Top Reasons Why Altcoin Season 2025 Is Far From Sight

The post Top Reasons Why Altcoin Season 2025 Is Far From Sight appeared first on Coinpedia Fintech News

With Bitcoin hovering well above $100k and altcoins failing at cycle lows, investors are curious if the altcoin season 2025, is still on the cards, or have we missed the boat? It is rightly said that history shows a rhythm in market behavior, while many claim “this cycle is different,” the data says otherwise.

From BTC dominance and institutional inflows to the Altcoin Season Index hitting rock bottom, all signs point to a forthcoming shift in liquidity. In this analysis I take you through crypto analyst Tracer’s thesis on altseason.

Bitcoin Is Soaring, But Alts Are Sleeping?

It has been disappointing to the marketers that, despite the total market cap sitting at $3.24 trillion, altcoins are still significantly underperforming relative to Bitcoin. Data reveals that most alts remain down 80–90% from their all-time highs. This is all while BTC continues breaking new streaks. The analyst highlights that this discrepancy isn’t new, as in past cycles, altseason only kicked off after Bitcoin concreted its top.

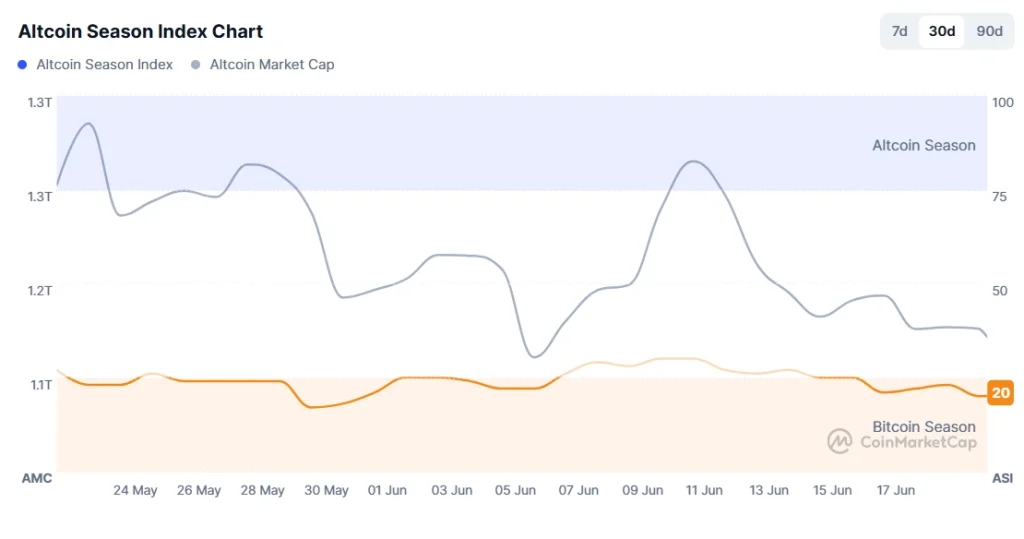

The Altcoin Season Index currently sits at 21/100, deeply into “Bitcoin Season” territory. Historically, these levels have marked the start to capital rotation from BTC into alts once Bitcoin shows signs of topping out.

Institutions Are Still Going All-In on Bitcoin?

Institutional behavior has tilted heavily toward Bitcoin. From Strategy’s billion-dollar buys to publicly traded firms and sovereign institutions building BTC treasuries.

Coming to the M2 global money supply, a key liquidity driver, shows a strong correlation with BTC, especially with a 76-day offset. As M2 expands, Bitcoin absorbs the initial liquidity. But when this flow saturates, past actions suggest altcoins often catch the spillover, triggering the true altseason.

Key Market Signals Flashing the Setup

The following market indicators are pointing to a classic pre-altseason setup:

-

Bitcoin Dominance:

Currently hovering at record highs. Past patterns show that when BTC.D drops below

55%

, it’s a clear sign that capital is rotating into alts.

-

Trading Volume Divergence:

BTC’s volumes have recently dipped compared to previous bull cycles from 2016 and 2021, and alt volumes remain sluggish. A simultaneous volume spike in alts, along with a BTC.D drop, will be a major trigger.

- Fear & Greed Index: Sitting neutral at 48 , indicating indecision, a common trait to market transitions.

Also worth noting is the geopolitical tension with Iran, which has temporarily frozen liquidity. However, such geopolitical dips tend to resolve swiftly and provide golden buying opportunities.

Keen on BTC’s future? Read our Bitcoin (BTC) Price Prediction 2025, 2026-2030!

FAQs

The altcoin season 2025 will start once the Bitcoin dominance drops below 55, volume flows into alts, and the altcoin season index rises above 75.

The current metrics suggest we’re in a prime accumulation phase. History favors those who enter before the crowd, not during euphoric runs.

SEI Price Rebounds Sharply, Eyes $0.2545 as Next Target?

The post SEI Price Rebounds Sharply, Eyes $0.2545 as Next Target? appeared first on Coinpedia Fintec...

U.S. Faces $37 Trillion Debt Crisis—Is Crypto the Escape Route?

The post U.S. Faces $37 Trillion Debt Crisis—Is Crypto the Escape Route? appeared first on Coinpedia...

Tron Flips Dogecoin as TRX Rises to 8th Rank

The post Tron Flips Dogecoin as TRX Rises to 8th Rank appeared first on Coinpedia Fintech NewsTron’...