BlackRock Purchases Over 22,000 Ethereum Tokens Valued at $54.8 Million

- BlackRock boosts Ethereum holdings with $54.8M purchase, now holding 1.4M ETH.

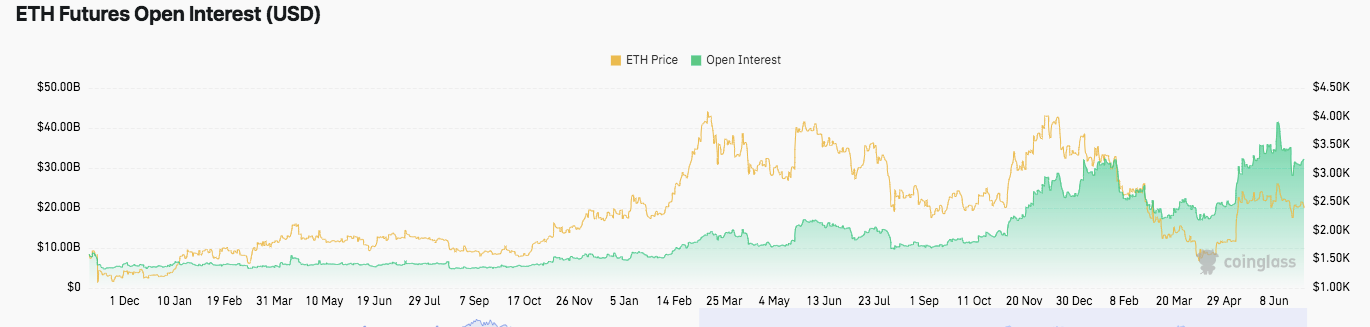

- Ethereum futures open interest stays high despite price dips, signaling strong market activity.

- ETH trades near $2,450 with steady volume and $295B market cap amid intraday price swings.

BlackRock, the world’s largest asset manager, has purchased 22,058.53 Ethereum (ETH), valued at approximately $54.8 million. This recent acquisition marks another move in BlackRock’s growing engagement with the crypto market, particularly with Ethereum, the second-largest digital asset by market capitalization.

The purchase was confirmed through blockchain tracking data shared by analytics firm Arkham, which monitors large transactions and institutional activity. The data indicated that BlackRock’s Ethereum buy was part of a series of transactions on Coinbase Prime, with individual purchases ranging from 9,000 to over 58,000 ETH tokens. These transactions reflect values between $23 million and $61 million each.

Following this latest purchase, BlackRock’s Ethereum holdings are estimated at around 1.4 million ETH, ranking it among the largest institutional holders of the cryptocurrency. The company’s interest in Ethereum complements its previous investments in Bitcoin-related products, including its iShares Bitcoin Trust and a USD Institutional Digital Liquidity Fund that operates on the Ethereum blockchain.

Ethereum Market Activity and Futures Overview

In parallel with BlackRock’s accumulation, Ethereum futures markets have remained active over recent months. From December through mid-March, Ethereum’s price ranged between $1,500 and $2,500, while futures open interest hovered around $5 billion. Starting in mid-March, Ethereum’s price surged, peaking at approximately $4,300 in mid-April. Open interest in Ethereum futures increased alongside this rally, reaching nearly $30 billion.

Despite a price decline below $2,000 in May and June, open interest in futures contracts stayed high, fluctuating between $20 billion and $35 billion. This continuing level of futures market activity indicates ongoing trading interest, which could include hedging and speculative positions by institutional and retail participants. As of late June and early July, Ethereum’s price recovered above $2,500, with futures open interest maintaining levels above $30 billion.

Current Ethereum Market Metrics

During the time of writing, Ethereum was trading at $2,450, displaying a 0.32% decrease in the last 24 hours. The market capitalization stands at $295.72 billion, with a drop of 0.33%. Trading volume increased by 4.07%, reaching $16.39 billion during this period.

The circulating supply of Ethereum is also experiencing no capped supply at 120.71 million ETH, which is equal to its total supply. It is a diluted value of about $295.69 billion. The near-term price action shows that it has moved up briefly under $2,400 and then came back to nearly $2,450, which is evidence of regular intraday movement.

AscendEx x Dechat: A Big Strategic Move Towards Secure, Decentralized Communication

Recently, the major crypto exchange AscendEx made a formal announcement of its partnership with Dech...

Bitcoin and Ethereum ETFs See Strong Inflows, Reflecting Growing Investor Interest

Bitcoin and Ethereum ETFs see strong inflows, with Ethereum experiencing larger growth, highlighting...

Internet Capital Markets: An Investor’s Guide

Internet Capital Market is a name given to digital assets that enable anyone not only to invest mone...