Bitcoin Needs a Bigger Push to Scale ATH

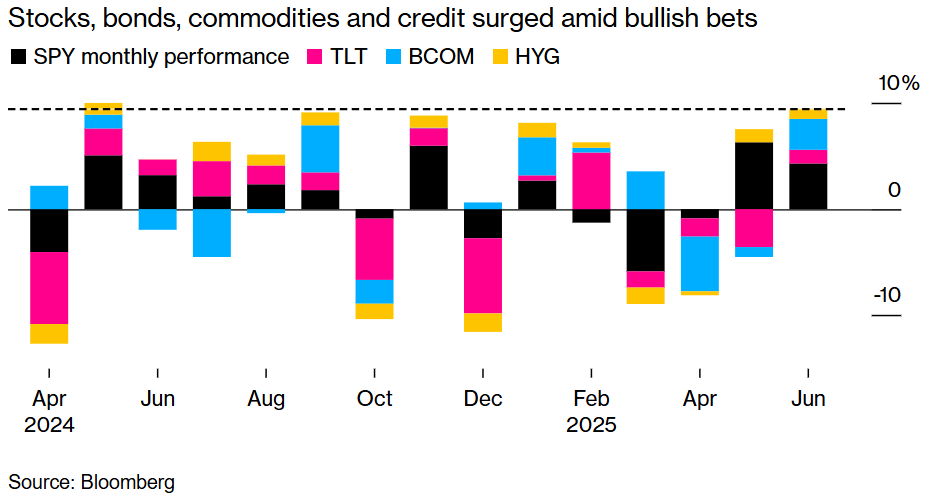

As concerns about a potential global trade war fade, markets closed out their largest cross-asset increase in almost a year, setting off a buying frenzy in a wide range of assets, from tech funds to cryptos to junk bonds.

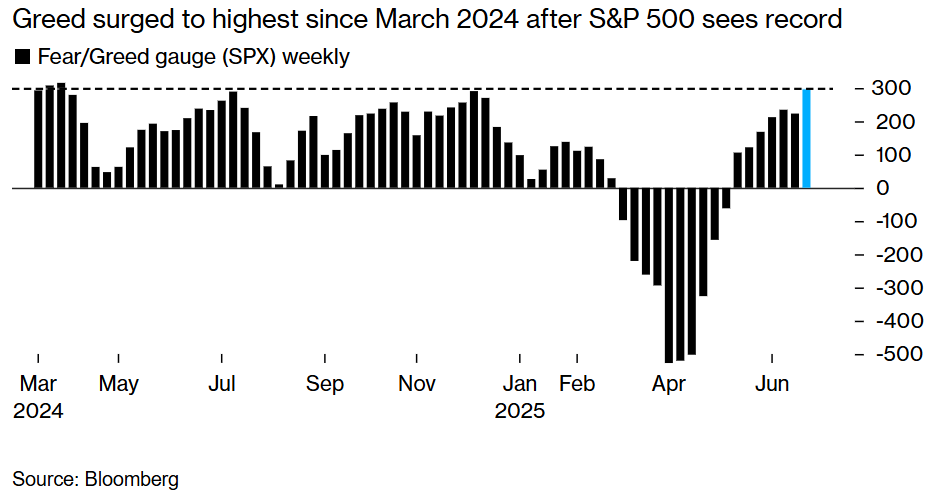

At a time when the economy, valuations, and government policies are shrouded in uncertainty, investors have triumphed in their confidence as the S&P 500 enjoys its first record high since February.

Despite rising claims for unemployment, a chilly housing market, weakening global trade, and dwindling expectations for an impending interest rate cut from the Federal Reserve, bulls are clinging to signs of falling inflation and increasing consumer morale.

An unbroken upswing in equities, bonds, commodities, and credit has surpassed the most extensive monthly increase since May 2024, driven by a spike in bullish conviction that has not been witnessed since Donald Trump's reelection.

Bitcoin gained almost 6% over the past week and has risen to over $108,500 after having fallen below $100,000.

BTC ETFs have seen inflows for fourteen days in a row, adding $4.5 billion dollars since June 8. Just in the last week, BTC ETFs saw inflows of $1.3 billion.

Add to it the fact that Anthony Pompliano and Michael Saylor have invested an additional $1 billion into Bitcoin. The token's price, though, remains below its ATH.

The $100,000 to $110,000 price range is being crushed by a deluge of institutional capital selling pressure.

At the same time, Wall Street's benchmark index, the S&P 500, hit a new record for the first time since February. The S&P 500 experienced a devastating 21 percent decline earlier this year, going from 6,147 to 4,835 points.

But the index is back to above 6,100 points, a new ATH.

A mad dash into hazardous investments has supplanted the volatility that rocked markets only a few weeks ago. With systematic investors increasing their exposure, retail traders have returned to the market.

On the other hand, here is what is on everyone's mind: What could push Bitcoin beyond $111k if such massive buying couldn't?

Whether the economic backdrop provides sufficient positive news to warrant stretched pricing is now the determining factor in the frenzy.

So far, June has marked the best cross-asset rally since May 2024.

What Comes After This?

August is infamously weak, and the United States' "trade pause" with the rest of the world ends on July 9. The market is full of factors that objectively play against risk assets.

When does it ever not? Volatility is on the horizon.

Constantly, those who fret about the market and economy have proven wildly incorrect.

Still, financial institutions like JP Morgan Chase have maintained a 40 percent probability of a recession, pointing to factors such as tariffs and the possibility of reduced consumer spending and business optimism colliding.

Like many others, JPMorgan is concerned that growth may decelerate in the second part of this year.

Popular funds linked to the speculative bets that drove the recent market gains, such as tech disruptors, small-cap stocks, gold miners, and uranium, are showing symptoms of caution, which is one hint of worry beneath the surface.

The demand for downside protection is on the rise; therefore, traders are stocking up on protective options.

Barclays reports that options markets have priced in substantial downside risk for funds such as ARK Innovation ETF, iShares Russell 2000 ETF, and VanEck Gold Miners ETF.

The risk rally, though, has been unaffected by any of that. Last week, the S&P 500 hit a new all-time high after a 3.4% jump during a $10 trillion rally.

As yields on 10-year Treasuries dropped by about 10 basis points, junk bonds continued to rise for five straight weeks.

The price of Bitcoin has risen past $100,000 again, and shares in Coinbase Global set a new record, the first since 2021.

June is becoming the greatest month for US stocks, long-dated Treasuries, junk bonds, and commodity indices, which had a pan-asset tandem rally.

This had not happened in thirteen months.

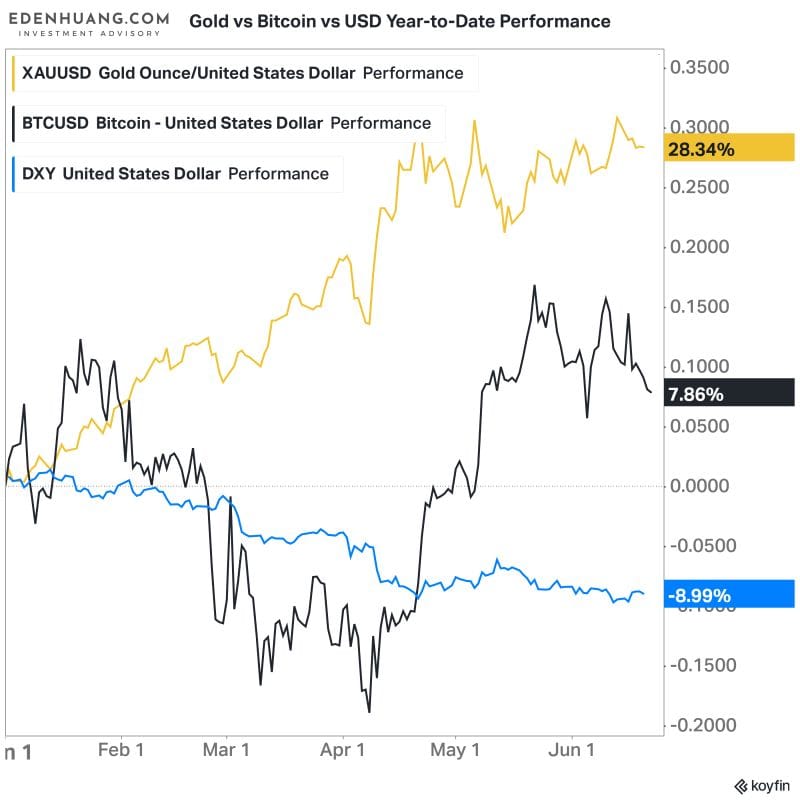

Bitcoin vs Gold & Dollar

When pitted against the dominance of the dollar and the heritage of the gold standard, Bitcoin will face its real test.

Throughout history, gold has always been associated with dependability. Limited in availability, geographically, and to public entities. However, because it is passive, it acts defensively rather than offensively.

Being networked, liquid, and enforced on a global scale, the dollar is the perfect utility asset.

It controls the oil market, the debt markets, and the money supply. However, its growing politicization, inflation, and weaponization make it both a strength and a weakness.

Next, we have Bitcoin.

The asset that digital scarcity and decentralization are fundamental to its value. Belief and code, not tanks and vaults, support it. Price movements are only one aspect of the stress test. Would it be possible for Bitcoin to be more programmable, portable, and harder than gold?

Without the state's apparatus, is it more reliable than fiat currencies?

A new age of renegotiated monetary trust is dawning on us. Despite currency tensions and Bitcoin volatility, gold remains relatively stable. A significant tectonic upheaval is on the cards, as the assets of the future will be determined by which ones align with the next monetary era.

Elsewhere

Blockcast

Ripple's Journey: From Payments to Financial Solutions

In this episode of Blockcast, host Takatoshi Shibayama interviews Eric van Miltenberg , SVP of Strategic Initiatives at Ripple, discussing the APEX 2025 conference, Ripple's evolution from a payment-focused company to a broader financial solutions provider, and the future of the crypto industry.

They explore the similarities between the internet boom and the current blockchain landscape, the importance of regulatory clarity, and the potential of tokenization in various sectors. Eric shares insights on Ripple's strategic acquisitions and the company's commitment to addressing real-world problems through innovative technology.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Zodia Completes Acquisition of UAE Digital Asset Custodian Tungsten

Bank-backed platform gains ADGM license and expands Middle East presence through regulated custodian...

Bitcoin Technical Indicators Signal Strong Buy as Price Eyes $116,000 Target

Multiple analysis platforms point to bullish momentum with ETF inflows supporting upward trend...

The Blockchain Group Acquires 60 BTC, Reports 1,270% YTD Bitcoin Yield

European bitcoin treasury company reports €46.7 million in bitcoin gains year-to-date as holdings re...