First U.S. Spot Solana ETF Featuring Staking Goes Live with $8M Volume in 20 Mins

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The first-ever U.S. Spot Solana ETF with staking features has officially launched, and its debut has since attracted attention from market observers.

Bloomberg's senior ETF analyst, James Seyffart, revealed this in a post on X. According to him, the REX-Osprey SOL + Staking ETF, trading under the ticker SSK, began its debut with $8 million in trading volume within the first 20 minutes. Seyffart described this as a healthy start for a completely new ETF.

https://twitter.com/JSeyff/status/1940407756051394680

How Does the REX-Osprey SOL + Staking ETF Operate?

Notably, this

new ETF

gives investors a direct way to gain exposure to Solana (SOL) while also earning staking rewards. About 80% of the fund's assets go into spot SOL, and the managers actively stake over half of that to generate on-chain yield.

Investors benefit directly from these staking returns, which currently offer an annual yield of roughly 7% to 7.3%. Meanwhile, the rest of the portfolio includes other

Solana

exchange-traded products, mostly from markets outside the U.S., along with a small slice in liquid staking assets like JitoSOL.

Interestingly, REX and Osprey structured the ETF as a C-corporation under the Investment Company Act of 1940. This move helped them clear regulatory hurdles that have slowed or blocked similar crypto funds in the past.

While this structure gives the fund a clear path to operate and distribute staking rewards, it also introduces less favorable tax treatment compared to more traditional ETF models. This is something institutional investors will need to weigh. Importantly, the ETF carries a management fee of 0.75%.

Regulatory Progress Toward Launch

Also, the road to launch was not smooth. REX and Osprey first filed their registration earlier this year, pitching a model that combines spot crypto holdings with staking income.

However, on May 30, the SEC asked them to delay the launch, citing questions around how to classify the fund. The team then restructured the product into a C-corp to address those concerns. By June 27, the SEC told the issuers it had no further comments, which industry insiders saw as a quiet green light. The fund officially went live today.

Path for Launch of Traditional Spot Solana ETF Products

Interestingly, the launch came just one day after the SEC approved the Grayscale Digital Large Cap Fund (GDLC), which holds Solana alongside Bitcoin, Ethereum, XRP, and Cardano.

Seyffart

had previously said

that GDLC would likely go first, followed by other Spot Solana ETF products. With both GDLC and the SSK ETF now trading, investors feel more confident that a traditional Spot Solana ETF may land next.

Notably, this optimism has continued to grow. The SEC is currently reviewing multiple Solana ETF applications from top firms like VanEck, Franklin Templeton, Galaxy Digital, Fidelity, and Grayscale.

While the SEC hasn't approved them yet, it continues to review updated filings and has pushed final decision deadlines into late July. Several applicants have tweaked their proposals to include in-kind redemptions and

staking features

.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/514857.html

Related Reading

Analyst Identifies Bitcoin Breakout of the Decade: Here’s The Potential Implication on BTC Price

Prominent market analyst MichaelXBT predicts Bitcoin could breach long-term resistance, leading to w...

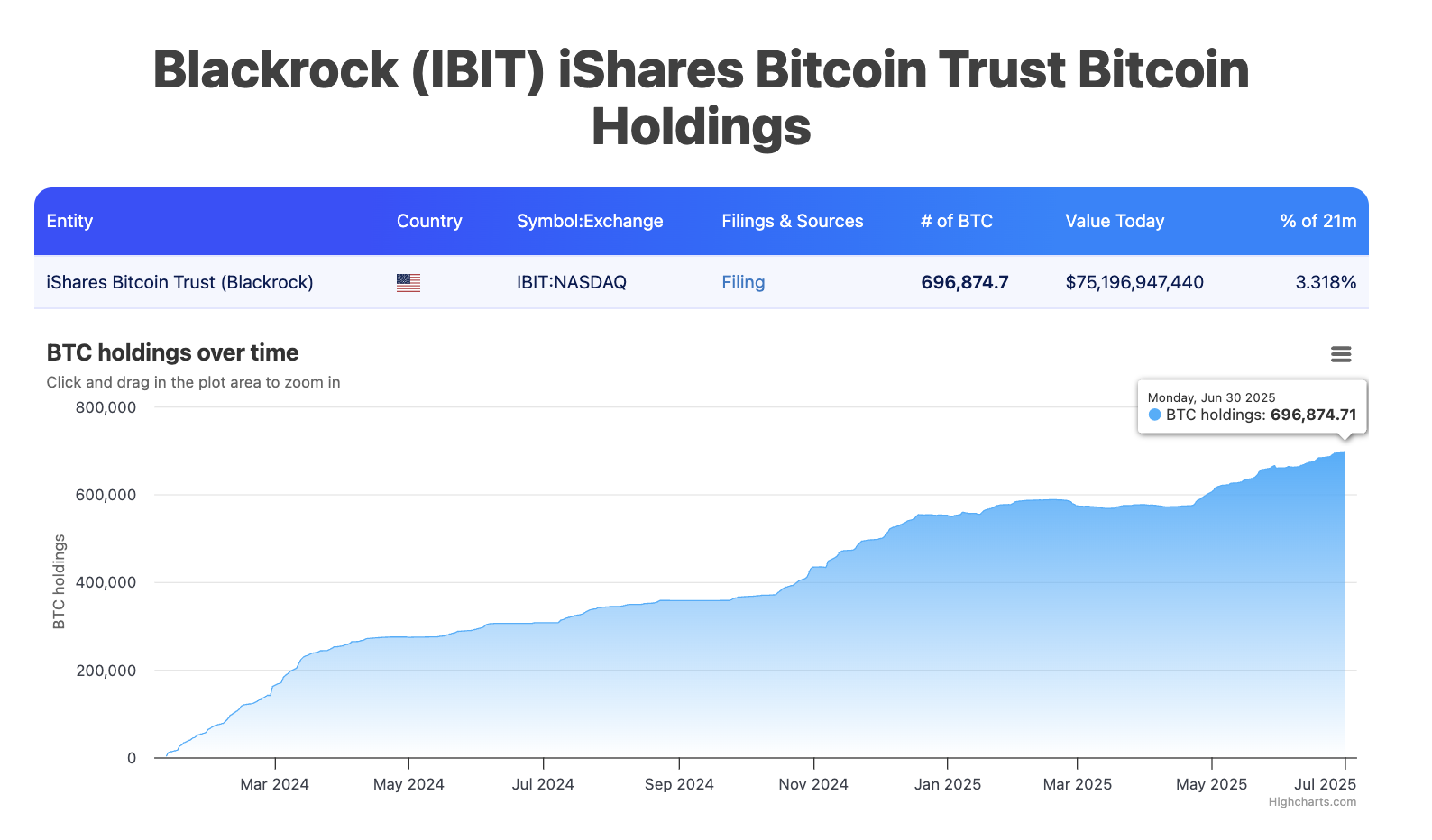

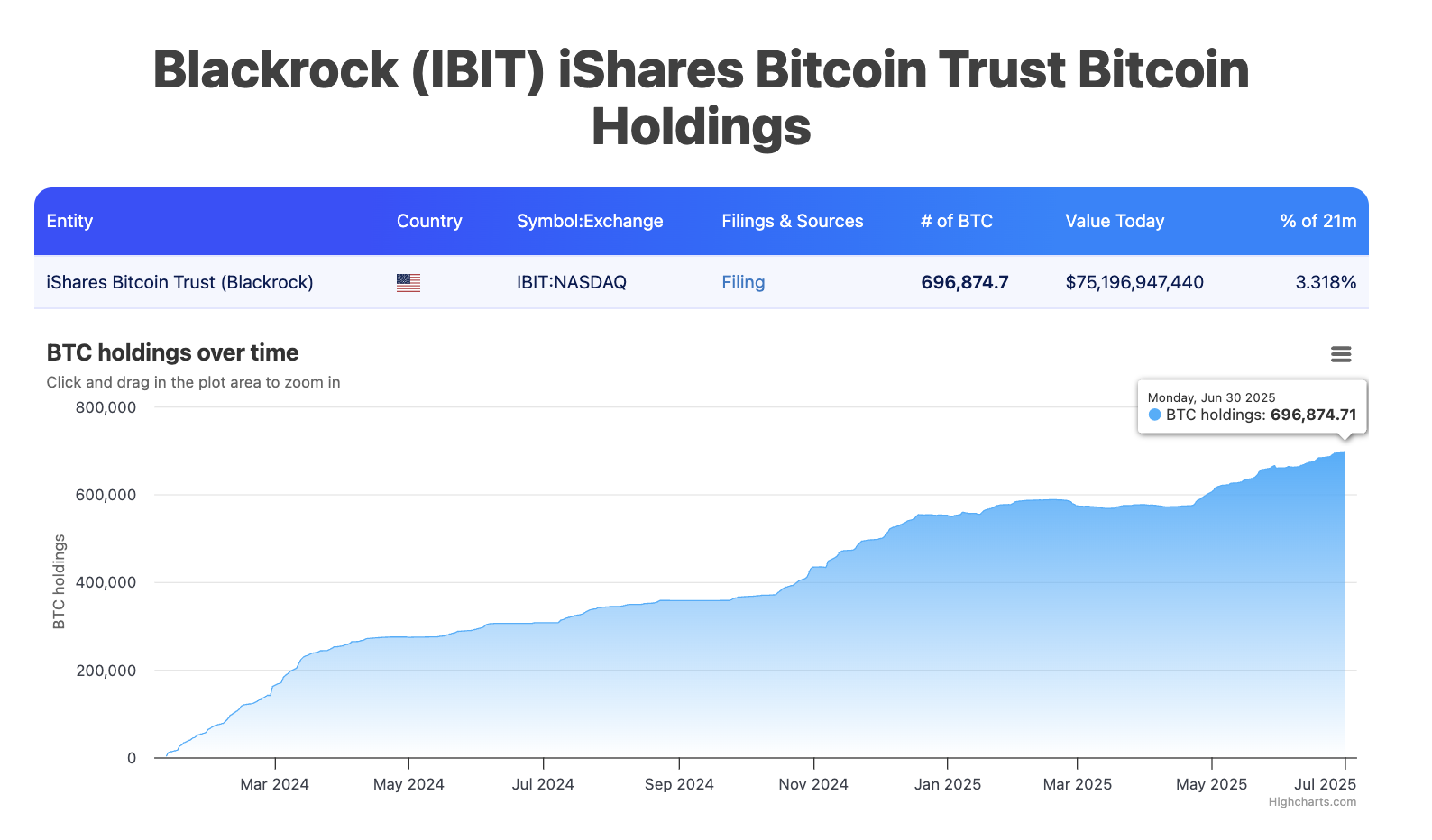

BlackRock Bitcoin ETF Now Holds 696,874 BTC with All-Time High Value of $75B+

The value of the BlackRock Bitcoin ETF, iShares Bitcoin Trust, is reaching historic levels as the pr...

Top Analyst Predicts Minimum XRP Price for July and Ultimate Target by December 2025 Amid Breakout

With XRP finally breaking out, a top market analyst has predicted its target for July and how high i...