Top 10 Blockchains by Weekly TVL: Ethereum Surges, Solana and Base Close Behind

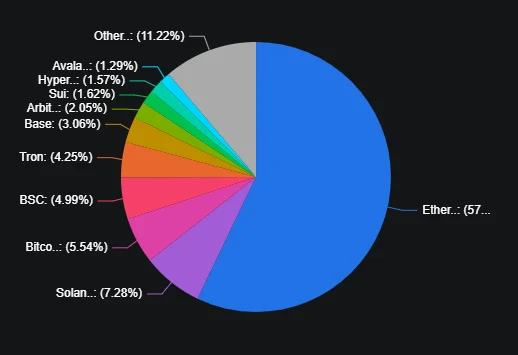

DeFi’s multi‑chain story this week is one of both consolidation and diversification. According to DeFiLlama’s July 12 data , the ten blockchains locking up the most capital saw a combined Total Value Locked (TVL) of over $114 billion, with Ethereum alone accounting for nearly two‑thirds of that total.

While Ethereum’s TVL jumped almost 11% on the back of unlocked staking rewards from the Shanghai upgrade, capital also flowed into high‑speed networks and rollups, showing DeFi’s evolving, multi‑chain reality. From Bitcoin’s growing yield‑bearing instruments to the emergence of new layer‑2 contenders, this week’s figures reveal both the enduring clout of older chains and the rising appeal of next‑generation platforms.

Ethereum and the Layer‑1 Heavyweights

This week, Ethereum once again asserted its supremacy in decentralized finance, with Total Value Locked surging by nearly 11% to about $72.1 billion. Much of that inflow stems from renewed activity on lending platforms and automated market makers following the Shanghai upgrade, which unlocked previously staked ETH and unleashed fresh liquidity across the network’s major protocols.

Not far behind, Bitcoin’s DeFi ecosystem, powered largely by wrapped BTC instruments and BTC‑pegged pools, saw its TVL climb roughly 11% to $6.9 billion, showing that Bitcoin is no longer just a store of value but an increasingly active yield‑seeking asset.

Meanwhile, BNB Smart Chain (BSC) added around 4.5% (lifting its TVL to $6.2 billion) as attractive yields on BSC‑native AMMs and fresh bridge deposits from other networks continued to draw capital. TRON also booked an 11.4% weekly gain, now holding $5.3 billion, thanks to its rock‑bottom fees and expanding USDT‑backed liquidity pools.

Layer‑2 Rollups and Emerging Contenders

Beyond the big three, a host of layer‑2 solutions and alternative chains are carving out their niches. Solana recorded a 7.4% uptick to roughly $9.1 billion, driven by high‑throughput DEX activity and a spate of new lending protocols on its fast, low‑fee network. Coinbase’s Base rollup impressed with an 11.6% weekly gain, pushing its TVL close to $3.9 billion, as both traders and developers flock to its Ethereum‑backed environment.

Other notable performers include Arbitrum (slipping just 0.9% to $2.5 billion), Avalanche (+7.9% to $1.6 billion), Polygon (+1.4% to $1.1 billion), and OP Mainnet, which led the pack with a 16.1% jump, rounding out the top ten and collectively highlighting that DeFi’s future is undeniably multi‑chain.

The capital continues to ebb and flow between layer‑1 behemoths, rollups, and alternative networks, so keeping an eye on these ten chains will remain essential for anyone tracking where the most exciting DeFi innovation and the deepest pools of liquidity are taking place.

Binance Lists $SPA, Unveiling Airdrop and Trading Contest with 44M Token Pool

Binance unveils exclusive $SPA airdrop and trading competition, also offering users 4,607 $SPA token...

CryptoPunks Dominate Top Weekly NFT Sales amid Overall Market Sales Volume Surges 34.19% to $133.66 Million

CryptoPunk has made waves again as all of the top 10 highest sales come from its NFTs, showing its p...

Top Weekly Crypto Gainers: Double-Digit Rallies Sweep the Market, Here’s the Full Breakdown

Altcoins surged from July 6–13, 2025, with MemeCore gaining 751%. Stellar, Pudgy Penguins, and Mog C...