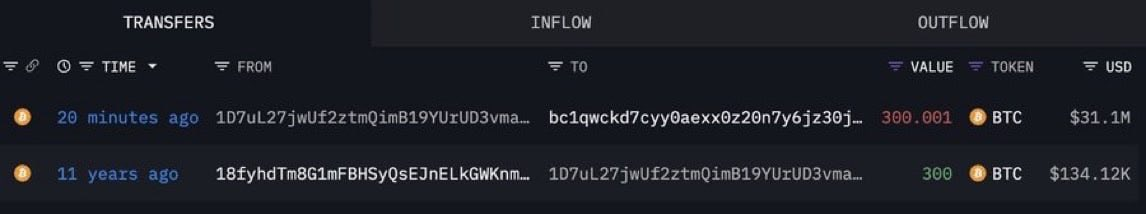

Bitcoin Whale Sells 300 BTC After 11 Years

- A whale held 300 Bitcoin and sold it at $31 million after 11 years of holding it.

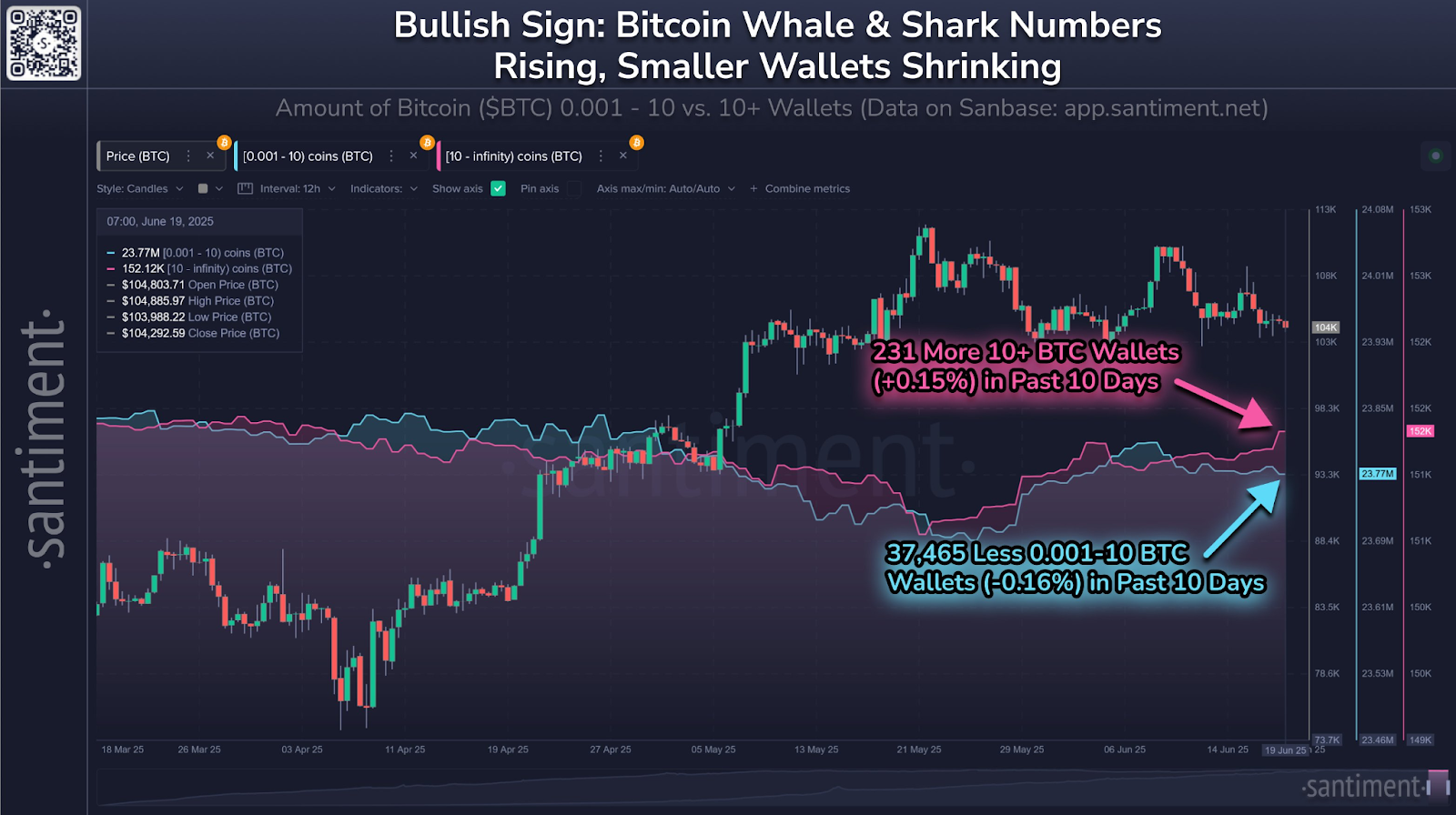

- There is an increase in whale wallets and depreciation of small wallets, indicating a change in Bitcoin holdings.

- Bollinger Bands of Bitcoin are narrowing down, and experts predict there will be a breakout once major resistance points are broken.

A Bitcoin whale has exited a decade-long position, selling 300 BTC for approximately $31 million. Blockchain data shows the wallet has held the coins since 2013, with the last inbound transaction recorded over 11 years ago. The funds were recently transferred to a new wallet, indicating a potential over-the-counter sale or custodial move.

On-chain transactions indicate that indeed the 300 BTC were first added when Bitcoin was valued at a mere fraction of its present-day value of $104,000. This rapid action has been accompanied by increasingly high hoarding by whale wallets and a sharp drop in exchange reserves.

CryptoQuant data reveals that all reserves of Bitcoin decreased to 2.4 million BTC – the indicator has not been observed since 2021. This descending trend has remained unchanged since its inception in late 2023, even as Bitcoin’s price surged to a local high of $105,800.

On-chain analysis also indicates that big holders are purchasing aggressively. According to Santiment, there are 231 more whale wallets with 10 BTC or more during the past 10 days. Smaller wallets, on the other hand, are leaving the market. More than 37,000 addresses that contained 0.001-10 BTC have sold over the same time, which indicates that retail investors are responding to fear and uncertainty. Such redistribution suggests that whales are actively accumulating Bitcoin against retail holders.

Bollinger Bands Signal Imminent Breakout

Technical indicators are in favour of a breakout. The Bollinger bands of Bitcoin have also narrowed down, a tendency usually followed by large price moves . The existing bands align with the recent price band of $100,000 and $110,000.

According to analyst Daan Crypto Trades, this squeezing of volatility is a bullish signal and could be used with bullish ascending triangles to more predictably forecast a rally. With Bitcoin finding support around $104,000, a clear break above the $110,000 resistance may trigger a series of bullish moves on the barriers at $114,000 and $118,000.

Another technical analyst, Jonathan Carter, noted that the lower support of a rising triangle on the 8-hour chart had seen Bitcoin rebound. He further noted that recapturing the 50-period moving average would probably enhance the speed of aggressive prices, reaffirming short-term trends on the bullish side.

However, despite pullbacks in the last 24 hours and week, the macro position of Bitcoin stays strong. The trading volume stands at $37.1 billion, showing a steady market interest. The seven-day drop of 1.96% is indicative of consolidation but not weakness.

These increased exchanges to cold wallet deposits, bullish structures, and whale presence indicate that the asset is potentially gearing up towards a significant upward leg. The main areas to monitor are the support at $100,000 and the resistance at $110,000 levels, which may determine the short-term dynamics of Bitcoin.

Record $6.8 Trillion Options Expiry Expected to Boost Market Volatility on June 20

Record $6.8T options expire June 20, led by S&P 500 puts, signaling potential market volatility duri...

HashKey Exchange Fuels Web3 Revolution of Hong Kong with Stablecoin Era

HashKey Exchange is driving the Web3 2.0 revolution in Hong Kong, showcasing stablecoins, tokenizati...

GAEA and InitVerse Launch Partnership to Advance AI-Driven Blockchain Development

GAEA has recently formed a collaboration with InitVerse. This is a major step towards changing the f...