Bitcoin Spot ETFs Register $2 Billion Inflows As Institutional Demand Surges – Details

The US Bitcoin spot ETFs logged over $2 billion in net inflows last week, marking a three-week streak of positive momentum. Despite a bearish start to June, with $128.81 million in net outflows during the first trading week, investor appetite soon quickly rebounded. This turnaround has resulted in a cumulative $4.63 billion in deposits over the past three weeks.

Bitcoin ETFs On Impressive 14-Day Positive Streak Despite Market Uncertainty

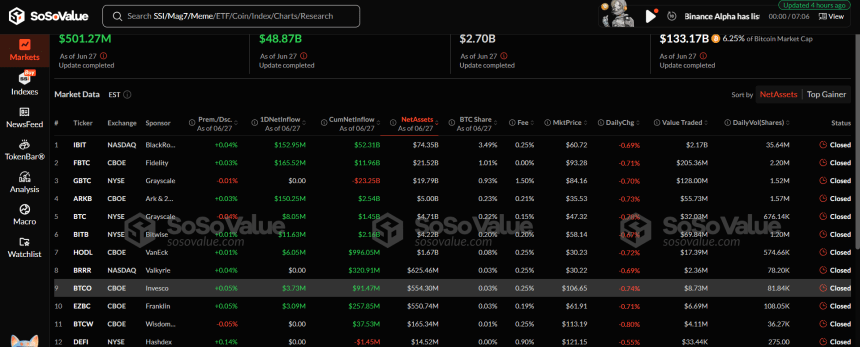

On Friday June 27, the 12 US Bitcoin ETFs registered net inflows of $501.27 million bringing the aggregate deposits of the last week to a staggering $2.22 billion. According to data from ETF tracking site SoSoValue , the clean streak of daily inflows from last week extends the ETFs’ positive performance to 14 consecutive days. In analyzing individual ETF data from this week, the BlackRock IBIT registered $1.31 billion in net deposits solidifying its position as the market’s unrivalled leader. Meanwhile, Fidelity’s FBTC and Ark/21 Shares’ ARKB also experienced substantial cumulative inflows of $504.40 million and $268.14 million, respectively.

Grayscale’s BTC, VanEck’s HODL, Valkyrie’s BRRR, Invesco’s BTCO, and Franklin Templeton’s EZBC also recorded moderate net flows ranging from $1million – $25 million. In familiar fashion, Grayscale’s GBTC produced the only net outflows losing $5.69 million in withdrawals, but still retains its position as the third largest Bitcoin ETF with $19.79 billion in net assets. Following this week, the US Bitcoin Spot ETFs have now recorded $4.50 billion in net flows in June signaling a resolute demand from institutional investors despite Bitcoin market troubles. Notably, the premier cryptocurrency has witnessed extensive corrections since hitting a new all-time high of $111,790 on May 22. Over the last month, BTC has made no new price discovery trading largely between $100,000 and $110,000 to form a descending price channel. While this price performance reflects a neutral market sentiment, the high influx of capital into the Bitcoin ETFs signal a long-term confidence by institutional investors on Bitcoin’s price appreciation prospects.

Ethereum ETFs Log $283 Million In Deposit To Close Out H1 2025

In other developments, SoSoValue data also reveals that US Ethereum Spot ETFs notched up a cumulative inflow of $283.41 million over the last week extending their positive streak to seven consecutive weeks. In June alone, these ETFs saw total inflows of $1.13 billion, marking their largest monthly gain in 2025.

As of the time of writing, the total net assets of the Ethereum ETFs stand at $9.88 billion, accounting for 3.37% of Ethereum’s market capitalization. Meanwhile, Ethereum continues to trade at $2,441 with Bitcoin prices set around $107,339.

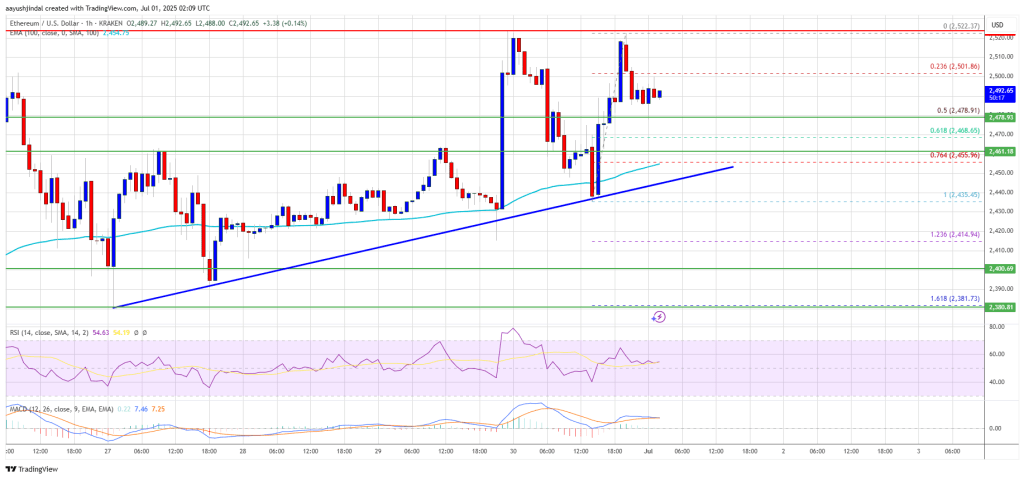

Ethereum Price Readies for Takeoff — Bulls Eye Fresh Highs

Ethereum price started a fresh increase above the $2,485 zone. ETH is now consolidating gains and mi...

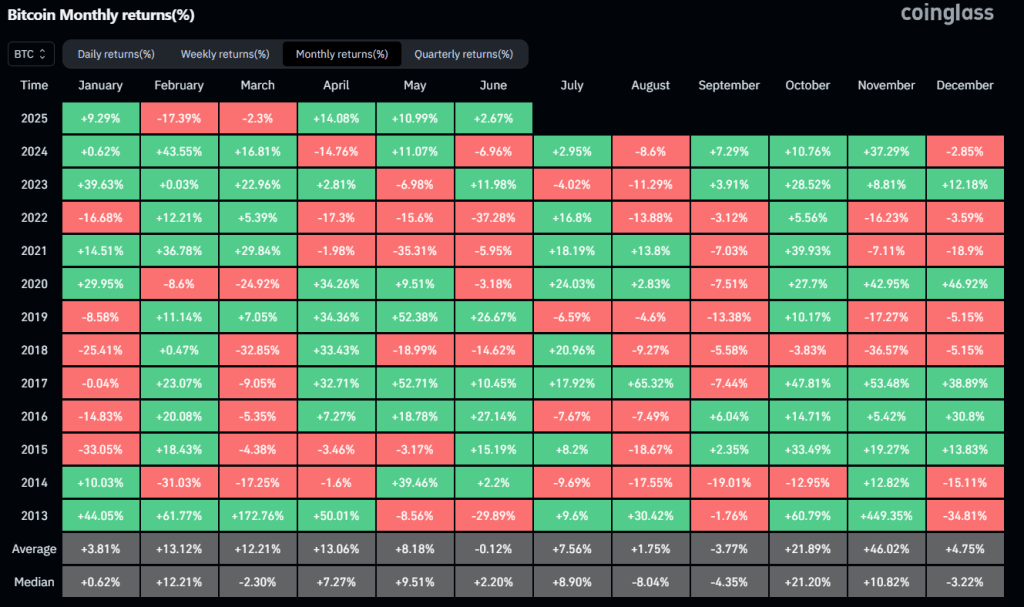

Bitcoin July Preview: History Says Don’t Trust The Quiet

Market tactician Daan Crypto Trades (@DaanCrypto) has put a statistical spotlight on Bitcoin’s habit...

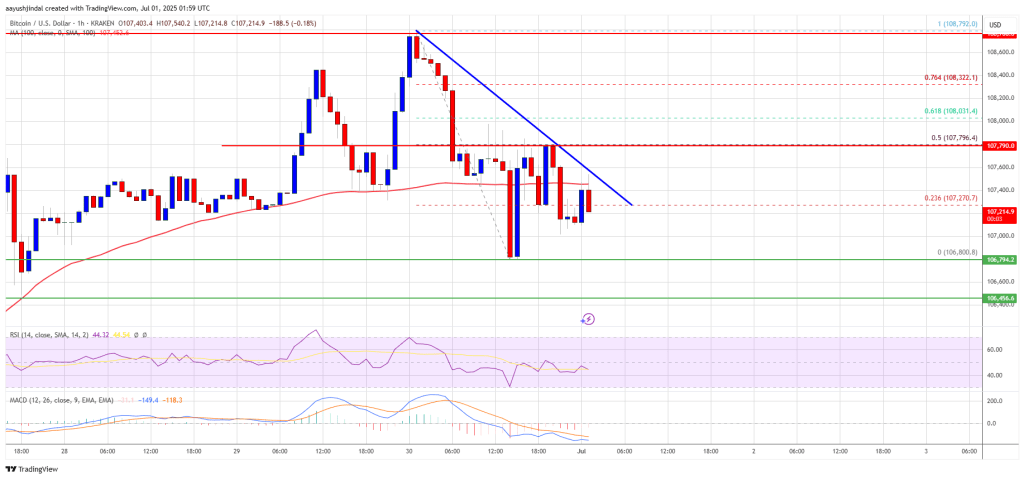

Bitcoin Price Holds Steady — Bullish Monthly Structure Suggests Rally Continuation

Bitcoin price started trading in a range below the $108,800 zone. BTC is now consolidating and might...