How the GENIUS and BITCOIN Acts Are Redefining U.S. Crypto Policy

In a sweeping update to U.S. cryptocurrency policy, the Trump administration has moved with unprecedented speed over the past 150 days to reshape the regulatory landscape, according to the newly released Bybit × Block Scholes Crypto Insights Report . From installing pro‐crypto regulators to laying the groundwork for large‐scale Bitcoin acquisitions, the report warns that both Wall Street and Main Street may be underestimating the downstream effects of the GENIUS and proposed BITCOIN Acts—and the ripple effects are already being felt around the globe.

A Whirlwind of Policy Shifts

Since taking office, President Trump has signed off on a series of executive actions and regulatory appointments that have effectively neutralized key legal battlegrounds, clarified the murky status of staking rewards and set the stage for the first U.S. spot‐market Bitcoin ETFs. But while those headlines have dominated crypto Twitter, the report argues the GENIUS Act could prove the quiet game‑changer.

GENIUS Act: Building Crypto’s Missing Rails

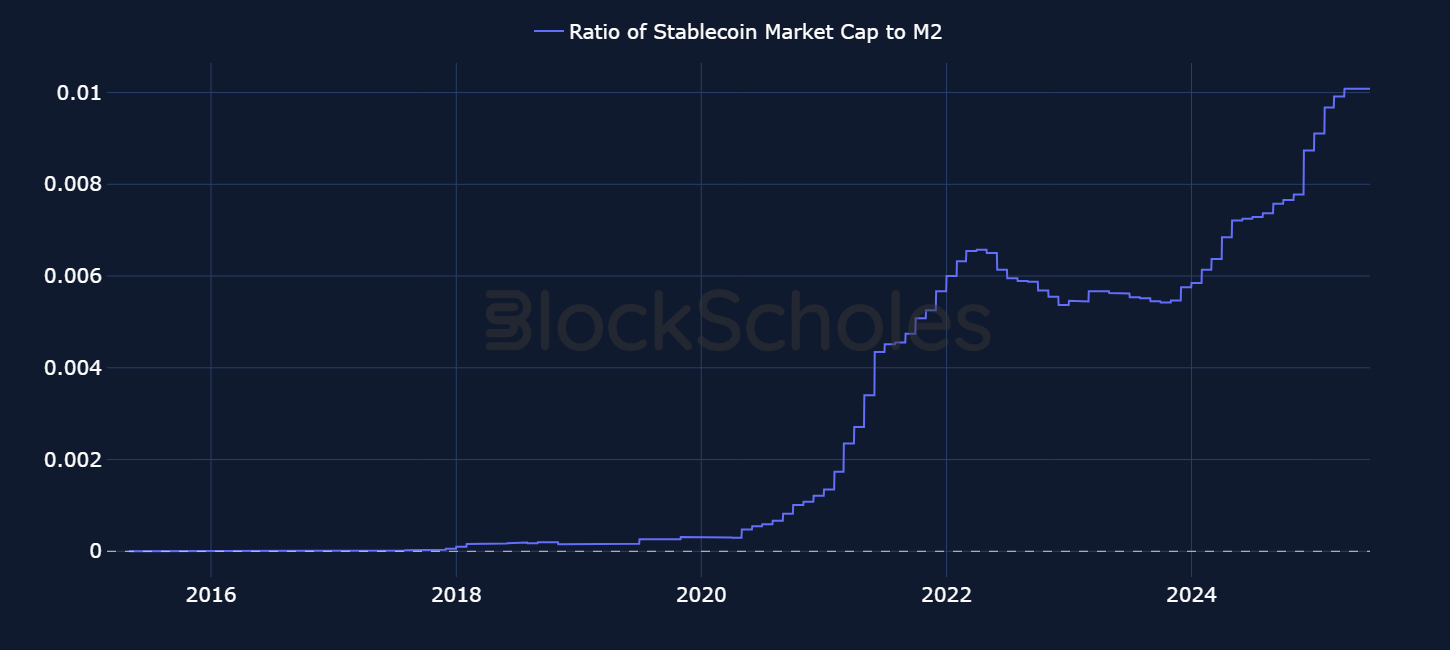

Stablecoins—digital assets pegged to fiat currencies—have long been the critical bridge between legacy finance and emerging blockchain networks. Yet, without a clear legal framework, institutional investors and everyday users have remained on the sidelines. The GENIUS Act fills that gap by laying out comprehensive rules for issuing and regulating stablecoins, instilling confidence in banks, payment processors and regulators alike.

GENIUS may not grab the headlines, but it has the potential to unlock trillions in institutional liquidity. Notably, the U.S. Treasury now estimates the stablecoin market cap will top $2 trillion—outpacing traditional measures such as the M2 money supply—and GENIUS provides the guardrails necessary for that growth to be both rapid and responsible.

By clarifying which entities can issue tokens, how reserves must be managed and which federal agencies hold oversight, the Act signals a broader shift in U.S. policy: from containment to competition. As other countries accelerate their own digital‐asset regimes, the report warns, America must strike while the iron is hot to maintain its leadership.

BITCOIN Act: From Policy Paper to Strategic Reserve

On the legislative front, Senator Cynthia Lummis’s long‑anticipated BITCOIN Act would take the next logical step: creating a U.S. Treasury‐held Bitcoin reserve. Under the bill, the Treasury would acquire 1 million BTC over five years—roughly 550 coins per day, or $57 million at current prices—potentially cutting national debt in half if those holdings were held for two decades.

Although President Trump’s executive order authorized the reserve concept, Lummis’s legislation is needed to unlock funding for fresh purchases. And its influence is already apparent at the state level: New Hampshire’s HB 302 now permits up to 5 percent of public funds—about $113 million—to be allocated to Bitcoin, while Arizona’s Bill 2749 taps abandoned digital assets for a similar reserve without using taxpayer dollars.

Global Dominoes Begin to Fall

America’s new posture is spurring counterparts worldwide. In South Korea, newly elected President Lee Jae‑myung fast‑tracked the Basic Digital Asset Act, empowering nonbank firms to issue won‑denominated stablecoins under Financial Services Commission oversight. Pakistan unveiled its own Bitcoin strategic reserve and created the Pakistan Digital Assets Authority in May, even earmarking up to 2,000 MW of power for mining—enough to drive nearly 10 percent of global hash rate, though the IMF has urged caution over energy use.

Meanwhile, Europe’s MiCA rules are set to harmonize regulations across the bloc, the U.K. is debating similar reserve proposals, and Middle Eastern financial hubs are racing to offer crypto‑friendly licensing frameworks.

Underestimated Impact

Most investors are focused on ETFs and lawsuits, but the real underdog here is GENIUS. Stablecoin clarity will be the spark that ignites a new wave of crypto adoption. And once that fire is burning, Congress will find it hard to ignore calls for a national Bitcoin reserve.

As policymakers and markets around the world adjust to this U.S. pivot, one thing is clear: the next 12 months could define how—and how broadly—digital assets integrate into the global financial system. And for an industry built on the promise of innovation, the rails are finally in place.

Bitcoin Targets $120K as Geopolitical Chaos Fuels Market Momentum, Altcoin Season Ready to Start

Bitcoin eyes $120K as macro instability and halving momentum converge. Altcoins like FPPE may offer ...

$270M in Bitcoin Pulled from Binance by a Big Whale in 30 Days, On-Chain Data Reveals

Onchain Lens reported that a Bitcoin whale has sent 600 $BTC from Binance. This further adds up to a...

Inferix GPU Partners with Spheron Network to Power Advanced Web3 Cloud Applications and AI Model Training

Inferix GPU collaborates with Spheron to boost Inferix’s decentralized cloud GPU network to deliver ...