Prenetics Becomes First Healthcare Company to Adopt Bitcoin Treasury Strategy with $20M BTC Purchase

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Prenetics Global Limited has become the first healthcare company in the world to establish a Bitcoin treasury.

In a press

statement

today, the firm announced that it had purchased 187.42 BTC for $20 million via a Kraken custody account, at an average price of $106,712 per coin. This latest move adds to the growing trend of firms adopting crypto assets for treasury purposes.

While the company is following in the footsteps of Bitcoin-forward firms like

MicroStrategy

and Japan’s Metaplanet, Prenetics is adopting a more comprehensive BTC strategy. In particular, its strategy goes beyond simply holding Bitcoin as a passive reserve.

Notably, the company’s board has approved allocating the majority of its $117 million balance sheet to Bitcoin. In addition, Prenetics is pursuing institutional financing collaborations and planning alpha-generating strategies. These include derivatives trading, yield generation, and structured lending products.

Danny Yeung, CEO of Prenetics, said they have a vision of establishing the most extensive Bitcoin treasury in healthcare. He added that while other healthcare firms are still trying to understand Bitcoin, Prenetics is already building the infrastructure to lead at the intersection of health and digital wealth over the next decade.

Bitcoin Strategy Backed by Elite Crypto Leaders

In tandem with the treasury announcement, Prenetics has nominated former OKEx COO Andy Cheung to its Board of Directors. Cheung brings over a decade of experience in crypto operations and governance, having overseen billions in daily crypto trading volume.

“This is not about passive Bitcoin storage,” said Cheung. He emphasized that Prenetics aims to actively manage Bitcoin through institutional-grade strategies such as derivatives and yield generation.

Moreover, Prenetics' move is supported by a strategic advisory team that includes two of the most influential figures in the digital asset space: Kraken executive Tracy Hoyos Lopez and TOKEN2049 founder Raphael Strauch.

Solid Financial Base Supporting the Strategy

A strong financial foundation backs Prenetics’ aggressive Bitcoin strategy. The company holds over $117 million in pro forma liquidity and maintains a debt-free balance sheet, allowing it to pursue high-conviction investments.

For fiscal year 2025, it projects revenue between $80 and $100 million. Its flagship brand, IM8 Health, is on track to exceed a $50 million annual recurring revenue run rate.

Additionally, Prenetics holds a strategic 35% stake in Insighta, which was recently worth $70 million following an investment by Tencent.

Accepting Crypto Payments

Looking ahead, Prenetics plans to integrate Bitcoin into its operational functions, including

accepting crypto payments

on its IM8 Health and CircleDNA platforms. This approach helps establish a Bitcoin ecosystem that makes digital assets central to the consumer health experience.

With this move, Prenetics is redefining corporate Bitcoin strategy. No longer confined to the tech or fintech sectors, Bitcoin is now entering industries once considered unlikely adopters.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/512276.html

Previous:战争的延续:伊朗人的加密货币财富被以色列洗劫一空

Related Reading

Why You Need a Crypto Wallet To Manage Your Cryptocurrency

In today's bustling digital economy, cryptocurrency has emerged as a transformative force. For those...

Should Every Investor Own at Least 10,000 XRP If Betting on XRP long-term Potential

The conversation about the importance of holding 10,000 XRP tokens continues to gain traction within...

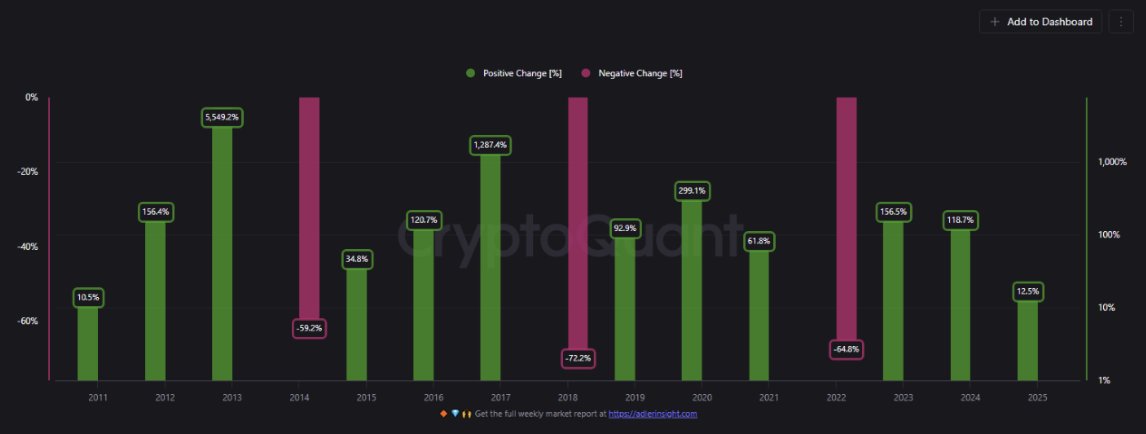

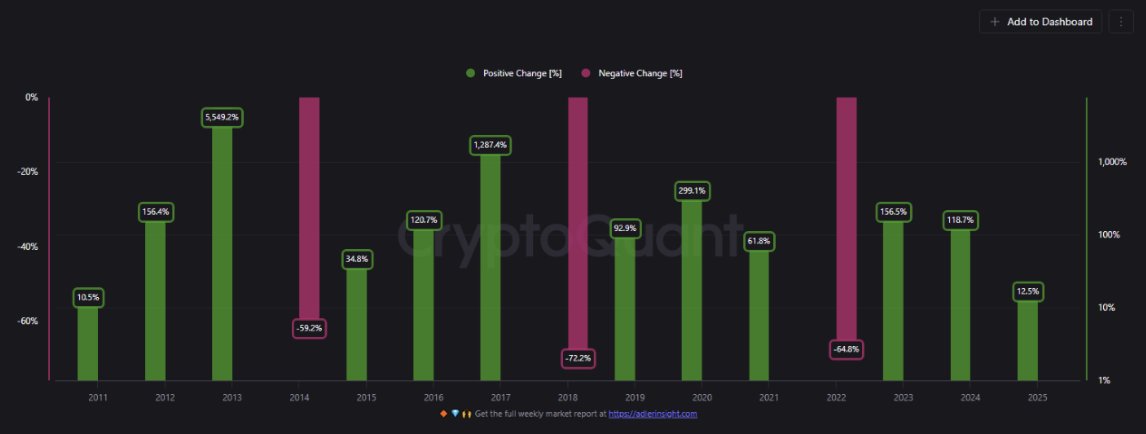

Bitcoin Could Grow 120% in 2025 If It Follows Typical Third-Year Trend

The Bitcoin growth cycle shows a potential increase in 2025 if it follows the typical pattern of the...