Top Crypto Coins Under $1 To Buy Today — Monster Altcoin Season Meets Bull Run

The post Top Crypto Coins Under $1 To Buy Today — Monster Altcoin Season Meets Bull Run appeared first on Coinpedia Fintech News

Altcoin giants under $1 are flashing breakout signals, backed by news, on-chain surges, and explosive technical setups as the next monster rally looms.

In Brief

- Arthur Hayes predicts a “monster altcoin season” led by ETH, ADA, XRP, and DOGE, as retail capital rotates from majors to mid-cap altcoins.

- Under $1 tokens like ADA, TRX, DOGE, and HBAR are flashing bullish patterns with increasing volume and breakout confirmations.

- Stellar and SYRUP are gaining momentum through real-world partnerships, while PENGU edges closer to a breakout from a classic formation.

- Most of these tokens are at breakout zones or entering price discovery, offering asymmetric upside in Q3 2025.

Arthur Hayes, the co-founder and former CEO of BitMEX and a well-known macro analyst in the crypto world, recently predicted a “Monster Altcoin Season” ahead, naming ETH, XRP, ADA, SOL, DOGE, and SHIB as leaders of the next rally.

With Bitcoin dominance starting to fade and liquidity rotating into mid-cap altcoins, this wave could be defined by strong performers under $1.

Coins like ADA, DOGE, and HBAR — already on Hayes’ list — are now backed by technical breakouts and ecosystem growth. Traders may want to position early before the next leg truly begins.

1. Cardano (ADA)

Cardano Price has seen a resurgence in both institutional adoption and on-chain strength. In July, Grayscale, the largest digital asset managers in the world, increased its ADA allocation to ~18.6% of its Smart Contract Platform Fund — one of the largest boosts among top L1 tokens.

This signals renewed institutional conviction in Cardano’s long-term roadmap.

On-chain metrics also reflect rising confidence: whale wallets have accumulated significantly, and African government partnerships, including land registry pilots and blockchain-based public service initiatives, are gaining traction.

Combined, these developments are laying the groundwork for ecosystem expansion during this altcoin cycle.

ADAUSD Technical Analysis

ADA just broke out of its multi-month resistance at $0.72 with strong volume and institutional backing. All key EMAs have flipped below price, and the MACD remains in bullish territory.

With this move, ADA enters price discovery with resistance around $0.83–$0.85 and a possible extension to $1.00. Support rests at $0.72 and $0.68.

Traders may look to scale in on dips above $0.72, targeting the $0.90–$1.00 zone during this altcoin-driven leg of the bull run.

2. TRON (TRX)

In Q2 2025, TRON price processed a record $1.93 trillion in USDT transfers , the highest ever by any blockchain, reaffirming its status as the leading chain for stablecoin transactions.

This comes alongside SRM Entertainment’s rebrand to Tron Inc. , where it staked 365M TRX and now holds the largest public crypto treasury of TRON.

TRXUSD Price has flipped the $0.30 psychological level for the first time since Dec 2024, backed by strong closes and no major selling wicks. It’s mimicking its 2023 breakout setup, supported by the 50 EMA and a bullish MACD crossover.

With $1.93T in stablecoin settlement last quarter and Tron Inc. staking 365M TRX, demand is anchored.

If TRX holds $0.29–$0.30, a breakout to $0.325–$0.34 looks likely.

3. Dogecoin (DOGE)

DOGE Price has broken a 5-month descending trendline while completing a V-bottom reversal — a pattern that historically precedes major upside. This reversal setup opens the door for a measured move to $0.30 by early August.

The OBV (On-Balance Volume) has risen sharply alongside price, a sign that accumulation is genuine. Moreover, DOGE has reclaimed its 200-day EMA for the first time since March, adding confirmation to this reversal.

Traders may accumulate above $0.20 for a risk-reward setup targeting $0.254–$0.30.

4. Stellar (XLM)

Stellar’s highly anticipated Protocol 23 upgrade is rolling out this month, introducing critical smart contract enhancements like **Soroban data caching and concurrent contract execution **The news sparked a 30% price surge on July 14 , as XLM hit $0.52 — its highest since late 2023.

Momentum is further driven by real-world integration. Franklin Templeton tokenized $446 million in U.S. Treasuries on Stellar, and speculation around PayPal’s PYUSD stablecoin launching on the network continues to build.

XLM price is flashing a strong bullish continuation setup. The price recently formed a clean engulfing candle above previous resistance, now acting as support at $0.45. MACD remains bullish and RSI is climbing with room to extend further.

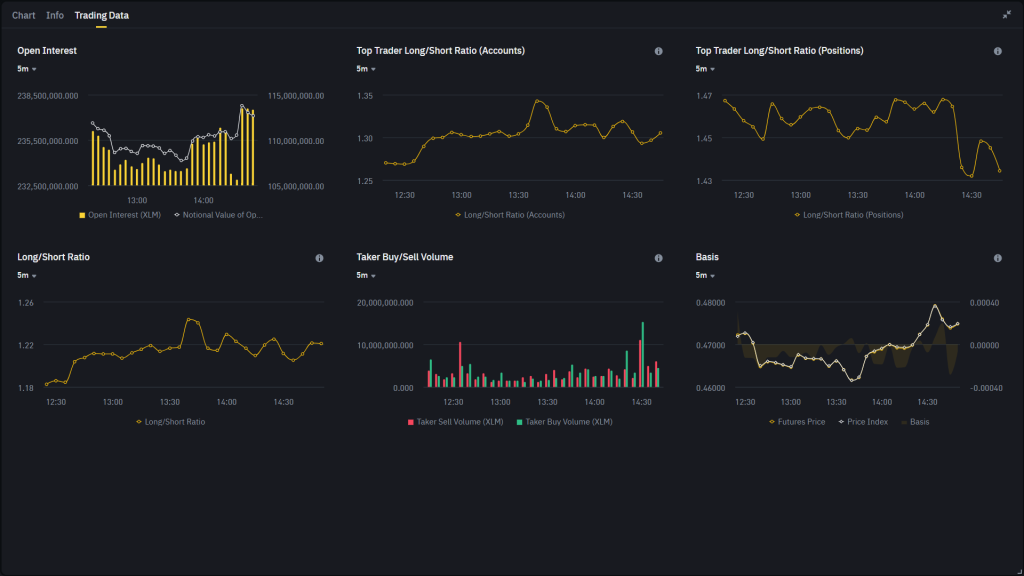

From the derivatives side, open interest is trending upward , now sitting around $238M , indicating a rise in leveraged participation.

Both Top Trader Long/Short Ratios (Accounts & Positions) remain skewed in favor of longs — at ~1.30 and ~1.45 respectively — showing confidence from experienced traders.

Additionally, taker buy volume is starting to dominate , signaling more aggressive long entries intraday.

With this setup, a sustained move above $0.47 could ignite another push toward the $0.52–$0.60 zone. Failure to hold $0.45 could delay the move but wouldn’t invalidate the broader trend unless $0.42 breaks.

5. Hedera (HBAR)

HBAR has broken above the Ichimoku cloud on the daily timeframe — its first clean breakout since 2021, signalling a long-term trend shift.

The Tenkan-sen has crossed above the Kijun-sen, and the Chikou span is now trending above the price curve. These alignments confirm bullish momentum.

Pair this with its growing USDC on-chain volume and selection as NVIDIA’s preferred ledger partner, and you get a fundamentally supported chart breakout.

If HBAR holds above $0.23–$0.25, the next resistance lies at $0.28–$0.30.

6. Maple Finance (SYRUP)

SYRUP Coin remains in a macro uptrend after a 600% move since April, catalyzed by its real-world asset lending pools.

Back on May 21, a similar announcement caused a 2x rally from $0.22 to nearly $0.60. Now with another Q3 catalyst — the SME lending pool launch — anticipation is building again.

The May event was centred on the future of asset management, sparking institutional interest. If the Q3 update delivers infrastructure or protocol upgrades, SYRUP could attract another round of aggressive inflows.

While price has pulled back, it remains above key support zones. The current structure of higher lows and stable volume suggests consolidation before another leg higher. If price reclaims $0.50–$0.52 on strong volume, a run to $0.60–$0.70 is in play.

7. Pudgy Penguins (PENGU)

PENGU is forming a textbook cup pattern that began in January and bottomed in April. While the U-shape isn’t yet fully complete, price is rapidly approaching the neckline zone around $0.036. The MACD remains bullish and volume has expanded significantly in July, a necessary condition for pattern completion.

A breakout above $0.036 would confirm the cup, projecting an upside to $0.045–$0.048. Dips to $0.030–$0.032 may offer accumulation opportunities if volume stays elevated.

Crypto Bills Pass Final House Vote: GENIUS Act Headed to President Trump’s Desk

The post Crypto Bills Pass Final House Vote: GENIUS Act Headed to President Trump’s Desk appeared fi...

Bit Origin Secures $500M to Launch Dogecoin Treasury: DOGE Price Aims Parabolic Rally Amid Network Growth

The post Bit Origin Secures $500M to Launch Dogecoin Treasury: DOGE Price Aims Parabolic Rally Amid ...

Michael Saylor Reveals Bitcoin Secret as MSTR Surges 3,558%

The post Michael Saylor Reveals Bitcoin Secret as MSTR Surges 3,558% appeared first on Coinpedia Fin...