Filing

The institutionally-focused digital asset platform, backed by prominent investors, seeks to list on ...

Altcoins Take the Lead as Bitcoin Dominance Drops Sharply – How We Position For Alt-Season

Your daily access to the backroom....