XLM Traders, Beware! Stellar’s Funding Rate Is Plummeting

Stellar Lumens hit a critical support level this week at $0.20, putting the token in a precarious spot. At that price, XLM sits 30% below its peak in May and 60% under its 2024 high.

Based on reports, bears have been piling on, pushing the funding rate into negative territory since early June. If that support gives way, traders warn XLM could slide toward $0.15, a drop of about 35%.

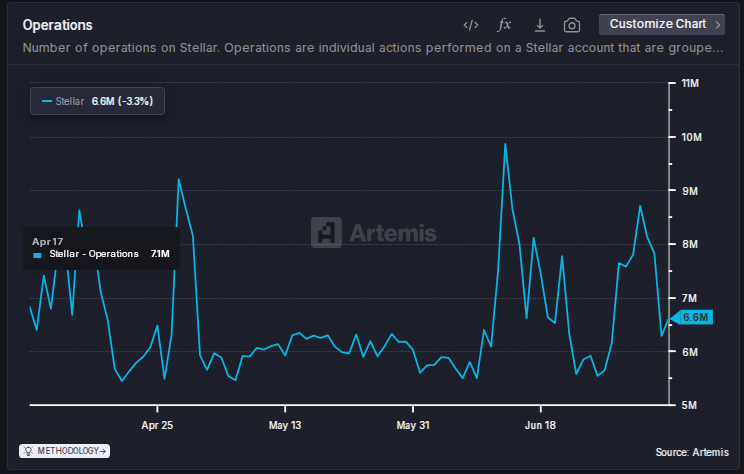

Network Activity Up

According to Artemis , operations on the Stellar network surged to 197 million in June. Stablecoin supply also reached a record $667 million.

Over the past five months, the total value locked in real‑world asset tokenization grew to $487 million, helped by new offerings such as the Franklin OnChain US Government Money Market Fund. Those figures suggest healthy demand for on‑chain services and asset tokenization inside Stellar’s ecosystem.

Funding Rates Down

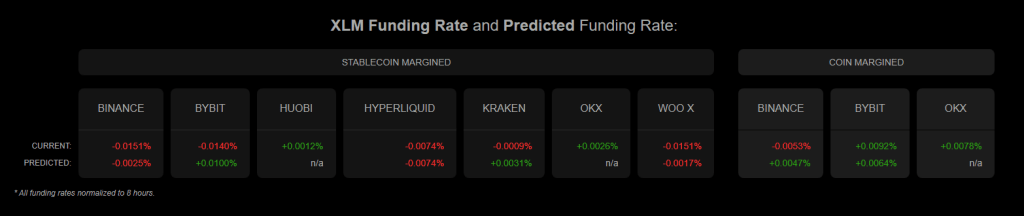

Funding rates in perpetual futures have been negative most days since May. That means more short positions than long ones, with short traders paying long traders to keep their bets in place.

XLM’s funding rate hit its lowest point since June 30, pointing to rising bearish sentiment. When funding rates stay deep in the red, it often adds selling pressure as traders brace for steeper losses.

The image above shows that XLM funding rates are down on most major exchanges, particularly for stablecoin-margined pairs, data from Coinalyze shows.

On‑Chain Growth Clashes With Market Mood

On‑Chain Growth Clashes With Market Mood

Nansen data shows the number of transactions rose by 11% over the last seven days to 182 million. Active addresses climbed 10% to 146,700 in the same span.

Even so, price action has ignored these gains. XLM fell beneath its 50‑day and 100‑day Exponential Moving Averages, and momentum appears to favor sellers.

Some market watchers suggest that deep negative funding could trigger a short squeeze, turning sentiment around if shorts rush to cover.

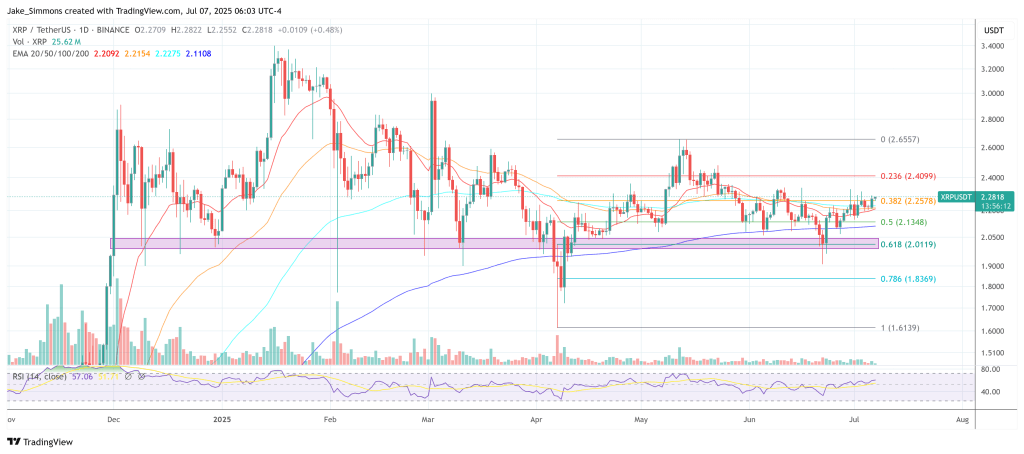

Chart Patterns Warn Of Drop

Chart Patterns Warn Of Drop

The daily chart reveals a descending triangle pattern, with $0.21 forming the lower trendline. That level also marked April’s lows when altcoins broadly sold off.

XLM has slipped below the 60% Fibonacci Retracement zone, where many traders expect a bounce. A clean break under the triangle could unleash algorithm‑driven orders, sending price toward $0.15.

Meanwhile, Stellar’s fundamentals look solid, but technical signals remain bearish. Traders and holders should watch that $0.21 line. A strong rebound there could restore confidence in on‑chain strength.

On the flip side, a slide through support may spark faster losses. Either way, XLM’s near‑term path hinges on that key level.

Featured image from Meta, chart from TradingView

XRP Could Hit $35 If It Captures A Quarter Of Remittance Market By 2029

XRP slipped to around $2.22 on July 7, marking a quiet session for the token. That price sits well b...

Analyst Predicts XRP Price Will Reach $20-$30 — Elliott Wave Theory Holds The Key

Crypto expert XForceGlobal has issued a new bullish forecast for the XRP price, predicting that the ...

XRP Set To Shock The Crypto Market With 30% Share, Analyst Predicts

XRP’s market dominance may be on the verge of a historic breakout, with analyst Cryptoinsightuk (@Cr...