Ethereum Heats Up With Record ETF Inflows And 6-Month Price Peak

Yesterday’s inflows into US Ethereum spot ETFs hit a new high, and the market took notice. Ether’s price jumped sharply as big and small funds alike funneled fresh money into these products.

Record Inflows Break Previous Highs

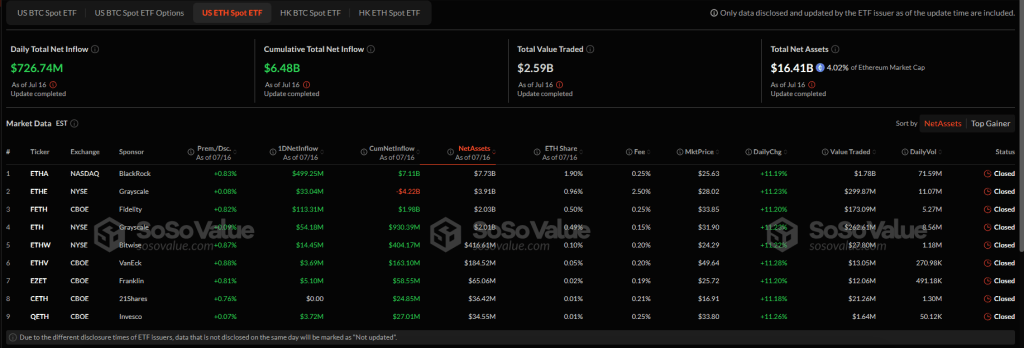

According to latest data, US Ethereum spot ETFs saw a single‑day inflow of $727 million yesterday. That smashes the prior record of $428 million set on December 5.

The nine funds tracked have now attracted new money every day for eight straight sessions before this surge. Based on reports, this eight‑day streak set the stage for what became the biggest one‑day haul in the ETFs’ history.

Big Names Lead The Charge

BlackRock’s iShares Ethereum Trust (ETHA) drew nearly $500 illion on Wednesday, pushing its total net inflow to $7.11 billion since launch. The Fidelity Ethereum Fund (FETH) wasn’t far behind, adding $113 million and lifting its cumulative haul to almost $2 billion.

Other vehicles chipped in too: Grayscale’s Ethereum Trust (ETHE) hauled in $54 million, the Grayscale Mini Trust added $33 million, and Bitwise’s ETHW ETF contributed $14.5 million. Based on those figures, it’s clear that both institutions and everyday investors are jumping on board across multiple brands.

ETF Leaders Dominate New MoneyNate Geraci, president of ETF Stores, noted on social media that these ETFs have gathered close to $2 billion over the past five trading days. That pace of inflows shows the growing comfort level big players have with owning Ether through a familiar wrapper. Retail investors often follow institutional moves, so these numbers could spark even more demand.

Ethereum Price Climbs Higher

Ethereum Price Climbs Higher

Ether’s price has climbed 9% in the last 24 hours, trading at $3,430 at the time of writing. According to market data, that level hasn’t been seen since January 31, when Ether last topped $3,370 before plunging below $1,500. The sharp rise underlines how sensitive Ether’s price can be to big capital flows into spot ETFs.

Price Reaction Fuels OptimismSome analysts are now eyeing $4,000 as the next milestone for Ether. The altcoin’s renewed momentum could lift other altcoins too. If top‑10 tokens follow Ether’s lead, the broader crypto market may ride this wave higher.

Strong inflows alone won’t guarantee sustained gains. Big inflows can reverse quickly if sentiment shifts or if traders chase profits too aggressively. But for now, the scene is bullish. If inflows keep rolling in and the price holds above $3,300, the push toward $4,000 might not be far off.

Featured image from Unsplash, chart from TradingView

Is That Right? US Senator Says Crypto Could ‘Blow Up’ Financial System

A bill moving through Congress could reshape how big companies sell their shares. Senator Elizabeth ...

Pundit Warns XRP Investors To Not Make This Grave Mistake This Cycle

A powerful message has emerged from a recent episode of the Good Evening Crypto YouTube show that ur...

Trump Prepares To Allow Crypto Investments In $9 Trillion Retirement Market

President Donald Trump is reportedly poised to open the $9 trillion retirement market to a range of ...