Adding liquidity to a Solana token involves creating a liquidity pool to enable trading on decentralized exchanges (DEXs) like Raydium, Orca, or Jupiter. Below is a step-by-step guide to help you add liquidity to your Solana token.

Wallet Setup: Ensure you have a Solana-compatible wallet (e.g., Phantom, Solflare, or Backpack) installed and funded with sufficient SOL for transaction fees (at least 0.5 SOL) and the tokens you wish to add to the pool.

Tokens: You need your custom token (the “base token”) and a quote token with market value (e.g., SOL or USDC). Ensure you have both tokens in your wallet.

Choose a DEX or ToolPlatforms like Raydium, Orca, or Jupiter are popular for creating liquidity pools on Solana. Alternatively, tools like GTokenTool simplify the process with a user-friendly interface.

For this guide, we’ll focus on using GTokenTool (as referenced in your provided link) and Raydium, as it’s a common choice for Solana tokens.

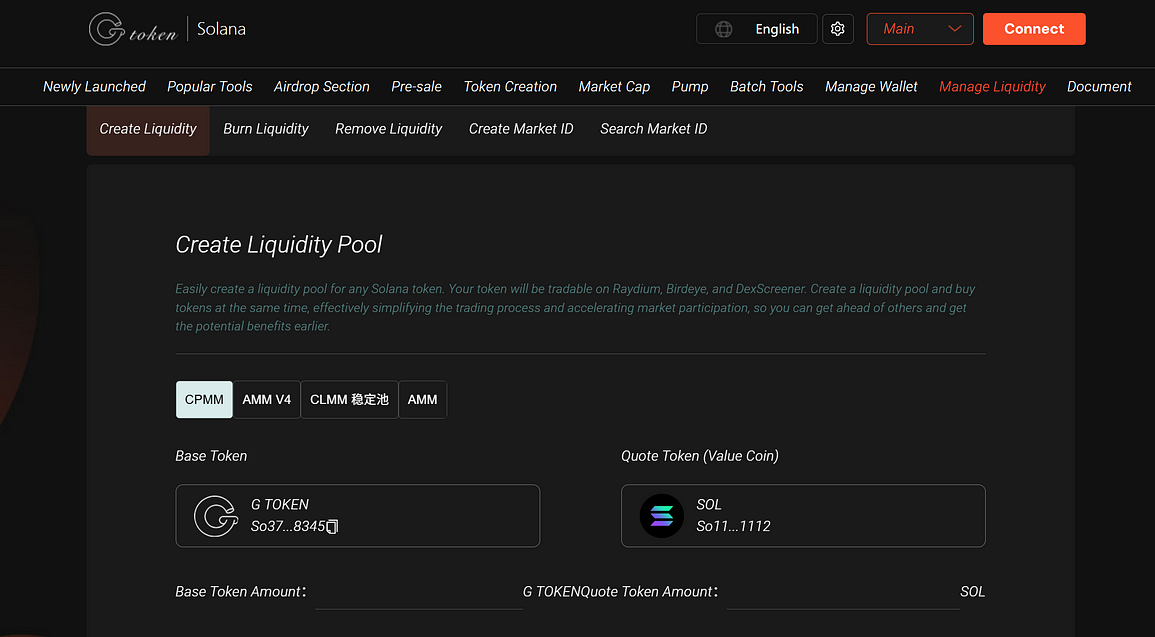

Access the Liquidity Management ToolVisit the GTokenTool liquidity management page:

Connect your Solana wallet (e.g., Phantom) by clicking “Connect Wallet” in the upper right corner.

Select Pool TypeGTokenTool supports multiple pool types: AMM, AMM V4, CPMM, or CLMM. For beginners, the CPMM (Constant Product Market Maker) pool is recommended due to its simplicity and default 0.25% fee tier.

If using Raydium directly, you can choose between AMM or CLMM pools based on your needs (CLMM offers concentrated liquidity for advanced users).

Configure the Liquidity PoolBase Token: Enter the token address of your custom token (the one you created).

Quote Token: Select a token with market value, such as SOL or USDC.

OpenBook Market ID: If required, provide the OpenBook Market ID for your token (GTokenTool offers an integrated option to skip manual Market ID creation).

Token Amounts: Specify the amount of base and quote tokens to add. Ensure you don’t exceed the balance in your wallet. GTokenTool will estimate the initial price based on the ratio of tokens provided.

Fee Tiers: For CPMM pools, the default fee is 0.25%. Stick with this unless you have specific requirements.

Jito Bundle Tips (Optional): Add a small tip (in SOL) to prioritize your transaction for faster confirmation.

Create the PoolReview the pool details (initial price, token amounts, fees).

Confirm the transaction in your wallet. GTokenTool requires two wallet signatures: one to create the pool and another to buy tokens (if you choose to buy immediately). A red prompt during the second signature is normal — confirm quickly.

Ensure your wallet has at least 0.5 SOL plus the pool addition and purchase amounts to cover fees and deposits.

Verify Pool CreationOnce created, your liquidity pool will be live and tradable on Raydium, Birdeye, or DexScreener. You’ll receive a Pool Address in a pop-up window.

Check platforms like DexScreener or Birdeye to confirm your token is listed and trading is active.

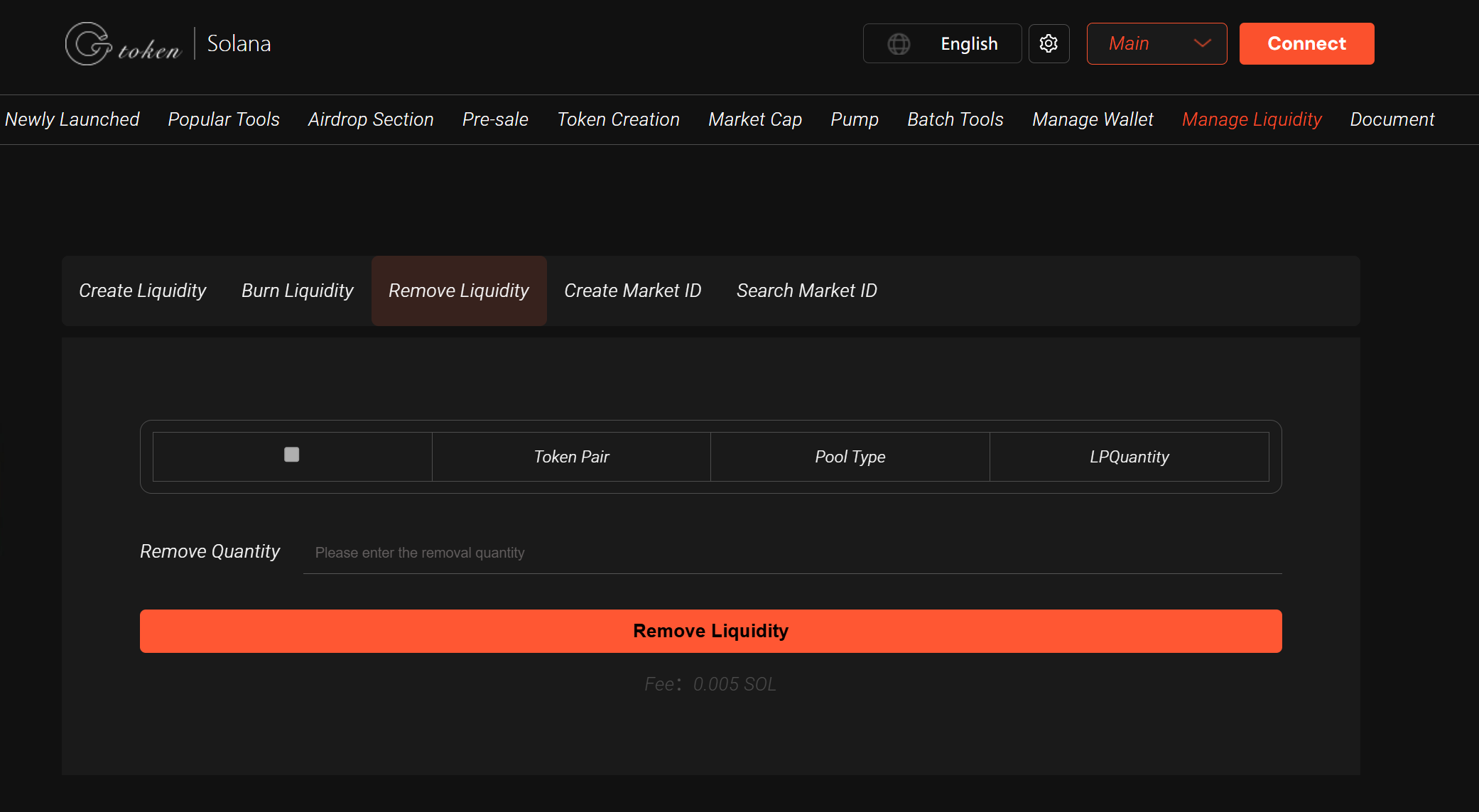

Burning: Permanently remove liquidity tokens from circulation using tools like GTokenTool’s Burn Liquidity feature.

Locked or burned liquidity is often displayed on DexScreener, increasing trust.

Key Tips for SuccessStart Small: Even $100–500 in liquidity can kickstart trading. More liquidity improves price stability and investor confidence.

Sufficient SOL: Ensure your wallet has enough SOL (at least 0.5 SOL + pool amounts) to cover fees and avoid transaction failures.

Check Blacklist Permissions: GTokenTool allows pool creation without giving up blacklist permissions, giving you more control.

Monitor Your Pool: Use tools like Solscan or GTokenTool’s Token Snapshot Tool to track token distribution and liquidity metrics.

Community Support: If you encounter issues, join GTokenTool’s Telegram group for assistance

Why Add Liquidity?Creating a liquidity pool transforms your token into a tradable asset, enabling price discovery and listing on DEXs like Raydium, Birdeye, and DexScreener. More liquidity reduces price volatility and attracts investors. GTokenTool simplifies this process, making it accessible even for non-technical users.