Global Uncertainty Puts Cryptos in a Tight Spot

Central banks, particularly those looking to fine-tune policy as they approach the conclusion of their rate-cutting phases, are faced with significant uncertainty regarding economic growth and inflation, which complicates their decision-making processes.

This is playing in crypto markets as the major theme in the current geopolitical backdrop and weighing on risk sentiment.

That’s creating challenges for crypto investors as well as the inflation outlook wavers across the board from geopolitical events and, of course, Trump's policies.

On Thursday, Norway's central bank surprised the markets by lowering interest rates, while the US Federal Reserve cautioned against placing too much emphasis on its policy forecasts.

Clearly, the Fed is equally confused as the rest of the markets.

Differing views are not new, but the confusion on the Fed rate path has not been as divided and fluid as it has been this year.

Several offbeat risks have pushed the US central bank to the sidelines, despite President Trump's statements and attack on Fed Chair Jerome Powell to cut rates.

Fed officials continue to indicate that reductions in interest rates are probable in the upcoming year.

Nonetheless, our BRN analysts remain skeptical that a significant number will be persuaded regarding the rationale for reductions before December, at which point they might find it necessary to implement a more assertive 50 basis point cut.

The earlier forecast made in March occurred before any tariff declarations.

It is important to note that 7 out of 19 individual member forecasts indicate no rate cuts this year.

However, in the broader context, these forecasts hold limited significance due to the prevailing economic and political uncertainties, which could lead to swift changes in policy outlook.

Chair Powell himself recognized that there are numerous potential outcomes to consider.

They have also adjusted the fourth quarter 2026 year-over-year GDP growth forecast down to 1.6% from 1.8% and increased the core CPE to 2.4% from 2.2%.

Additionally, they now project only one 25 bps cut in 2026, compared to two previously anticipated. Recognizing their long-term expectation for the Fed funds rate equilibrium at 3% is crucial.

Consequently, the indications suggest a central bank that is inclined toward reducing rates but remains somewhat uncertain about the justification for doing so.

This uncertainty is affecting cryptocurrencies more than the Israel-Iran conflict, as Bitcoin is hovering around $105,000 while other crypto tokens are mostly stagnating.

Central Banks & Bets on Their Action

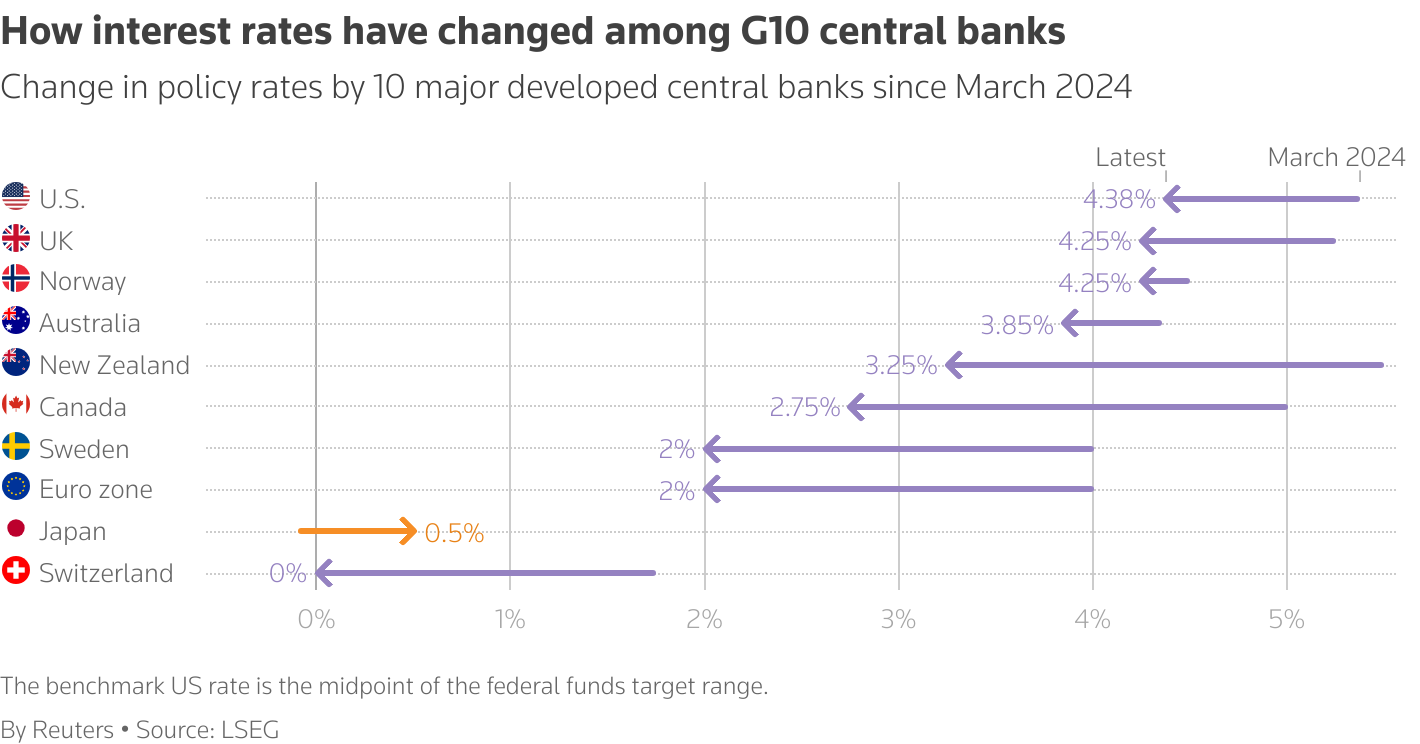

BRN outlines how central banks line up at the moment on their rate paths after the latest central banks' actions.

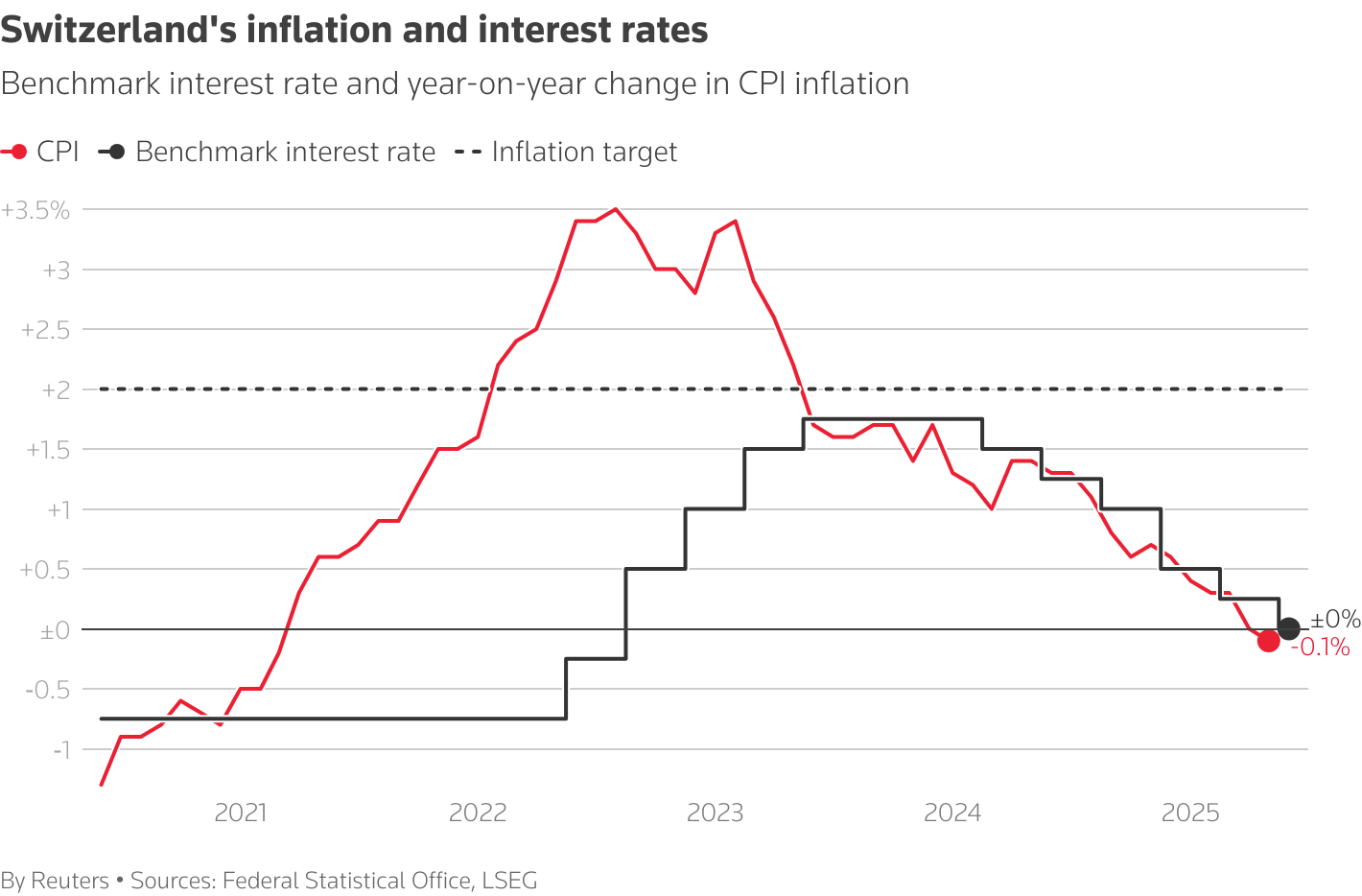

Switzerland : On Thursday, the Swiss National Bank reduced its benchmark rate to 0%, citing declining inflation, a robust Swiss franc, and economic uncertainty stemming from erratic U.S. trade policy as the reasons for this decision.

The critical question is whether it will lower rates into negative territory during the next meeting.

The Swiss National Bank is considering all possibilities, yet chairman Martin Schlegel indicates that the threshold for additional cuts has increased now that rates have reached zero.

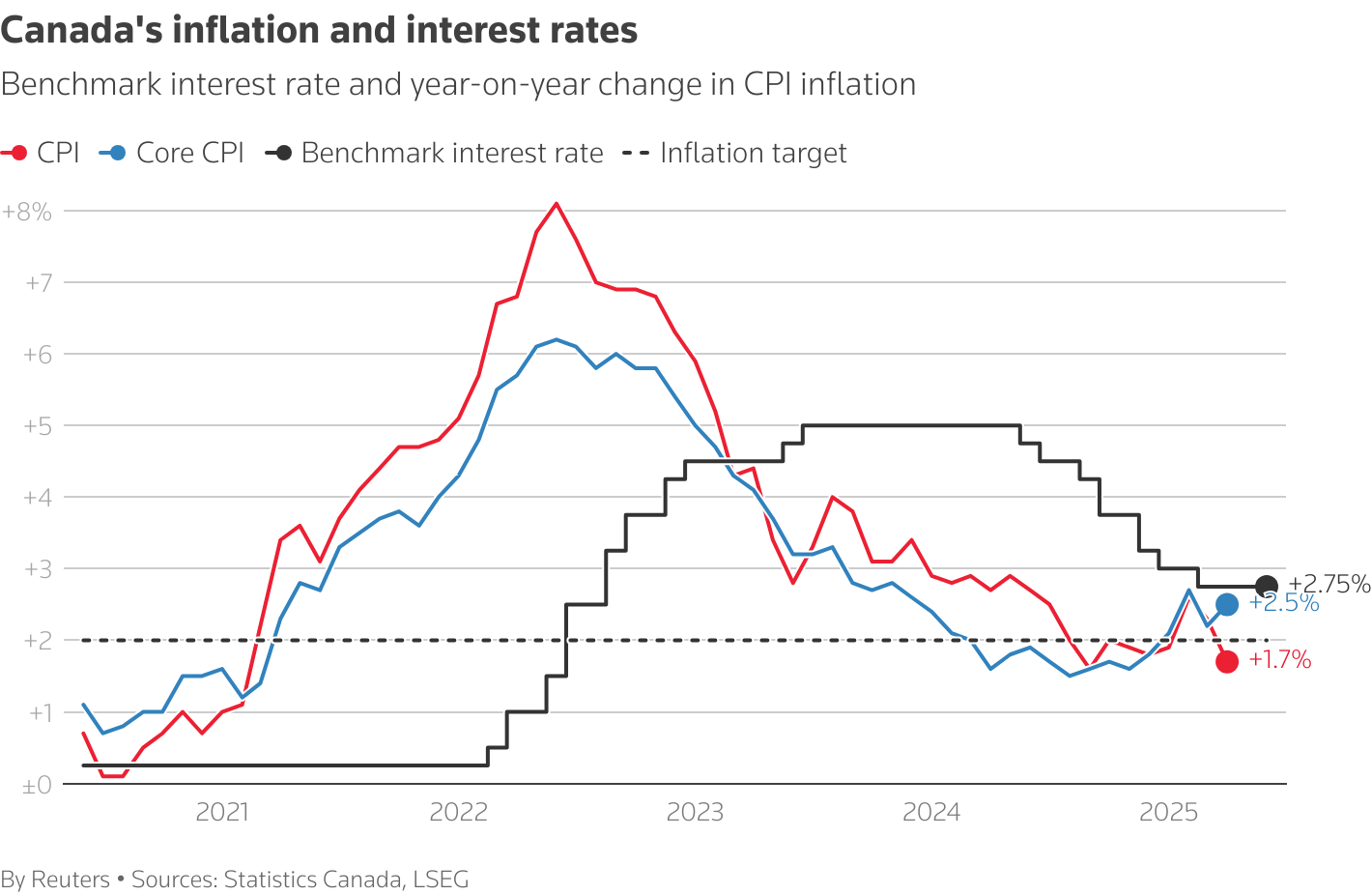

Canada : The Bank of Canada maintained its rate at 2.75% in early June, indicating that a further reduction could be warranted should the economy show signs of weakening due to tariffs.

The recent pause marks the second consecutive instance for the central bank, following a vigorous cycle of rate reductions that saw a decrease of 225 basis points within a span of nine months. Market expectations suggest an additional 25 basis points reduction by the end of the year.

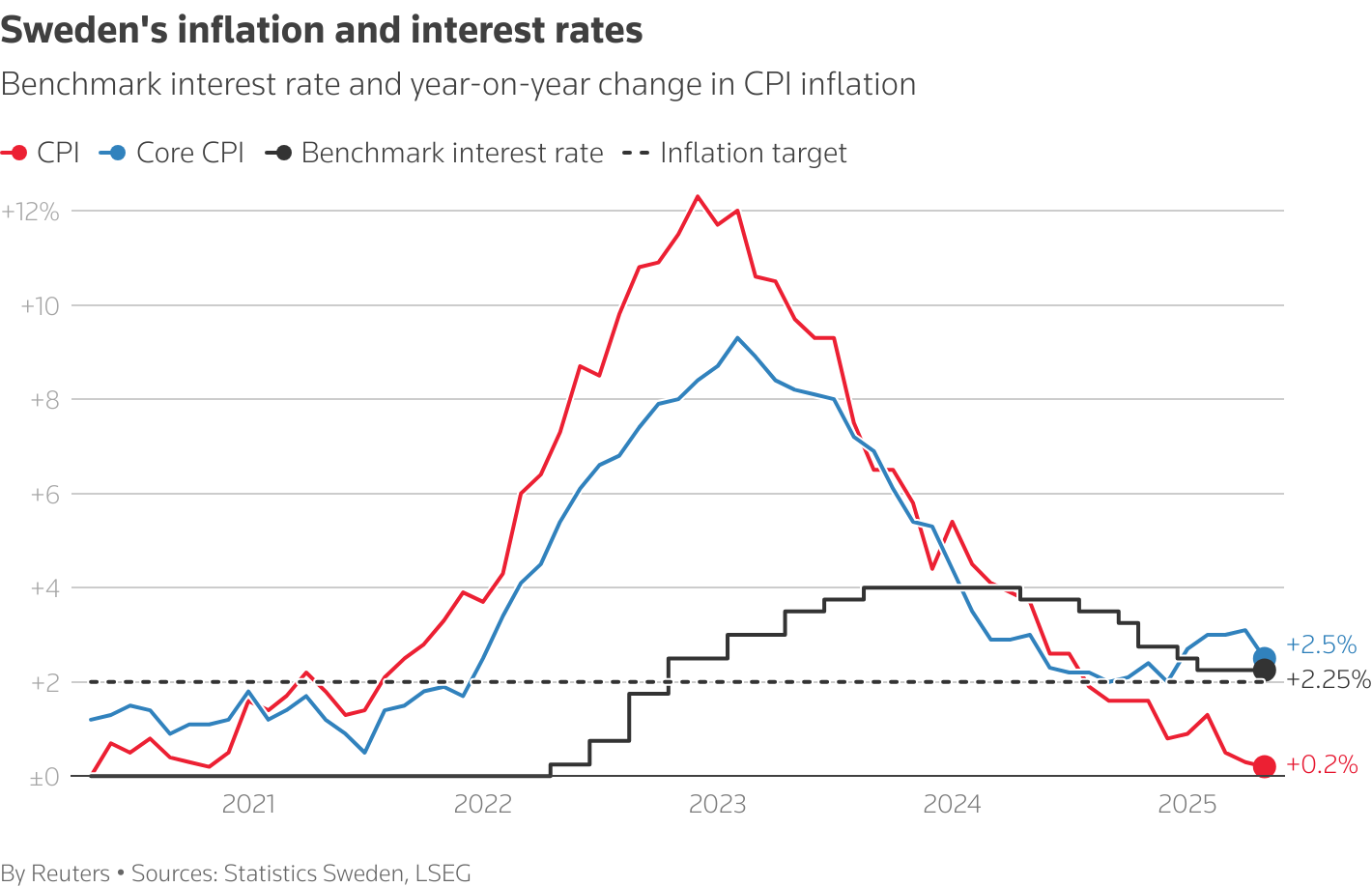

Sweden : On Wednesday, Sweden's central bank reduced its key rate from 2.25% to 2%, indicating that, given the current weak price pressures, there may be further reductions before the end of the year to stimulate lackluster growth.

The Riksbank has adopted a notably assertive stance, implementing 200 basis points of reductions since May 2024.

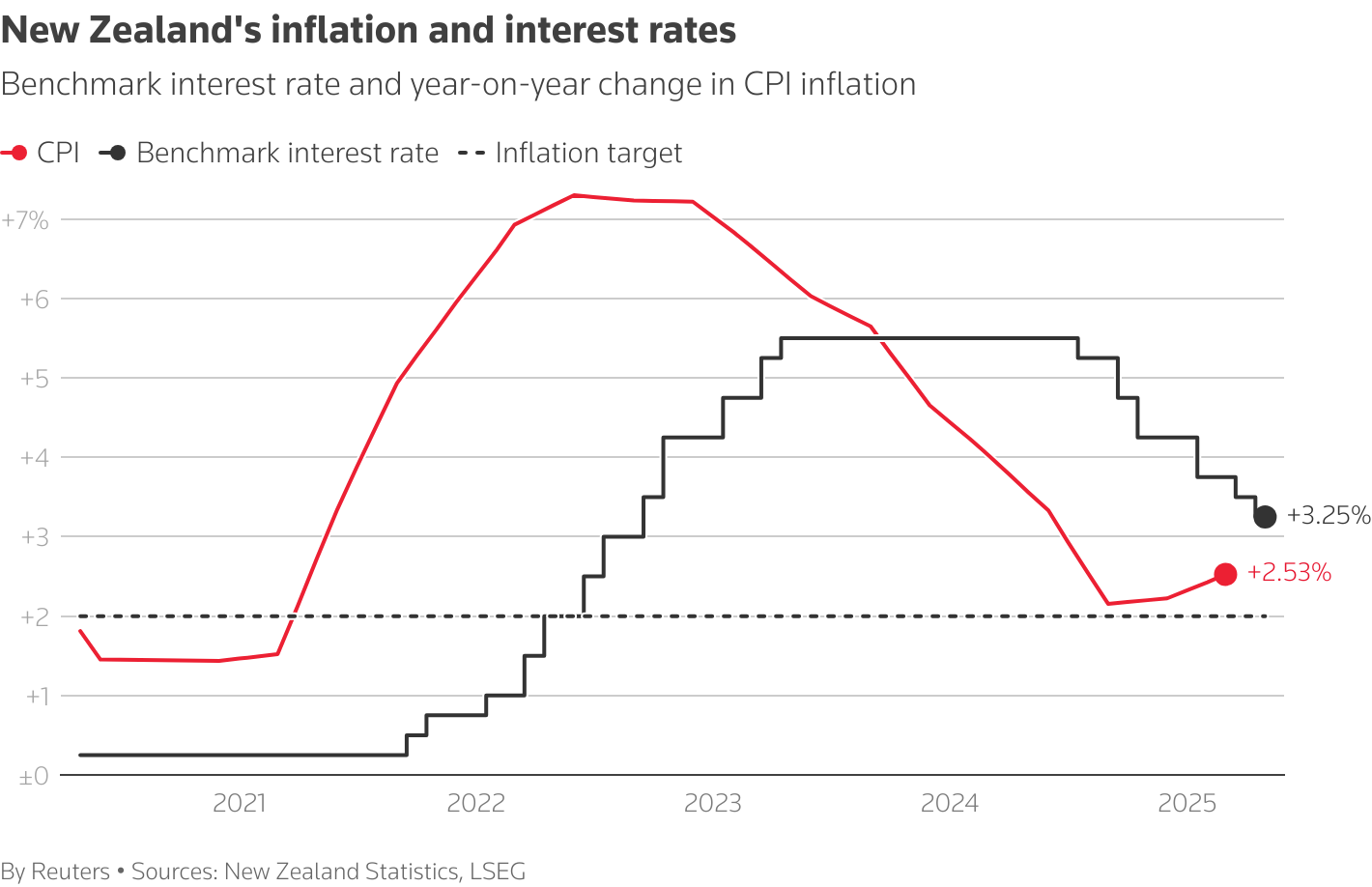

New Zealand : Market participants anticipate that the Reserve Bank of New Zealand will maintain its current stance on July 9, following a 25 basis points reduction to 3.25% in May aimed at safeguarding the economy heavily reliant on China.

The RBNZ cautioned that uncertainties in global trade rendered future actions ambiguous. Expectations indicate an additional 25 basis point reduction this year, following the 225 basis points already implemented in this cycle.

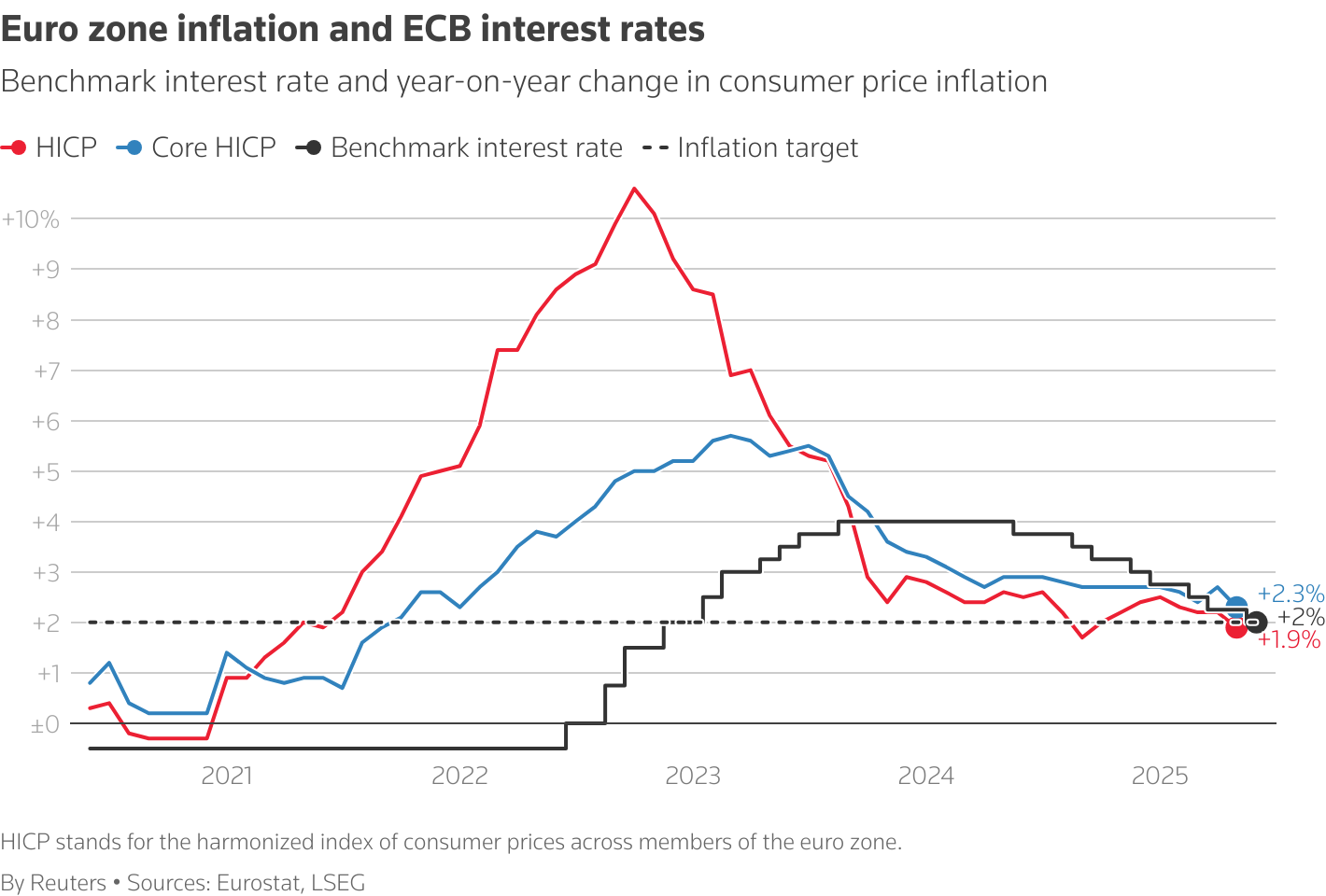

Eurozone : The ECB implemented a rate cut earlier this month, marking its eighth decrease since mid-2024, while maintaining a flexible approach for upcoming meetings.

ECB President Christine Lagarde asserts that the central bank's goal of achieving a 2% inflation rate within the eurozone is attainable.

The inquiry for stakeholders revolves around whether inflation will fall short of that target, potentially requiring additional easing measures.

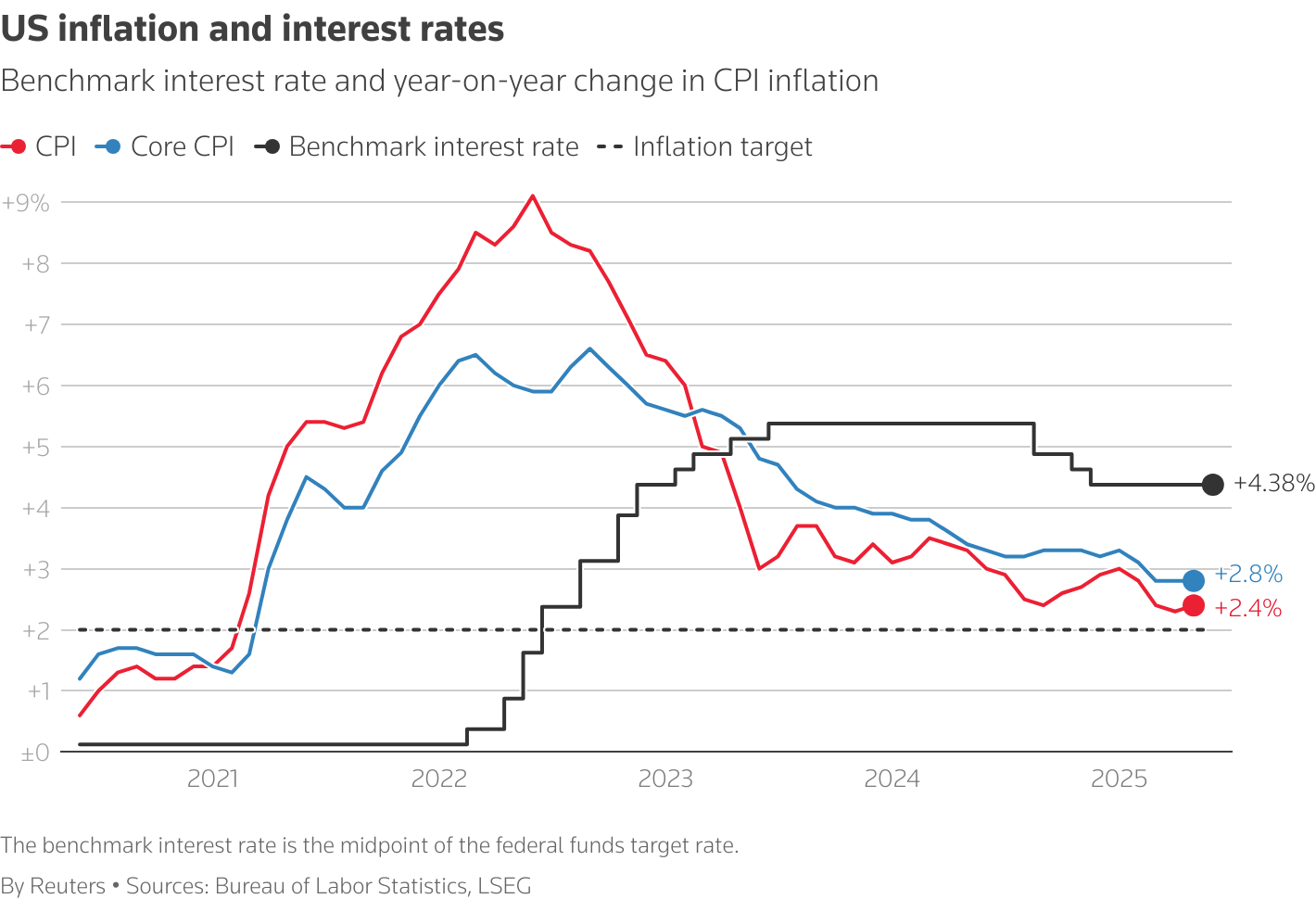

US : The Federal Reserve maintained its current interest rates on Wednesday and indicated that borrowing costs are expected to decrease in 2025. However, Chair Jerome Powell cautioned on inflation.

"There is a lack of strong conviction regarding these rate paths, and it is widely acknowledged that they will all be contingent on data," Powell stated.

He noted that absent tariffs, it may have been appropriate to consider rate cuts in light of the recent low inflation readings. Market expectations indicate approximately two 25-basis point reductions by the end of the year.

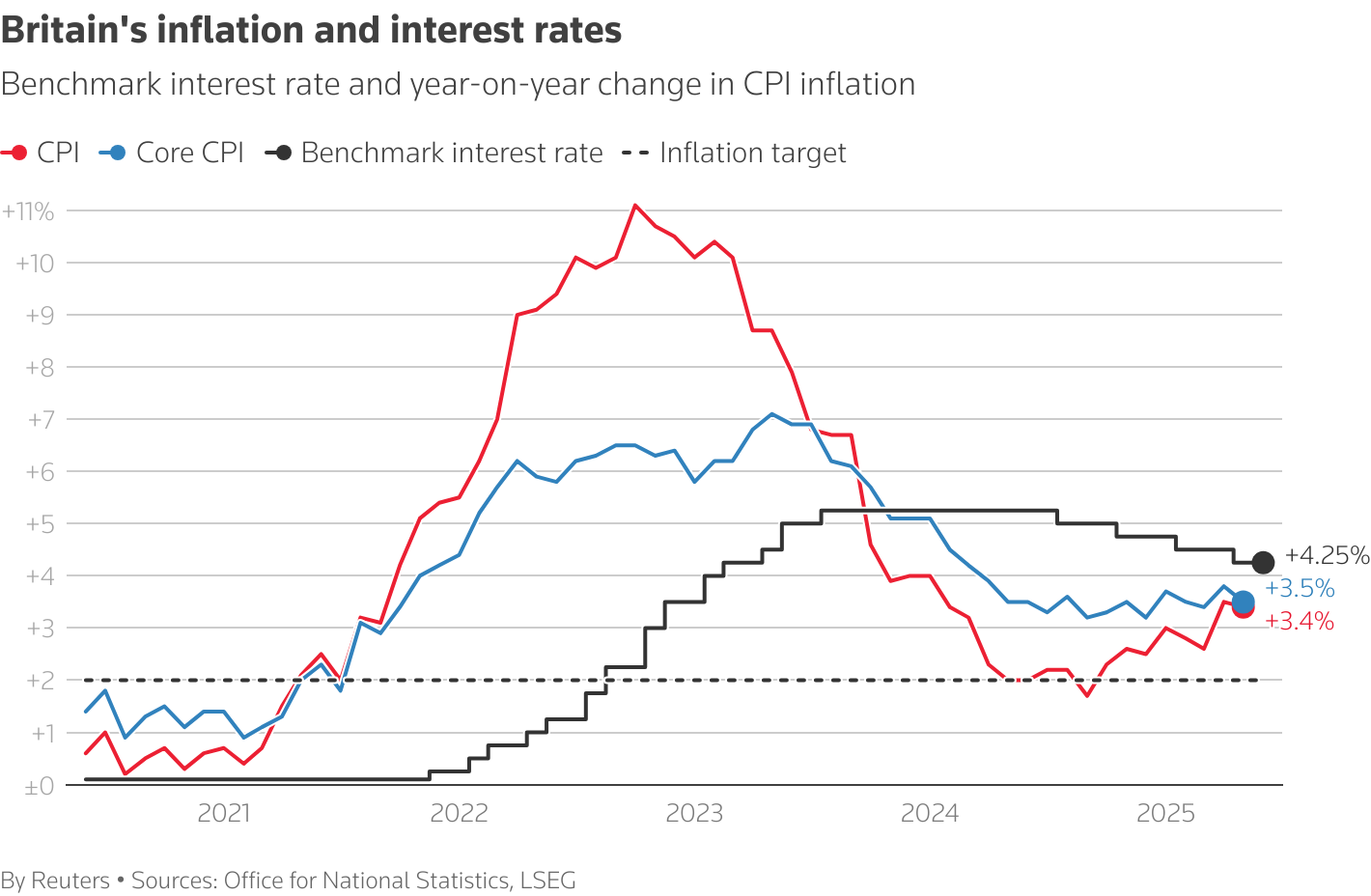

Britain : The Bank of England, often full of surprises, aligned with market expectations on Thursday by maintaining interest rates at 4.25%.

The BoE has implemented cuts approximately every three months over the last year, and market expectations suggest this trend will persist, with two additional cuts anticipated by the end of the year.

On Thursday, three out of the nine decision-makers expressed their support for a reduction.

Some market participants speculate that weakening labor data might prompt the central bank to accelerate the pace of cuts, while others believe it will be constrained by elevated inflation levels in the UK.

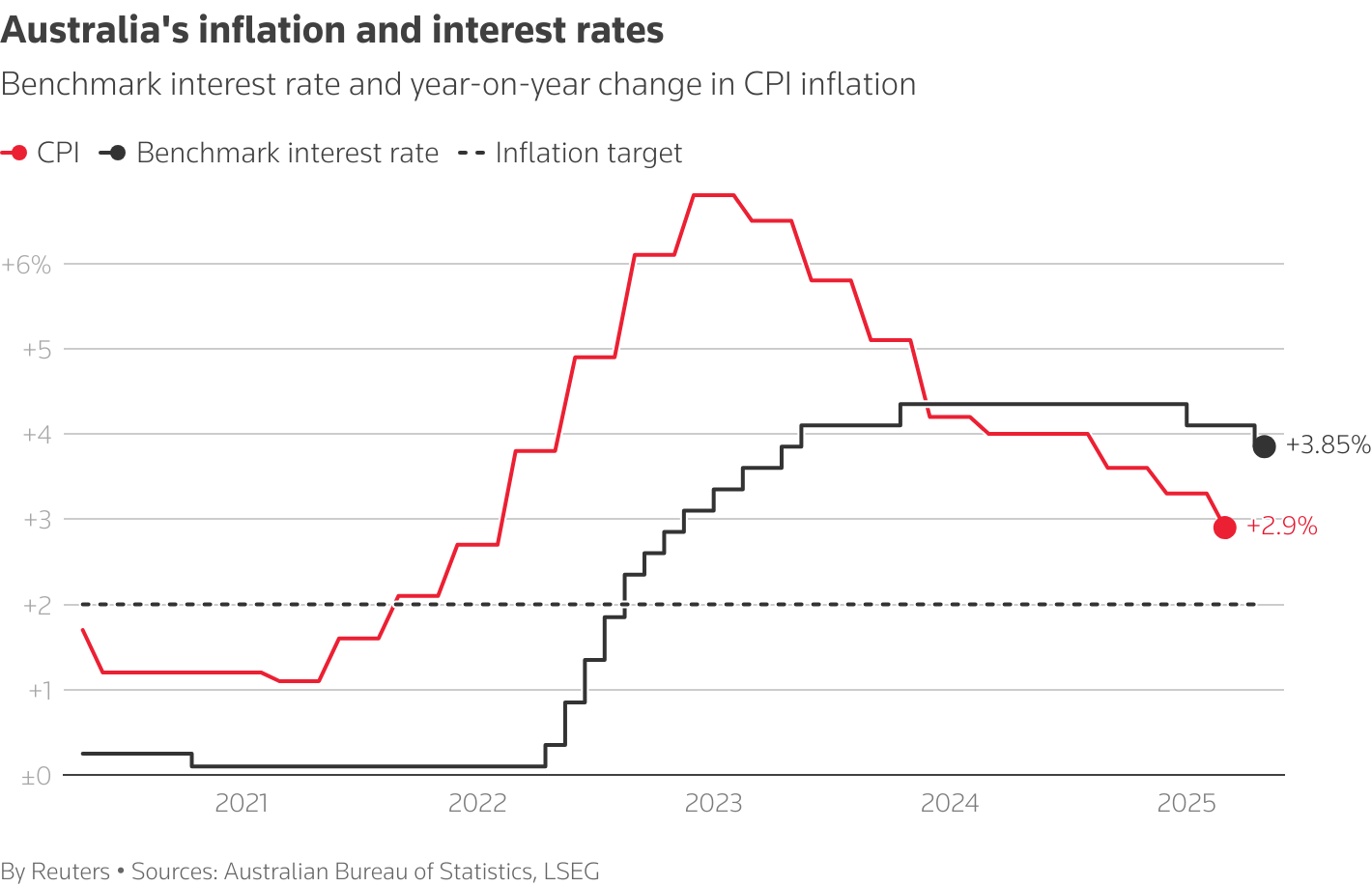

Australia : Subpar growth indicators and concerns that commodity producers and mining sectors may suffer due to escalating U.S.-China trade tensions suggest that the Reserve Bank of Australia is prepared to implement swift interest rate reductions.

The Reserve Bank of Australia reduced rates by 25 basis points to 3.85% in May, with market participants anticipating a decline in borrowing costs to approximately 3% by the end of the year.

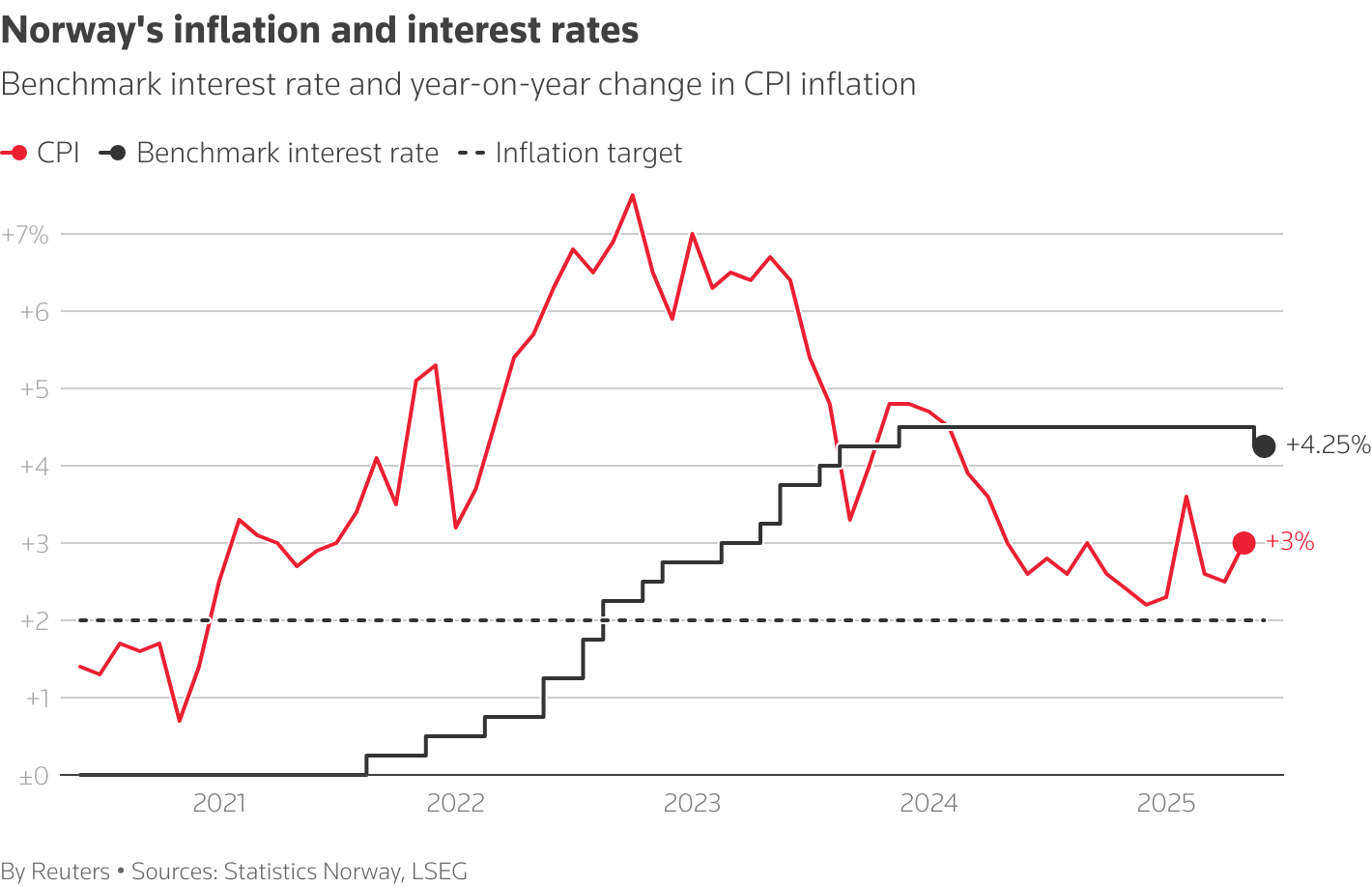

Norway : On Thursday, Norway's central bank lowered its policy interest rate by 25 basis points to 4.25%, marking its first reduction since 2020.

Many experts were taken aback by this unexpected decision, which resulted in a depreciation of the currency.

The Norges Bank has exhibited a prudent approach compared to other central banks in developed markets regarding rate cuts, with Governor Ida Bache indicating that only one or two additional reductions are anticipated this year.

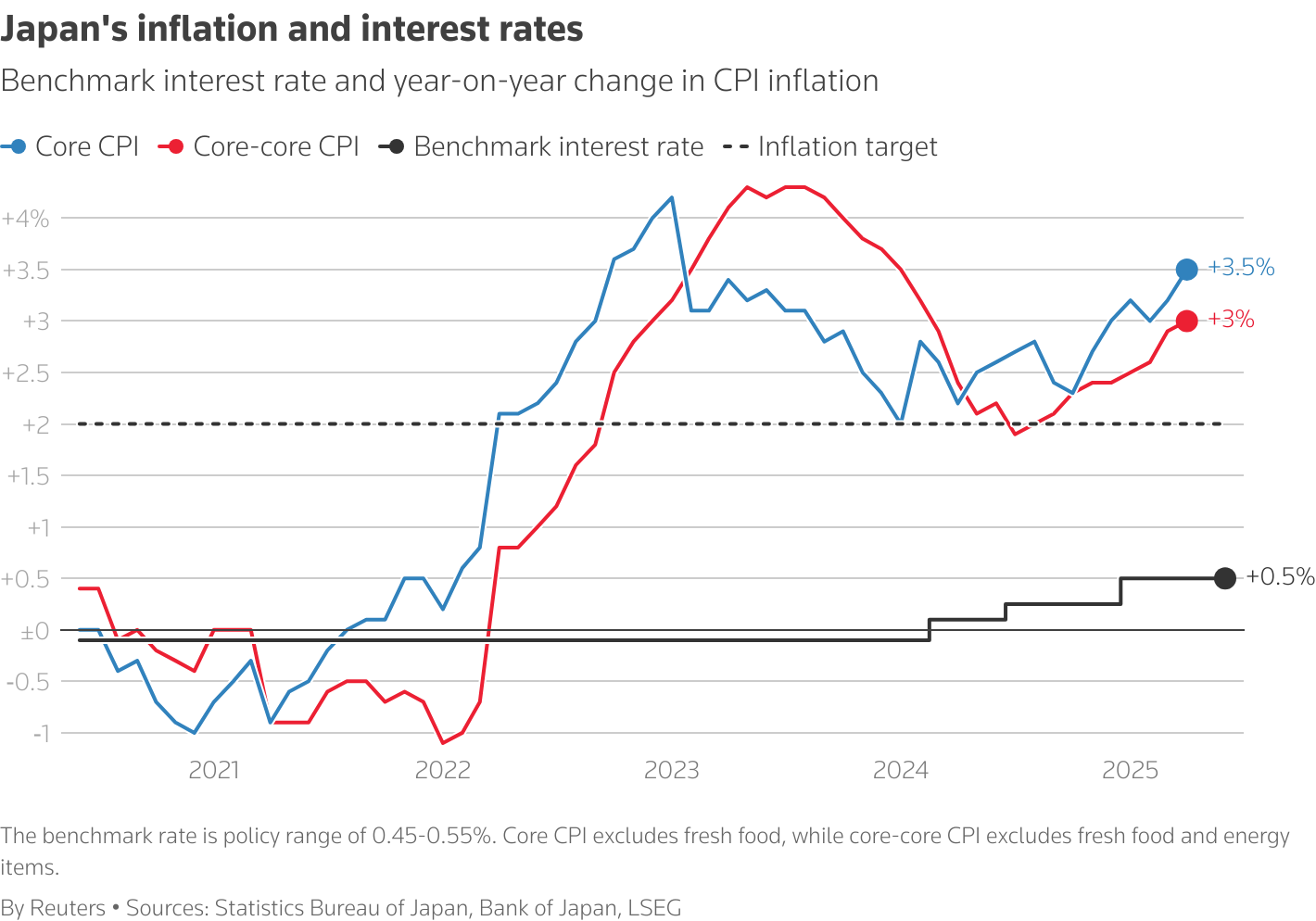

Japan : The Bank of Japan, the only central bank currently in a tightening phase, maintained its rates on Tuesday, aligning with investor expectations.

The increasing tensions in the Middle East and the imposition of U.S. tariffs present significant challenges for the Bank of Japan as it seeks to raise its currently low interest rates and manage a balance sheet that has expanded to approximately match the size of Japan's economy.

On Tuesday, it opted to slow the rate of its balance sheet reduction for the upcoming year, indicating a careful approach to unwinding the remnants of its prolonged stimulus efforts.

Overall, bets on central bank action for the rest of this year indicate that the driver for crypto's next leg up still seems far away.

The price action so far in large crypto tokens has more or less already factored in the positive drivers.

Despite some positive signs such as new regulations boosting the sector, the outlook for cryptos remains unclear due to the uncertainty surrounding central banks' plans for this year.

For cryptos, Fed rate cuts are the next real boost, and for a consistent move up to new highs, it looks equally uncertain at the moment.

Elsewhere

Blockcast

The Intersection of AI & Blockchain Technology ft. Node Foundry

This week, host Takatoshi Shibayama explores the intersection of AI and blockchain technology with guests Abhinav Ramesh and Vinay Mohan, co-founders of Node Foundry . The conversation covers their backgrounds in crypto, current adoption challenges, and the potential of decentralized AI infrastructure to address rising compute costs.

Central to the discussion is Node Foundry's approach as "a two-sided marketplace" that simplifies access to decentralized AI solutions. The guests emphasize their goal to "abstract away the complexity of Web3" while maintaining privacy and security for enterprise users. As they highlight, the cost of compute is getting very expensive, but decentralized infrastructure can provide cheaper alternatives to traditional centralized models.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Blockcast 67 | The Intersection of AI & Blockchain Technology ft. Node Foundry

The co-founders discuss Node Foundry's revenue models, market strategies, and their focus on "helpin...

Semler Scientific Appoints Bitcoin Strategist, Sets Target for 105,000 BTC by 2027

Healthcare company plans aggressive Bitcoin accumulation strategy with new director overseeing treas...

Corporate BTC Ambitions Grow – Why We've Added to Our Positions

Your daily access to the backroom....