Bitcoin Shows Strong Price Gains Amid Continued Exchange Outflows and ETF Market Activity

- Bitcoin hits $109K amid five weeks of net exchange outflows totaling $920 million.

- Bitcoin ETFs hold $138B AUM with high trading volumes and low expense ratios.

- Price rise from $50K to $110K aligns with sustained outflows and holder accumulation.

Bitcoin’s price has surged beyond $109,000, supported by consistent outflows from exchanges and active trading within the Bitcoin ETF market . Data from early July 2025 shows a fifth consecutive week where Bitcoin experienced net withdrawals from exchanges, signaling a shift in asset custody. This trend aligns with rising transaction fees and strong ETF market capitalization, showing increased investor engagement across multiple fronts.

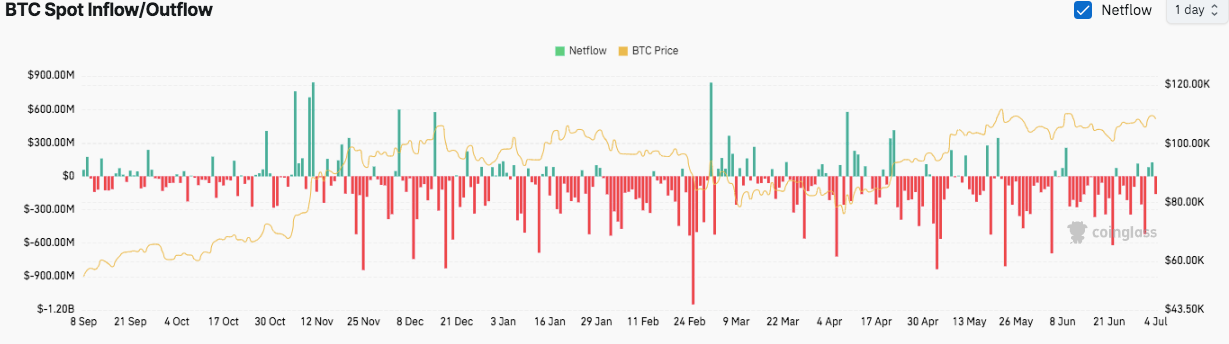

Recent figures disclose that Bitcoin exchanges have seen net outflows totaling $920 million. This signals a sustained pattern where holders are transferring BTC off exchanges into private wallets. Such behavior may suggest a preference for long-term storage rather than immediate selling, as sell pressure on exchanges appears to be reducing. The rise in network fees, which have risen by 13.8% to $3.86 million, also indicates heightened transaction volume and activity on the Bitcoin blockchain.

Historical flow data matches this pattern, with large outflows coinciding with Bitcoin price surges. Notable peaks in outflows occurred in late November, mid-February, and April, periods that also marked BTC price rallies. In contrast, inflows onto exchanges occur less frequently and tend to spike during price corrections or consolidations, possibly reflecting short-term trading or profit-taking activity.

Bitcoin ETF Market Remains Strong

The Bitcoin ETF market continues to show large scale and liquidity. The total market capitalization for all listed Bitcoin ETFs is reported at $138.35 billion, matched by assets under management (AUM) of $138.09 billion. Trading volumes remain high, with $2.63 billion recorded across the market.

Leading the sector, the iShares Bitcoin Trust (IBIT) maintains an AUM of $76.31 billion and holds the highest trading volume of $2.04 billion despite a slight price decrease of 0.37% to $62.19. The Fidelity Wise Origin Bitcoin Fund (FBTC) holds $21.35 billion in assets and trades with a volume exceeding $150 million. The Grayscale Bitcoin Trust ETF (GBTC) retains a market cap of $20.15 billion, with a current price of $86.07, albeit with a minor decline of 0.42%.

The highest turnover rate of 5.34% implies that ProShares Bitcoin ETF (BITO) has a relatively active spirit to trade out of all the ETFs. Among the ETFs , the average expense ratios are 0.20-0.25% with GBTG having a rate of 1.50%.

The cost of Bitcoin has been increasing since September 2024 when it was priced at about $50,000 at one moment to over $110,000 in early July 2025. Such expansion is linked to continued outflows on exchanges, which can decrease liquidity that can be used in trading and help create upward price pressure. Daily inflow and outflow numbers confirm that spikes in inflows will regularly occur but the net effect will still tend toward net outflows, in favor of holders’ accumulation.

Midle and Globe Vault Collaborate to Redefine Wallet Experience Across Chains

The collaboration with Midle aligns with its wider vision of improving decentralized infrastructure,...

NFT Market Sees Recovery, Records 17.23% in Weekly Sales, Guild of Guardians Leads Sales with $29.61 Million

The NFT market experienced a significant increase in sales volume over the past seven days. This ris...

Top 10 Web3 Gaming Projects Revealed: FLOKI, Render, and IMX Lead in Interactions

Web3 gaming is one of the most active fields on crypto Twitter. On July 4, Phoenix Group published i...